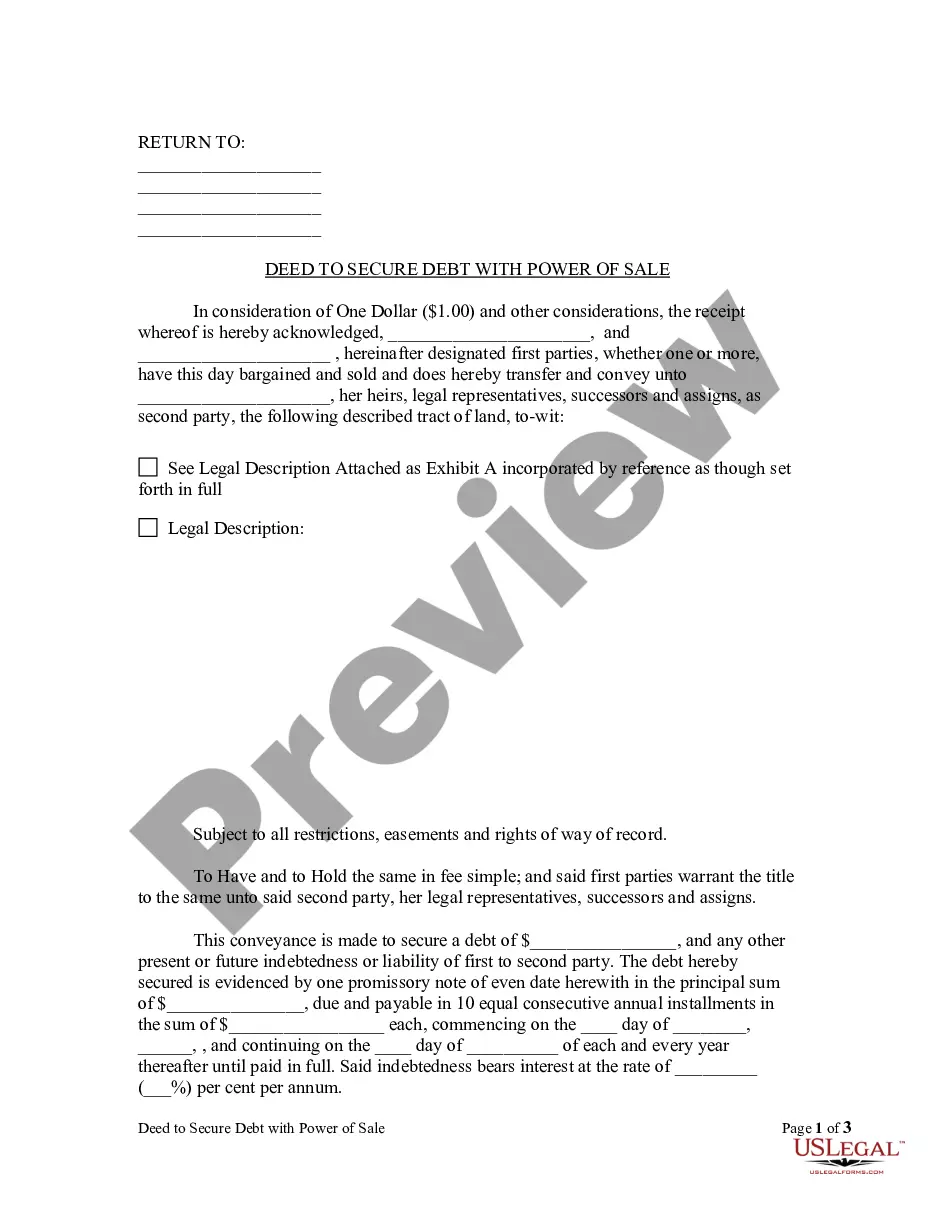

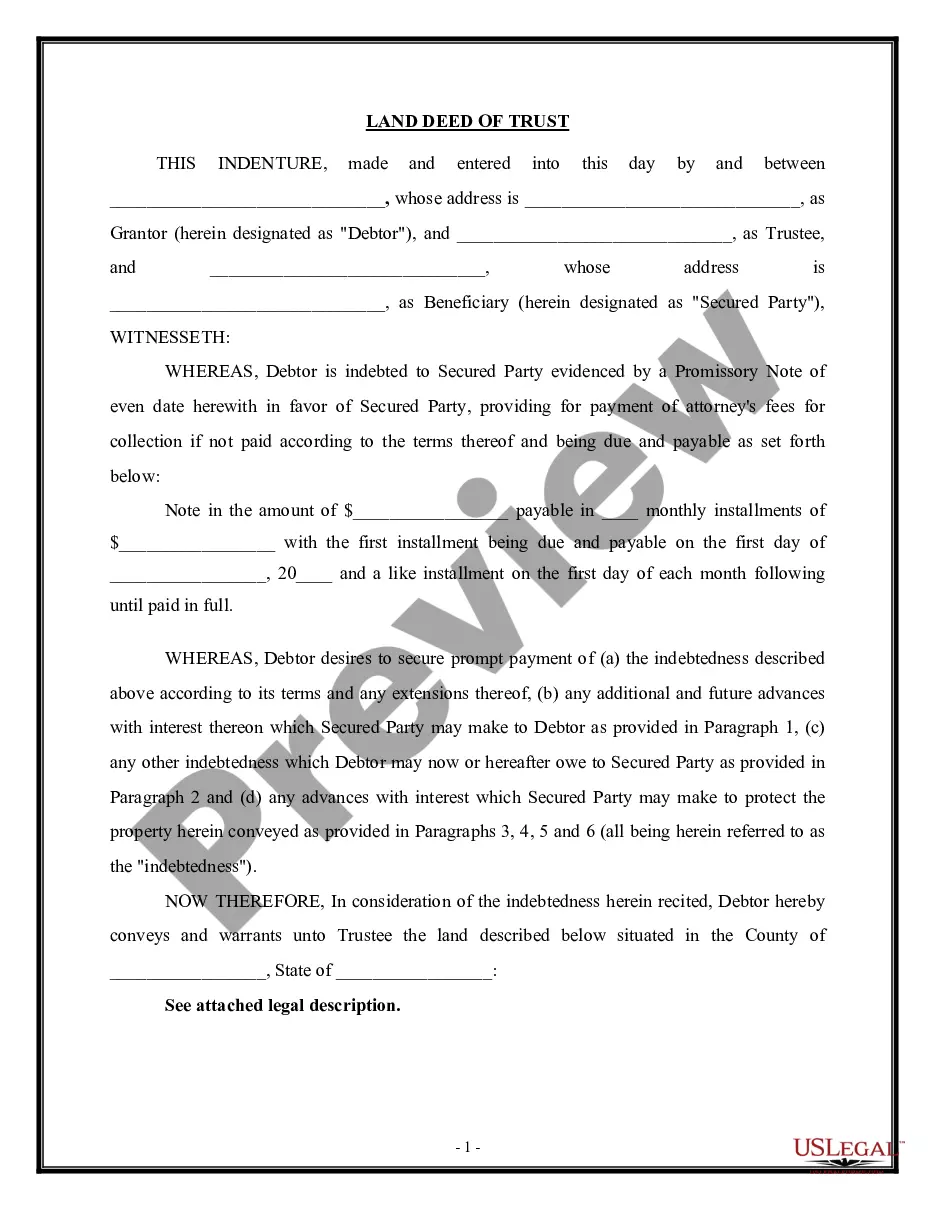

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed to Secure Debt with Power of Sale, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. GA-8206

Georgia Deed to Secure Debt with Power of Sale

Description

How to fill out Georgia Deed To Secure Debt With Power Of Sale?

Obtain access to one of the most extensive collections of authorized documents.

US Legal Forms is essentially a platform where you can discover any state-specific template in moments, including examples of Georgia Deed to Secure Debt with Power of Sale.

There's no need to squander your time searching for a court-acceptable template. Our certified professionals guarantee that you always receive updated samples.

After selecting a pricing plan, establish your account. Make payment via card or PayPal. Download the template to your device by clicking on the Download button. That’s it! You need to submit the Georgia Deed to Secure Debt with Power of Sale form and verify it. To ensure everything is accurate, consult your local legal advisor for assistance. Register and easily access over 85,000 useful documents.

- To take advantage of the document collection, select a subscription and create an account.

- If you have already registered, simply Log In and click on the Download button.

- The Georgia Deed to Secure Debt with Power of Sale example will quickly be saved in the My documents section (a section for all documents you download from US Legal Forms).

- To set up a new profile, refer to the brief instructions below.

- If you intend to use a state-specific document, ensure you select the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if available to view the document's details.

- If everything is accurate, click Buy Now.

