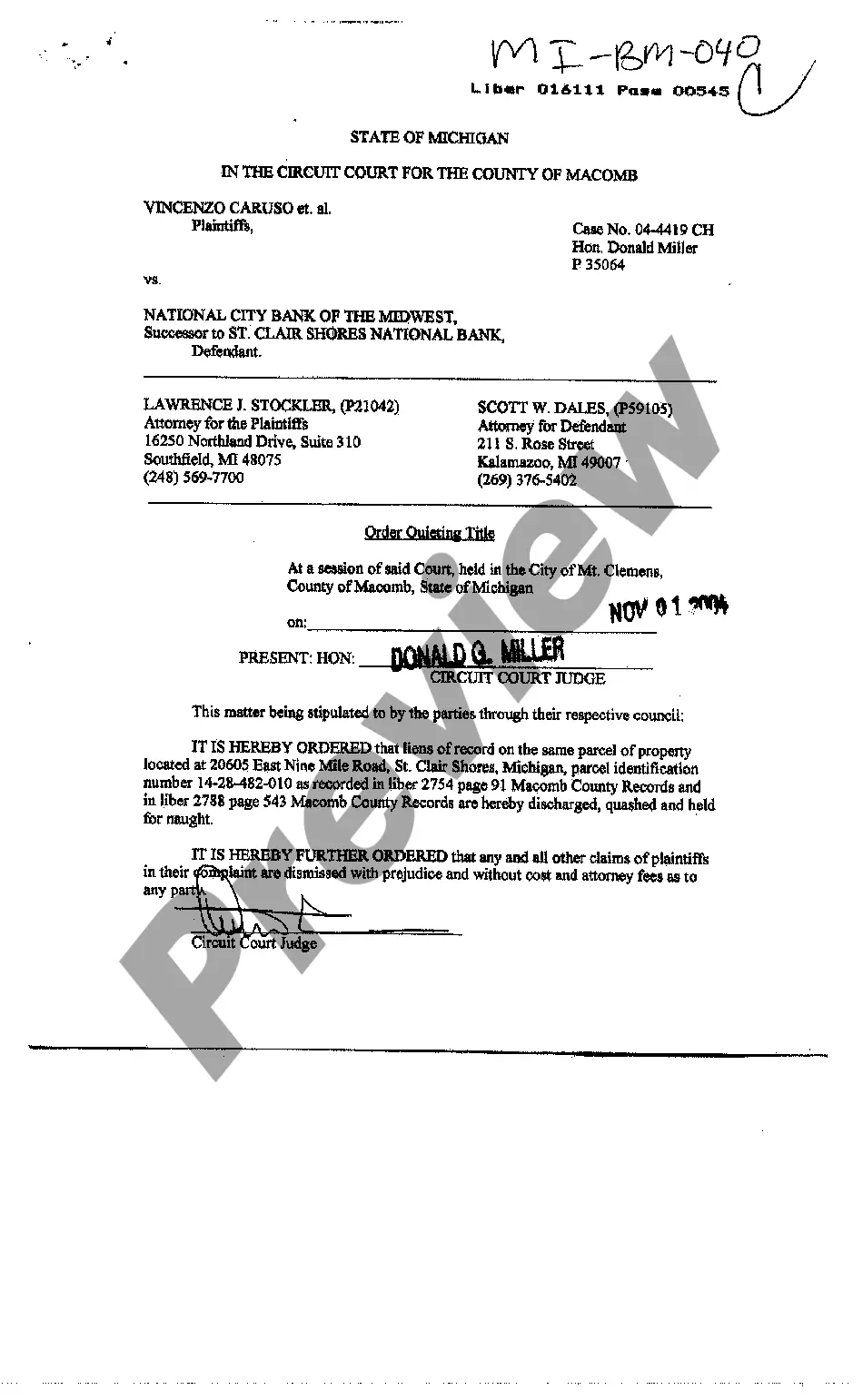

An estoppel affidavit enables a property owner, the grantor, to convey complete title of his property to the grantee so that the grantee assumes all obligations of the grantor. It can also act as a certificate in which a borrower certifies the amount owed on a mortgage loan and the rate of interest.

