Florida Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

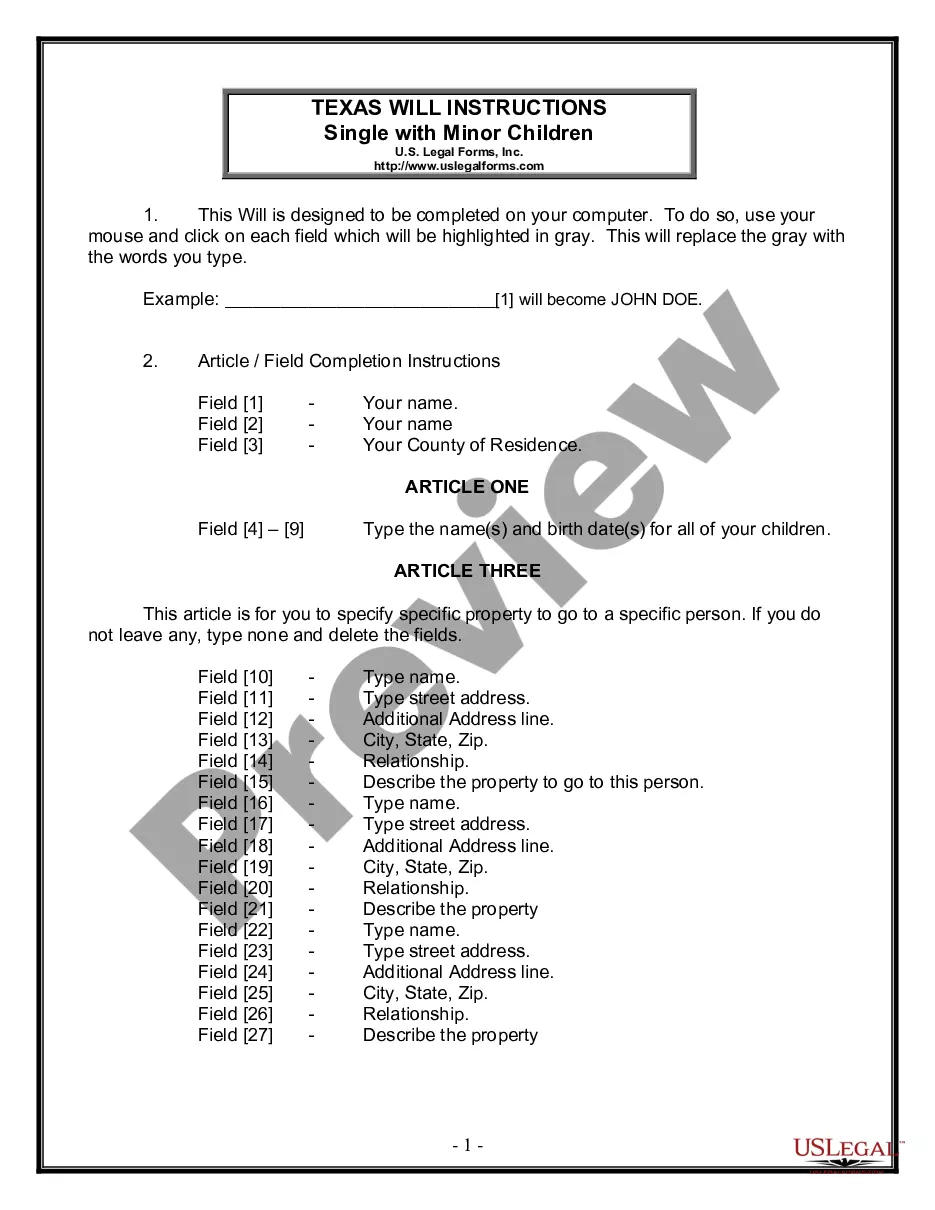

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

If you want to full, acquire, or produce authorized document web templates, use US Legal Forms, the most important variety of authorized forms, which can be found on the Internet. Make use of the site`s basic and convenient research to get the documents you will need. Different web templates for enterprise and specific uses are sorted by categories and states, or search phrases. Use US Legal Forms to get the Florida Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form within a number of mouse clicks.

If you are currently a US Legal Forms client, log in in your profile and click the Download switch to get the Florida Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form. You may also accessibility forms you formerly saved within the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for your proper metropolis/region.

- Step 2. Make use of the Preview choice to look over the form`s articles. Do not overlook to see the explanation.

- Step 3. If you are unsatisfied together with the type, use the Look for field on top of the screen to get other variations of your authorized type web template.

- Step 4. When you have found the shape you will need, go through the Acquire now switch. Opt for the pricing program you favor and put your qualifications to register for the profile.

- Step 5. Approach the purchase. You may use your charge card or PayPal profile to perform the purchase.

- Step 6. Find the formatting of your authorized type and acquire it in your product.

- Step 7. Complete, edit and produce or sign the Florida Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

Each and every authorized document web template you purchase is your own property forever. You might have acces to each and every type you saved with your acccount. Click on the My Forms segment and decide on a type to produce or acquire once more.

Contend and acquire, and produce the Florida Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form with US Legal Forms. There are millions of specialist and status-certain forms you may use for your enterprise or specific requires.

Form popularity

FAQ

Subsection (b) specifies that the discharge granted under this section discharges the debtor from all debts that arose before the date of the order for relief. It is irrelevant whether or not a proof of claim was filed with respect to the debt, and whether or not the claim based on the debt was allowed.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

Filing Chapter 7 bankruptcy in Florida includes the following steps: Determine if bankruptcy is the best option. ... Evaluate applicable exemptions. ... Prepare the bankruptcy petition. ... Automatic stay. ... Assignment to a Chapter 7 trustee. ... Objection to exemptions. ... Adversary claims. ... Bankruptcy discharge.

In most cases, a Chapter 7 bankruptcy can stay on your credit reports for up to 10 years from the date you file bankruptcy. Once the 10-year period ends, the bankruptcy should fall off your credit reports automatically.

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Having your case dismissed means it's thrown out without having your debts discharged. When a court grants a bankruptcy discharge, it means you're no longer responsible for paying certain debts.

Discharge (of debts) refers to the process in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer allowed to make attempts to collect the debt.