Georgia Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

Have you ever been in a location where you needed papers for either business or personal reasons virtually every time.

There are numerous legal document templates available online, but finding reliable ones isn't straightforward.

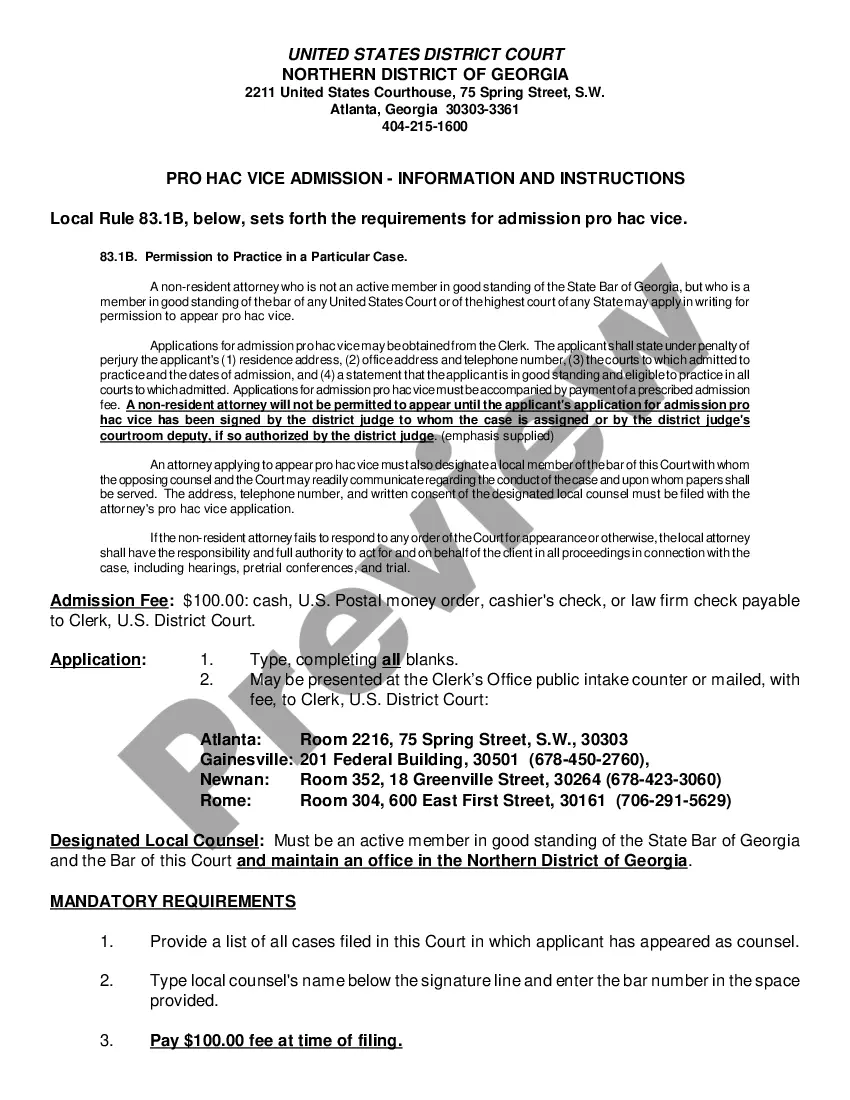

US Legal Forms offers a vast assortment of form templates, such as the Georgia Agreement to Transfer Partnership Interest to a Third Party, that are designed to comply with national and state regulations.

Select the pricing plan you desire, fill out the required information to create your account, and complete your purchase using PayPal or credit card.

Choose a convenient document format and download your version.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can access the Georgia Agreement to Transfer Partnership Interest to a Third Party template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct region/state.

