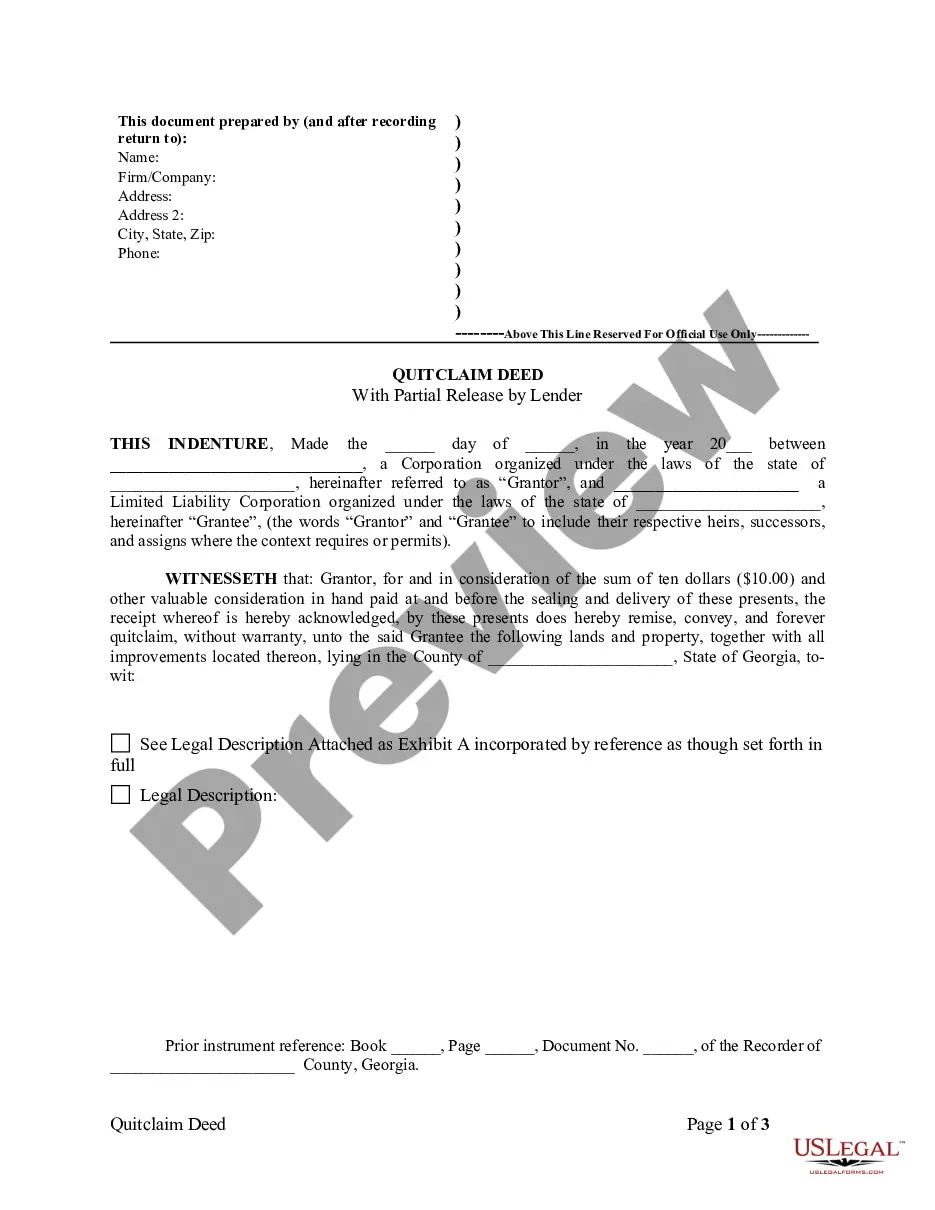

Georgia Quitclaim Deed with Partial Release by Lender

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Georgia Quitclaim Deed With Partial Release By Lender?

Obtain the most extensive collection of legal documents.

US Legal Forms is indeed a platform to locate any state-specific file in just a few clicks, such as examples of Georgia Quitclaim Deed with Partial Release by Lender.

No need to invest hours searching for a court-acceptable sample.

Use the Preview feature if it’s available to verify the document's content. If everything seems correct, click on the Buy Now button. After selecting a pricing option, create your account. You can pay with a credit card or PayPal. Save the sample to your computer by clicking the Download button. That’s it! You are ready to submit the Georgia Quitclaim Deed with Partial Release by Lender template and check out. To make sure everything is accurate, consult your local legal advisor for help. Sign up and simply explore over 85,000 useful templates.

- Our certified experts guarantee that you receive updated samples each time.

- To take advantage of the forms library, select a subscription and create your account.

- If you have already set it up, simply Log In and click the Download button.

- The Georgia Quitclaim Deed with Partial Release by Lender document will automatically be stored in the My documents section.

- To create a new profile, follow the quick instructions below.

- If you intend to use a state-specific sample, ensure you specify the correct state.

- If possible, review the description to understand all the details of the document.

