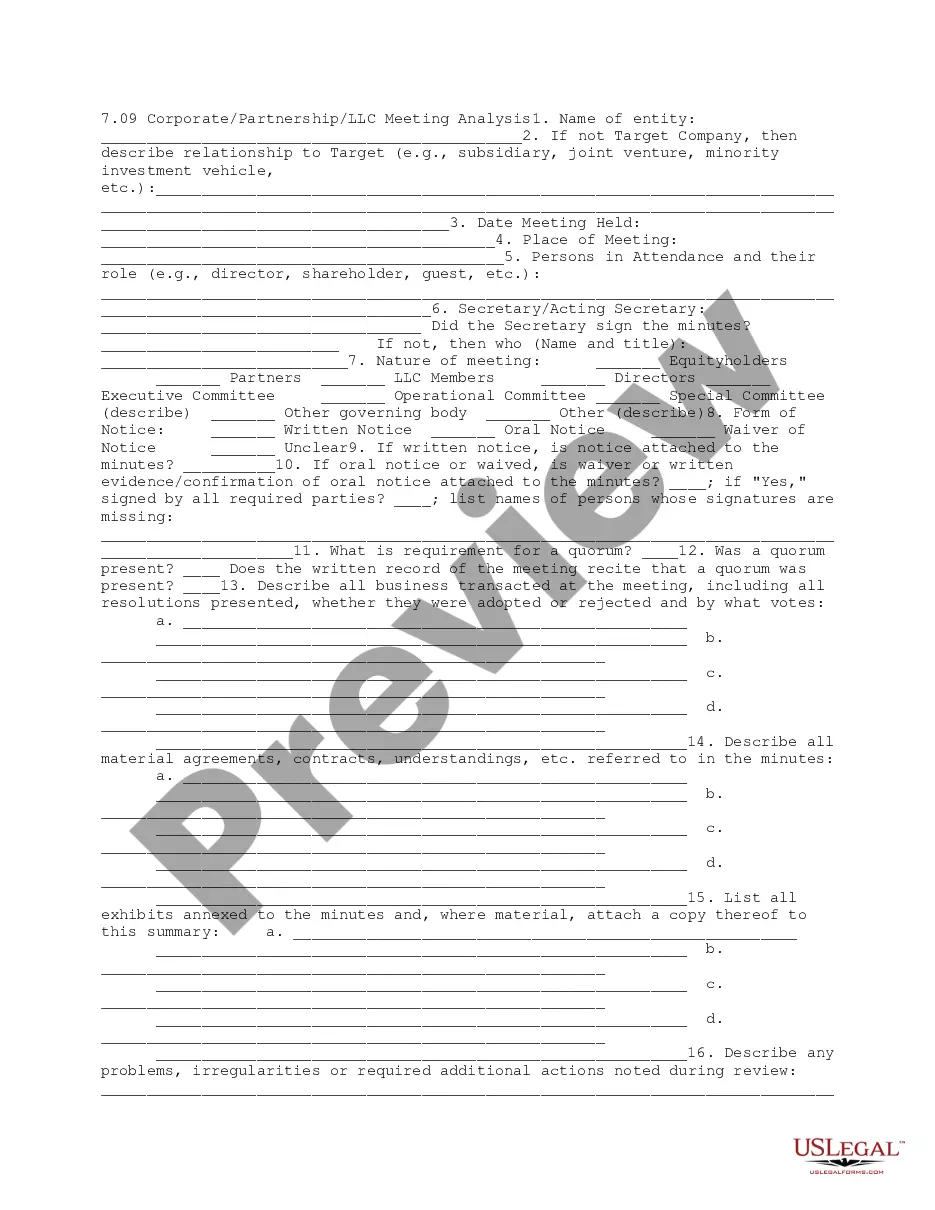

This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Georgia Partnership Data Summary

Description

How to fill out Partnership Data Summary?

If you require exhaustive, obtain, or generating legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Leverage the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours forever. You have access to every form you obtained in your account. Visit the My documents section and select a form to print or download again.

Complete and obtain, and print the Georgia Partnership Data Summary with US Legal Forms. There are numerous professional and state-specific forms you can use for your personal or business requirements.

- Use US Legal Forms to acquire the Georgia Partnership Data Summary in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Georgia Partnership Data Summary.

- You can also access forms you previously obtained in the My documents tab of your profile.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Utilize the Preview feature to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Georgia Partnership Data Summary.

