This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Agreement to Extend Debt Payment Terms

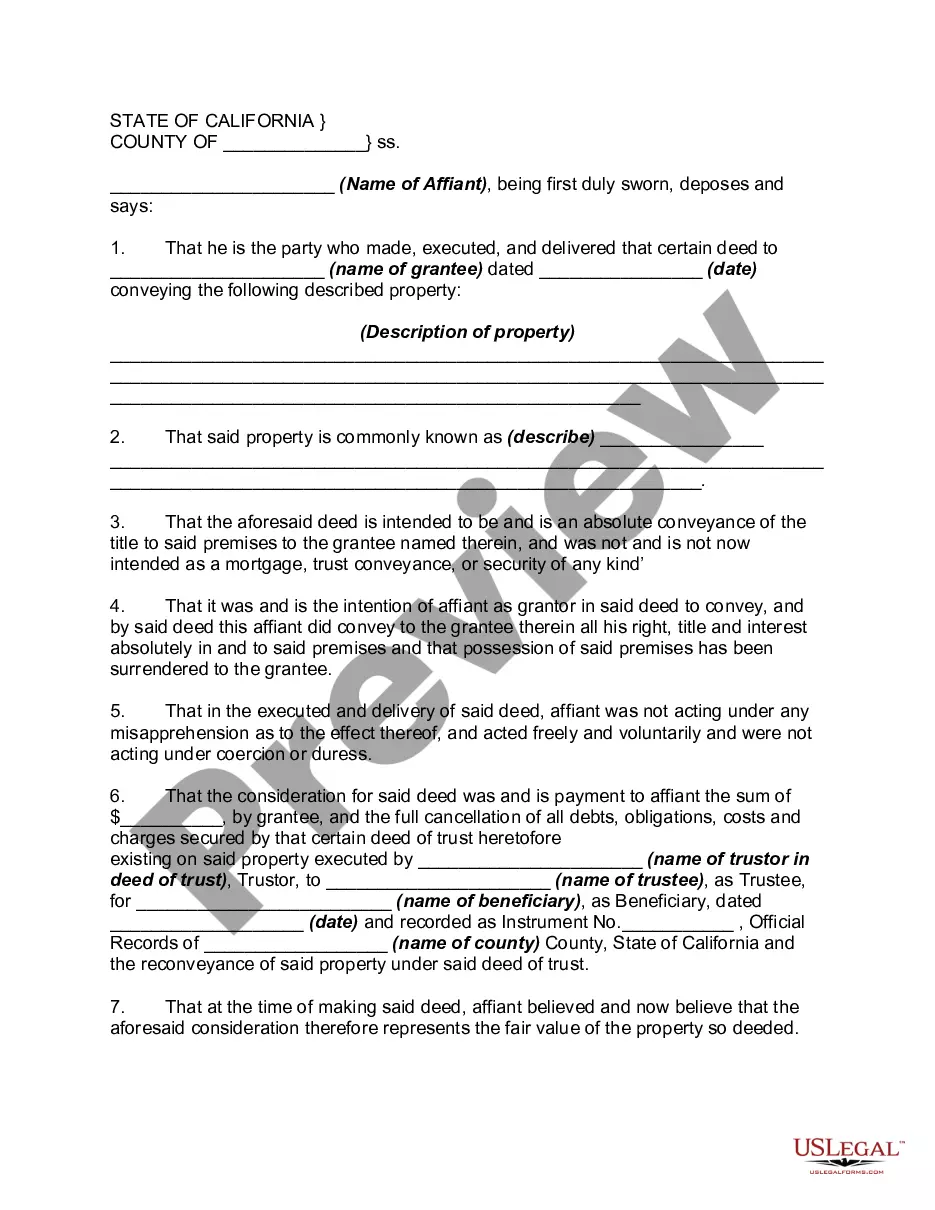

Description

How to fill out Agreement To Extend Debt Payment Terms?

If you need to total, obtain, or print authorized document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the website's user-friendly search feature to find the documents you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to find the Georgia Agreement to Extend Debt Payment Terms with just a few clicks.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Georgia Agreement to Extend Debt Payment Terms.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview option to view the form's content. Remember to read the details.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, select the Acquire now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Georgia Agreement to Extend Debt Payment Terms.

- Each legal document template you purchase is yours forever. You will have access to every form you acquired in your account. Go to the My documents section and select a form to print or download again.

- Compete and obtain, and print the Georgia Agreement to Extend Debt Payment Terms with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

Yes, the tax deadline can be extended under certain circumstances in Georgia. If you find yourself needing more time, you should look into a Georgia Agreement to Extend Debt Payment Terms to help meet your obligations without rushing. This can ease your financial burden while ensuring you remain compliant with state tax laws.

Georgia taxpayers often have until April 18 to file their taxes, but specific extensions can apply. If you require more time, consider applying for a Georgia Agreement to Extend Debt Payment Terms, which can provide the flexibility you need. Always check the latest updates from the state for the most accurate deadlines.

The IRS extends the tax deadline for various states during specific circumstances such as natural disasters. However, Georgia is among states that may require separate agreements, like a Georgia Agreement to Extend Debt Payment Terms, to ensure compliance. Stay informed about your state's regulations to maximize your benefits.

Yes, you can establish a payment plan if you owe taxes to Georgia. Using a Georgia Agreement to Extend Debt Payment Terms allows you to negotiate a manageable payment schedule, enabling you to settle your debt over time. This option can provide considerable relief and help you avoid immediate financial strain.

To request a payment plan, you will need to fill out the specific form provided by the Georgia Department of Revenue. This form typically includes details about your tax liabilities and your proposed payment schedule. Using the correct form is crucial for a smooth process under the Georgia Agreement to Extend Debt Payment Terms.

Yes, the Georgia Department of Revenue can garnish wages to collect unpaid taxes. If you fall behind on your tax obligations, they may take this step after thorough notifications. This emphasizes the importance of understanding the Georgia Agreement to Extend Debt Payment Terms to avoid such measures.

You can request a payment plan with the Georgia Department of Revenue directly through their online services or by submitting a written request. Be sure to include details about your tax situation and the payment terms you propose. This process is crucial for aligning with the Georgia Agreement to Extend Debt Payment Terms.

To request a payment plan for your owed taxes, you'll need to complete the appropriate forms provided by the Georgia Department of Revenue. It's essential to be clear about your financial situation, as this helps in establishing terms that work for both parties, reflecting the Georgia Agreement to Extend Debt Payment Terms.

Georgia does not automatically extend the state tax deadline based on federal extensions. You must file for a separate extension with the Georgia Department of Revenue. Understanding this distinction can help you manage your obligations under the Georgia Agreement to Extend Debt Payment Terms.

To contact the Georgia Department of Revenue, you can call their customer service line directly. Alternatively, you may visit their official website for chat options or to find additional resources. Engaging with them can provide clarity on the Georgia Agreement to Extend Debt Payment Terms.