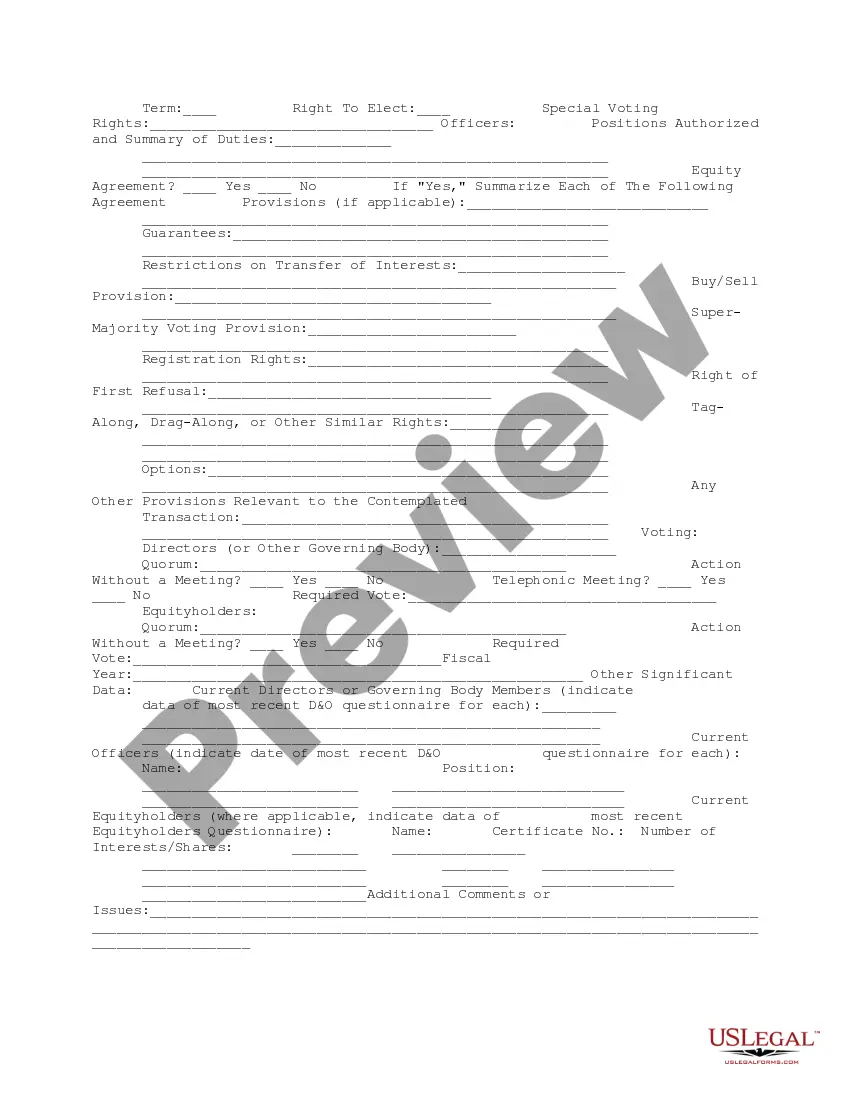

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Georgia Company Data Summary

Description

How to fill out Company Data Summary?

If you wish to be thorough, obtain, or generate official document templates, utilize US Legal Forms, the largest collection of legal documents, which can be accessed online.

Leverage the site’s straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are categorized by groups and states, or keywords.

Every legal document template you purchase is yours permanently.

You have access to every document you have acquired in your account. Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to acquire the Georgia Company Data Overview in a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Georgia Company Data Overview.

- You can also access forms you have previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct region/country.

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions in the legal document template.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Georgia Company Data Overview.

Form popularity

FAQ

Yes, you can view a company’s articles of incorporation in Georgia. By using the Georgia Company Data Summary, you can search for any registered business and access their incorporation documents. This feature enables you to gather important information about the company's structure and operations.

An annual report for an LLC in Georgia is a required document that updates the state on your business's information, such as ownership and address. This report contributes to the Georgia Company Data Summary ensuring your records remain accurate and up to date. Filing it on time helps maintain your good standing with the state.

To look up a business in Georgia, start by visiting the Georgia Secretary of State's website. You can use the Georgia Company Data Summary to input the business name or entity ID. This search will provide you with comprehensive details, including the company’s status, registered agent, and filing history.

Yes, you can find your articles of organization online through the Georgia Secretary of State's website. By accessing the Georgia Company Data Summary, you can easily search for your business information. This resource allows you to view and download your company’s records at your convenience.

If your LLC does not file an annual report in Georgia, it risks administrative dissolution. This means your business could lose its legal status, making it impossible to operate legally in the state. To prevent this from happening, make sure to file your annual report on time and maintain your Georgia Company Data Summary.

Yes, filing an annual report is necessary for all LLCs in Georgia. This requirement helps the state keep accurate records about your business. Additionally, it updates your Georgia Company Data Summary, ensuring that your entity information remains current and accessible.

In Georgia, LLCs are required to file an annual report. This report is essential for maintaining your business status and must be filed with the Secretary of State. By submitting your annual report, you help ensure your Georgia Company Data Summary is updated, keeping your LLC in good standing.

If you fail to renew your LLC in Georgia, your business could face administrative dissolution. This means you may lose your legal protection and the right to conduct business in the state. To avoid this setback, ensure you keep track of renewal deadlines and maintain your Georgia Company Data Summary to stay compliant.

Performing a GA corporation search is straightforward. You can access the Georgia Secretary of State's corporate database online, where you can input the name of the entity you are searching for. This search will provide you with a Georgia Company Data Summary that includes details such as the LLC's status, registered agent, and formation date.

If you don't file an annual report for your LLC, you risk your company being marked as inactive or even dissolved. This can lead to complications in maintaining your business status and accessing state services. It’s crucial to keep your Georgia Company Data Summary current to avoid any disruptions in your business operations.