Form popularity

FAQ

The top trading partners of Georgia include countries like Canada, China, and Mexico. These relationships influence the state's economy by providing access to diverse markets for Georgia-made products. By referencing the Georgia Partnership Data Summary, you can gain a clearer picture of trade volumes and trends. This information is crucial for businesses looking to expand their reach.

GA Form 700 must be filed by certain entities that operate in Georgia, especially those involved in partnerships and corporate transactions. Compliance with Georgia's tax regulations is essential for businesses. Utilizing insights from the Georgia Partnership Data Summary can ensure that you understand filing requirements. Knowing your obligations can lead to smoother operations.

Georgia's biggest trading partner is often found to be China. This relationship significantly impacts Georgia's economy, particularly in terms of exports. The Georgia Partnership Data Summary can provide a detailed breakdown of goods and services traded, showcasing how important these international connections are. Effective strategies can help businesses navigate global trade.

The main trading partner of Georgia is the state of Georgia's relationship with its nearby southeastern states. These connections foster both regional commerce and growth. The Georgia Partnership Data Summary serves as a valuable resource to analyze trade dynamics and trends. Understanding these partnerships can lead to strategic advantages for local businesses.

Georgia's economy primarily relies on agriculture, manufacturing, and services. The state has a rich agricultural history, producing commodities like cotton and poultry. Moreover, the Georgia Partnership Data Summary highlights the growth of the tech sector and film industry in recent years. This diverse economic base offers numerous opportunities for employment and entrepreneurship.

As of recent data, Canada holds the position of the US's #1 trade partner. This strong economic relationship encompasses various sectors, including agriculture and technology. The Georgia Partnership Data Summary can provide insight into how Georgia interacts with major partners like Canada. Maintaining robust trading relationships is vital for Georgia's economy.

The leading cause of death in Georgia is heart disease. This condition affects many residents and often results from lifestyle choices. Understanding health trends is essential, and comprehensive reports like the Georgia Partnership Data Summary can help highlight critical health issues. By analyzing these statistics, we can work toward better health outcomes for all Georgians.

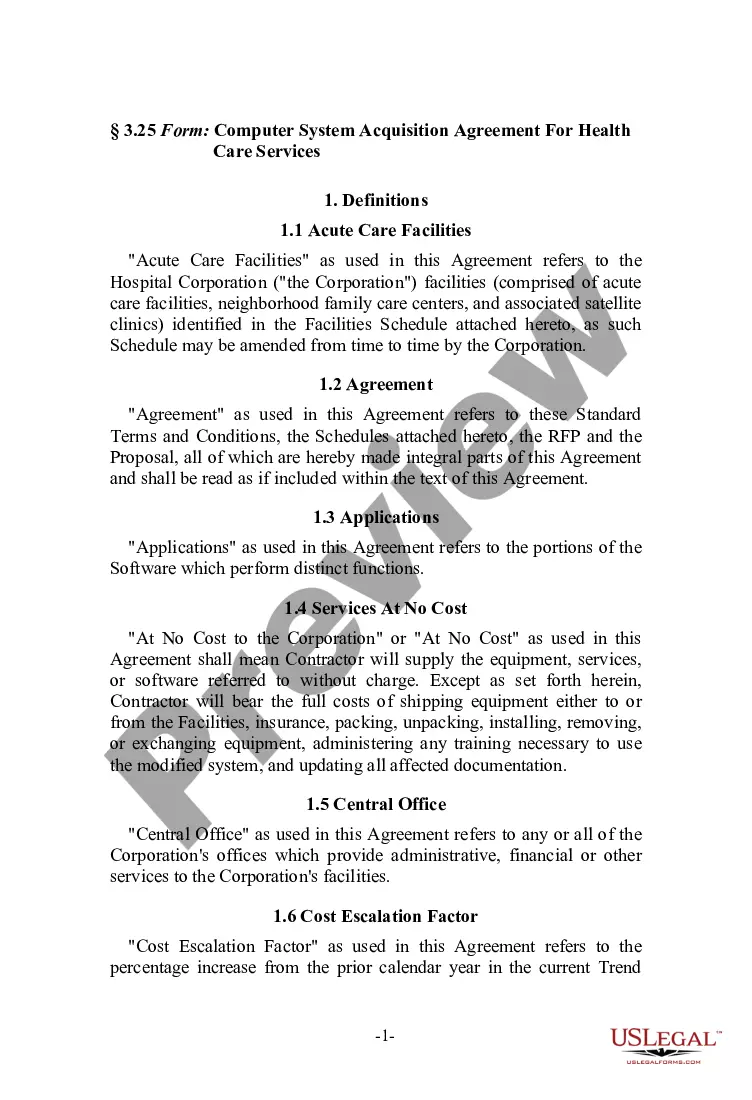

Partnerships in Georgia must complete and submit the 'Application for Registration of Partnership' form to the Georgia Secretary of State. This form officially registers your partnership and includes essential details such as the partnership name, address, and names of partners. For easy access to this form and other related documents, you can visit US Legal Forms. This platform can streamline your experience with the Georgia Partnership Data Summary and help you stay compliant.