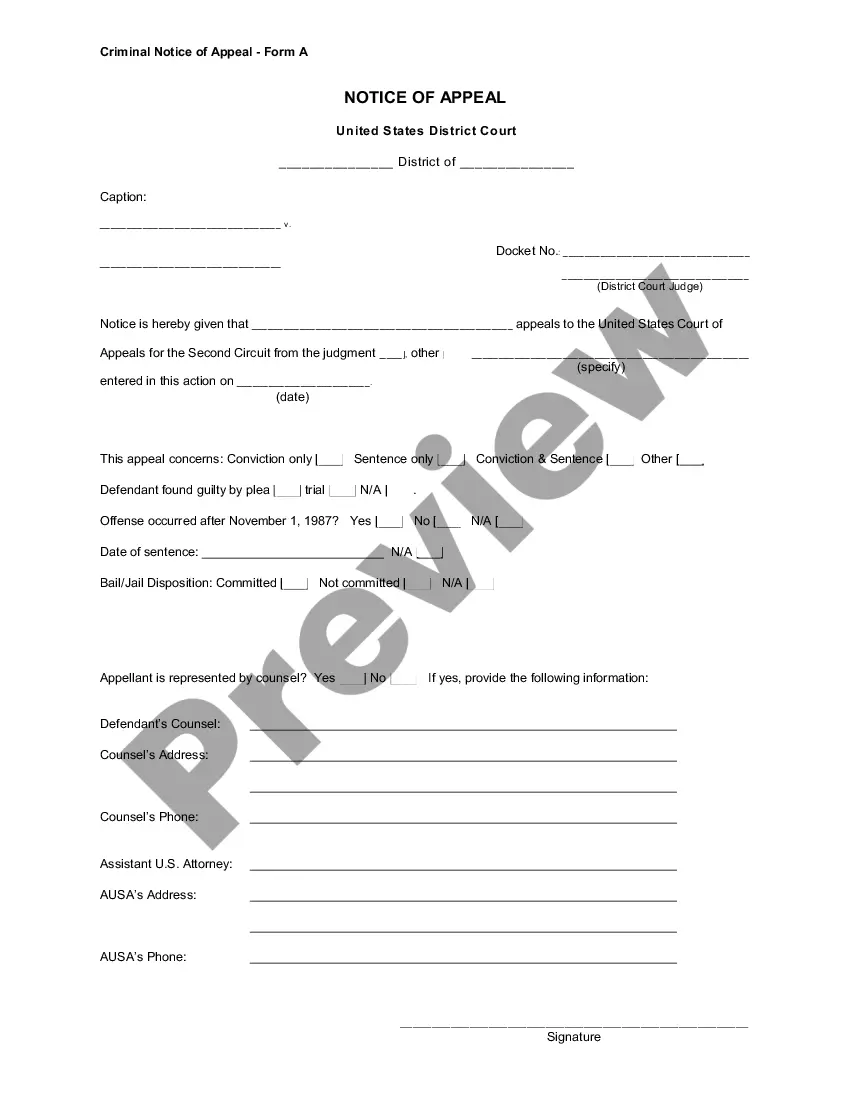

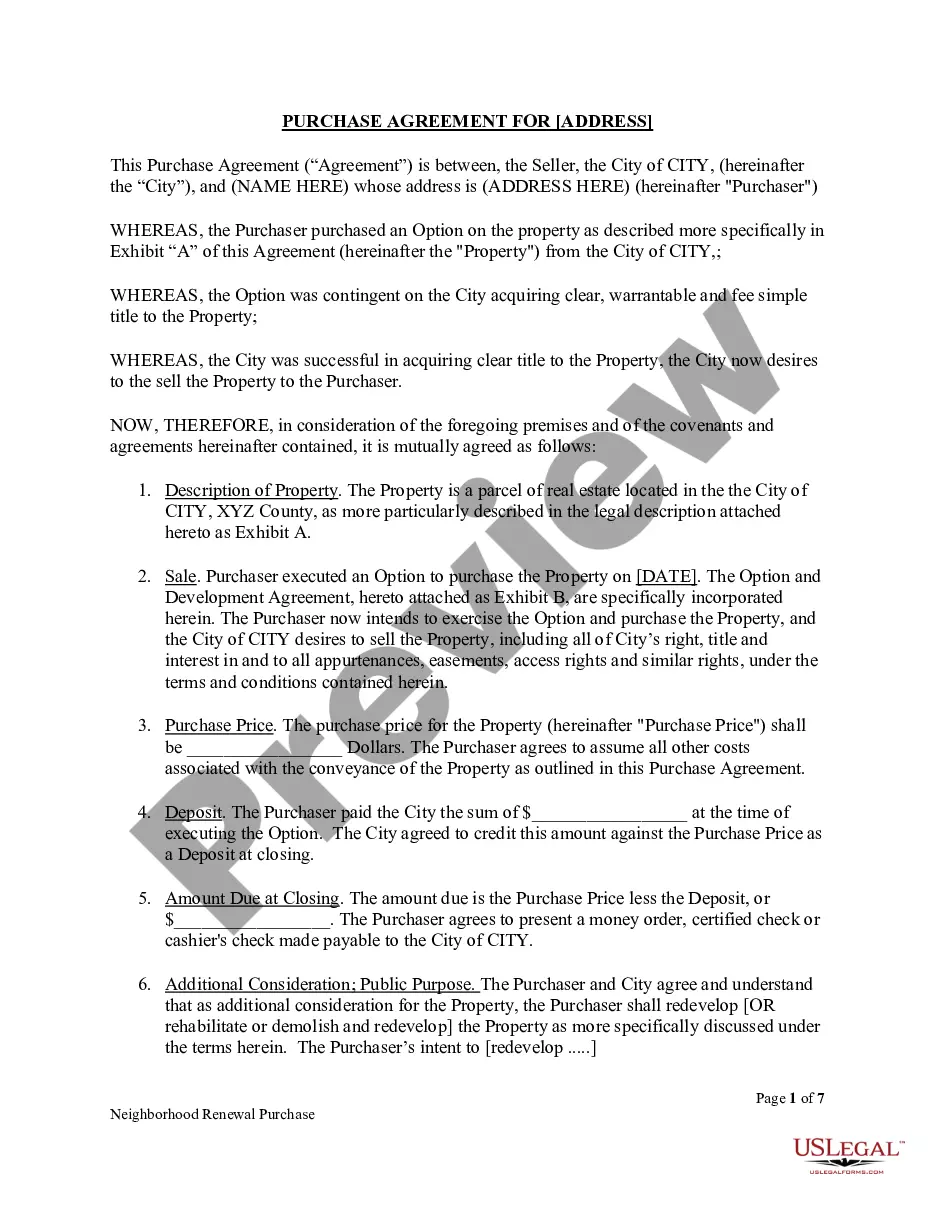

