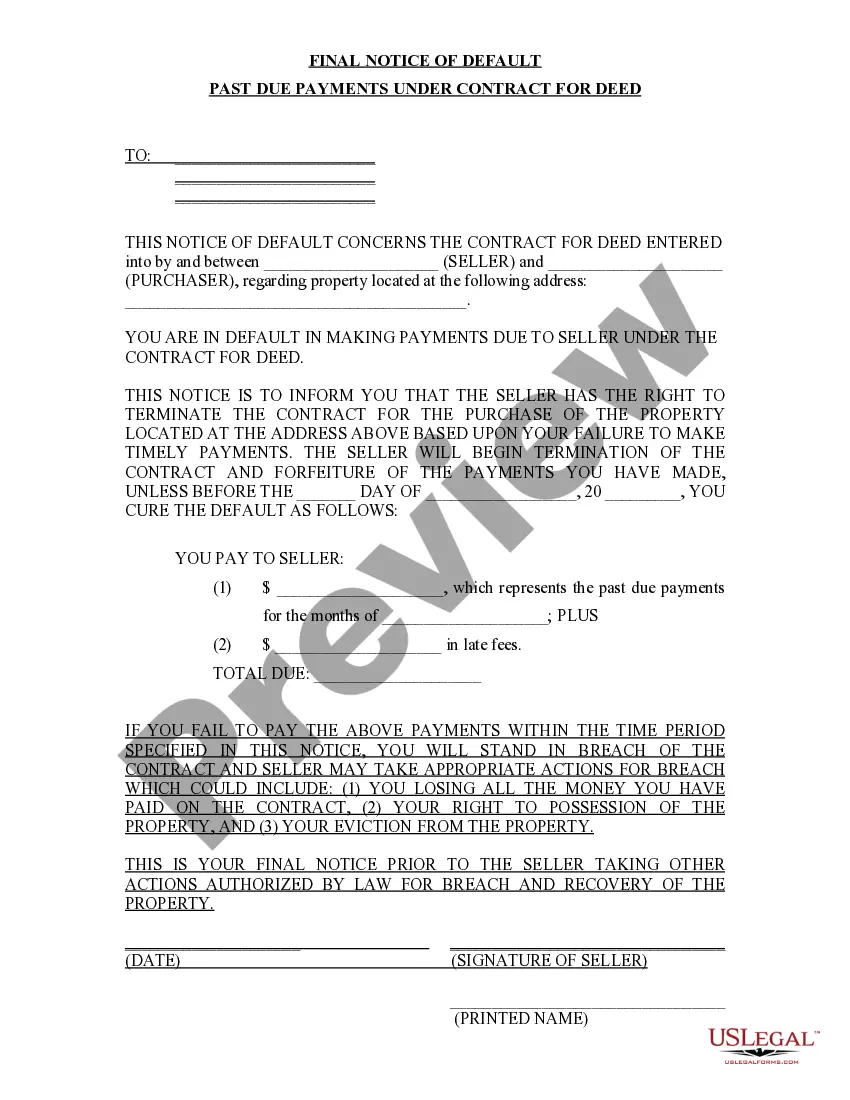

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Georgia Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Georgia Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to obtain a printable Georgia Final Notice of Default for Outstanding Payments regarding Contract for Deed. Our legally acceptable forms are crafted and consistently refreshed by experienced attorneys.

We offer the most comprehensive Forms library available online, providing economical and precise samples for clients, legal professionals, and small to medium-sized businesses.

The templates are organized by state-specific categories, and a selection of them may be previewed prior to downloading.

Create your account and complete payment via PayPal or by debit/credit card. Save the form to your device and feel free to reuse it multiple times. Use the Search feature if you need to locate another document template. US Legal Forms provides thousands of legal and tax templates and bundles for both business and personal requirements, including the Georgia Final Notice of Default for Outstanding Payments related to Contract for Deed. Over three million users have successfully benefited from our service. Choose your subscription plan and obtain high-quality documents in just a few clicks.

- To access samples, users must possess a subscription and sign in to their account.

- Click Download next to any template you wish to acquire and locate it in My documents.

- For those without a subscription, adhere to the following steps to effortlessly find and download the Georgia Final Notice of Default for Outstanding Payments connected to Contract for Deed.

- Verify that you have the correct template according to the necessary state.

- Examine the document by reviewing the description and utilizing the Preview function.

- Select Buy Now if it’s the desired template.

Form popularity

FAQ

People often choose contracts for deed because they offer a simpler pathway to homeownership. This arrangement allows buyers to make monthly payments directly to the seller, rather than going through a traditional mortgage lender. Additionally, contracts for deed can be appealing to those with less-than-ideal credit, as they may face fewer barriers compared to conventional financing. However, be aware that a Georgia Final Notice of Default for Past Due Payments in connection with Contract for Deed can lead to serious repercussions if payments are missed.

To set aside a default judgment in Georgia, you need to file a motion in the same court that issued the judgment. You must demonstrate a valid reason for missing the original court date, such as lack of notice or an error in your information. If you can prove your case, the court may grant you relief, allowing you to contest the judgment. Understanding how a Georgia Final Notice of Default for Past Due Payments in connection with Contract for Deed influences these proceedings can help you navigate the process.

Con: Buyer Depends On Seller Unless the seller owns the property outright, he is still making payments to a lending institution. If, for any reason, the seller does not make regular payments, the property can be foreclosed upon, leaving the buyer with a worthless contract and no home.

A land contract is a form of seller financing. It is similar to a mortgage, but rather than borrowing money from a lender or bank to buy real estate, the buyer makes payments to the real estate owner, or seller, until the purchase price is paid in full.

No statute prevents selling your mortgaged home using a contract for deed.A mortgage lender, though, can immediately foreclose its loan if it discovers a contract for deed sale took place. Other than mortgage lender permission to sell your home via contract for deed, you have no easy way around the due-on-sale clause.

A closing IS performed, and real estate professionals are paid, if any are involved. They are NOT paid at the expiration/maturity of the land contract, that is, when the buyers payoff the land contract. 3. The land contract IS then recorded at the county clerk's office to make it official record.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

In a self-financed real estate transaction where no new bank loan is involved, the Seller can still enter into a purchase agreement with the Buyer even if the property being sold is encumbered by an existing mortgage held by Seller's lender.

As the property is mortgaged, you can not sell part of the land without first getting your lender's consent.You may find that the lender wants to have a professional valuation carried out, for which you will have to pay and if there is still sufficient equity to support your mortgage you should get consent.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.