Florida Certification of Compliance with Foreclosure Procedures

Description

Definition and meaning

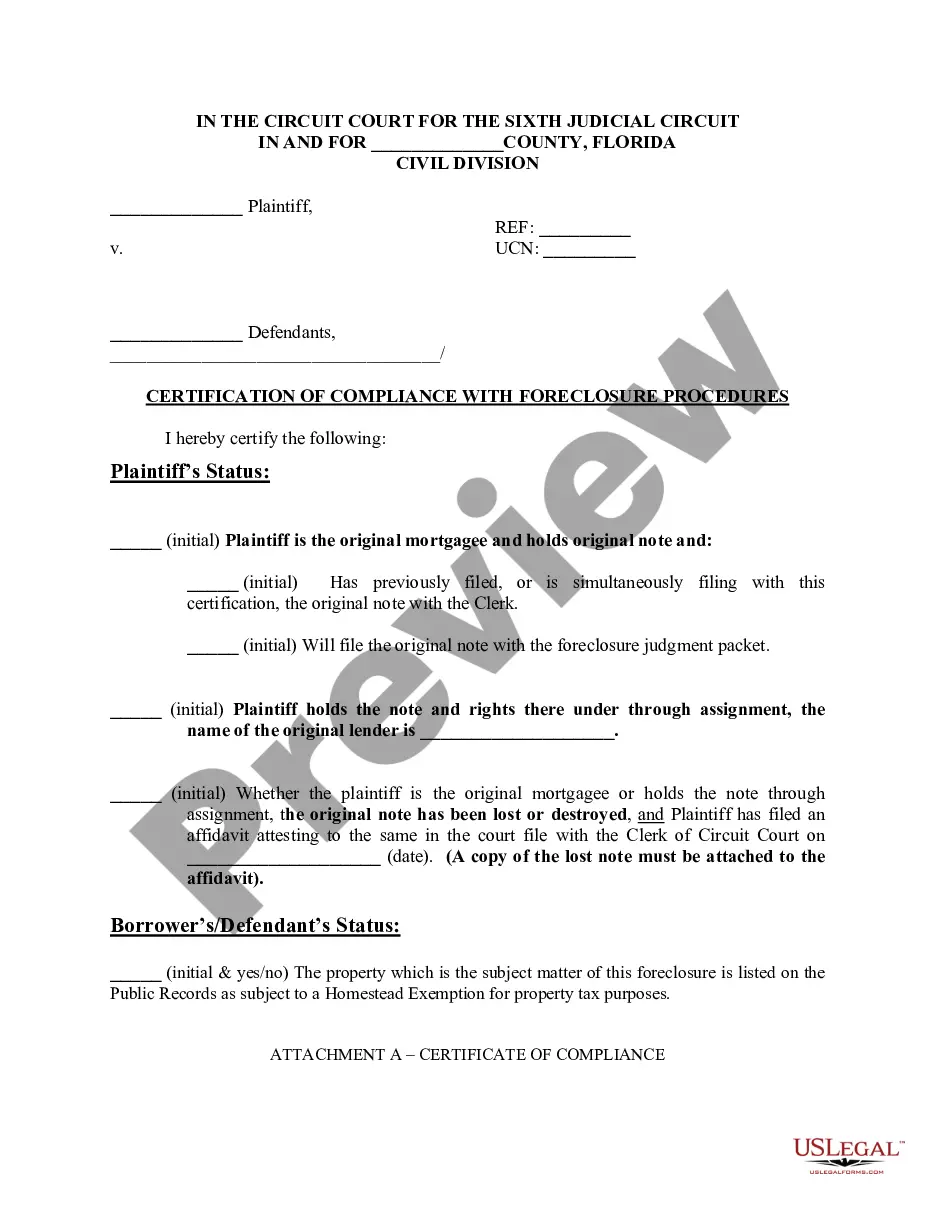

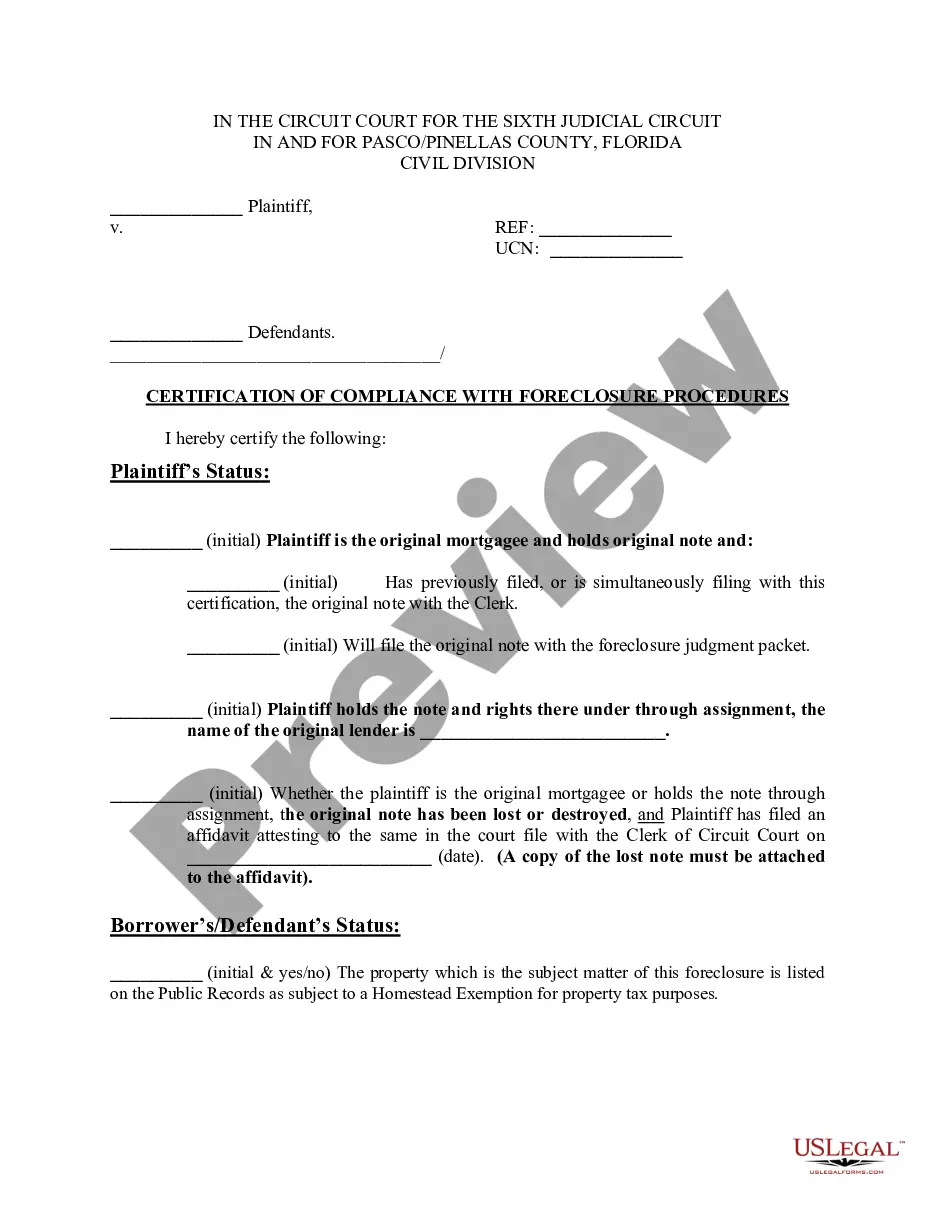

The Florida Certification of Compliance with Foreclosure Procedures is a legal document used by plaintiffs in foreclosure cases. This certification attests that the plaintiff has followed the necessary steps as mandated by Florida law before pursuing foreclosure. By completing this form, the plaintiff confirms adherence to all procedural requirements and certifies specific details about the mortgage and the borrower’s status.

