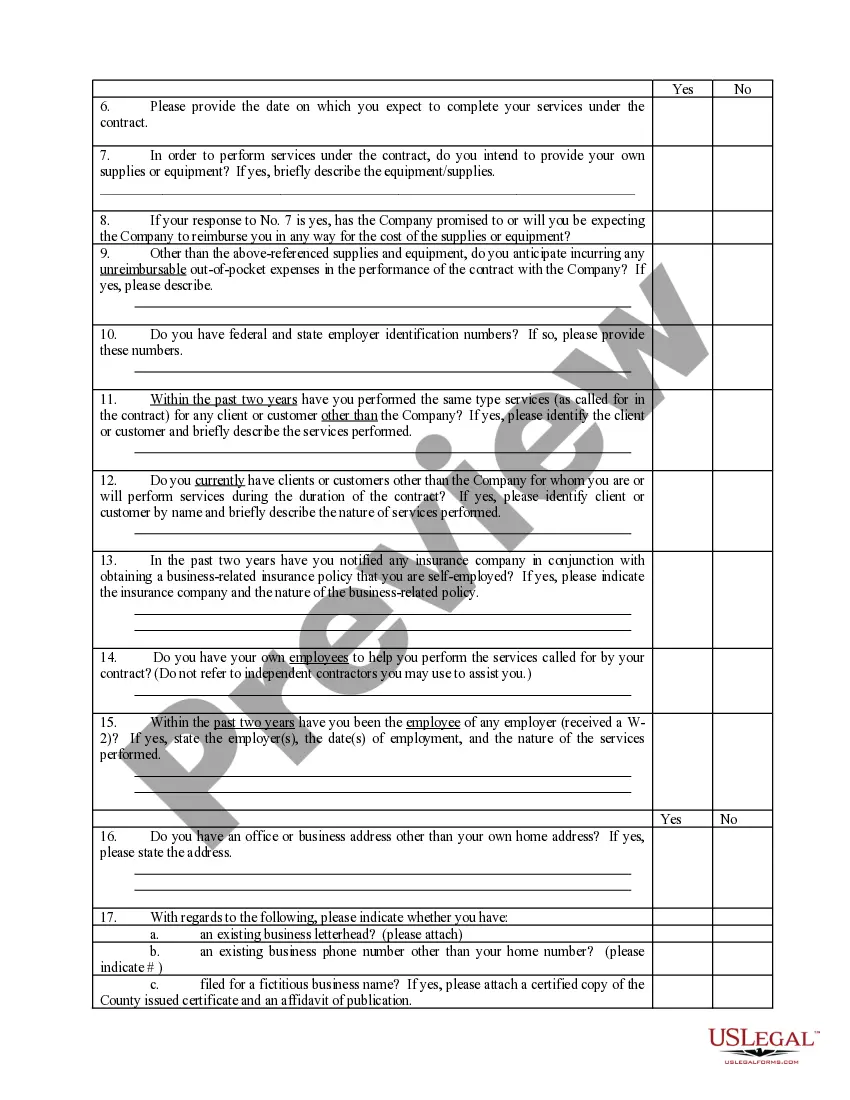

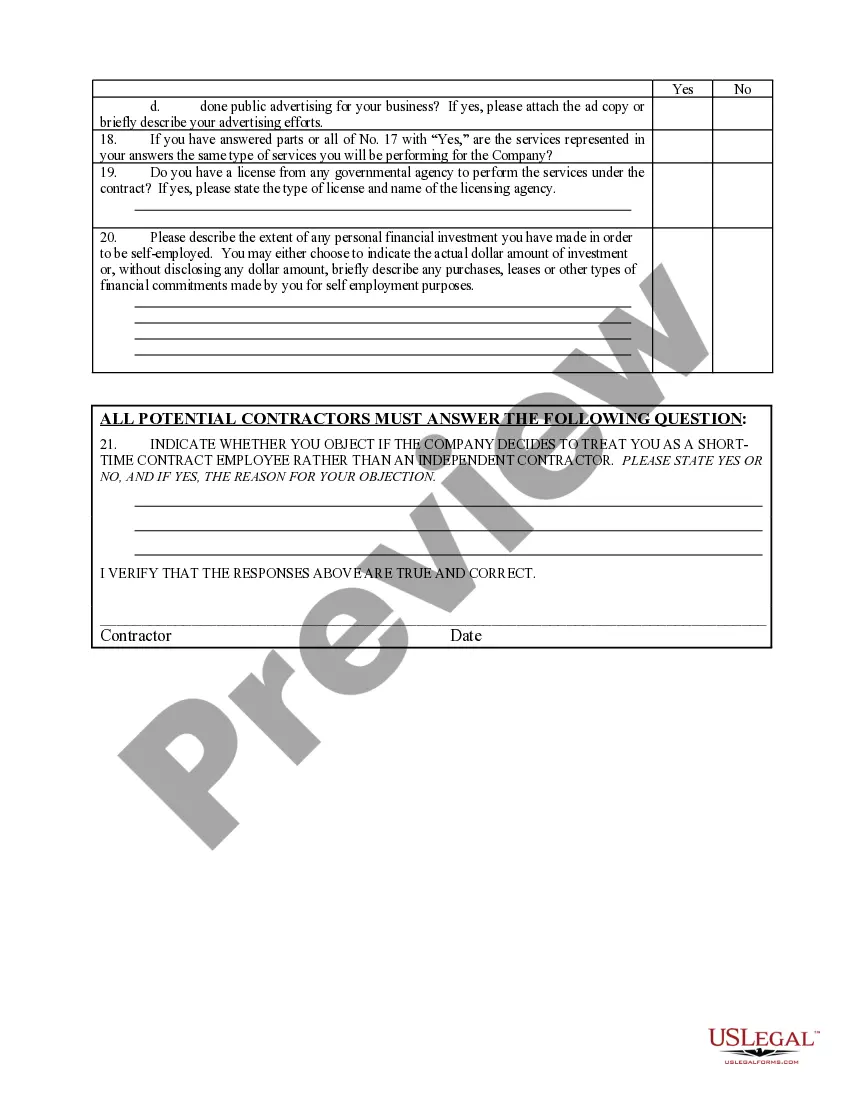

Georgia Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

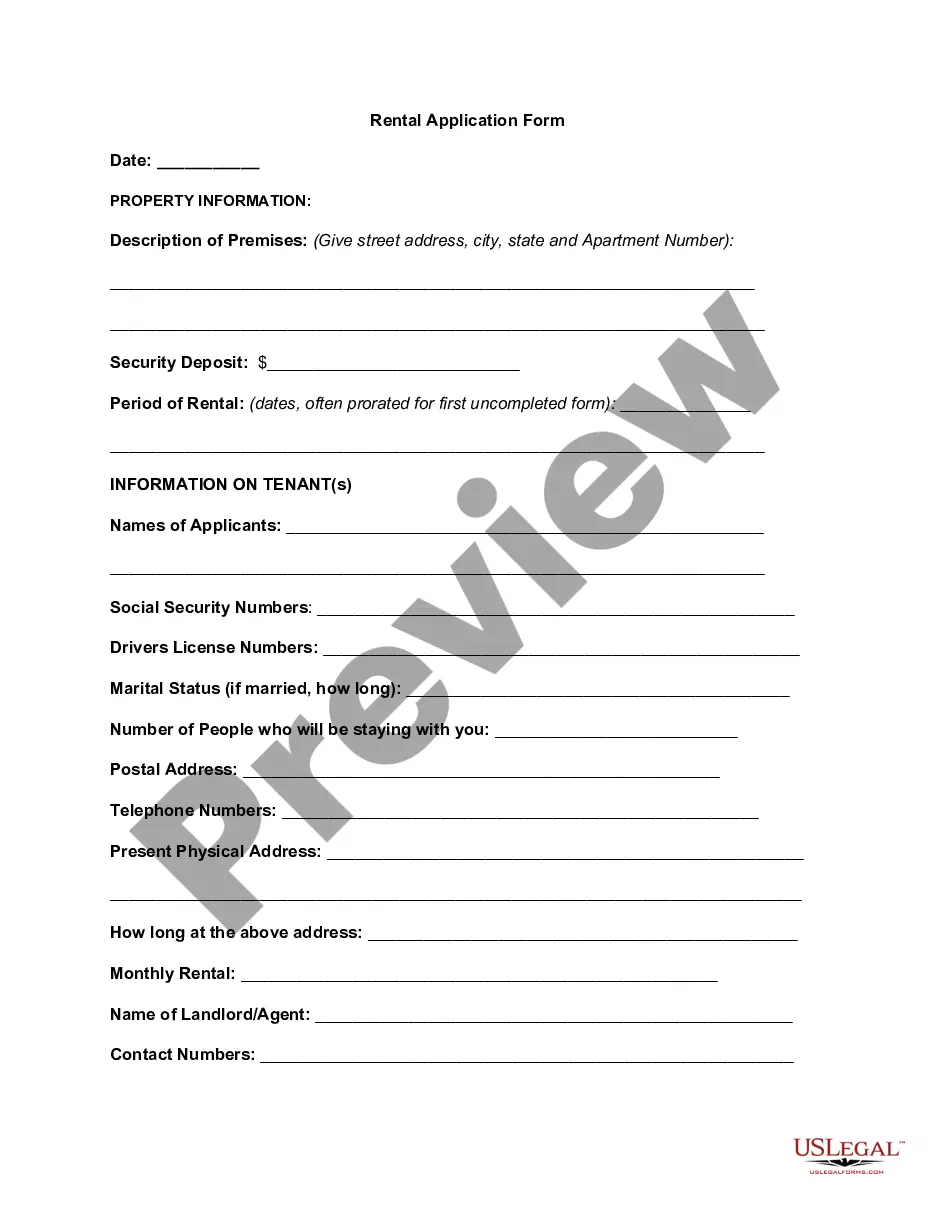

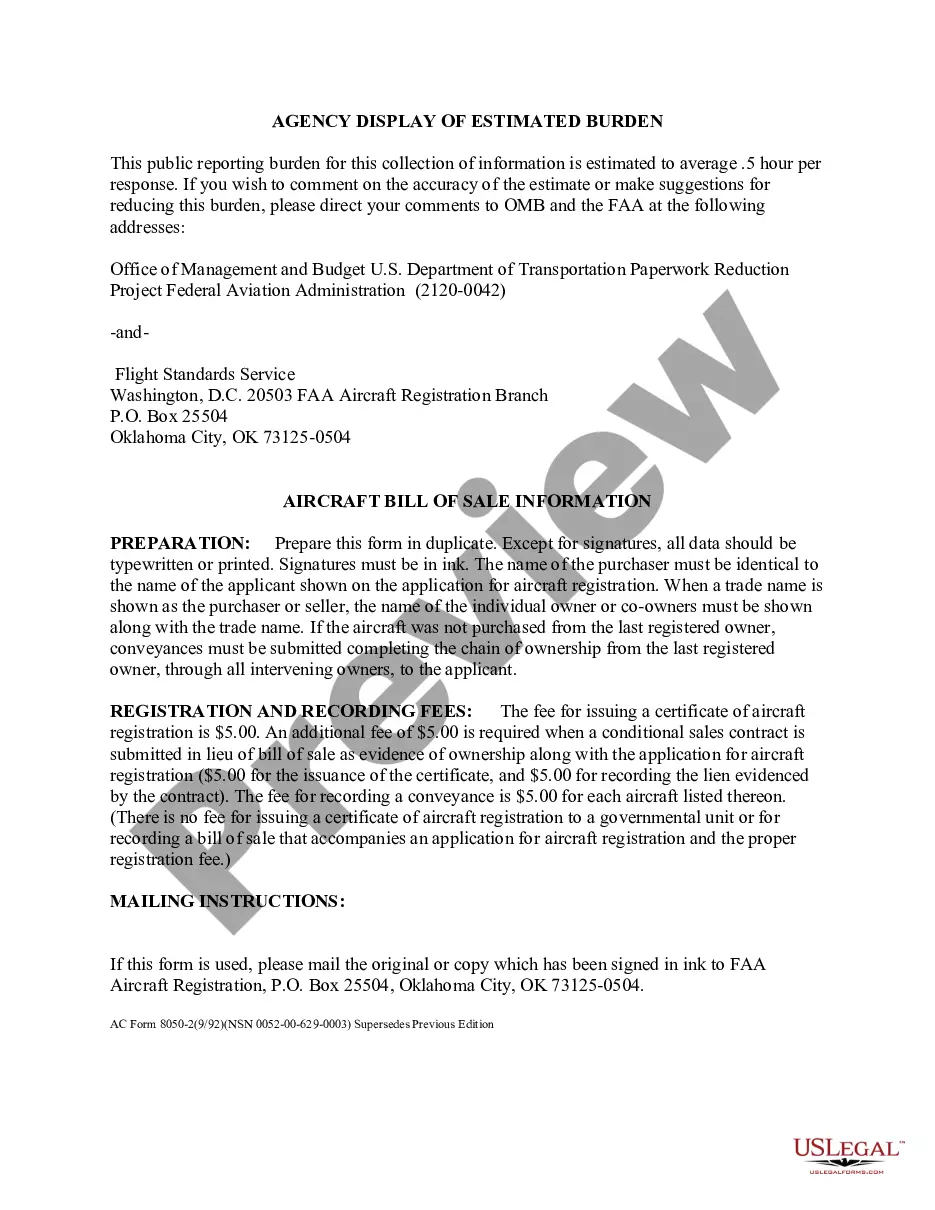

You can spend hours online trying to locate the valid document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of valid documents that are reviewed by experts.

You can download or print the Georgia Self-Employed Independent Contractor Questionnaire from my services.

You can download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of valid forms. Utilize professional and state-specific templates to handle your business or personal needs.

- If you possess a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Georgia Self-Employed Independent Contractor Questionnaire.

- Every valid document template you acquire is yours indefinitely.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/city of preference.

- Review the form information to make sure you've chosen the right one.

Form popularity

FAQ

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

Like many other states, you do indeed need a contracting license to work as a contractor in Georgia.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The test is called the ABC Test, and it's included in federal legislation called the Protecting the Right to Organize Act (commonly known as the PRO Act) that's currently being considered by Congress. If freelancers or independent contractors pass the test, they can continue working independently.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

Applicable Test (ABC Test)Georgia uses a modified ABC test for unemployment insurance purposes.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Like many other states, you do indeed need a contracting license to work as a contractor in Georgia.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.