Georgia Direct Deposit Form for IRS

Description

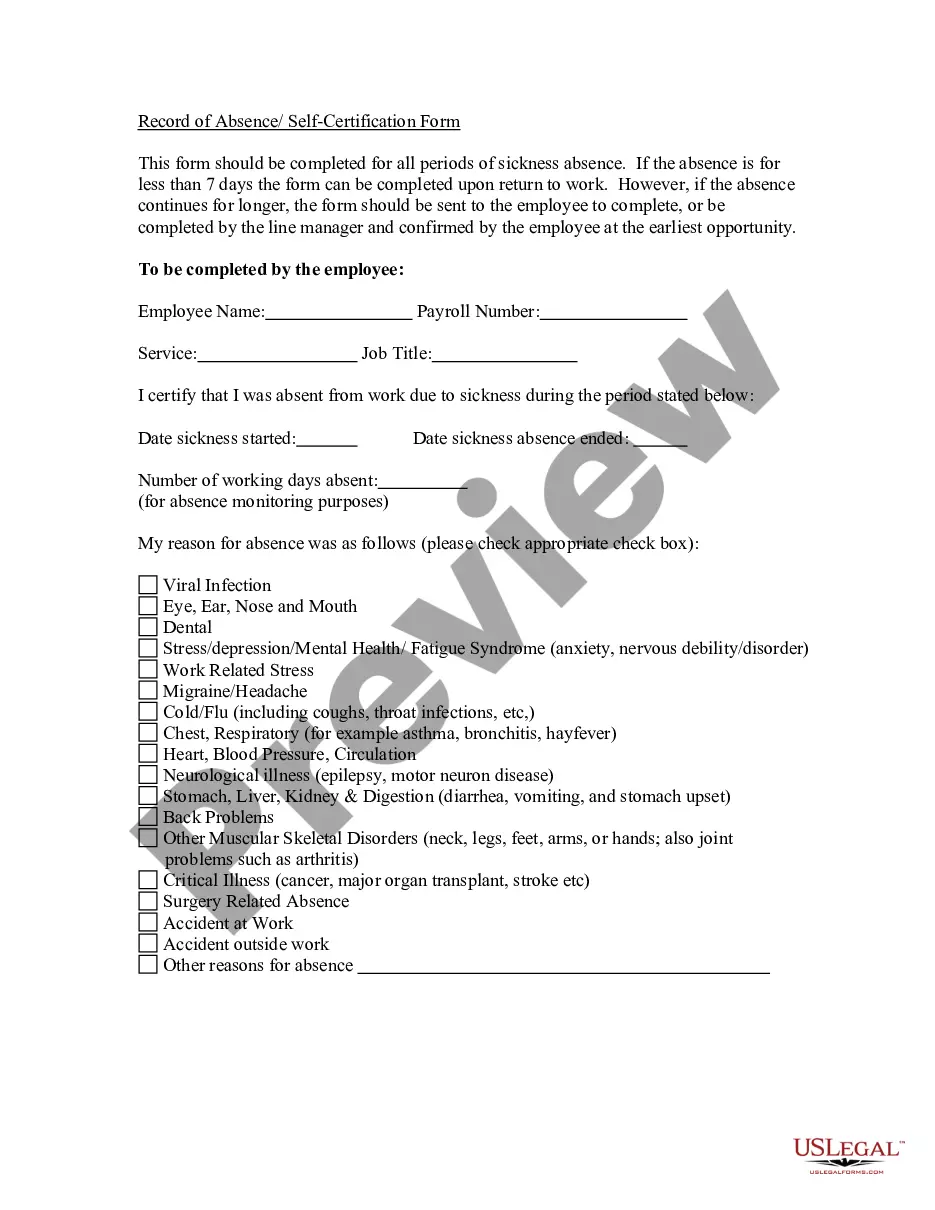

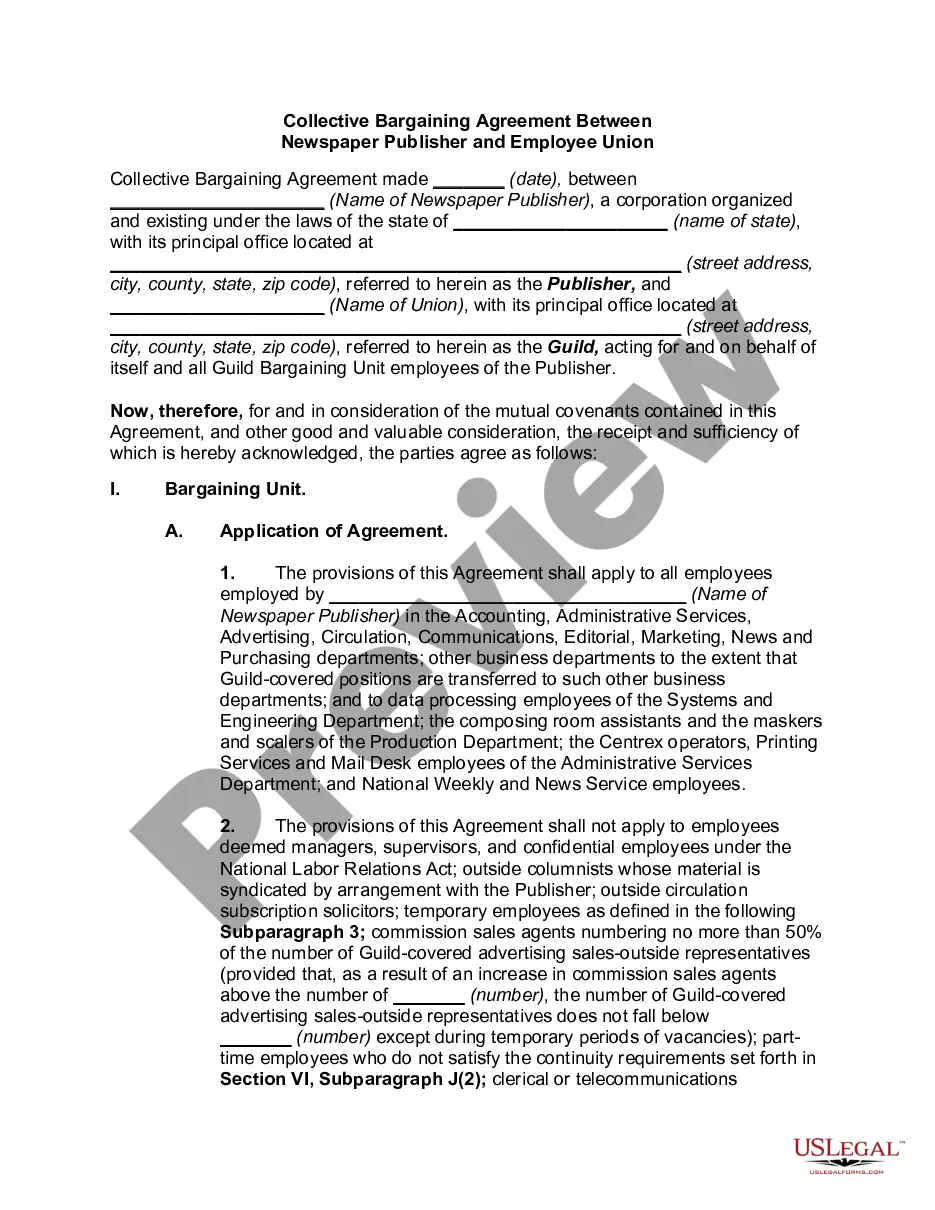

How to fill out Direct Deposit Form For IRS?

US Legal Forms - one of the largest collections of authentic documents in the United States - offers a variety of legal template options that you can download or create. By utilizing the website, you can discover numerous templates for business and personal use, organized by categories, states, or keywords. You can access the latest templates such as the Georgia Direct Deposit Form for IRS within seconds.