How to complete a form

To properly complete the Florida Certification of Compliance with Foreclosure Procedures, follow these steps:

- Begin by filling out the plaintiff's and defendant’s details at the top of the form.

- Indicate the plaintiff's status by checking the appropriate boxes about the mortgage ownership and notes.

- Complete the section regarding the borrower's status, especially concerning any homestead exemptions.

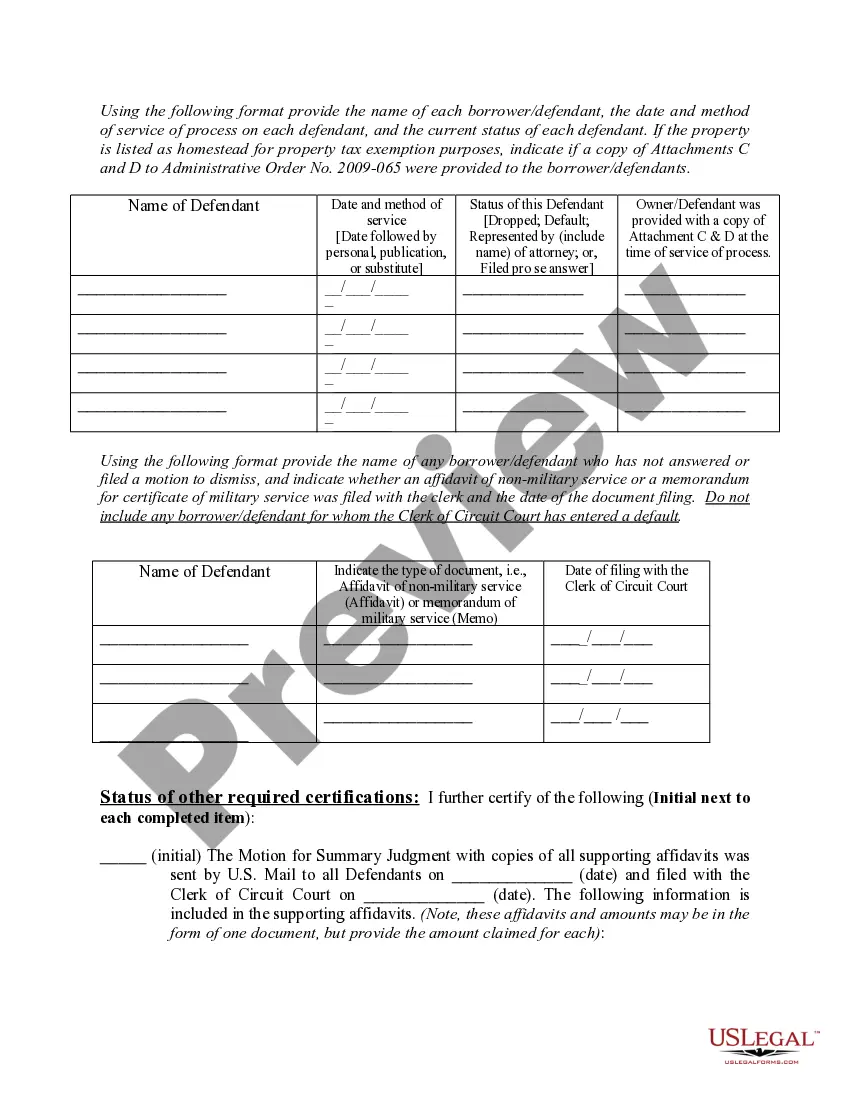

- Provide details in Attachment A regarding each defendant, such as name, date of service, and current status.

