Georgia Personnel Status Change Worksheet

Description

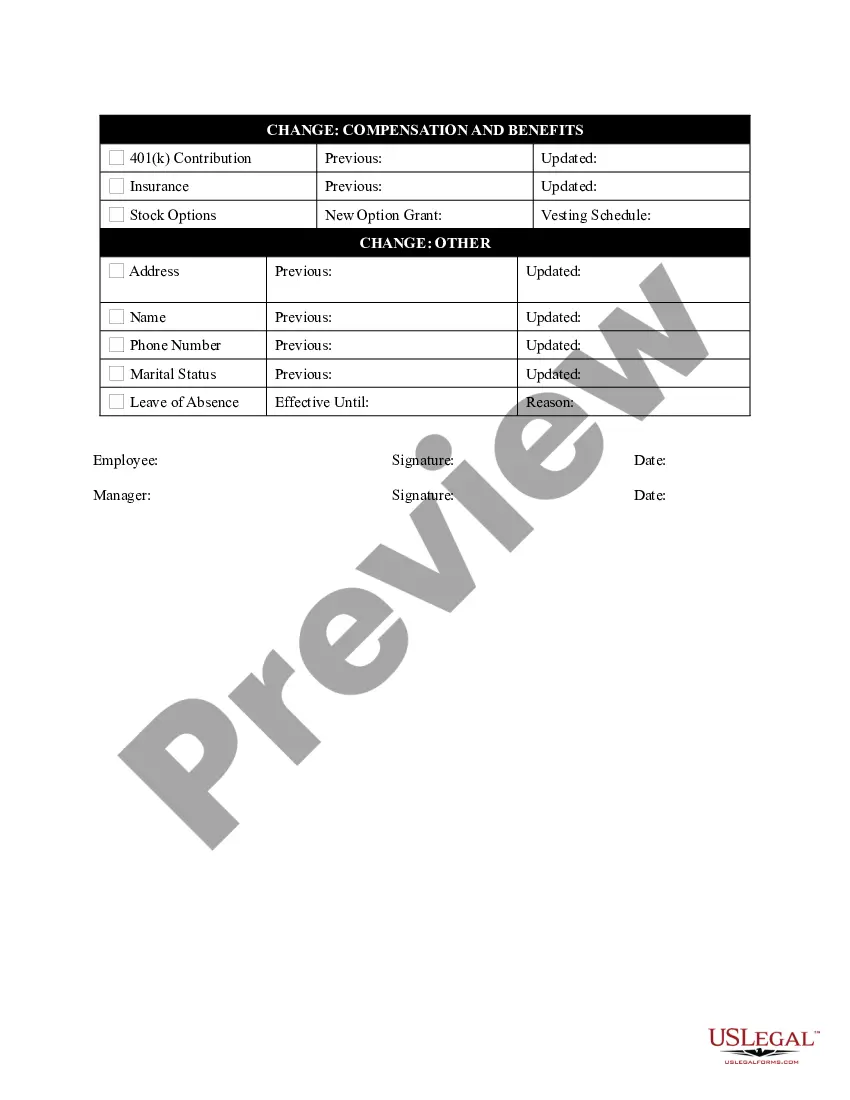

How to fill out Personnel Status Change Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can find thousands of documents for business and personal use, organized by categories, states, or keywords. You can locate the latest versions of documents such as the Georgia Personnel Status Change Worksheet within moments.

If you have an account, Log In and download the Georgia Personnel Status Change Worksheet from the US Legal Forms library. The Download button will appear on every document you view. You have access to all previously saved documents from the My documents section of your account.

