Florida Subordination Agreement (Deed of Trust to Storage Agreement)

Description

How to fill out Subordination Agreement (Deed Of Trust To Storage Agreement)?

Finding the right legitimate file format can be a struggle. Needless to say, there are plenty of layouts available online, but how will you discover the legitimate kind you require? Use the US Legal Forms site. The support gives a huge number of layouts, such as the Florida Subordination Agreement (Deed of Trust to Storage Agreement), which can be used for organization and private needs. Every one of the kinds are inspected by specialists and meet state and federal demands.

In case you are previously authorized, log in to your accounts and click the Down load switch to have the Florida Subordination Agreement (Deed of Trust to Storage Agreement). Make use of your accounts to search throughout the legitimate kinds you possess acquired formerly. Proceed to the My Forms tab of your own accounts and acquire an additional version in the file you require.

In case you are a brand new user of US Legal Forms, listed here are straightforward guidelines that you should adhere to:

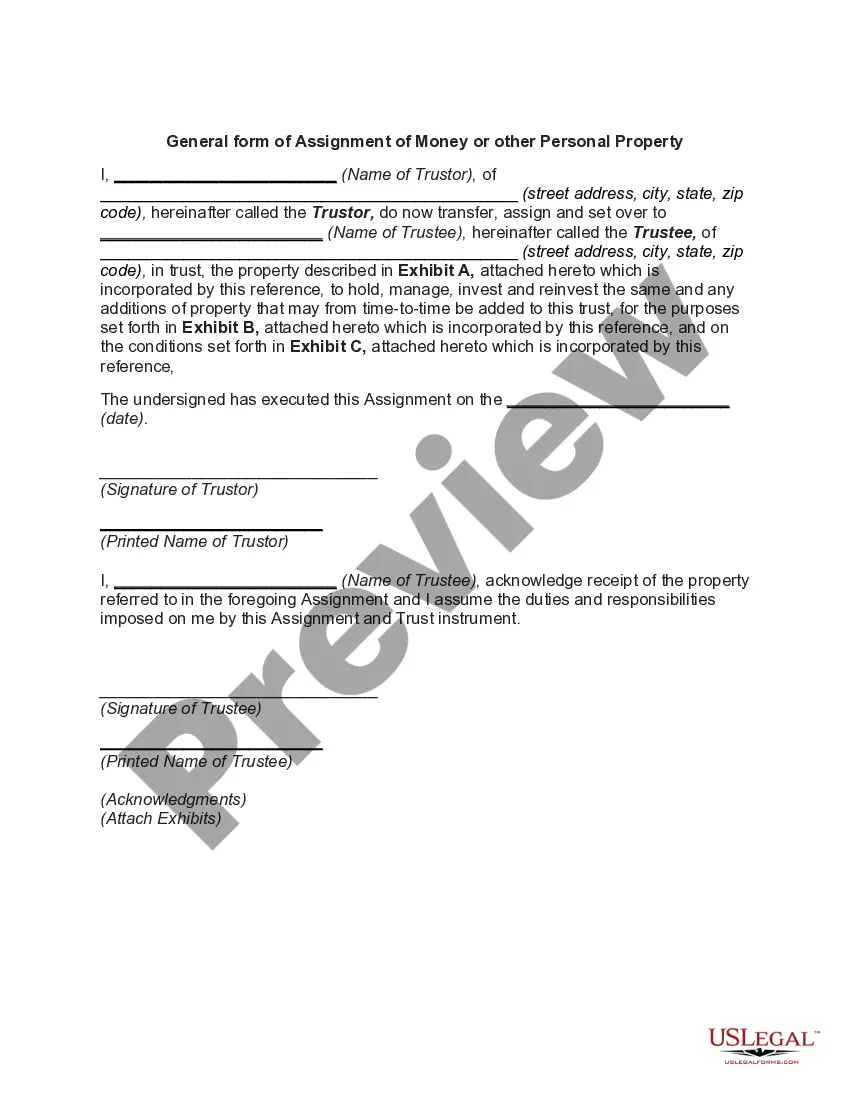

- Initially, be sure you have chosen the proper kind for the city/area. You may look over the shape while using Preview switch and study the shape explanation to ensure it is the right one for you.

- In case the kind fails to meet your requirements, take advantage of the Seach field to find the proper kind.

- Once you are sure that the shape would work, click on the Purchase now switch to have the kind.

- Opt for the costs plan you desire and type in the required information and facts. Create your accounts and buy an order making use of your PayPal accounts or bank card.

- Opt for the data file format and download the legitimate file format to your gadget.

- Full, modify and print out and indicator the received Florida Subordination Agreement (Deed of Trust to Storage Agreement).

US Legal Forms may be the greatest collection of legitimate kinds that you can discover a variety of file layouts. Use the company to download appropriately-made files that adhere to condition demands.

Form popularity

FAQ

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

Two types of subordination agreements are: Executory Subordination and Automatic Subordination. These differ in the timing of when priority rights are given and the contractual performance required by the subordinated party.

Key Takeaways. A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

High-yield bondholders primarily consider four types of subordination: Contractual subordination. Debt of the issuer that is defined as 'senior indebtedness' under the bond documentation is expressly senior in right of payment to the bonds. Collateral subordination. ... Structural subordination. ... Temporal subordination.

Get the terminology right In addition, a deed of priority usually addresses what steps each lender may take to enforce its security. Subordination deed ? this deals with the entitlement of the different creditors to receive payments .

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.

Broadly, there are two types of subordination: structural (common in the UK and mainland Europe) and contractual (common in the US). On a contractual subordination, loans are made to the same company but the senior creditor and junior creditor agree priority of payment by contract.

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

A Subordination Agreement is a narrow form of Intercreditor Agreement that focuses on the priority of two or more creditors' debts and claims concerning a borrower with multiple loans and common security interest. It is also known as a Priority Agreement.