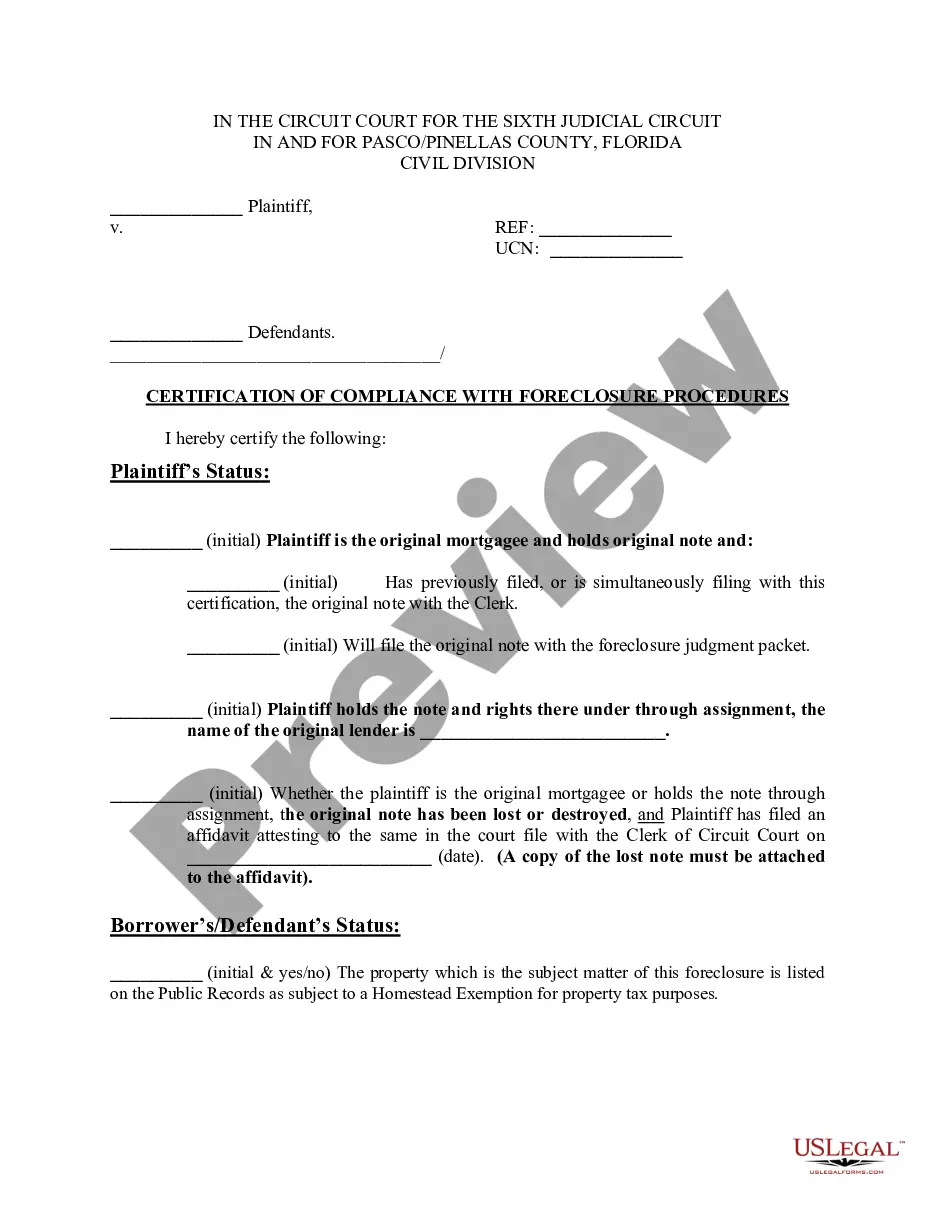

