Delaware Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Subordination Agreement?

Utilize US Legal Forms to secure a printable Delaware Subordination Agreement.

Our legally permissible forms are formulated and consistently revised by qualified attorneys.

Ours is the most comprehensive catalog of forms available online and provides cost-effective and precise templates for clients, legal professionals, and small to medium-sized businesses.

Hit Buy Now if it’s the form you desire. Create your account and make payment via PayPal or credit card. Download the template to your device and feel free to utilize it as many times as you like. Use the Search box if you wish to find another document template. US Legal Forms provides thousands of legal and tax templates and packages for both business and personal requirements, including the Delaware Subordination Agreement. Over three million users have successfully utilized our platform. Select your subscription plan and acquire high-quality documents in just a few clicks.

- The templates are categorized by state-based classifications and some may be viewed prior to downloading.

- To download templates, users need a subscription and must Log In to their account.

- Select Download next to any form you require and locate it in My documents.

- For individuals without a subscription, please adhere to the following steps to swiftly find and download the Delaware Subordination Agreement.

- Ensure you check and verify that you acquire the correct form relevant to the required state.

- Examine the document by reviewing the description and utilizing the Preview function.

Form popularity

FAQ

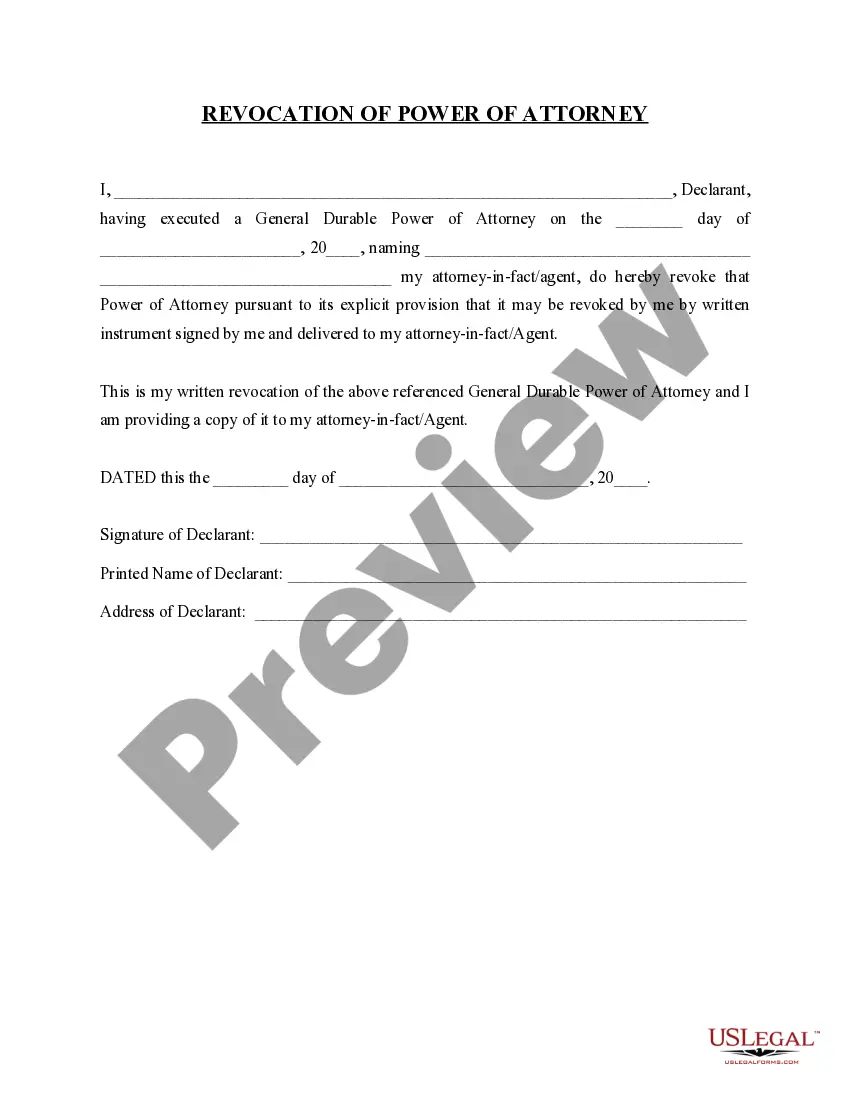

To create a subordination agreement, specific elements must be present. First, it must be in writing and signed by all involved parties, including the property owner, lender, and tenants. Clear identification of the lease and mortgage details is essential to avoid future disputes. Understanding the nuances of a Delaware Subordination Agreement can help ensure all parties comply with legal requirements.

A lease subordination agreement is a legal document that establishes the relationship between a lease and a mortgage. This agreement allows a lender to have a priority claim to the property used as collateral. Essentially, if the property owner defaults on their mortgage, the lender can take control of the property, even if a lease is in place. This can affect tenants, so understanding the implications of a Delaware Subordination Agreement is crucial.

Typically, the parties involved in a Delaware Subordination Agreement are the borrower and the lenders. Each lender must sign to acknowledge their understanding of their position in the repayment hierarchy. Having all parties sign ensures that everyone is aware of the terms and agrees to the structure set forth in the agreement.

A Delaware Subordination Agreement is a legal document that establishes the order of priority among creditors regarding the debtor's assets. It clarifies which obligations must be met first in case of liquidation, providing security to primary lenders. This agreement fosters trust and collaboration between lenders while facilitating easier access to additional funding for borrowers.

In legal terms, a subordination sentence might state: 'The borrower agrees that the Delaware Subordination Agreement will prioritize the second lender's claim over the first lender.' This sentence illustrates the essence of subordination in financial agreements, highlighting which claims take precedence in case of default.

To obtain a Delaware Subordination Agreement, you should first consult your lender or mortgage company. They can provide the necessary documentation and guide you through the process. Additionally, platforms like uslegalforms offer simple templates and legal resources to help you draft your agreement efficiently.

While it's not always required, notarizing a written agreement, including a Delaware Subordination Agreement, can provide added legal validity. Notarization helps ensure that all parties involved fully understand and agree to the terms outlined in the agreement. It’s a practice that can protect against future disputes.

The primary purpose of a subordination agreement is to change the order of lien priority among loans. By signing a Delaware Subordination Agreement, borrowers can secure better financing options or make necessary adjustments in their financial structure. This agreement enables smoother management of mortgages and other debts.

Someone might seek a subordinate mortgage to take advantage of lower interest rates or to access additional funds for home improvements. With a Delaware Subordination Agreement, the homeowner can use their equity while ensuring the second mortgage remains in a subordinate position. This strategy can enhance financial flexibility.

A subordination request form is a document that a borrower submits to a lender to formally ask for a change in the priority of their mortgage. This form typically accompanies a Delaware Subordination Agreement, outlining the request details and context. This process helps borrowers manage their financial obligations effectively.