Form popularity

FAQ

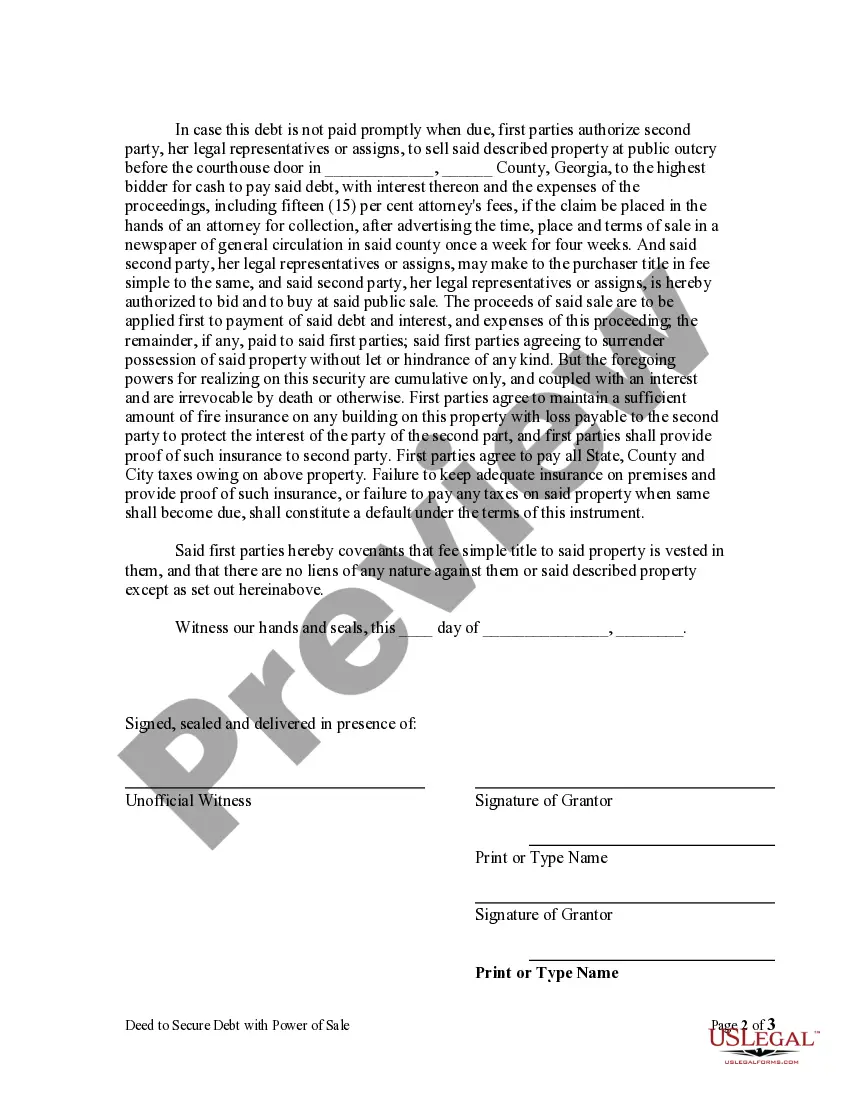

A deed under power in Georgia refers to a legal provision included in a deed to secure debt that allows the lender to sell the property if the borrower fails to meet their obligations. This instrument streamlines the foreclosure process and ensures that lenders can quickly recover their investment when needed. If you are navigating this process, consider how the Georgia Deed to Secure Debt with Power of Sale can optimize your real estate transactions. Resources like USLegalForms can provide valuable guidance as you move forward.

Yes, a deed can be signed under power of attorney, allowing someone to act on behalf of another person. This process is often helpful in situations where the original signer cannot be present. When dealing with a Georgia Deed to Secure Debt with Power of Sale, it is essential to ensure that the power of attorney document is valid and includes the necessary authority for real estate transactions. If you're unsure about the process, resources such as US Legal Forms can provide guidance and necessary forms.

The Georgia Deed to Secure Debt with Power of Sale is specifically designed to include a power of sale clause, making it a popular choice for real estate transactions in Georgia. This type of deed allows lenders to sell the property quickly in case of default. Homeowners should be aware that not all deeds include a power of sale clause, so it's crucial to review the deed's terms before finalizing a mortgage. If you have questions about specific deeds, consider consulting with professionals through platforms like US Legal Forms.