California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure

Description

How to fill out California Estoppel Affidavit Regarding Deed In Lieu Of Foreclosure?

If you are looking for precise California Estoppel Affidavit Pertaining to Deed in Lieu of Foreclosure samples, US Legal Forms is what you seek; obtain documents crafted and reviewed by state-licensed attorneys.

Utilizing US Legal Forms not only saves you from issues related to legal documents; additionally, you conserve time and energy, and finances!

And that's it. Within a few easy clicks, you have an editable California Estoppel Affidavit Pertaining to Deed in Lieu of Foreclosure. After you create your account, all subsequent orders will be even easier. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button visible on the form’s webpage. Then, when you need to access this template again, you'll always be able to locate it in the My documents section. Do not waste your time comparing multiple forms across different sites. Purchase accurate templates from a single reliable service!

- Initiate by completing your registration process by entering your email and creating a password.

- Follow the provided instructions to create your account and acquire the California Estoppel Affidavit Pertaining to Deed in Lieu of Foreclosure template to meet your requirements.

- Utilize the Preview tool or examine the file description (if available) to confirm that the form is the one you need.

- Verify its legality in your jurisdiction.

- Click on Buy Now to process your purchase.

- Select a suggested pricing plan.

- Create an account and make payment with your credit card or PayPal.

- Choose a suitable file format and download the form.

Form popularity

FAQ

A lender is not required to accept a deed in lieu of foreclosure, although many do. They will consider various factors, including the property's value and the borrower's financial situation. If you are navigating this process, a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can help clarify terms and protect your interests. To ensure a smooth process, consider utilizing resources from US Legal Forms, where you can access customized documents and guidance tailored to your needs.

When writing a foreclosure letter, clearly state your intention to transfer your property to the lender to avoid foreclosure. Begin by including your details, such as your name, property address, and mortgage account number. Then, outline your reasons for choosing this path and reference any discussions with the lender about a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure. Finally, request a written acknowledgment of the agreement to ensure transparency and protection for both parties.