To form a partnership in Georgia, you start by deciding on the structure of your partnership, whether it's a general partnership or a limited partnership. It is essential to draft a partnership agreement that outlines each partner’s roles, responsibilities, and profit-sharing arrangements. Once you have your agreement, you will need to file the appropriate documents with the Georgia Secretary of State. Utilizing the resources provided by US Legal Forms can simplify this process and ensure your Georgia Partnership Data Summary is completed correctly.

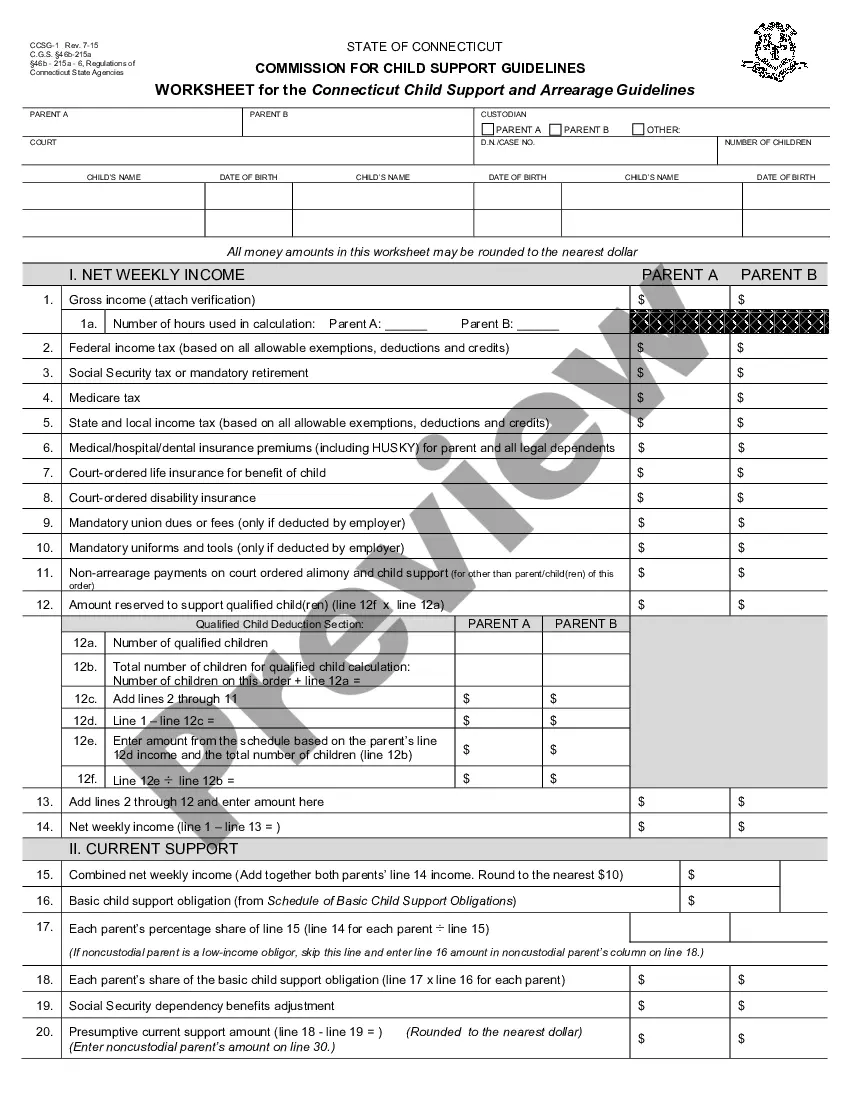

Reporting partnership distributions requires you to document how much each partner is receiving in accordance with your partnership agreement. Generally, each partner should report their share of the distributions on their individual tax returns. Keep track of these distributions, as they are important elements of your Georgia Partnership Data Summary that impact both state and federal taxes.