Florida Resolution of Meeting of LLC Members to Acquire Assets of a Business

Description

How to fill out Resolution Of Meeting Of LLC Members To Acquire Assets Of A Business?

Are you in a location where you require documentation for potential corporate or personal purposes almost every time.

There are numerous legal document templates available online, but finding trustworthy ones isn't easy.

US Legal Forms provides thousands of document templates, including the Florida Resolution of Meeting of LLC Members to Acquire Assets of a Business, that are designed to meet federal and state regulations.

Once you find the correct document, click Get now.

Choose the payment plan you require, complete the necessary information to create your account, and purchase the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Florida Resolution of Meeting of LLC Members to Acquire Assets of a Business template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for your specific city/state.

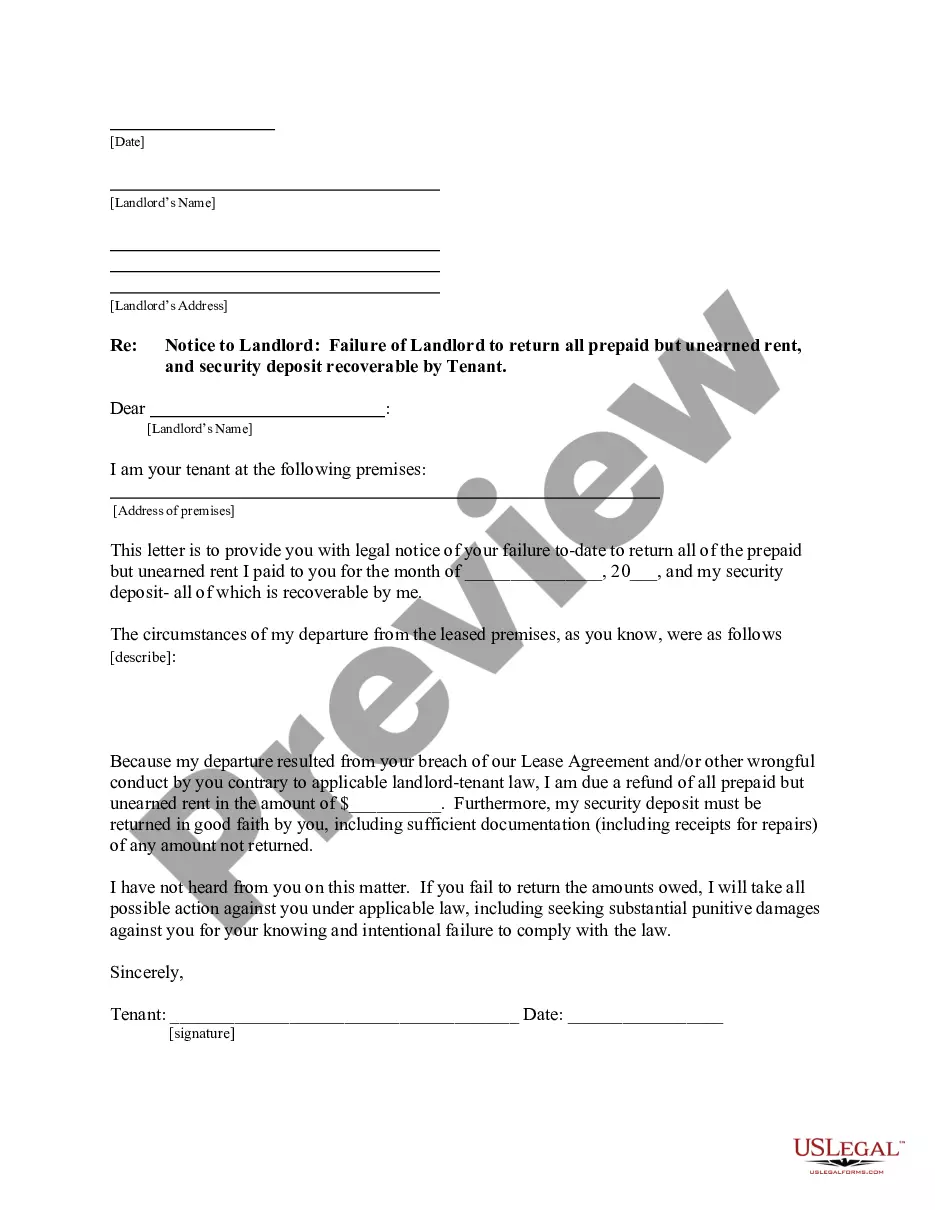

- Utilize the Review button to inspect the document.

- Check the description to confirm that you have selected the correct document.

- If the document is not what you’re looking for, make use of the Search field to find the form that fits your needs.

Form popularity

FAQ

Issuing corporate resolutions is one way for corporations to demonstrate independence and avoid piercing the veil. In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

A corporate resolution is a legal document that outlines actions a board of directors will take on behalf of a corporation. by Staff.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Why Are LLC Member Resolutions So Important? LLC member resolutions are written documents that confirm and record decisions and actions taken by the members. Having written proof of decisions helps avoid disputes and misunderstandings between members down the line.

Florida doesn't require that you have an Operating Agreement for your Limited Liability Company (LLC), but it is recommended that you have one. When setting up your company, it's beneficial to seek legal advice from a Florida LLC Business litigation attorney.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.