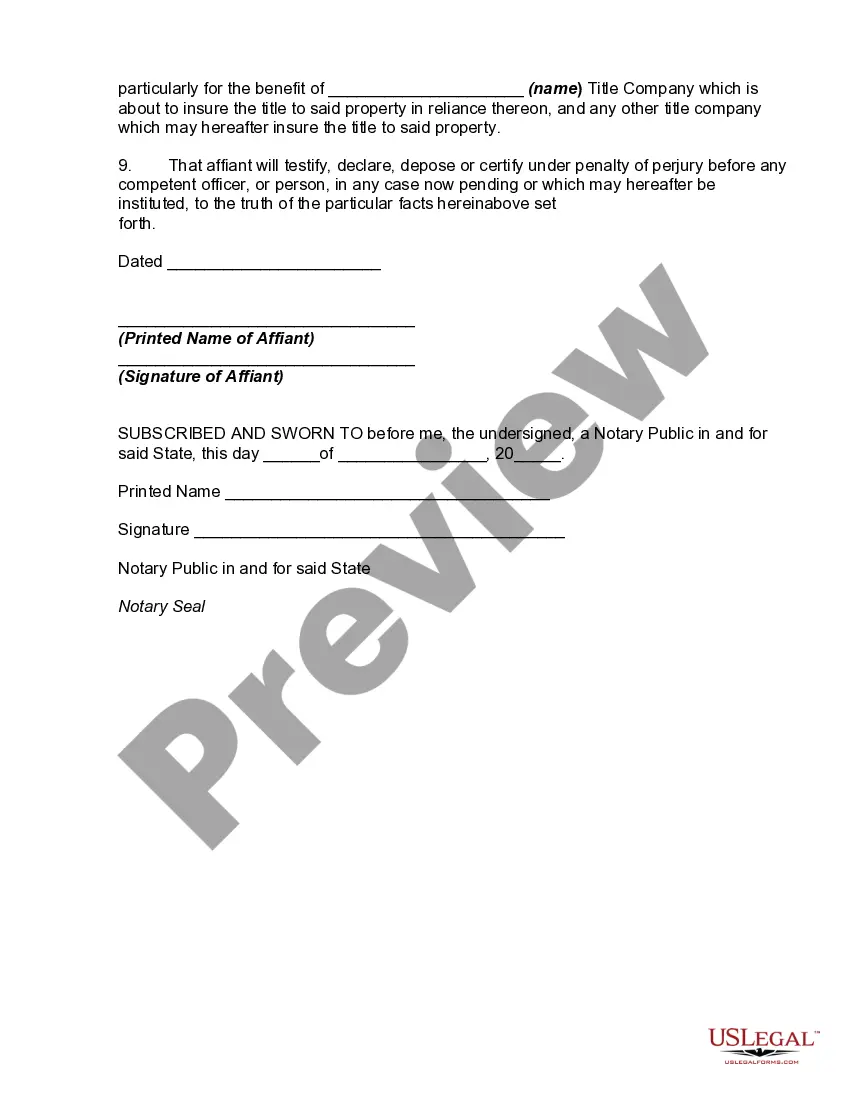

To file a deed in lieu of foreclosure, start by contacting your lender to discuss your situation and express your interest in this option. Next, gather necessary documents, including the title deed and a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, to outline the agreement between you and your lender. Once you have your documents in order, execute the deed transfer according to your state’s guidelines and ensure it is recorded with the appropriate county office.

A deed in lieu of foreclosure occurs when a homeowner transfers their property title to the lender to avoid the lengthy foreclosure process. For instance, if you owe $300,000 on your mortgage but can no longer make payments, you may negotiate with your lender to hand over the property in exchange for the cancellation of your debt. It's important to document this process, often through a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, to clarify the terms and avoid future disputes.

The biggest disadvantage for lenders regarding a deed in lieu of foreclosure is the potential for accelerated losses. When they accept a deed, they may acquire a property that has decreased in value due to neglect or market conditions. Additionally, lenders might face legal and administrative costs during the transfer process. Employing a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can mitigate some of these risks by providing clear terms and responsibilities for all parties involved.

One significant disadvantage of a deed in lieu of foreclosure is that it may not erase the borrower’s obligation to repay the remaining debt. In some cases, lenders still seek deficiency judgments after the deed transfer. This process can result in unexpected financial burdens for the borrower. For clarity and protection, incorporating a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure becomes essential, as it outlines the agreed terms and conditions clearly.

A major disadvantage to lenders when accepting a deed in lieu of foreclosure is the potential loss of collateral value. This process can lead to longer timelines for recovering owed amounts, depending on the condition of the property. Moreover, lenders may face difficulties in reselling the property, especially if it requires significant repairs. Utilizing a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can help clarify the terms and responsibilities, reducing confusion during this transition.

To execute a deed in lieu of foreclosure effectively, start by discussing the process with your lender and ensuring they agree to this alternative. Prepare and present all required documents, particularly the California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, which clarifies your intentions. Finally, sign the deed and have it notarized, so it can be recorded in public records, finalizing the transfer.

To execute a deed in lieu of foreclosure, you must first reach an agreement with your lender. Gather all necessary documents, including the California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, and submit them for approval. Once your lender accepts the terms, sign the deed in front of a notary, ensuring all parties understand the transaction implications.

One disadvantage of a deed in lieu of foreclosure is that it may impact your credit score significantly. This can lead to difficulties in securing future loans or mortgages. Additionally, be aware that lenders will typically require a California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, which may require additional paperwork and consultation.