Kansas Release of All Auto Accident Claims

Description

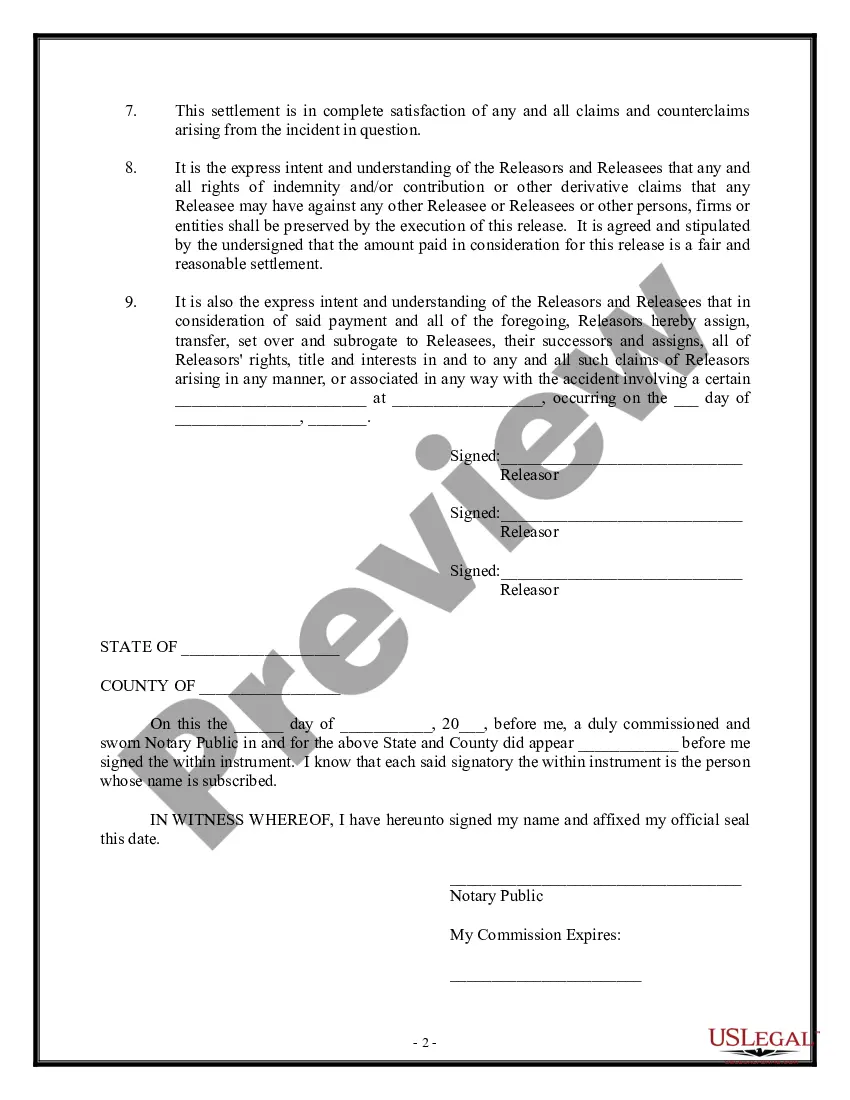

How to fill out Release Of All Auto Accident Claims?

If you require to fully download or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site's simple and efficient search to find the documents you require. Various templates for business and personal use are organized by categories and jurisdictions, or by keywords.

Utilize US Legal Forms to procure the Kansas Release of All Auto Accident Claims in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click on the My documents section to choose a form to print or download again.

Stay competitive and download and print the Kansas Release of All Auto Accident Claims with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the Kansas Release of All Auto Accident Claims.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the appropriate state/jurisdiction.

- Step 2. Use the Review option to examine the content of the form. Remember to review the overview.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose a payment plan you prefer and provide your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Kansas Release of All Auto Accident Claims.

Form popularity

FAQ

It can take anywhere from a couple of weeks to several months (or years) for a car accident case to settle. There is plenty to investigate on each party's end, and if you suffered extensive injuries and property damage, this could explain why the settlement process is lengthy.

Post-accident Insurance ProcessKansas is one of the states with mandatory "no-fault" insurance, which covers drivers and passengers alike; even pedestrians injured by a driver. Under our no-fault system, your own insurance company will pay medical without need of a lawsuit.

Generally, the money an insurance company receives in premiums goes into investment accounts that generate interest. The insurance company retains this money until the time they pay out to a policyholder, so an insurance company may delay a payout to secure as much interest revenue as possible.

Insurance companies in Kansas have at least 25 working days to acknowledge a claim and decide whether or not to accept it.

The easiest may be to ask your existing car insurance provider for details of any claims you've made in the past. This information could include the date of any claims, the type of claims, how much was paid out, and details of any injuries. Alternatively, you could contact the Claims and Underwriting Exchange (CUE).

The simplest method of checking your car insurance claims history is to request it directly from the insurance company you were with when you made the claim. They should be able to tell you when the incident happened, what type of claim you made, and what the outcome was - including whether anyone was injured.

HOW LONG CAN THE INSURER TAKE? IMPORTANT: The above information is a guide to the timeframes under the Code. The insurer has 45 days from the date you stated you had a complaint/dispute to respond or resolve it.

The easiest may be to ask your existing car insurance provider for details of any claims you've made in the past. This information could include the date of any claims, the type of claims, how much was paid out, and details of any injuries. Alternatively, you could contact the Claims and Underwriting Exchange (CUE).

In the case of delay in the payment of a claim, the company shall be liable to pay interest from the date of receipt of last necessary document to the date of payment of claim. The insurer will pay at 2 per cent above the bank rate, the Insurance Regulatory and Development Authority of India (Irdai) said.

Payment Act In general, an insurer has 30 days to pay a clean claim or to send a notice to the provider stating why the payment has been delayed or denied.