New Jersey Direct Deposit Form for Employees

Description

How to fill out Direct Deposit Form For Employees?

Selecting the appropriate authentic documents template can be a challenge.

Naturally, there is a multitude of templates available online, but how can you find the genuine form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the New Jersey Direct Deposit Form for Employees, which you can use for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal requirements.

If the form does not meet your requirements, utilize the Search field to find the right form. Once you are certain that the form will work, click the Purchase now button to acquire the form. Choose the pricing plan you need and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, edit, print, and sign the received New Jersey Direct Deposit Form for Employees. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to download properly crafted documents that adhere to state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the New Jersey Direct Deposit Form for Employees.

- Use your account to browse through the legal forms you have purchased previously.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure that you have selected the correct form for your area/state.

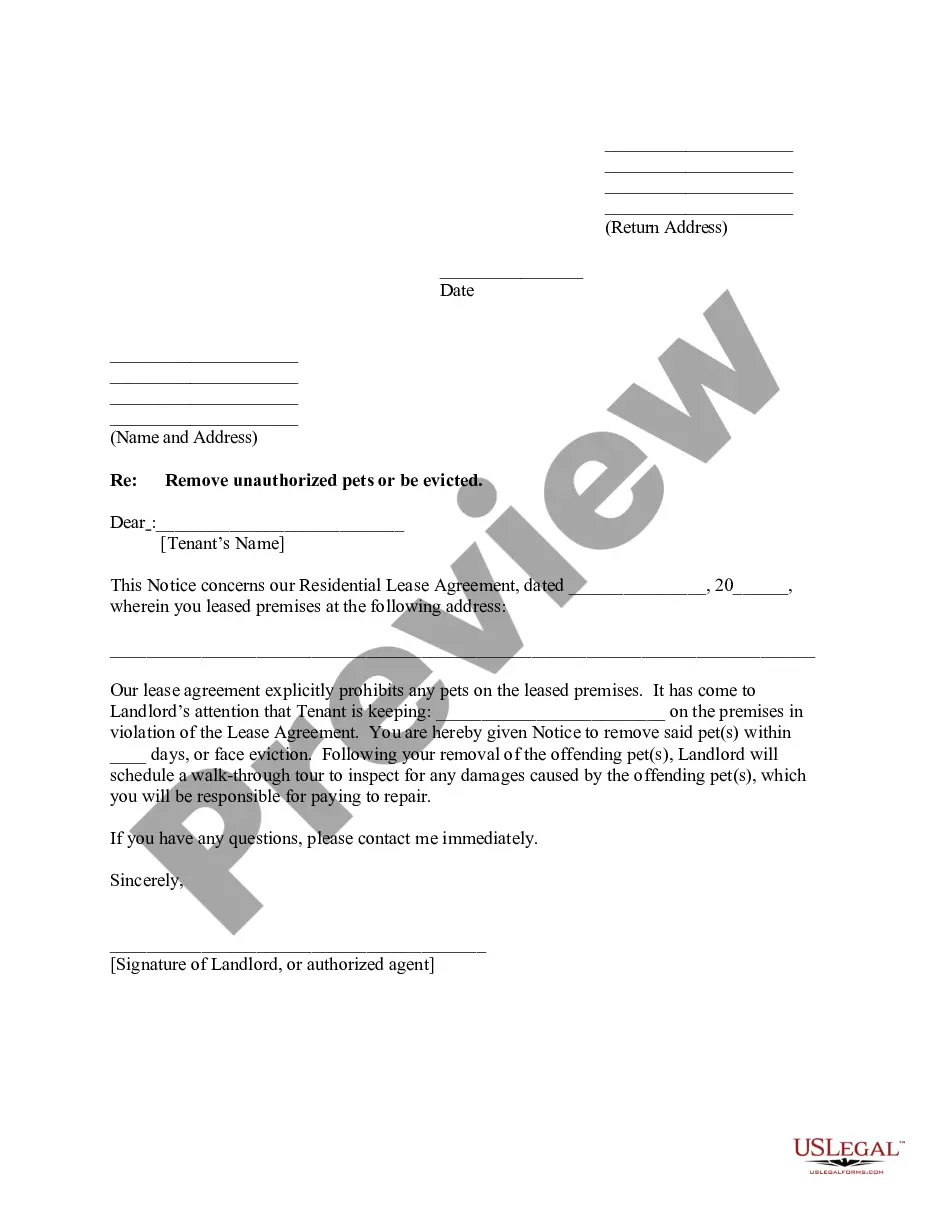

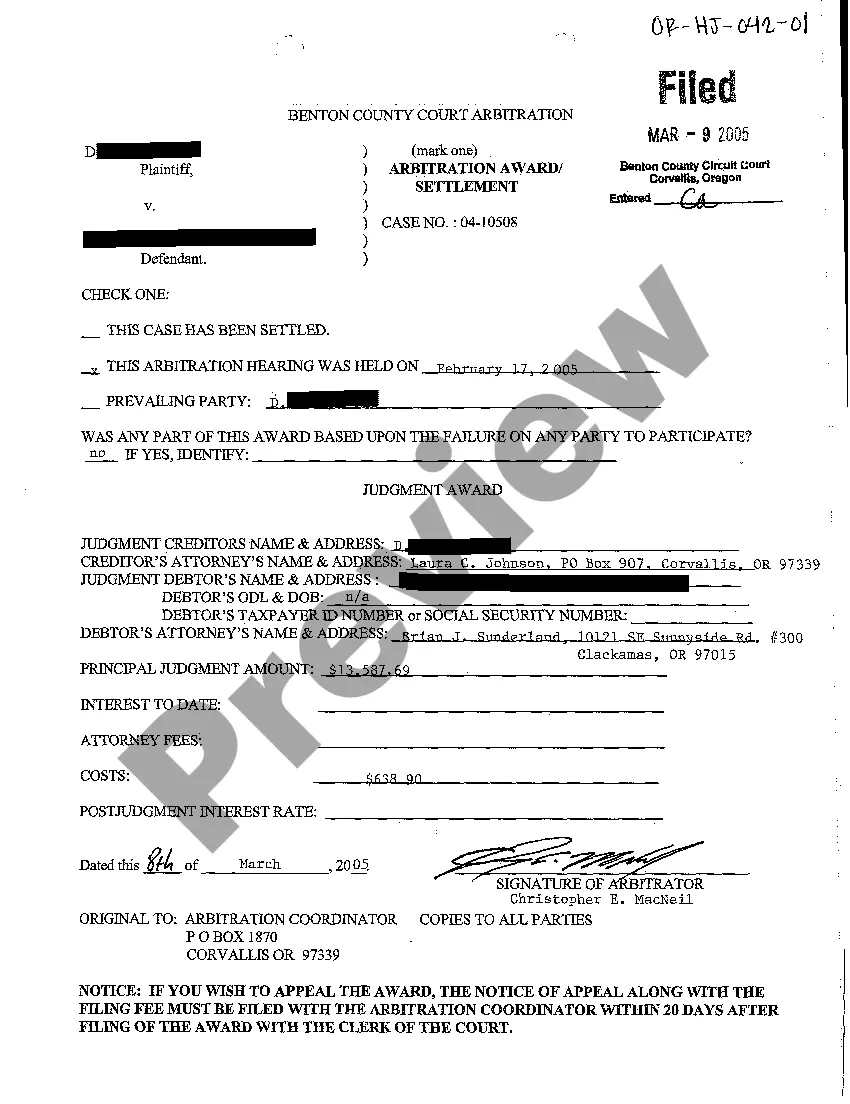

- You can review the form using the Preview button and examine the form details to confirm this is suitable for you.

Form popularity

FAQ

Employers typically require a New Jersey Direct Deposit Form for Employees to set up direct deposit. This form collects essential information such as your bank account details and authorization for deposits. Using a standardized form helps streamline the process and ensures accuracy in payroll transactions. You can find a reliable version of this form at US Legal Forms, making it simple for both you and your employer.

Yes, you can easily print off a New Jersey Direct Deposit Form for Employees. This form is available through various online platforms, including US Legal Forms, where you can find a template tailored to your needs. Simply download the form, fill in the required information, and print it out. This allows you to have a physical copy ready for submission to your employer.

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

How to set up direct deposit. If you apply online for Unemployment Insurance benefits, you can enter your direct deposit information when completing the application. We will need the nine-digit bank routing number and your personal checking or savings account number (see below).

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.

Direct Deposit Authorization Form Company Information. Employee Information. Bank Account Information. ?I hereby authorize?? Statement. Employee Signature and Date. Space for Attached Physical Check (Optional)

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

Direct deposit (also called "electronic funds transfer") is how businesses can send an employee's or contractor's paycheck directly into their bank account. This can be set to run automatically to your custom pay periods: weekly, biweekly, or monthly.

What information do I need to provide in order to set up direct deposit? Your employer or depositor's name and address. Your Employee ID or account number with depositor. Your account number. Your routing/ABA number.

Steps for Direct Deposit Setup Choose A Payroll Service Provider. ... Establish A Company Payroll Account. ... Send A Direct Deposit Authorization Form To Employees. ... Verify Correct Account Information. ... Run standard payroll process.