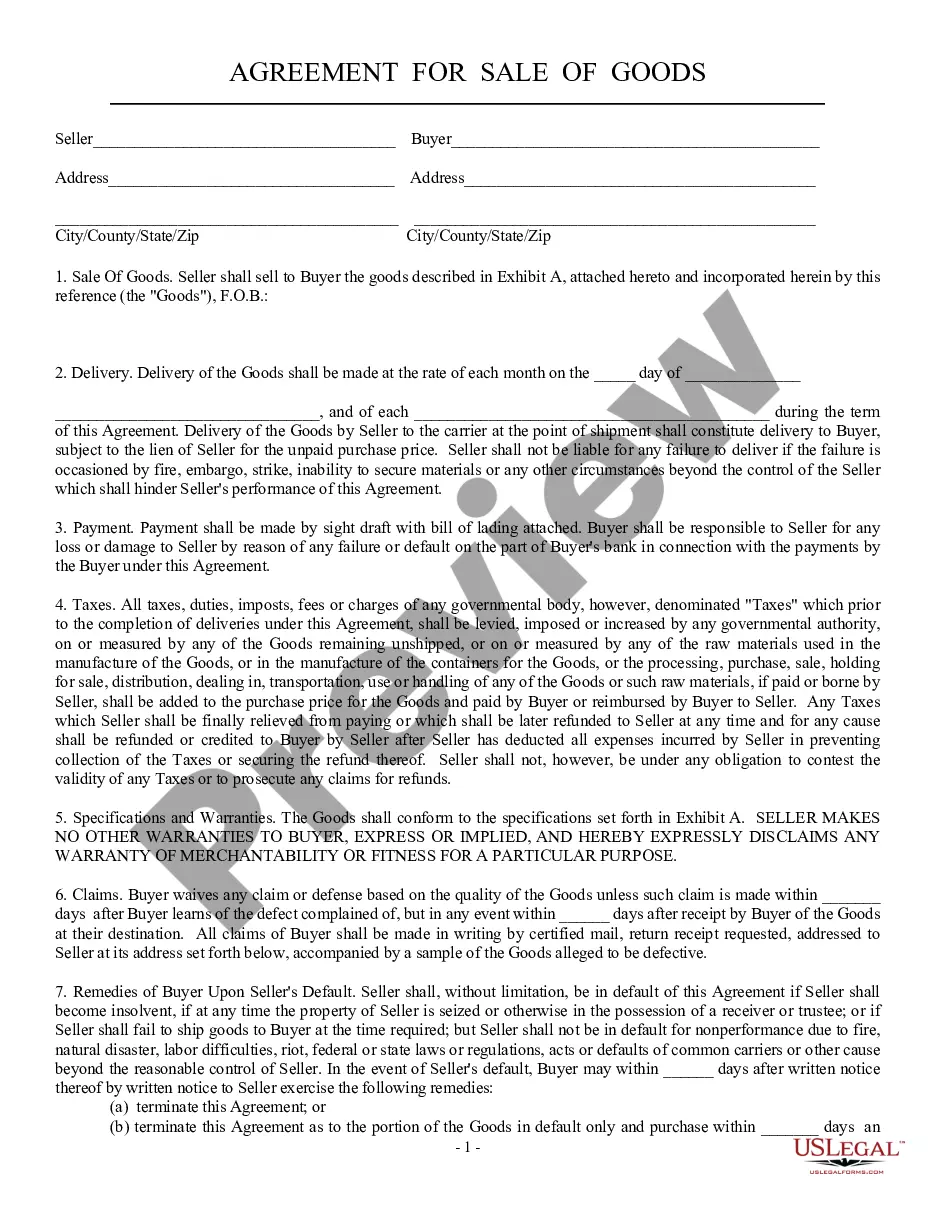

Georgia Sale of Goods, General

Description

How to fill out Sale Of Goods, General?

Finding the correct official document template can be a challenging task. Naturally, there is a wide array of designs available online, but how do you secure the official form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Georgia Sale of Goods, General, which can serve both business and personal purposes.

All of the documents are reviewed by experts and comply with state and federal regulations.

If the form does not satisfy your requirements, utilize the Search bar to find the correct form. Once you are certain the form is appropriate, click the Purchase now button to obtain the document. Choose your preferred pricing plan and input the necessary information. Create your account and complete your payment using your PayPal account or credit card. Select the file format and download the official document template to your device. Fill out, amend, print, and sign the acquired Georgia Sale of Goods, General. US Legal Forms represents the largest repository of official templates where you can discover a variety of document designs. Take advantage of the service to download professionally crafted paperwork that adhere to state requirements.

- If you are already a registered user, Log In to your account and click on the Obtain button to retrieve the Georgia Sale of Goods, General.

- You can use your account to review the official forms you have purchased previously.

- Visit the My documents section of your account to acquire another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the proper form for your region/state.

- You can preview the form using the Preview button and review the form description to confirm it is the right one for your needs.

Form popularity

FAQ

Retail sales tax in Georgia refers to the tax imposed on the sale of tangible personal property to consumers. Generally, it is set at 4% for the state, with local municipalities potentially adding additional taxes. The combined rates mean that retail businesses need to ensure they apply the correct total tax when selling goods. Utilizing solutions like US Legal Forms can streamline this process and keep your business compliant.

Local general sales tax rates in Georgia differ by county and city. These local rates typically range from 0% to 4%, adding to the state sales tax. Therefore, it is crucial to check the specific local tax requirements where you conduct your business. Understanding these rates helps in the accurate assessment of the total taxes on each sale of goods, general.

The general sales tax for Georgia is set at 4%. This state-wide tax applies to most retail sales of goods, including tangible personal property. In addition to the state tax, local governments may impose their own sales taxes, which can vary. To compute the total sales tax, you need to include both the state and any applicable local rates.

To claim general sales tax in Georgia, businesses must file and remit their collected sales tax returns to the Georgia Department of Revenue. This includes detailing all taxable and non-taxable sales. For assistance, consider using uslegalforms, which can provide the necessary templates and guidance for managing tax claims under the Georgia Sale of Goods, General.

In Georgia, certain services and products are not taxed, such as unprepared food, prescription drugs, and some medical devices. Understanding the full spectrum of exclusions is vital for anyone involved in the Georgia Sale of Goods, General, helping you to accurately assess taxable versus non-taxable sales.

Yes, if you sell tangible personal property in Georgia, you must register for a sales tax permit. This registration enables you to collect and remit the appropriate sales taxes. Utilizing platforms like uslegalforms can streamline your registration process and assist with compliance related to the Georgia Sale of Goods, General.

Certain items are exempt from sales tax in Georgia. Exemptions often include groceries, prescription medicines, and some educational materials. Familiarizing yourself with these exemptions can help you navigate the complexities of the Georgia Sale of Goods, General, optimizing your tax liabilities.

In Georgia, most tangible items sold are subject to the general sales tax. This includes goods such as clothing, electronics, and many household items. When engaging in the Georgia Sale of Goods, General, it is crucial to understand which items incur sales tax, as this can impact your overall sales strategy.

Currently, there are five states in the U.S. that do not impose a general sales tax. These states are Alaska, Delaware, Montana, New Hampshire, and Oregon. It's important to understand how the absence of a general sales tax could affect your business operations, especially if you're considering transactions related to the Georgia Sale of Goods, General.

An example of a goods sale could be a consumer purchasing a laptop from an electronic store. In this transaction, the store transfers ownership of the laptop to the buyer in exchange for payment. This scenario is a common illustration of Georgia Sale of Goods, General, and demonstrates the practical application of the legal principles involved in selling goods.