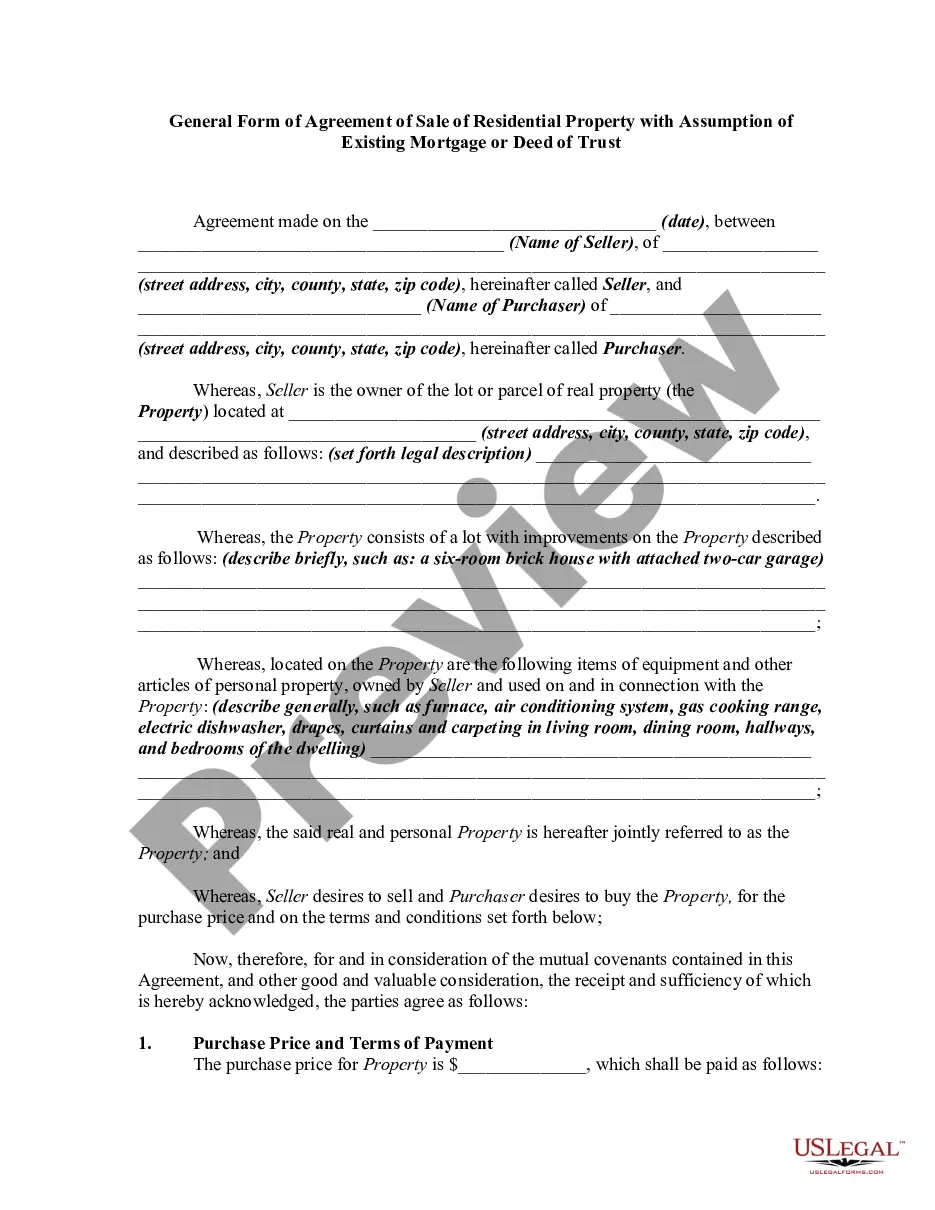

