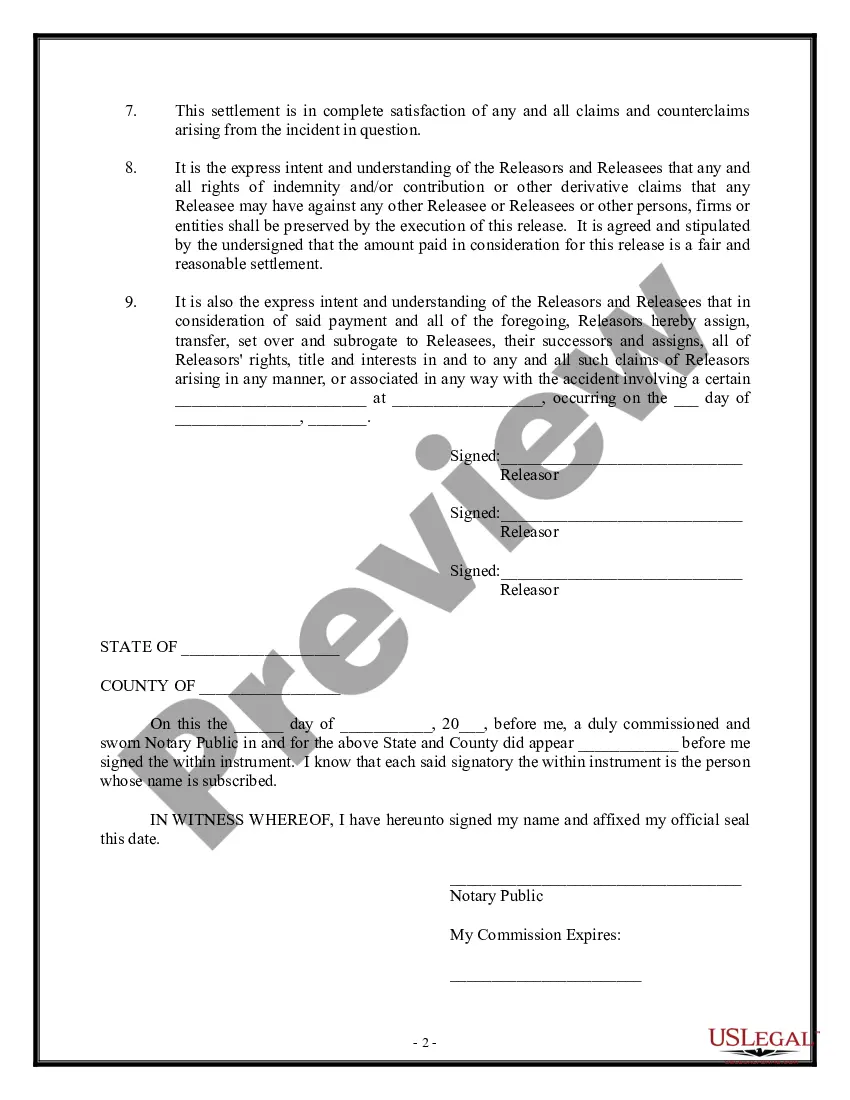

Kentucky Release of All Auto Accident Claims

Description

How to fill out Release Of All Auto Accident Claims?

Are you within a position in which you need to have files for both company or individual reasons virtually every working day? There are plenty of authorized file web templates available on the Internet, but finding versions you can depend on is not easy. US Legal Forms gives thousands of type web templates, like the Kentucky Release of All Auto Accident Claims, which are created to satisfy state and federal demands.

Should you be currently familiar with US Legal Forms web site and also have an account, simply log in. Afterward, you are able to down load the Kentucky Release of All Auto Accident Claims template.

If you do not offer an profile and need to begin using US Legal Forms, abide by these steps:

- Get the type you require and make sure it is for your correct metropolis/area.

- Utilize the Preview button to review the form.

- Read the outline to actually have selected the right type.

- In the event the type is not what you`re searching for, make use of the Search industry to obtain the type that meets your needs and demands.

- Once you get the correct type, simply click Purchase now.

- Select the costs plan you need, fill in the necessary info to produce your money, and buy the transaction utilizing your PayPal or bank card.

- Select a convenient data file formatting and down load your duplicate.

Locate all the file web templates you possess purchased in the My Forms food selection. You may get a further duplicate of Kentucky Release of All Auto Accident Claims anytime, if necessary. Just click the required type to down load or print the file template.

Use US Legal Forms, by far the most substantial selection of authorized forms, to save lots of some time and stay away from errors. The service gives skillfully created authorized file web templates which can be used for a range of reasons. Create an account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

"Choice No Fault" Car Insurance in Kentucky In a traditional no-fault state, each driver turns to their own car insurance policy to get compensation for medical bills and certain other financial losses stemming from the accident, regardless of who was at fault.

The state of Kentucky is called a no-fault state because of a law stating that each driver in the state of Kentucky has to file a claim with their insurance company first to get compensation for medical bills and other financial losses caused by the accident according to their own insurance policy.

Call the Police to Report the Driver This is especially true if the other driver is breaking a law, such as driving while uninsured. Calling the police can lead to a ticket against the driver for breaking Kentucky's insurance law, forcing the driver to obtain the required insurance before getting back on the road.

If you're found responsible for an auto accident, you should expect your car insurance rates to go up. In Kentucky, the mean insurance rate following an at-fault crash is $3,291, versus the U.S. average of $2,012. A serious accident such as an at-fault collision will stay on your insurance record for up to three years.

Yes, Kentucky is a choice no-fault state, which means that, by default, drivers in Kentucky are required to carry PIP coverage on their auto policy and file accident claims through their own insurance first, but the Commonwealth does allow drivers to opt out of the no-fault system by request.

Kentucky No-Fault artificially restricts your right to sue someone who causes injuries to you in an auto accident. If you do not like this restriction, you can reject Kentucky no-fault and be free to sue anyone you want. All you need to do is sign a rejection form that your insurance agent can provide for you.

Pull your vehicle to the side of the road, if possible. Determine if you or a loved one has been injured. Call 911 immediately, even if you believe nobody has been injured. Obtain contact information (including auto insurance information and license number) from all parties involved in the accident.

But generally, insurers will ask about the last 5 years. If your insurer asks about the last 5 years, claims you made and accidents you had more than 5 years ago won't affect the price of your car insurance. Sometimes, insurers will ask for a more detailed claims history from some drivers than others.

If you're found responsible for an auto accident, you should expect your car insurance rates to go up. In Kentucky, the mean insurance rate following an at-fault crash is $3,291, versus the U.S. average of $2,012. A serious accident such as an at-fault collision will stay on your insurance record for up to three years.

Insurance companies in Kentucky have at least 45 days to settle a claim and make a payment after the claim is filed. Kentucky insurance companies must also acknowledge a claim within 15 days.