Georgia Conveyance of Deed to Lender in Lieu of Foreclosure

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Are you within a place where you require files for sometimes organization or personal uses just about every working day? There are tons of legitimate file web templates accessible on the Internet, but getting types you can depend on isn`t effortless. US Legal Forms offers a large number of develop web templates, much like the Georgia Conveyance of Deed to Lender in Lieu of Foreclosure, which are created to meet state and federal requirements.

When you are currently knowledgeable about US Legal Forms internet site and possess your account, basically log in. Following that, you are able to down load the Georgia Conveyance of Deed to Lender in Lieu of Foreclosure design.

Unless you have an accounts and wish to start using US Legal Forms, follow these steps:

- Find the develop you want and make sure it is for your appropriate town/county.

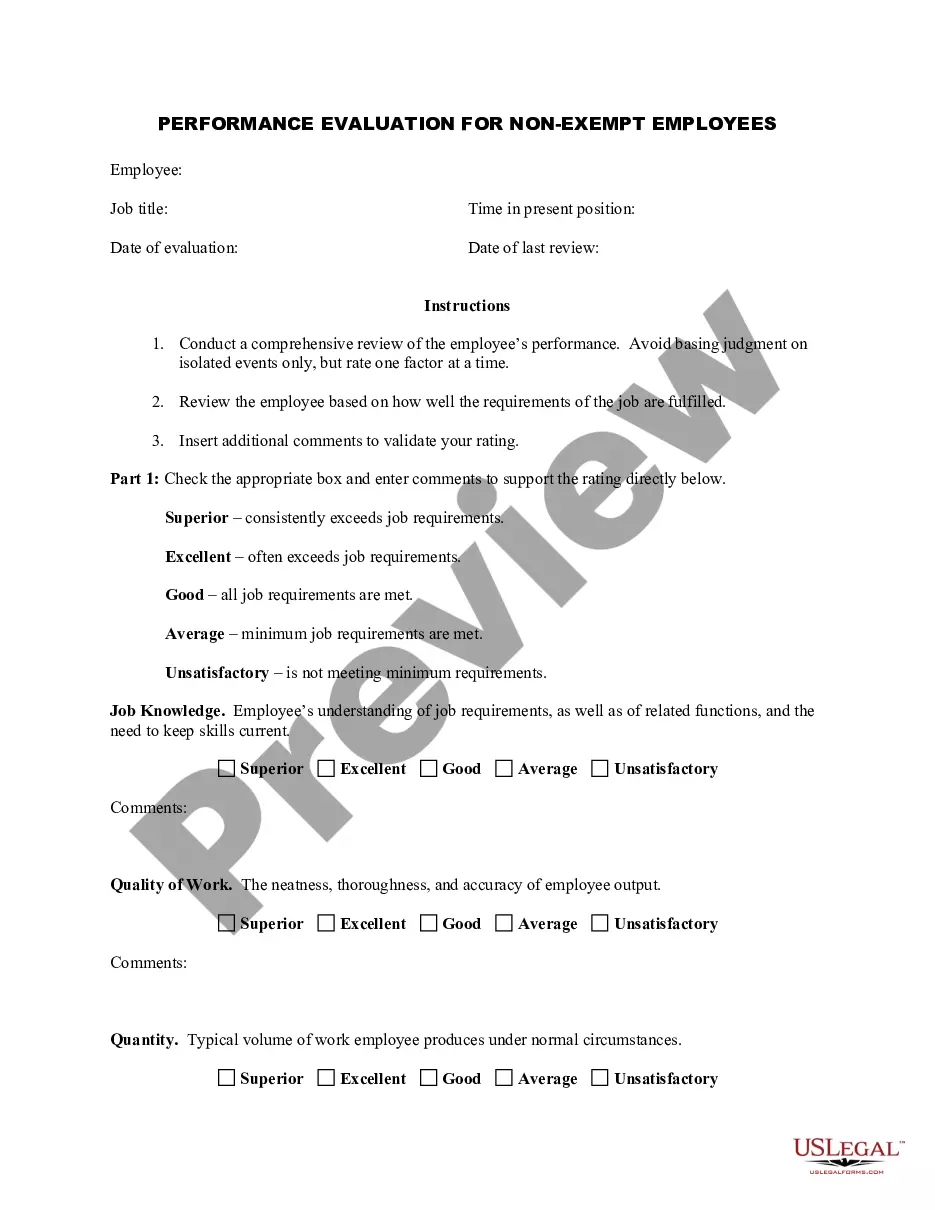

- Utilize the Preview key to examine the shape.

- Look at the description to actually have chosen the right develop.

- When the develop isn`t what you are seeking, utilize the Research area to find the develop that suits you and requirements.

- If you find the appropriate develop, simply click Purchase now.

- Choose the costs program you desire, fill out the necessary information and facts to generate your money, and purchase an order utilizing your PayPal or credit card.

- Select a hassle-free file structure and down load your duplicate.

Locate every one of the file web templates you have purchased in the My Forms menus. You can aquire a more duplicate of Georgia Conveyance of Deed to Lender in Lieu of Foreclosure whenever, if necessary. Just select the needed develop to down load or printing the file design.

Use US Legal Forms, the most considerable variety of legitimate kinds, to conserve some time and steer clear of blunders. The services offers professionally made legitimate file web templates which you can use for an array of uses. Make your account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

Yes, a deed in lieu of foreclosure harms your credit, but less so than a foreclosure would. If you obtain a deed in lieu, your mortgage will be listed on your credit reports as closed with a zero balance, but not paid in full. This is a negative entry that will remain on your credit report for up to seven years.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

Disadvantages of a deed in lieu of foreclosure You will have to surrender your home sooner. You may not pursue alternative mortgage relief options, like a loan modification, that could be a better option. You'll likely lose any equity in the property you might have.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process.

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt. Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding.

A deed in lieu of foreclosure is a legal document signed by the homeowner to voluntarily transfer ownership of the property to the lender in exchange for a release from the loan.