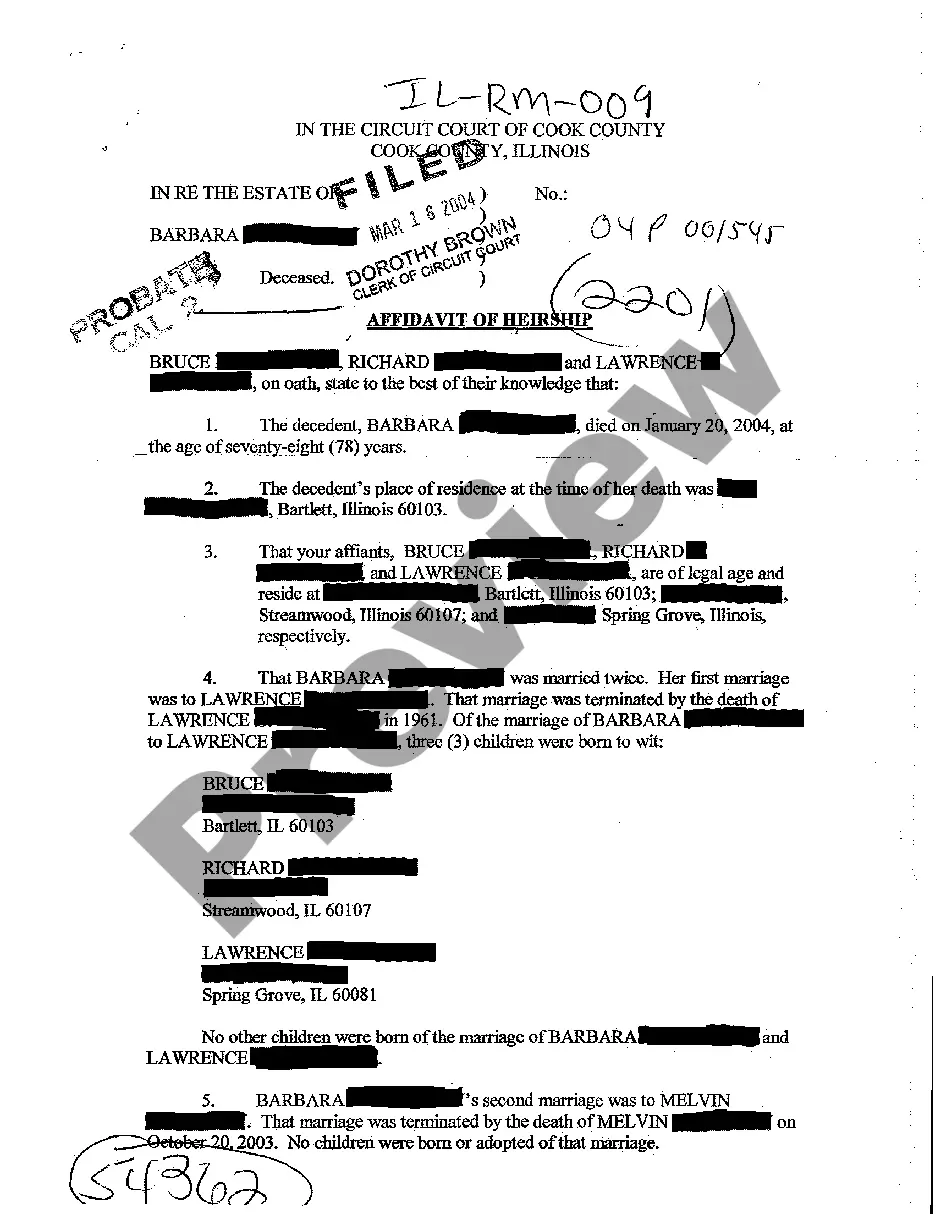

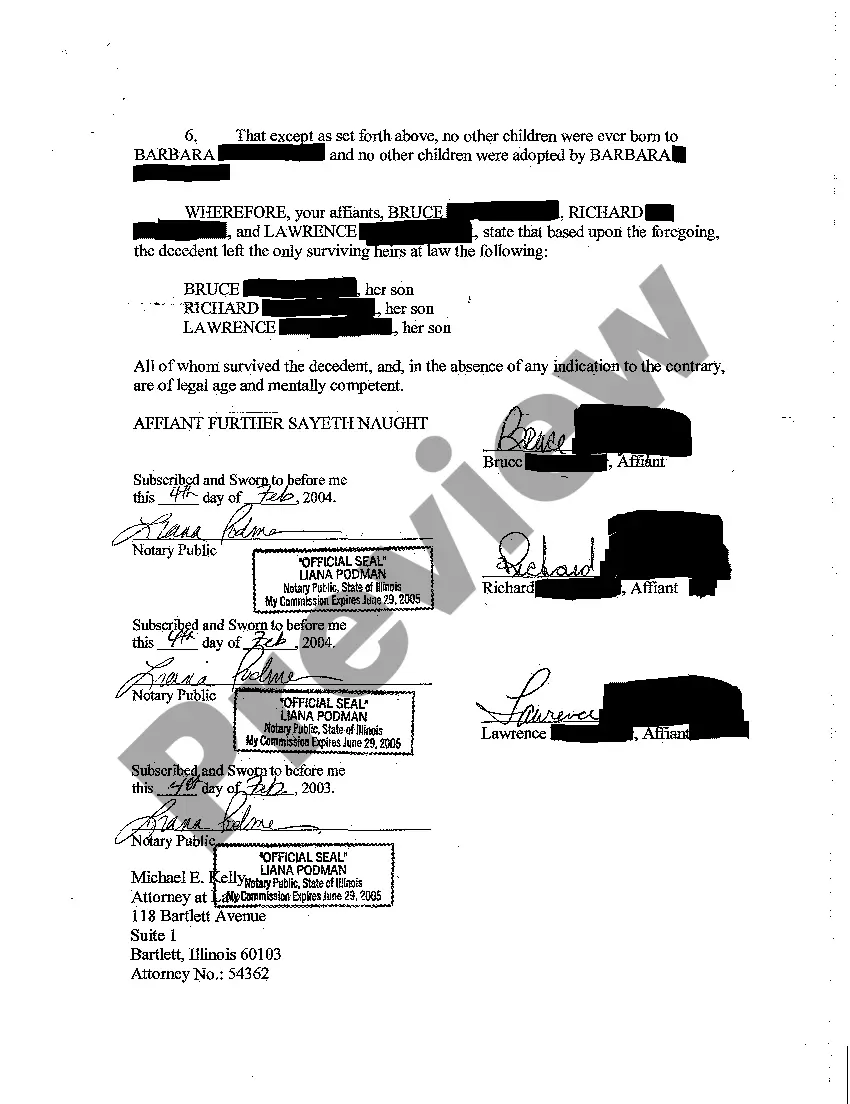

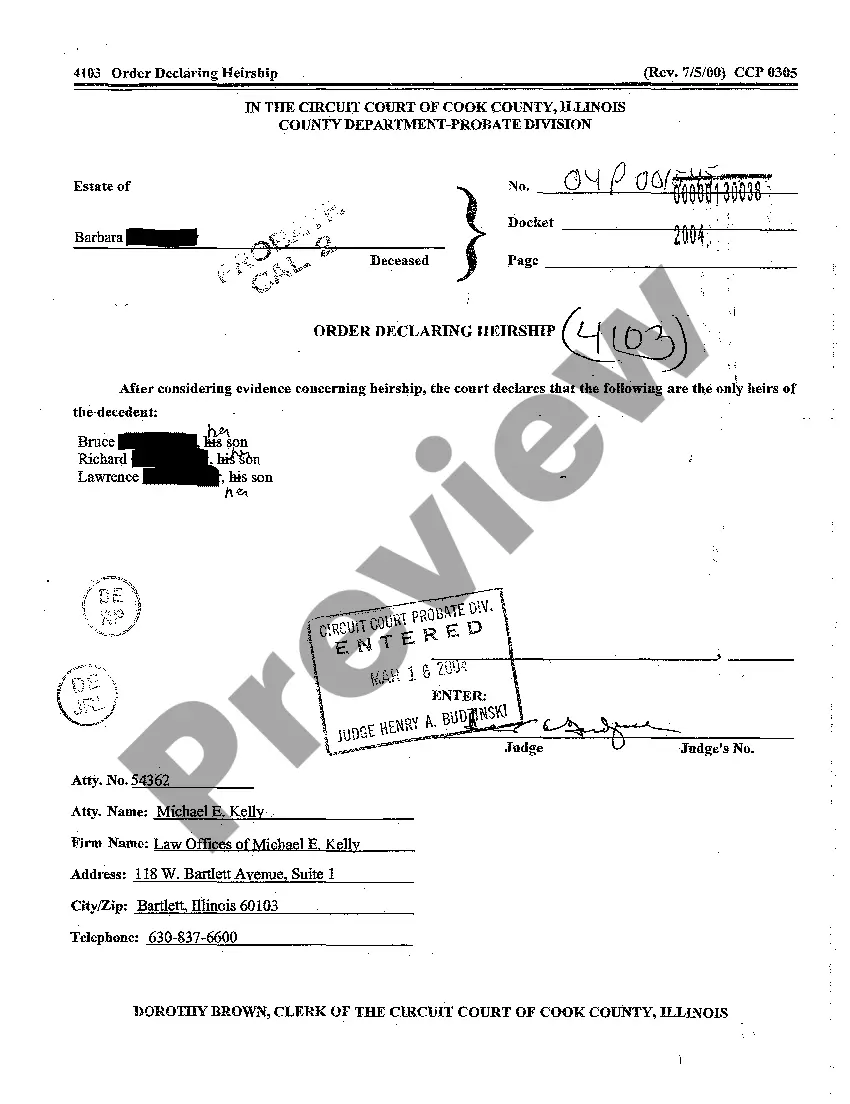

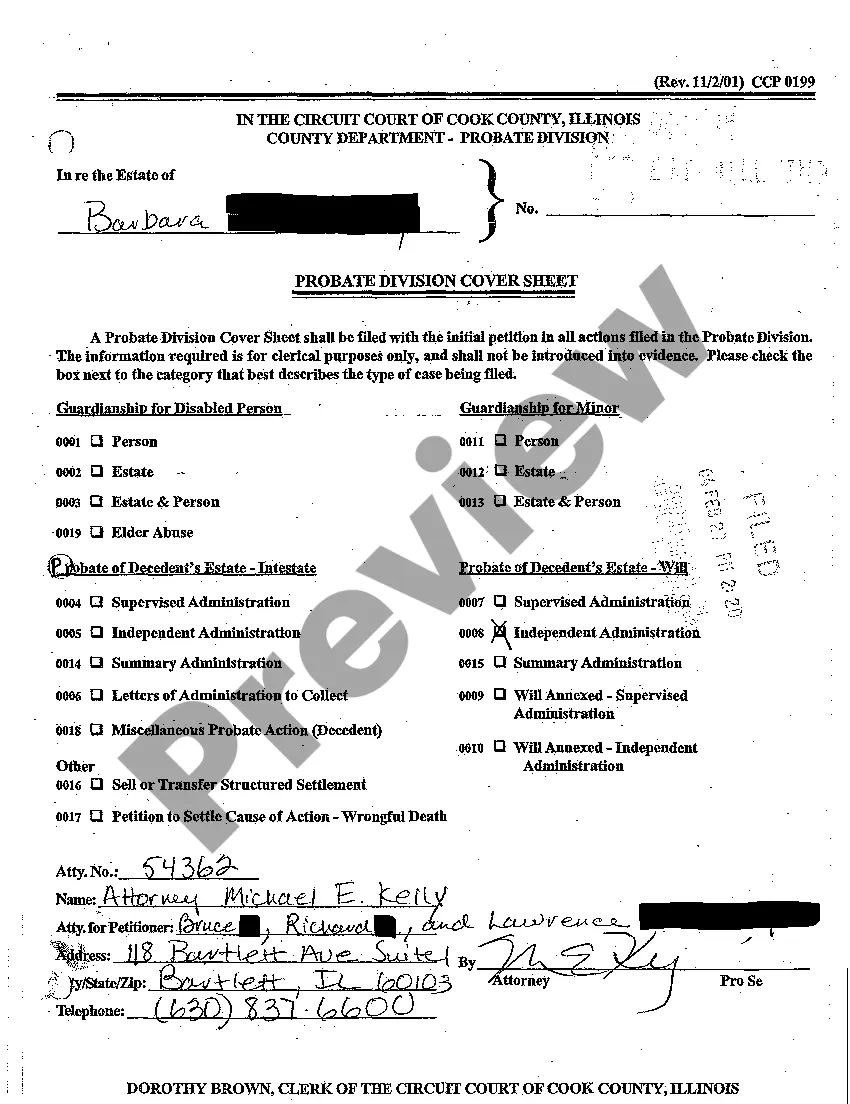

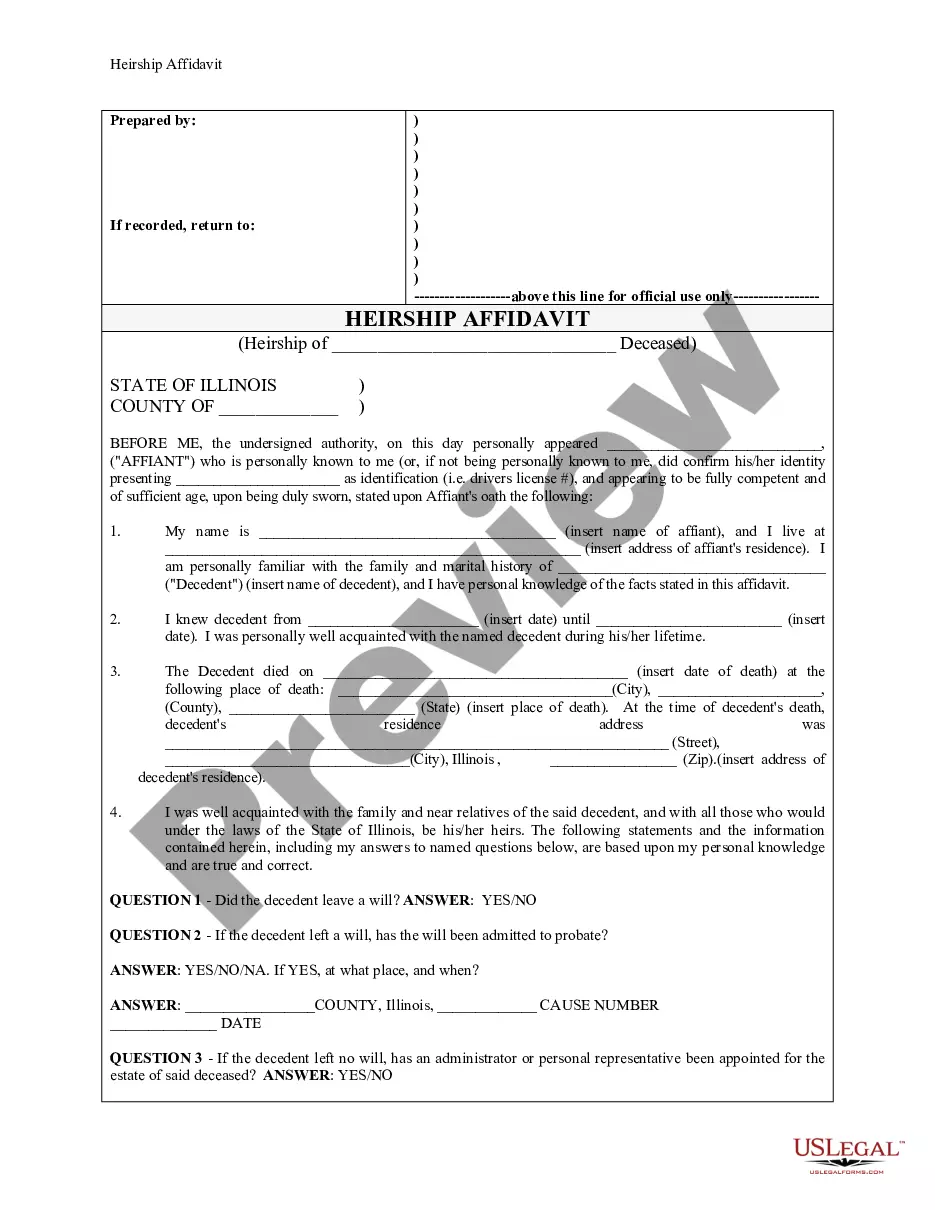

Illinois Affidavit Of Heirship - Descent

Description

How to fill out Illinois Affidavit Of Heirship - Descent?

Looking for Illinois Affidavit Of Heirship - Descent documents and completing them could be challenging.

To conserve significant time, expenses, and effort, utilize US Legal Forms to locate the appropriate sample tailored for your state in just a few clicks.

Our attorneys prepare every document, so all you need to do is to complete them. It's genuinely that simple.

