Florida Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

You can spend several hours online searching for the valid document template that fulfills the federal and state regulations you will require.

US Legal Forms offers thousands of valid forms that are examined by professionals.

You can download or print the Florida Business Deductibility Checklist from the service.

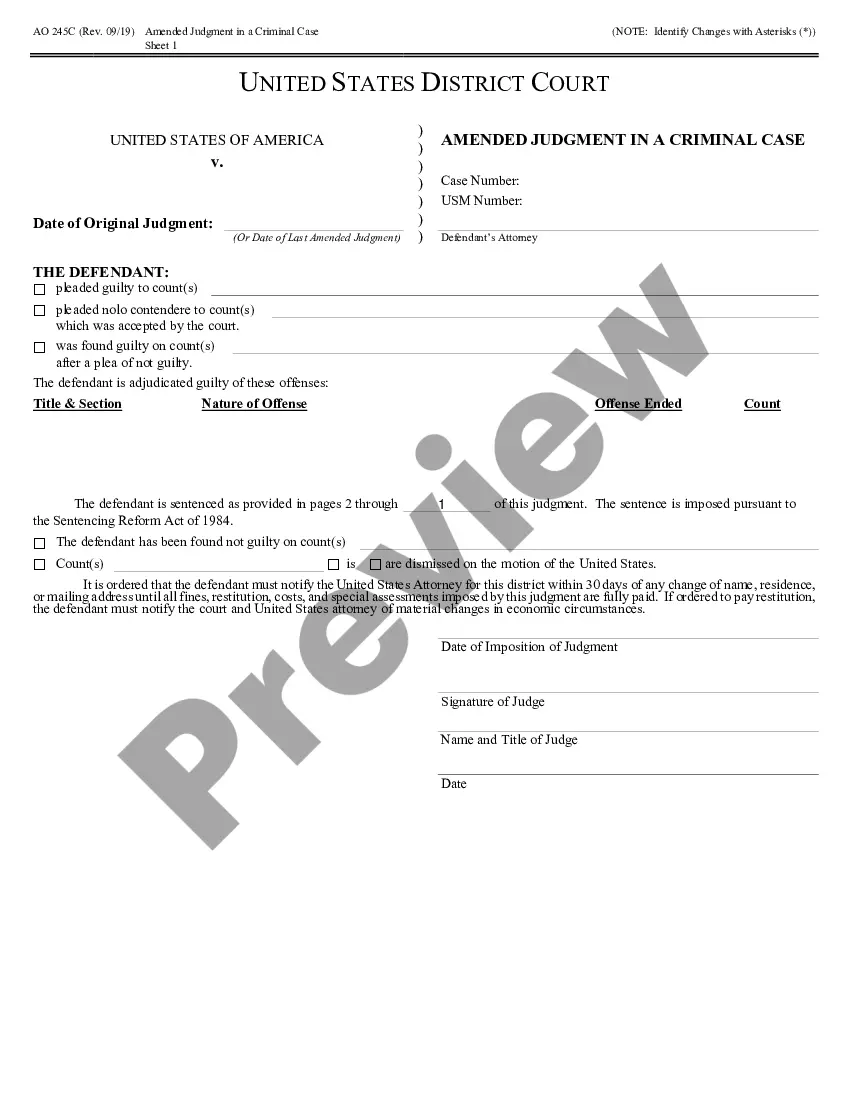

If available, use the Preview button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Florida Business Deductibility Checklist.

- Every valid document template you acquire is yours indefinitely.

- To get another copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/city of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

For an expense to be deductible, it must be ordinary and necessary for your business. This means that the expense must be common in your industry and appropriate for your business operations. Familiarizing yourself with the Florida Business Deductibility Checklist will help you identify qualifying expenses and ensure compliance.

21 Small-business tax deductionsStartup and organizational costs. Our first small-business tax deduction comes with a caveat it's not actually a tax deduction.Inventory.Utilities.Insurance.Business property rent.Auto expenses.Rent and depreciation on equipment and machinery.Office supplies.More items...

These are informally known as above-the-line tax deductions, and here are some of the most common:Traditional IRA deduction.HSA/FSA deduction.Dependent care FSA contributions.Student loan interest deduction.Teacher classroom expenses.Self-employed tax deductions.Alimony deduction.More items...?

When you're totaling up your business's expenses at the end of the year, don't overlook these important business tax deductions.Auto Expenses.Expenses of Going Into Business.Books and Legal and Professional Fees.Insurance.Travel.Interest.Equipment.Charitable Contributions.More items...

Self-Employment Tax Deduction. Social Security and Medicare Taxes.Home Office Deduction.Internet and Phone Bills Deduction.Health Insurance Premiums Deduction.Meals Deduction.Travel Deduction.Vehicle Use Deduction.Interest Deduction.More items...

Federal tax laws allow LLCs to deduct initial startup costs, as long as the expenses occurred before it begins conducting business. A business is considered active the first time the company's services are offered to the public. The IRS sets a $5,000 deduction limit on startup and organizational costs.

Types of Deductible ExpensesSelf-Employment Tax.Startup Business Expenses.Office Supplies and Services.Advertisements.Business Insurance.Business Loan Interest and Bank Fees.Education.Depreciation.More items...?

5 tax deductionsMortgage interest.Mortgage points and insurance.Property taxes.Medical home improvements.Energy efficient upgrades.

Can my LLC deduct the cost of a car? Yes. A Section 179 deduction allows you to deduct part of or the entire cost of your LLC's vehicle.

Business location expenses are deductible for tax purposes by an LLC. If the owner or owners of the LLC operate it from a home office, then such things as supplies and a phone meant specifically for business qualify as business expenses that can be written off.