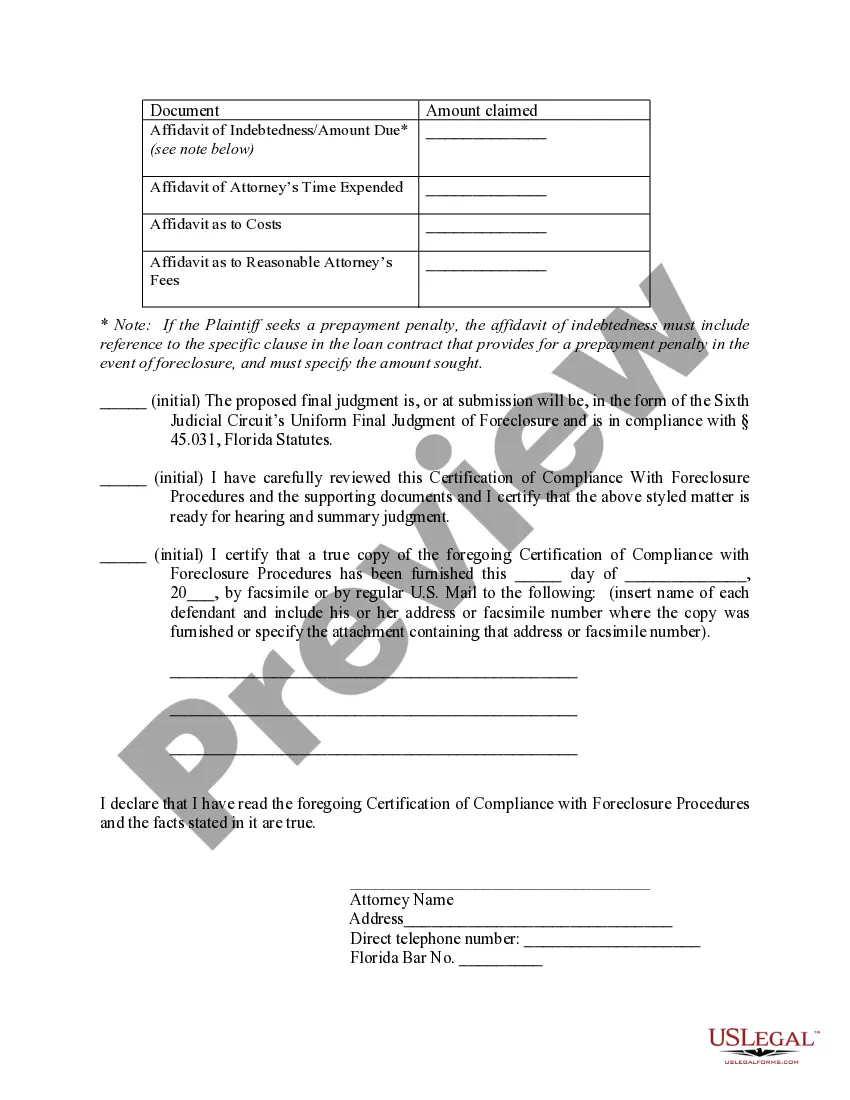

- Ensure all required signatures and initials are present before submitting the form to the Clerk of the Circuit Court.

Who should use this form

This form should be used by lenders or plaintiffs who are initiating foreclosure proceedings against borrowers in Florida. It is applicable when the lender needs to prove compliance with foreclosure processes and ensure that all parties involved are properly notified and informed.

Key components of the form

The Florida Certification of Compliance with Foreclosure Procedures consists of several key components, including:

- Identification of the plaintiff and defendants.

- Verification of the ownership of the mortgage and status of notes.

- Details about the borrower's property status, including any exemptions.

- Documentation of service of process provided to defendants.

- Certification of compliance with form submission to the Clerk of the Court.

Legal use and context

This certification is employed in the context of real estate law and the legal procedures surrounding foreclosure in Florida. It is crucial for legal compliance to ensure that the foreclosure process adheres to state laws, protecting the rights of all parties involved in the proceedings.

Common mistakes to avoid when using this form

To ensure the form is valid and accepted, avoid these common mistakes:

- Failing to check all necessary sections related to plaintiff and defendant statuses.

- Omitting required signatures or initials.

- Neglecting to attach supporting documents as necessary.

- Submitting the form without correctly verifying the service of process for all defendants.

