Georgia Specific Guaranty

Description

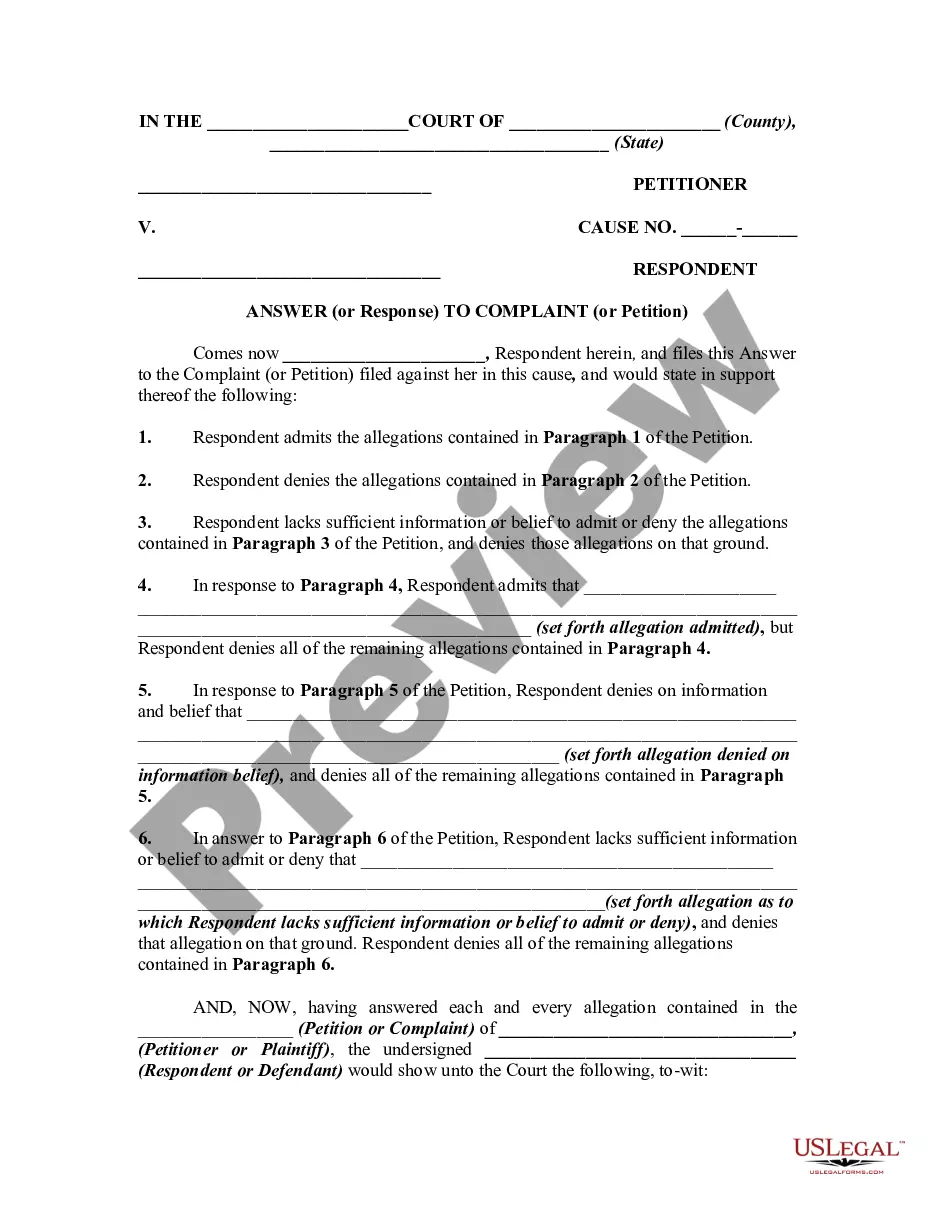

How to fill out Specific Guaranty?

If you require extensive, acquire, or produce valid document templates, utilize US Legal Forms, the foremost collection of lawful forms available online.

Utilize the site’s straightforward and efficient search functionality to locate the documents necessary for you.

Numerous templates for corporate and personal purposes are categorized by types and regions, or keywords.

Every legal document template you purchase is yours permanently.

You have access to each form you saved in your account. Go to the My documents section and select a form to print or download again.

- Use US Legal Forms to locate the Georgia Specific Guaranty in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Georgia Specific Guaranty.

- You can also access forms you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

- Step 4. After locating the form you need, click the Get now button. Choose the payment plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Georgia Specific Guaranty.

Form popularity

FAQ

Surety bonds in Georgia act as a financial guarantee ensuring compliance with laws and regulations. When you secure a Georgia Specific Guaranty, a third-party surety company backs your promise to fulfill contractual obligations. If you fail to meet these obligations, the surety company steps in to cover losses, which you then must repay. This process protects project owners and stakeholders from potential risks associated with contractual failures.

Yes, if you earn income in Georgia as a nonresident, you must file a Georgia nonresident tax return. This requirement applies even if you live in another state. Understanding your tax liabilities is important, especially when navigating the Georgia Specific Guaranty context. Consulting with a tax professional can help clarify your obligations and ensure you comply with state laws.

To obtain a surety bond in Georgia, start by assessing your needs and the type of bond required. Next, gather relevant documents, such as your financial information and project details. It’s beneficial to work with a reputable bonding company or broker who understands the Georgia Specific Guaranty process. They can guide you through the application process, ensuring you meet all state requirements efficiently.

The State Small Business Credit Initiative (SSBCI) is a federal program designed to enhance access to capital for small businesses. It provides states with funding to develop programs that support lending, which can be particularly beneficial when obtaining a Georgia Specific Guaranty. This initiative serves as a crucial resource for small business owners, ensuring they have the financial backing necessary to grow and thrive.

The Georgia Fair Lending Act aims to prevent discriminatory lending practices and promote equitable access to credit for all residents. By establishing guidelines and protections, this act enhances the landscape for borrowers seeking financing, including those interested in Georgia Specific Guaranty options. The law's provisions ensure that lending practices remain fair and transparent, strengthening trust between lenders and the community.

The code 44 14 13 in Georgia relates to the rights and obligations of a debtor and their guarantor in real estate transactions. It elaborates on the related provisions that protect both parties' interests. Knowing this code is essential for anyone dealing with property agreements under a Georgia Specific Guaranty. It ensures compliance with local regulations.

Section 11 2 314 of the Georgia Code addresses warranty and the guarantee in contracts related to the sale of goods. It specifies the standards that ensure the goods sold meet certain expectations. Understanding this section is vital for both buyers and sellers involved in a Georgia Specific Guaranty. It can support legal clarity in commercial transactions.

The obligation of a guarantor includes meeting the financial commitments if the primary borrower fails to do so. This responsibility can cover loans, leases, and other agreements. The Georgia Specific Guaranty outlines these obligations clearly to prevent confusion between parties. Understanding these duties is crucial for anyone considering becoming a guarantor.

A guarantor has specific rights against a creditor following the fulfillment of their obligations. For instance, once the guarantor pays off the defaulted amount, they can seek reimbursement from the borrower. The Georgia Specific Guaranty ensures that these rights are protected by law. It creates a framework for guarantors to reclaim their financial standing.

The act of God law in Georgia refers to unforeseen events that prevent a party from fulfilling contractual obligations. This law acknowledges natural disasters like floods and hurricanes as valid justifications. Acknowledging these circumstances can protect involved parties under the Georgia Specific Guaranty. It is essential to understand how these situations may impact agreements.