Georgia Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

You can dedicate time online seeking the legal form template that satisfies both state and federal requirements. US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can easily obtain or create the Georgia Assignment of Partnership Interest through their service.

If you already have a US Legal Forms account, you may Log In and click on the Acquire button. Then, you can complete, amend, create, or sign the Georgia Assignment of Partnership Interest. Every legal document template you receive is yours indefinitely. To access another copy of any purchased form, go to the My documents tab and click on the corresponding button.

Select the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, amend, sign, and produce the Georgia Assignment of Partnership Interest. Access and create numerous document templates through the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal requirements.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen county/region. Review the document outline to confirm that you have selected the correct form.

- If available, use the Review button to view the document template as well.

- If you wish to obtain another version of the form, use the Search section to find the template that meets your requirements.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing option you prefer, enter your details, and create your account on US Legal Forms.

- Complete the transaction. You can use a credit card or your PayPal account to purchase the legal document.

Form popularity

FAQ

Yes, you can transfer partnership interest, but it is subject to the terms of your partnership agreement. Typically, this transfer involves completing a Georgia Assignment of Partnership Interest to document the transaction. This ensures all parties are aware of the change and that the new partner can step into the role. Always consider seeking legal advice to navigate any complexities.

Yes, you can change partners in a partnership, but it usually requires consent from all existing partners. When a partner decides to leave or a new partner joins, you will need to execute a Georgia Assignment of Partnership Interest to facilitate the transition. This process helps to keep the partnership legally compliant and clear. Open communication with all partners can streamline this change.

An assignee of a partner's interest is someone who receives the rights and benefits of a partner's ownership share. In Georgia, this transition is formalized through a Georgia Assignment of Partnership Interest, which allows the assignee to enjoy profits without assuming full partner responsibilities. This arrangement can be beneficial for managing investments while retaining control within the existing partnership. Make sure to review your partnership agreement for any restrictions on assignments.

Yes, you can gift an interest in a partnership, but there are specific legal procedures to follow. The process typically involves a formal Georgia Assignment of Partnership Interest to ensure the new partner is recognized. You should also consider potential tax implications associated with the gift. Consulting with a legal expert can provide you with the right guidance.

Yes, Georgia recognizes Limited Liability Partnerships (LLPs). Registering as an LLP can offer personal liability protection for partners, which is a key benefit. To form an LLP in Georgia, partners must file a Certificate of Limited Liability Partnership with the Secretary of State. If you are contemplating a Georgia Assignment of Partnership Interest, it's particularly beneficial to structure your partnership as an LLP for added security and flexibility in ownership transitions.

To register a general partnership in Georgia, start by choosing a unique name for your partnership. Next, you must file a Partnership Registration form with the Georgia Secretary of State. It’s essential to have a clear partnership agreement that outlines each partner’s responsibilities and shares in the venture. Considering a Georgia Assignment of Partnership Interest can also help in defining how interests in the partnership can be transferred in the future.

A 751 gain, which relates to the sale of a partnership interest involving unrealized receivables or inventory, should be reported on IRS Form 1065. Partnerships must accurately reflect these gains on the K-1 forms distributed to partners. For clarity and compliance, consider using resources from USLegalForms to facilitate the reporting process.