How to fill out Florida Certification Of Compliance With Foreclosure Procedures?

How much time and resources do you frequently invest in drafting official documentation.

There’s a more efficient method to obtain such forms than employing legal professionals or squandering hours searching the internet for an appropriate template. US Legal Forms is the premier online repository that provides professionally created and validated state-specific legal documents for any intention, including the Florida Certification of Compliance with Foreclosure Procedures.

Another benefit of our library is that you can retrieve previously purchased documents that you securely store in your profile under the My documents tab. Access them anytime and redo your paperwork as often as you need.

Save time and effort preparing legal documentation with US Legal Forms, one of the most reputable online solutions. Register with us today!

- Review the form details to confirm it aligns with your state regulations. To do this, consult the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, look for an alternative using the search tab at the top of the page.

- If you already have an account with us, Log In and download the Florida Certification of Compliance with Foreclosure Procedures. If not, continue to the next steps.

- Click Buy now once you locate the correct blank. Choose the subscription plan that best fits your needs to gain access to our library’s complete services.

- Create an account and pay for your subscription. You can make a payment using your credit card or through PayPal - our service is wholly secure for that.

- Download your Florida Certification of Compliance with Foreclosure Procedures onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

In Florida, the redemption period after a foreclosure sale is generally set at the end of the sale process. However, the specific time can vary based on the nature of the mortgage and court decisions. Keeping track of these details ensures that you are aware of your rights to recover your property, especially with guidance from resources like the Florida Certification of Compliance with Foreclosure Procedures.

Foreclosure in Florida typically involves several key steps: first, the lender must send a notice of default to the borrower. Next, if the issue remains unresolved, the lender can file a foreclosure lawsuit in court. Finally, the court may issue a judgment and auction the property. Understanding these steps is crucial for navigating your responsibilities and rights, especially with the Florida Certification of Compliance with Foreclosure Procedures in focus.

The statute of limitations for mortgage foreclosure in Florida is five years, which is consistent with the timeline set by state law. This timeframe begins when the borrower defaults on the mortgage agreement. Knowing this period can empower you to take timely actions, such as seeking assistance from platforms like USLegalForms that guide you through the Florida Certification of Compliance with Foreclosure Procedures.

In Florida, the statute of limitations for mortgage foreclosure is five years. This means that lenders have five years from the date of default to initiate foreclosure proceedings. If they fail to act within this period, they may lose the right to recover the property through foreclosure, highlighting the importance of understanding your rights and options under the Florida Certification of Compliance with Foreclosure Procedures.

The 120 day foreclosure rule in Florida mandates that lenders must wait at least 120 days from the date of delinquency before initiating the foreclosure process. This gives homeowners an opportunity to catch up on missed payments or negotiate with their lender. Understanding this rule is crucial for borrowers facing financial difficulties. Seeking out informational resources like the Florida Certification of Compliance with Foreclosure Procedures can help clarify your options during this time.

A deficiency judgment in Florida occurs when the sale of a foreclosed property does not cover the full amount owed on the mortgage. The lender may seek this judgment against the borrower for the remaining balance. This can significantly impact your financial standing, so it's vital to understand your rights and options. Consulting services that relate to the Florida Certification of Compliance with Foreclosure Procedures can provide valuable insights into this issue.

To file for foreclosure in Florida, you must first gather your mortgage documents and any relevant correspondence with your lender. You then need to submit a complaint to the local court, stating the reasons for foreclosure. Following this, you may receive a court date, where both parties can present their case. Utilizing resources like the Florida Certification of Compliance with Foreclosure Procedures can guide you through this legal process effectively.

In Florida, the foreclosure process begins when a lender files a lawsuit against the borrower for defaulting on their mortgage payments. The court will then issue a summons, allowing the borrower time to respond. If the borrower does not respond or loses the case, the court may issue a final judgment and the property can be sold at auction. It's essential to obtain a Florida Certification of Compliance with Foreclosure Procedures to ensure that all legal protocols have been followed.