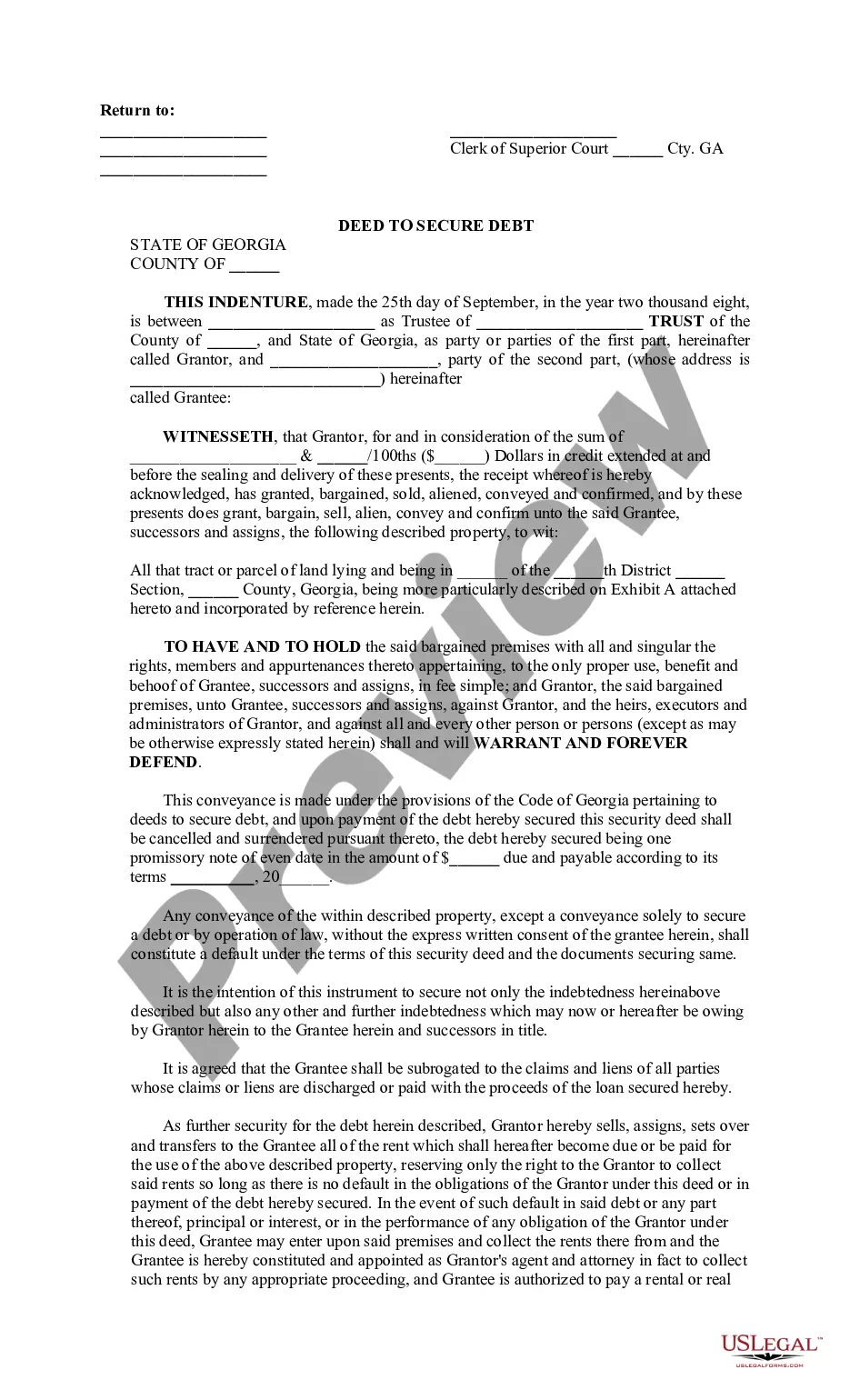

The type of deed used when property serves as security for a debt in Georgia is known as a deed to secure debt. This legal instrument establishes a lien on the property, giving the lender rights to the asset until the debt is fulfilled. The inclusion of a power of sale clause is common, which facilitates quick action in case of default. Being informed about your deed options can enhance your willingness to invest in property.

In Georgia, a deed to secure debt must meet several requirements. It must be in writing, clearly identify the parties involved, and describe the property used as collateral. Additionally, the deed should include the power of sale clause to expedite the process of foreclosure if needed. Consulting resources like US Legal Forms can help ensure you meet all criteria and understand the steps involved.

To record a deed in Georgia, certain requirements must be met to ensure its legitimacy. The deed must be in writing and include signatures from both the grantor and grantee. Additionally, the document should be notarized before submission. Finally, the deed must be recorded in the county where the property is located to be enforceable, protecting your rights under the Georgia Deed to Secure Debt with Power of Sale.

Filing a deed in lieu of foreclosure involves several straightforward steps. First, you should contact your lender to discuss your intentions and obtain their consent. Afterward, you will prepare the necessary documents, including the deed to transfer the property to the lender. Lastly, you will record the deed in the appropriate county office to finalize the process and move forward with your financial plans.