California Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker

Description

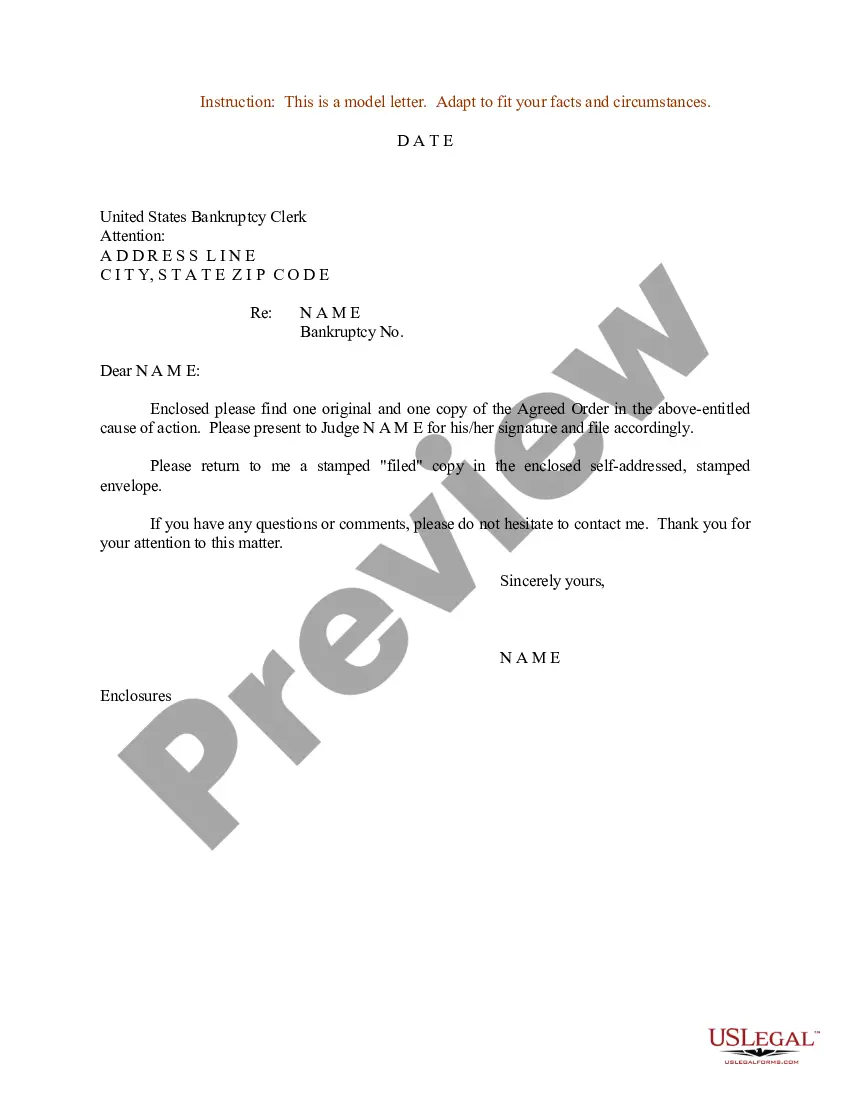

How to fill out Sample Letter For Application Of Unsecured Creditors For An Order Authorizing Employment Of Investment Banker?

If you wish to complete, download, or print out legal papers layouts, use US Legal Forms, the largest selection of legal kinds, which can be found on-line. Utilize the site`s simple and easy hassle-free research to get the papers you need. A variety of layouts for enterprise and specific uses are sorted by categories and claims, or key phrases. Use US Legal Forms to get the California Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker in just a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in to your bank account and click the Obtain key to have the California Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker. You may also access kinds you previously acquired in the My Forms tab of your respective bank account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape to the correct town/region.

- Step 2. Use the Preview choice to check out the form`s content. Do not forget about to see the description.

- Step 3. In case you are not satisfied using the develop, utilize the Look for industry near the top of the screen to get other versions from the legal develop web template.

- Step 4. Upon having identified the shape you need, go through the Purchase now key. Opt for the pricing program you like and add your credentials to register for the bank account.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Select the formatting from the legal develop and download it on the gadget.

- Step 7. Complete, change and print out or signal the California Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker.

Each and every legal papers web template you acquire is your own property eternally. You possess acces to each and every develop you acquired inside your acccount. Click the My Forms section and select a develop to print out or download once more.

Remain competitive and download, and print out the California Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker with US Legal Forms. There are millions of skilled and status-specific kinds you can use for your enterprise or specific requirements.

