This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Florida Partnership Data Summary

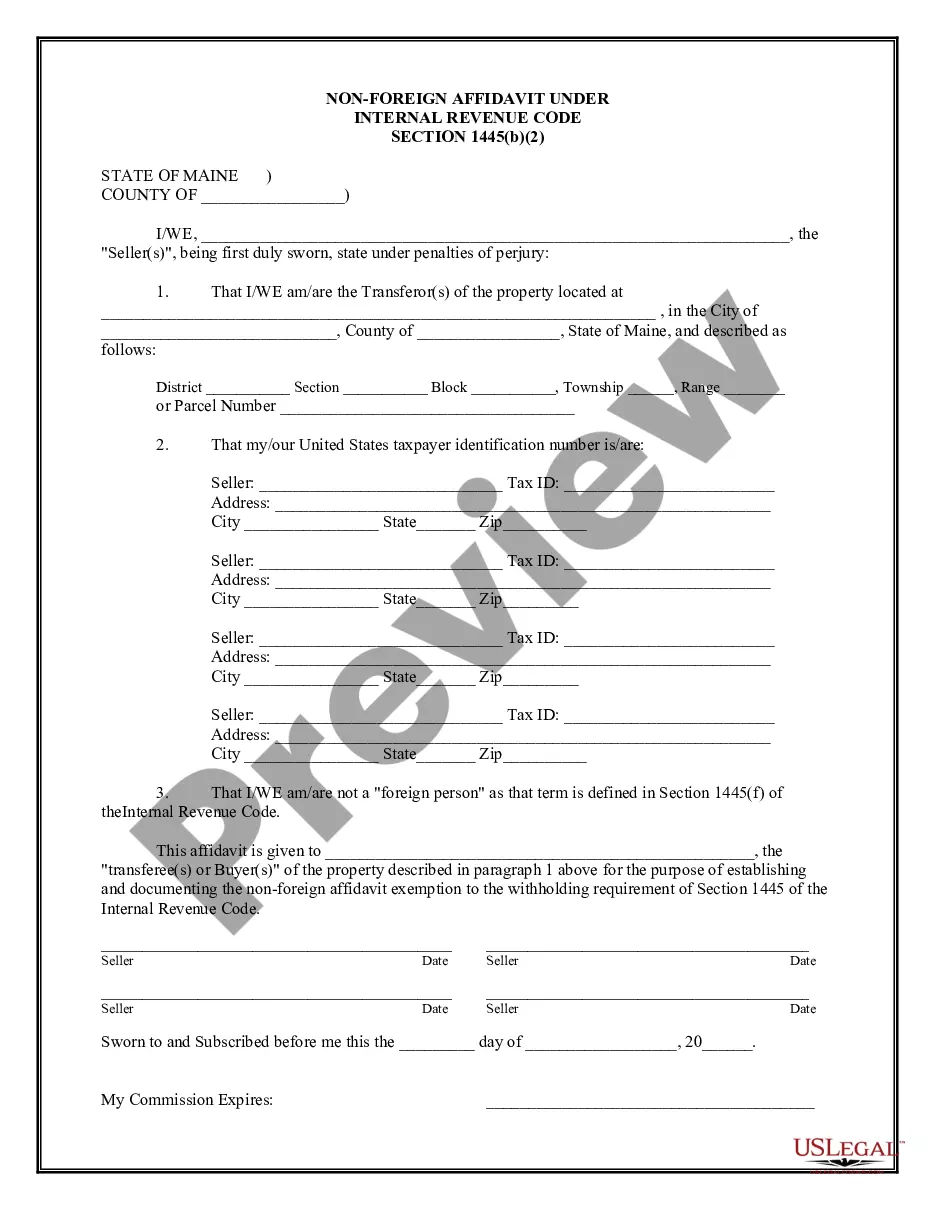

Description

How to fill out Partnership Data Summary?

If you require to complete, acquire, or print legal document templates, make use of US Legal Forms, the largest selection of legal forms available on the Internet.

Utilize the website's straightforward and user-friendly search to find the documents you need.

A collection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you wish to purchase, click on the Buy now option. Choose your pricing plan and enter your details to register for an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Florida Partnership Data Summary with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Florida Partnership Data Summary.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, Florida requires businesses, including partnerships, to file an annual report. This report ensures that the Florida Partnership Data Summary remains current and accurate with up-to-date business information. Filing your annual report on time is essential to maintain your good standing with the state.

Certain entities or individuals may qualify for tax exemptions in Florida, such as not-for-profit organizations or individuals below a specific income threshold. It is essential to review the criteria to determine if you match any exemptions. Understanding these details can also impact the Florida Partnership Data Summary, keeping your filings aligned with your circumstances.

Yes, if you operate a partnership in Florida, you are required to file an annual partnership tax return. This returns includes relevant details that are essential for the Florida Partnership Data Summary. Properly handling these filings supports clear records and reflects your partnership's commitments.

Yes, Limited Liability Companies (LLCs) in Florida are typically required to file tax returns, depending on their structure and income. This obligation allows the state to gather information reflected in the Florida Partnership Data Summary. Engaging with tax professionals can simplify this process for LLCs, ensuring compliance.

To uncover the owners of a business in Florida, you can access public records maintained by the state. These records often contain information available in the Florida Partnership Data Summary. Online databases and state websites provide valuable insights that can help you identify business ownership effortlessly.

A Florida partnership is a business structure where two or more individuals share ownership and management responsibilities. It allows for flexibility and shared decision-making, which can benefit various business ventures. This structure is often highlighted in the Florida Partnership Data Summary, showcasing the names and details of the parties involved.

Indeed, partnerships are generally required to file information returns with the state. This filing includes key details that contribute to the Florida Partnership Data Summary. It is crucial for partnerships to understand their responsibilities and deadlines, as this ensures operational transparency and legality.

Yes, Florida does require partnerships to file specific documents. Depending on the type of partnership, there may be different obligations to fulfill. Filing helps maintain transparency and supports the management of the Florida Partnership Data Summary. Adhering to these requirements ensures legal compliance for your partnership.

On Sunbiz, users can find a wealth of information including business registrations, LLC ownership details, and corporate documents. This comprehensive database helps you gather essential facts for the Florida Partnership Data Summary and ensure compliance.

To find a business partner number in Florida, search the Sunbiz website using the business name. This will lead you to the relevant profile, where you can find associated identification numbers. This is crucial for anyone working with the Florida Partnership Data Summary.