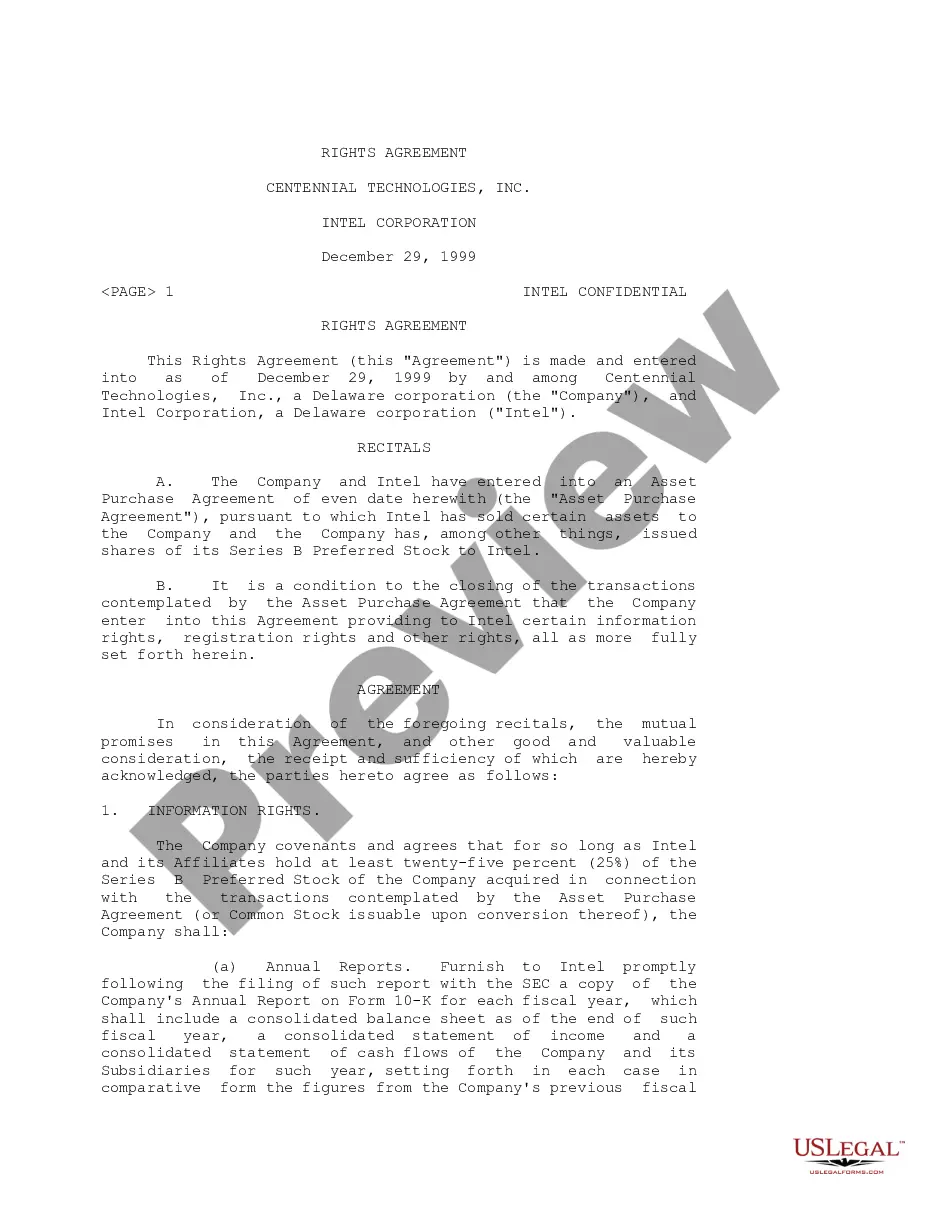

- Utilize the Review button to examine the form.