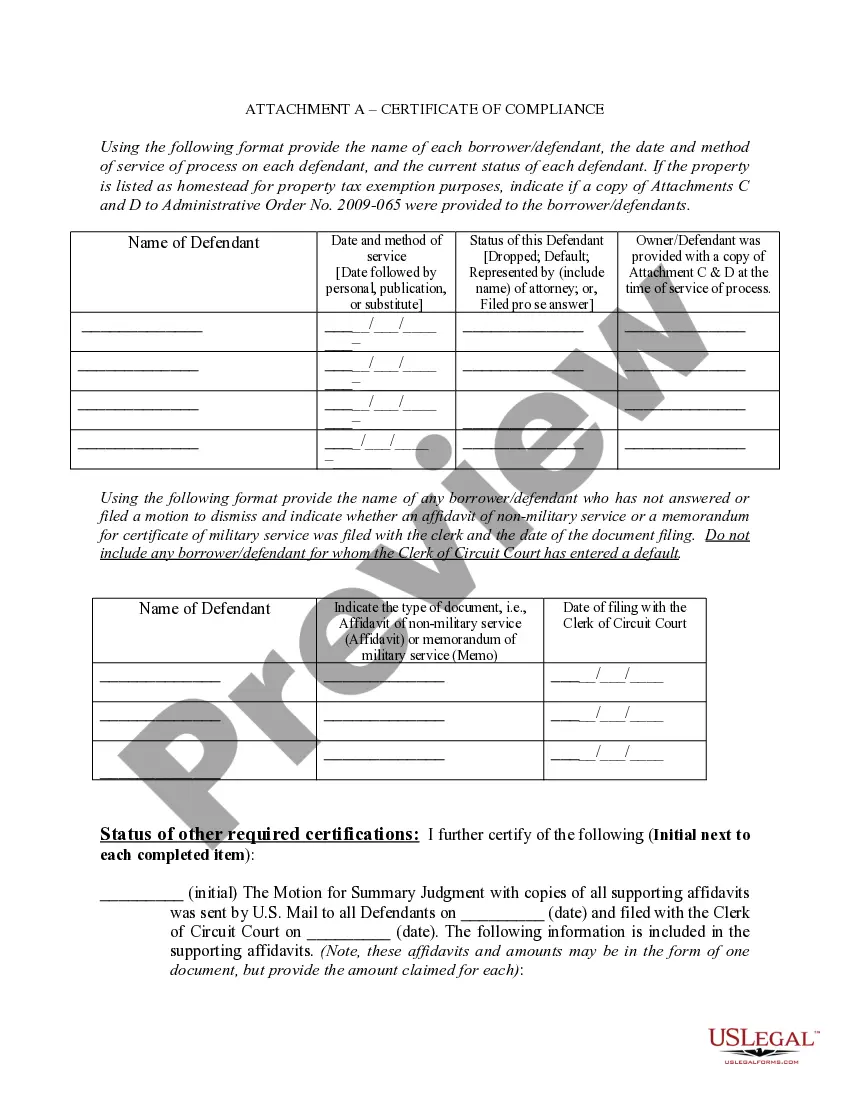

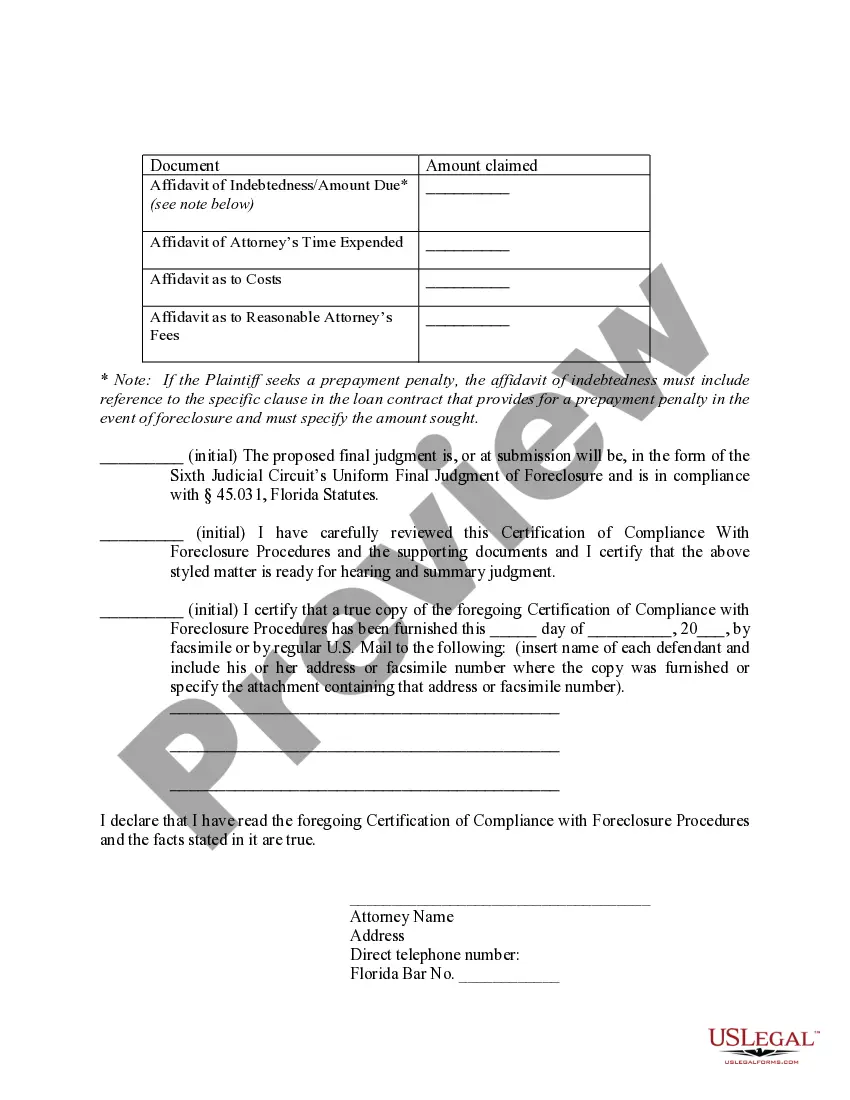