Form popularity

FAQ

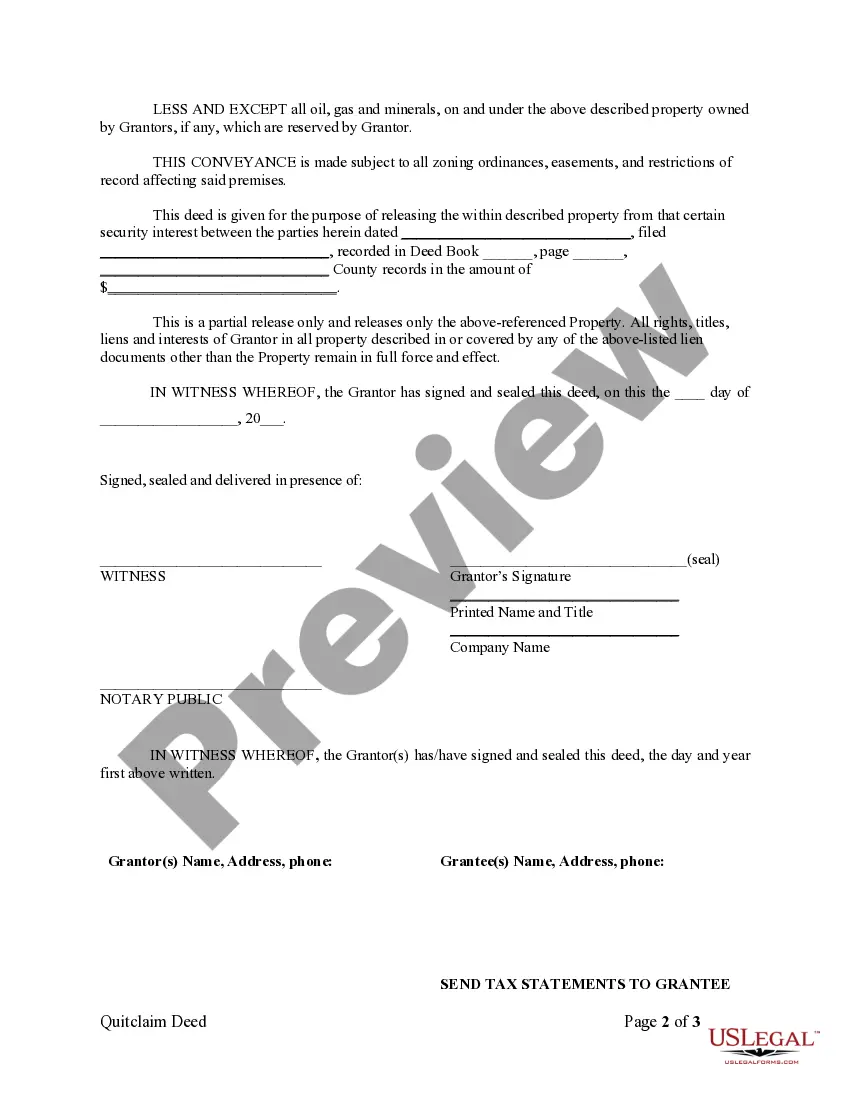

A quit claim deed can become void if it is found to be signed under duress, fraud, or if it fails to meet state requirements. Additionally, if the property is transferred without proper legal representation or notarization, it can lead to issues. When considering a Georgia Quitclaim Deed with Partial Release by Lender, ensure you follow all guidelines to maintain the deed's validity.

Whether a mortgage company accepts a quit claim deed typically depends on their specific policies. Some lenders may be open to accepting such deeds, especially if accompanied by a partial release. When utilizing a Georgia Quitclaim Deed with Partial Release by Lender, always check with your mortgage provider to determine if additional documentation or conditions are required.

Obtaining a mortgage for a property transferred via a quit claim deed can be challenging. Most lenders prefer traditional deeds that clearly outline ownership rights and responsibilities. If you are navigating the waters of a Georgia Quitclaim Deed with Partial Release by Lender, it is crucial to speak with your lender about their policies on such deeds to avoid potential complications.

A quitclaim deed may not be suitable for certain circumstances, such as when transferring property subject to a mortgage without lender approval. It cannot be used to clear title disputes or to ensure guarantees about property condition. Understanding these limitations is vital when considering a Georgia Quitclaim Deed with Partial Release by Lender, as specific lender requirements may also apply.

To create a valid quit claim deed in Georgia, you need to include the legal names of both the grantor and grantee, a clear description of the property, and the proper signatures. You must also have the deed notarized for it to be legally binding. When utilizing a Georgia Quitclaim Deed with Partial Release by Lender, ensure you understand any additional stipulations the lender might include.

In Georgia, if a spouse signs a quit claim deed, they generally relinquish their claim to the property. However, this does not automatically mean that they lose all rights, especially if other agreements exist. It's important to understand how a Georgia Quitclaim Deed with Partial Release by Lender can affect ownership rights in the context of marital property. Consulting with a legal expert can clarify specific situations.

One significant disadvantage of a quitclaim deed is that it offers no warranties or guarantees about the property’s title. This means that if any claims arise, you bear the risk. When using a Georgia Quitclaim Deed with Partial Release by Lender, it's vital to understand these limitations to make informed choices regarding your property.

While you can prepare a quitclaim deed yourself, hiring a lawyer is often a wise decision. A lawyer can ensure that the Georgia Quitclaim Deed with Partial Release by Lender complies with all legal requirements and protects your interests. Their expertise can help you avoid pitfalls that may arise during the deed preparation process.

A quitclaim deed can be deemed invalid if it lacks proper signatures, does not meet state-specific requirements, or is executed under fraud or coercion. Additionally, if the property description is unclear or missing, the deed may not hold legal weight. In cases involving a Georgia Quitclaim Deed with Partial Release by Lender, it's crucial to ensure all details are precise and accurate to avoid potential disputes.

While it's not mandatory to hire a lawyer for a quitclaim deed in Georgia, having legal assistance can provide valuable guidance through the process. A professional can help clarify any complex requirements, especially when dealing with partial releases from lenders. If you prefer a DIY approach, US Legal Forms offers the necessary tools to assist you in creating a Georgia Quitclaim Deed with Partial Release by Lender effectively.