Form popularity

FAQ

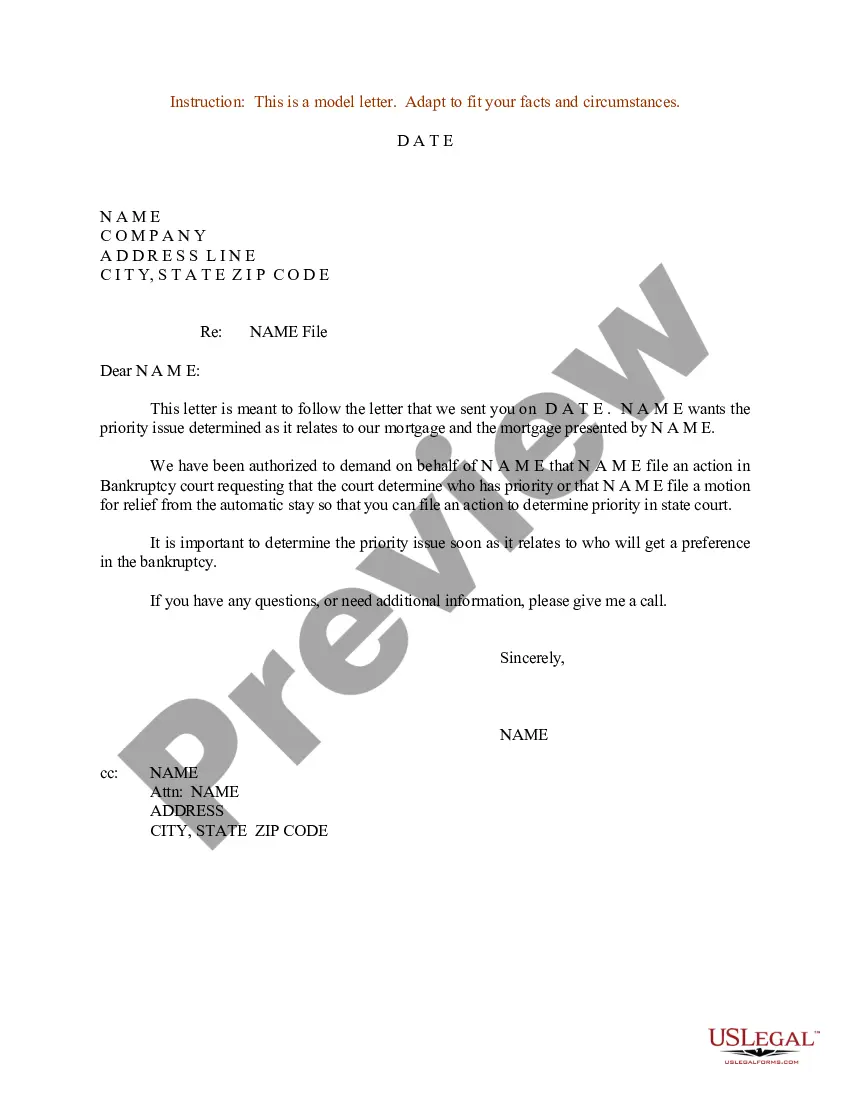

Creditors' Rights for Unsecured Claims In general, unsecured debts, such as medical debt or most credit card debt, are given the lowest priority. As an unsecured creditor, you can file a proof of claim, attend the first meeting of creditors, and file objections to the discharge.

An unsecured creditor may become a secured creditor after a lawsuit and judgment. A secured creditor, who has an interest (referred to as a lien) on a particular asset, can use the court system to seize the asset and to satisfy the debt.

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

In the event of the bankruptcy of the debtor, the unsecured creditors usually obtain a pari passu distribution out of the assets of the insolvent company on a liquidation in ance with the size of their debt after the secured creditors have enforced their security and the preferential creditors have exhausted ...

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

Also known as general creditor and general unsecured creditor. A creditor holding an unsecured claim, or having no liens against a debtor's property. Unsecured creditors have no rights against specific property of the debtor. Also, they generally have no right to receive postpetition interest in a bankruptcy case.

Understanding Unsecured Debt A loan is unsecured if it is not backed by any underlying assets. Examples of unsecured debt include credit cards, medical bills, utility bills, and other instances in which credit was given without any collateral requirement.

An unsecured loan is not protected by any collateral. If you default on the loan, the lender can't automatically take your property. The most common types of unsecured loan are credit cards, student loans, and personal loans.