- Check the details to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Search field to locate the form that suits your needs and criteria.

- When you find the appropriate form, click Acquire now.

Form popularity

FAQ

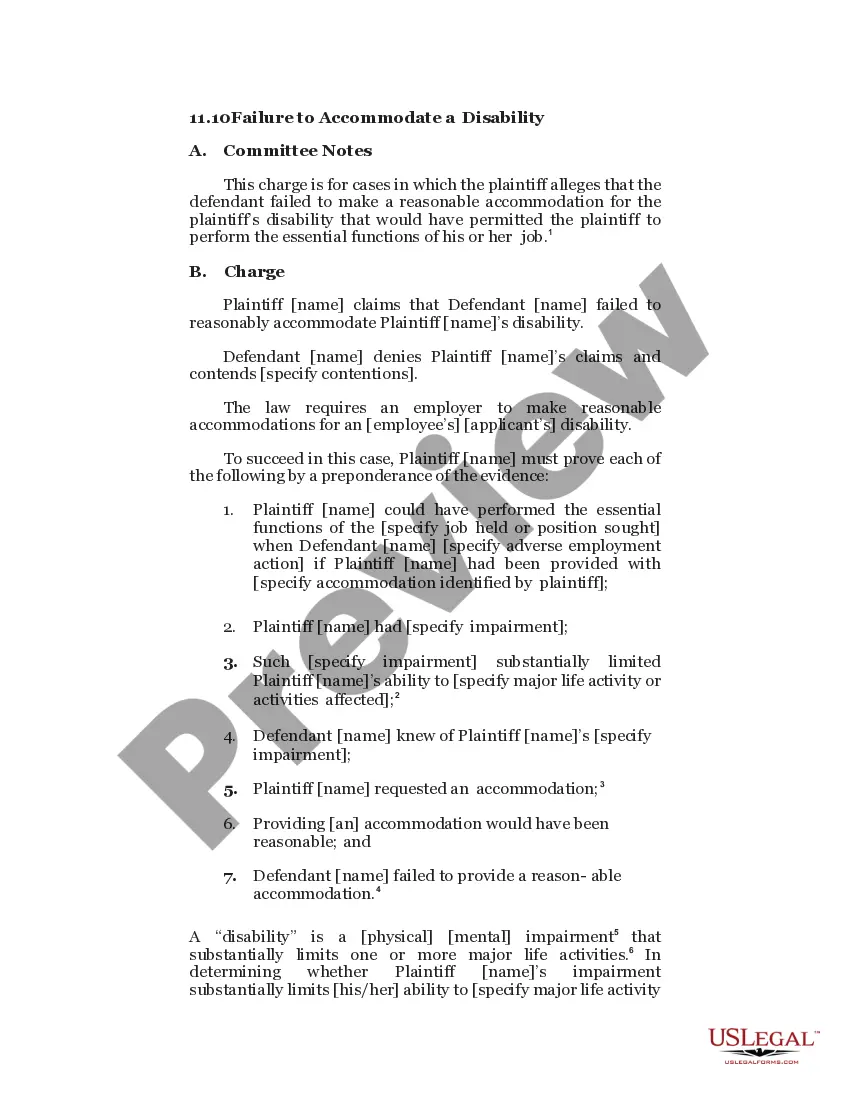

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

Essentially, partners share in the profits and the debts of the daily workings of the business. Because of that, when one partner wants to sell, they cannot sell the entire business. They can only sell their assets i.e., their share of the partnership.

If your business is a limited liability company or general partnership, your partner can't sell the company without your consent. He may, however, sell his interest in the company if you don't have a buy-sell agreement.

Buyouts over time agree that the purchasing partner will pay the bought out partner a predetermined amount over time until their ownership has been fully purchased. Similarly, an earn-out pays the partner out over time but requires the partner to stay with the company during a defined transition period.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

Partners in a firm are jointly and severally liable for any breach of trust committed by one partner, in which they were implicated. Persons other than partners may have authority to deal with third parties on behalf of the firm; however, such persons have no implied mandate.

Your legal partnership is essentially a single legal entity, and the situation can become complicated when one partner wants to sell his or her shares and the other partner refuses. Whether or not you can force your business partner to buy you out largely depends on your written agreement.