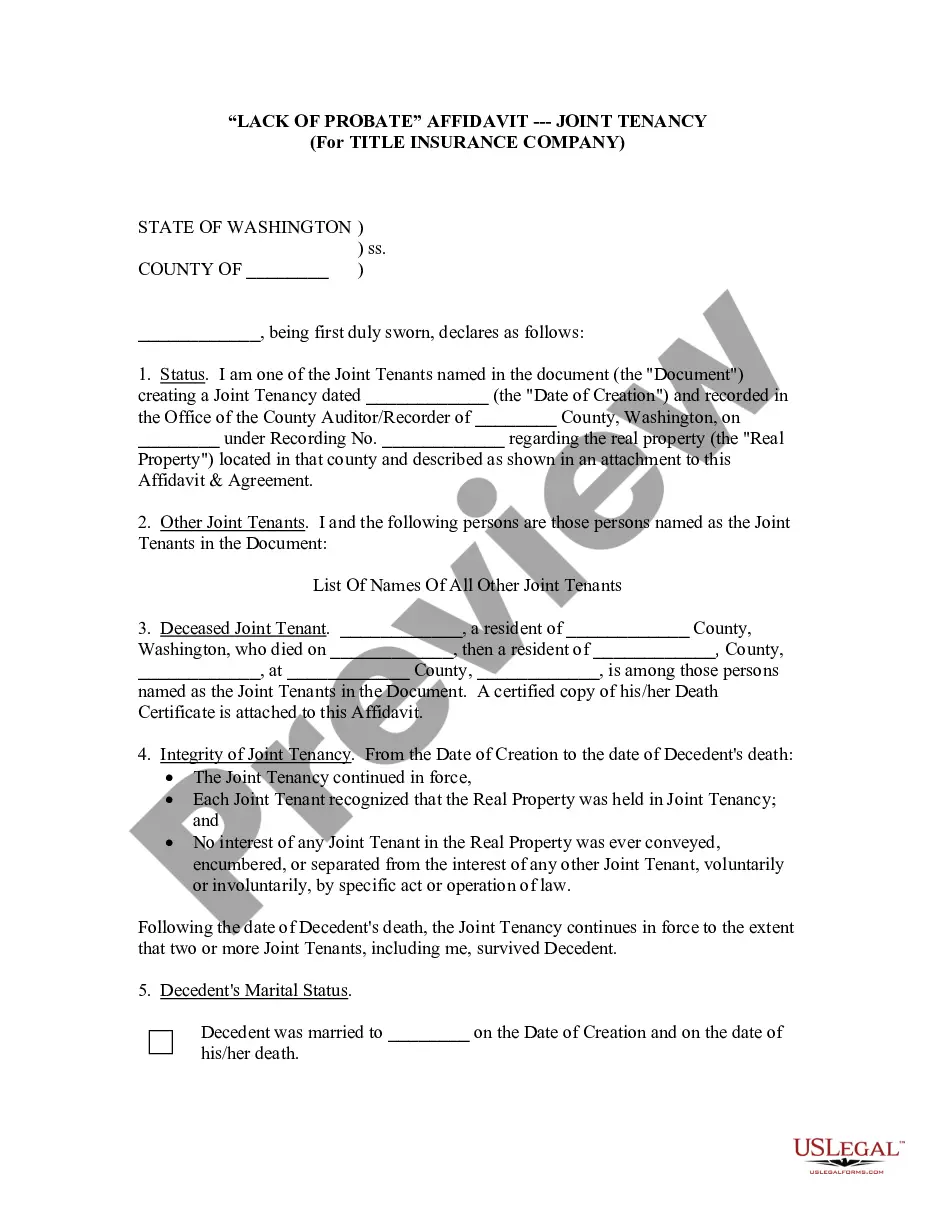

An assignment of an interest in a general partnership allows a partner to transfer their rights to profits and losses to another individual or entity. This does not change the underlying partnership structure but shifts the economic benefits. Each partnership agreement may have specific provisions, so reviewing these details is crucial for a proper assignment.

Yes, the sale of a partnership interest is reported on Schedule K-1 of IRS Form 1065. The partnership must provide the K-1 to both the departing partner and the IRS, detailing any gains or losses from the sale. Proper documentation is essential to ensure compliance with federal tax regulations and to provide transparency for all partners involved.

To transfer ownership interest in a partnership, you typically need to notify the other partners and follow the guidelines set in your partnership agreement. This process might involve drafting a formal assignment document that outlines the terms of the transfer. Using resources like USLegalForms can help ensure that all necessary legal documents are completed accurately.