If you already possess a subscription, Log In and download the Georgia Direct Deposit Form for IRS from the US Legal Forms library. The Download option will appear on every template you view. You have access to all previously downloaded templates in the My documents section of your account.

If you want to use US Legal Forms for the first time, here are simple steps to get you started: Ensure you have chosen the correct template for your city/state. Click the Preview option to examine the document’s content. Review the template description to confirm you have selected the right one. If the template does not meet your needs, use the Search bar at the top of the page to find one that does. If you are satisfied with the document, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to create an account. Complete the transaction. Use your credit card or PayPal account to finalize the payment. Choose the file format and download the document onto your device. Make adjustments. Fill out, modify, and print and sign the downloaded Georgia Direct Deposit Form for IRS.

With US Legal Forms, you can efficiently navigate through a vast selection of legal document templates tailored to your specific needs.

Take advantage of the user-friendly platform to enhance your experience in obtaining legal forms quickly and easily.

- Each template added to your account does not expire and belongs to you indefinitely.

- To download or create another version, simply access the My documents section and click on the template you need.

- Access the Georgia Direct Deposit Form for IRS with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure to follow all steps carefully to streamline your document acquisition process.

- Enjoy the convenience and reliability of having access to a comprehensive library of legal forms.

Form popularity

FAQ

To set up direct deposit with the IRS, complete the Georgia Direct Deposit Form for IRS during your tax filing process. You will need to provide your bank account information to ensure your tax refund is deposited directly. For additional assistance, visit USLegalForms, where you can find templates and guidance tailored to your needs.

An example of direct deposit is when your employer deposits your paycheck directly into your bank account instead of issuing a physical check. This process is efficient and secure, allowing you to access your funds immediately. Using the Georgia Direct Deposit Form for IRS makes it easy to set up this convenient payment method.

Filling up the deposit form involves entering your personal and banking information accurately. On the Georgia Direct Deposit Form for IRS, make sure to include your name, Social Security number, and bank account details. Double-check your entries to ensure there are no mistakes, as this can affect your direct deposit setup.

To set up direct deposit with your employer, obtain the Georgia Direct Deposit Form for IRS and fill it out completely. You will need to provide your bank account details and sign the form. Once completed, submit it to your employer's payroll department, ensuring they have all the necessary information to process your deposits accurately.

Filling out a tax withholding form requires you to provide your personal information and indicate your filing status. Additionally, you should claim any allowances or additional withholding amounts based on your financial situation. For clear guidance, consider using USLegalForms, where you can find resources tailored to help you complete the Georgia Direct Deposit Form for IRS.

To fill out the Georgia Direct Deposit Form for IRS, start by entering your personal information, such as your name and Social Security number. Next, provide your bank account details, including the account number and routing number. Ensure that all information is accurate to avoid any delays in processing your direct deposit.

IRS Form 982 is used to claim a reduction of tax attributes due to discharge of indebtedness. This form is important for taxpayers who have had debt forgiven and need to report it correctly. If you are dealing with such financial situations, it may be beneficial to know about the Georgia Direct Deposit Form for IRS, as it can help in processing any potential refunds resulting from your tax filings.

Yes, you can print out a direct deposit form for your convenience. Many platforms, including uslegalforms, offer easy access to the Georgia Direct Deposit Form for IRS. By printing this form, you can complete it manually and submit it according to your needs, ensuring you receive your funds quickly and securely.

As of now, there is no official announcement regarding the IRS sending $3000 tax refunds in June 2025. Tax refunds are typically based on your tax return and the eligibility criteria set by the IRS. To stay informed about any potential changes, keep an eye on IRS announcements or consider using the Georgia Direct Deposit Form for IRS to expedite your refund process when applicable.

No, the Georgia Department of Revenue and the IRS are not the same. The Georgia Department of Revenue manages state taxes, while the IRS is responsible for federal taxes. If you need to submit a Georgia Direct Deposit Form for IRS-related matters, it is crucial to understand which agency you are dealing with to ensure compliance with the correct regulations.