If you are happy with the document, confirm your choice by clicking the Get now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

Complete the payment process. Use your Visa or Mastercard or PayPal account to finalize the transaction. Select the format and download the document to your device. Make edits. Fill out, modify, and print and sign the saved Georgia Personnel Status Change Worksheet.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

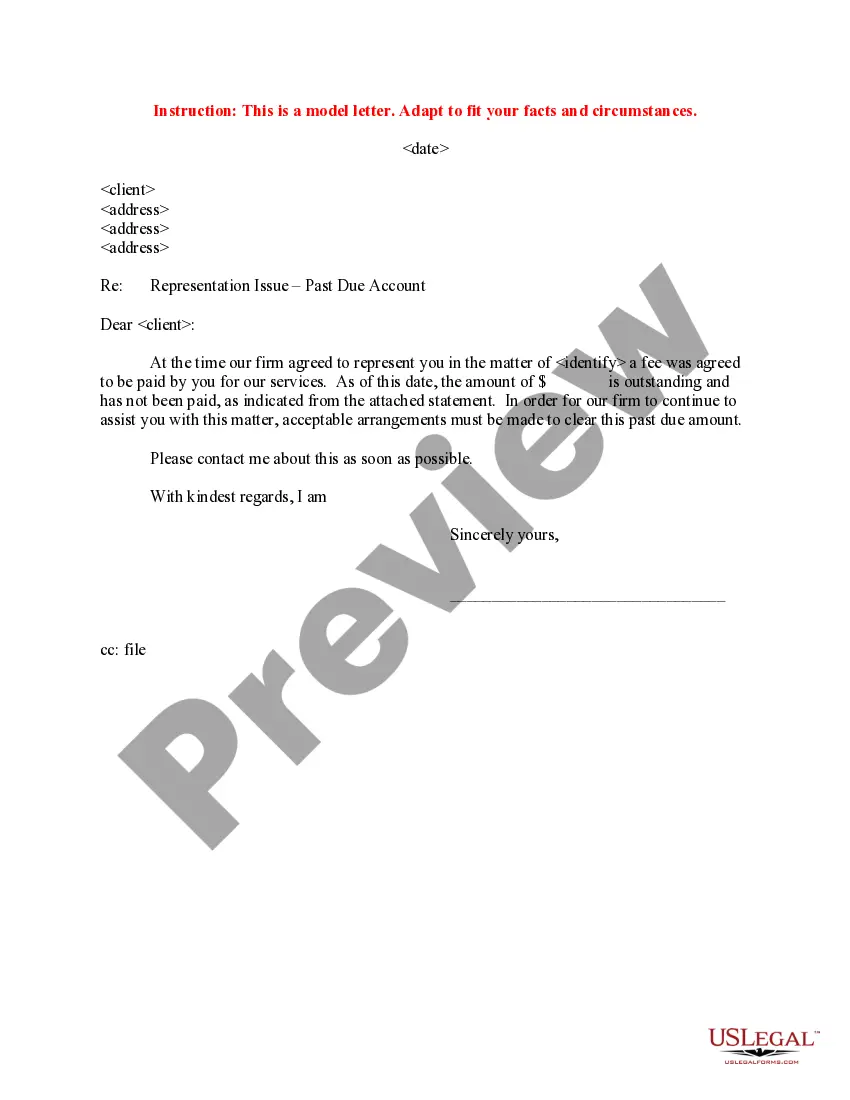

- Ensure you have selected the correct document for your city/county. Click on the Preview button to review the document's content.

- Read the document details to make sure that you have selected the appropriate document.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

The married filing status allowances on the G-4 form allow you to indicate whether you and your spouse are filing a joint tax return or filing separately. Married taxpayers claim allowances using either Lines 3B, 3C or 3D.

If one spouse is a resident and one is a part-year resident or nonresident, enter 3 in the residency status box and complete Form 500, Schedule 3 to calculate Georgia taxable income. Part-year Residents.

How to Complete the W-4 Tax FormDetermine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently disabled. Retirement income includes items such as: interest, dividends, net rentals, capital gains, royalties, pensions, annuities, and the first $4000.00 of earned income.

Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Initially, there were six new schedules, but the IRS has since consolidated these down to three: Schedule 1 for additional income and "above the line" deductions. Schedule 2 for additional taxes. Schedule 3 for additional credits and payments.

According to Liberty Tax declaring one as your tax withholding is a good bet if you're single and you work just your 9 to 5. This allowance could get you a refund. If you claim zero, the most will be taken out of your paycheck and you will most likely get a refund.