Select your preferred method of payment via credit card or PayPal. Download the template in your chosen format. You can now print the Illinois Affidavit Of Heirship - Descent template or complete it using any online editor. Don’t worry about making errors because your form can be used, submitted, and printed as many times as desired. Try US Legal Forms to access over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's page to download the document.

- All your saved templates are kept in My documents and are always available for future use.

- If you haven’t registered yet, you will need to enroll.

- Review our comprehensive instructions on how to obtain the Illinois Affidavit Of Heirship - Descent template within minutes.

- To acquire a valid form, verify its suitability for your state.

- Examine the form using the Preview option (if available).

- If there's a description, read it to understand the details.

- Click the Buy Now button if you have found what you need.

Form popularity

FAQ

The next of kin is determined by the Illinois Probate Act, and under that statute, the next of kin depends on who survives the death: If there is a spouse and/or child surviving, then the spouse and/or children are the next of kin.

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

Merriam-Webster defines heir as "one who inherits or is entitled to inherit property" and legatee as "someone who receives money or property from a person who has died."

If a person dies without a will, the person died intestate. The person who died is called the decedent. The decedent's property is given to the decedent's heirs during a probate court case.If the person had no spouse or children, then their property goes to their next closest surviving relatives.

Any one person, organization (such as a religious group or a charity), or trust named in a will can be thought of as a legatee for the purposes of probate.

Meaning differences. Merriam-Webster defines heir as "one who inherits or is entitled to inherit property" and legatee as "someone who receives money or property from a person who has died."

A person who receives Personal Property through a will. The term legatee is often used to denote those who inherit under a will without any distinction between real property and personal property, but technically, a devisee inherits real property under a will.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.