Georgia Personal Guaranty - General

Description

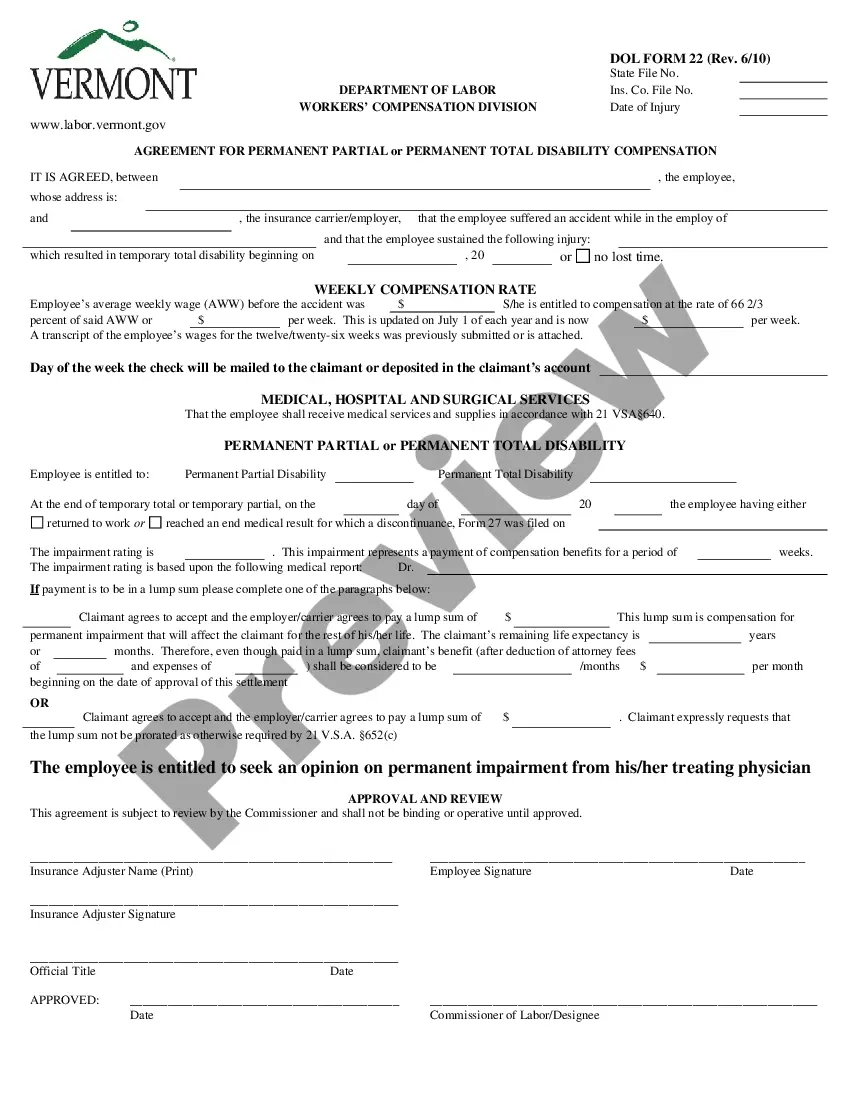

How to fill out Personal Guaranty - General?

It is feasible to spend hours online seeking the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that are vetted by experts.

You can download or print the Georgia Personal Guaranty - General from our platform.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Georgia Personal Guaranty - General.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you're utilizing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the county/town you choose.

- Check the form description to confirm you have picked the appropriate form.

Form popularity

FAQ

A personal guarantor can be anyone who meets the necessary financial criteria and is willing to accept the risks of guaranteeing your obligations. Typically, this includes individuals with good credit ratings and a reliable income. It's essential for the guarantor to understand their role in a Georgia personal guaranty - general context, as their financial future may also be impacted. Always discuss the implications of this role before making any agreements.

An ideal guarantor is someone who maintains a solid credit score, has sufficient income, and demonstrates financial responsibility. They should be trustworthy and ready to support you in a Georgia personal guaranty - general situation. Often, this person is a family member, close friend, or business associate who is familiar with your financial habits and is willing to accept the associated risks.

Not everyone can qualify as a personal guarantor. Typically, a guarantor should have a good credit history and a stable financial situation. This requirement ensures that the guarantor can fulfill the obligations if the primary borrower defaults. Therefore, it's wise to choose someone who understands the risks associated with a Georgia personal guaranty - general agreement.

In general, anyone with a strong financial profile can be a guarantor for you. Common choices include family members, friends, or business partners who trust you and are willing to help. It’s important that the person understands the responsibilities involved in a Georgia personal guaranty - general arrangement. This agreement can significantly enhance your chances of securing loans or leasing agreements.

Collecting on a personal guarantee, especially within the framework of Georgia personal guaranty - general, involves several steps. First, you must determine if the borrower has defaulted on their obligations. Then, you can contact the guarantor to discuss repayment. If necessary, you may consider legal action to enforce the guarantee if the amount owed is significant.

A personal guarantor is an individual who agrees to take responsibility for another person's financial obligations. In the context of Georgia personal guaranty - general, this means if the primary borrower defaults, the guarantor commits to repay the debt. This arrangement is often used in leasing agreements or loans to add security for lenders. It's a crucial role that impacts both the guarantor’s and the borrower's financial standing.

To get out of a personal guaranty, start by reviewing the terms of your agreement for any exit clauses. You can also negotiate with your lender or seek legal assistance to possibly restructure or release the guarantee. Understanding Georgia Personal Guaranty - General can equip you with the knowledge to approach this situation effectively.

Cancelling a personal guarantee is not always straightforward, but it may be possible through negotiation or by meeting specific criteria outlined in the agreement. Engaging a skilled attorney can help ensure that a cancellation process aligns with the laws governing Georgia Personal Guaranty - General.

The enforceability of a personal guarantee primarily depends on the specific terms and conditions stated in the agreement. Generally, most personal guarantees are legally binding unless proven otherwise. It is essential to understand the nuances of Georgia Personal Guaranty - General to determine how enforceable your particular agreement is.

To invalidate a personal guarantee, you typically need to demonstrate that the agreement was signed under duress, fraud, or without proper authority. Legal advice is invaluable in navigating this process, as each case can present unique challenges. Understanding Georgia Personal Guaranty - General can help you build a case to challenge the validity.