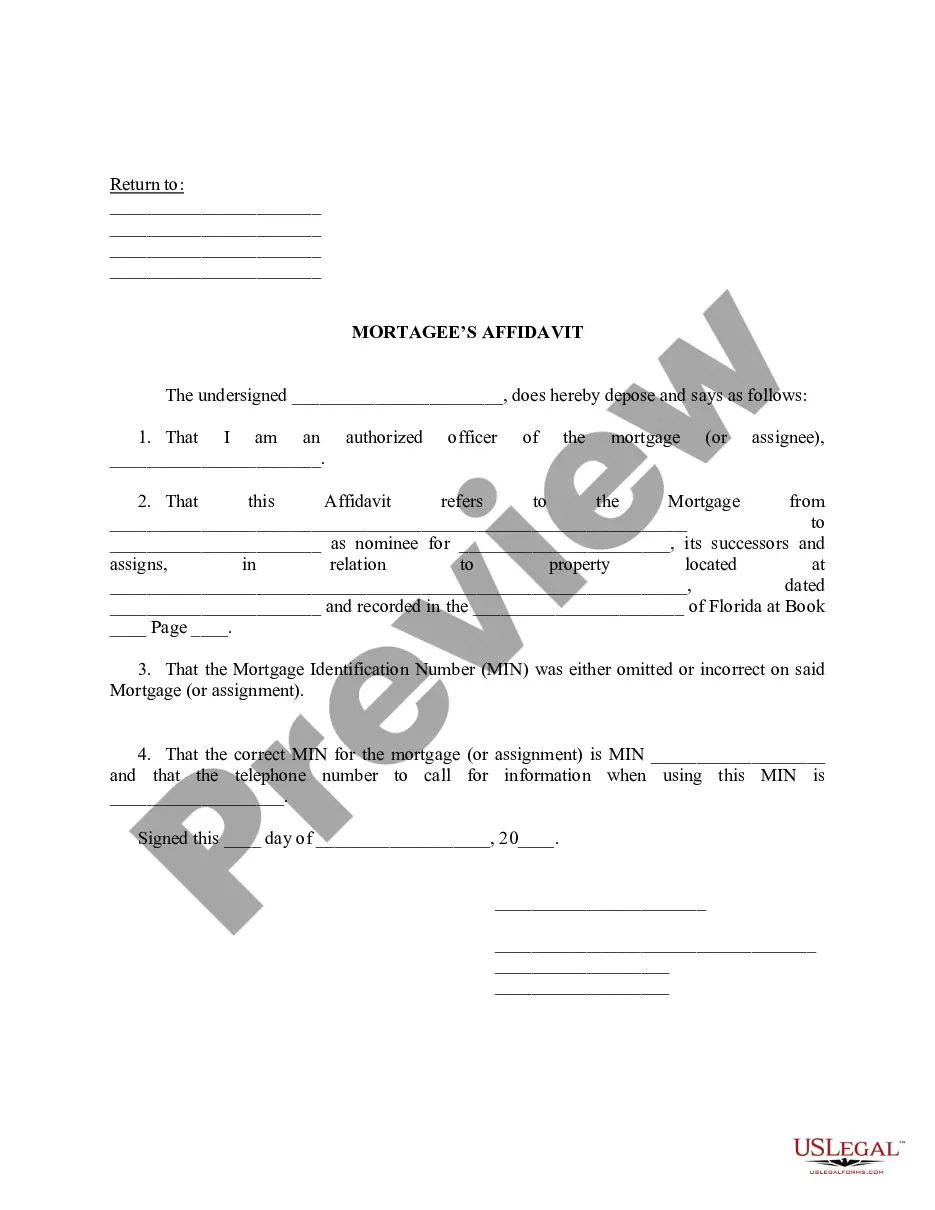

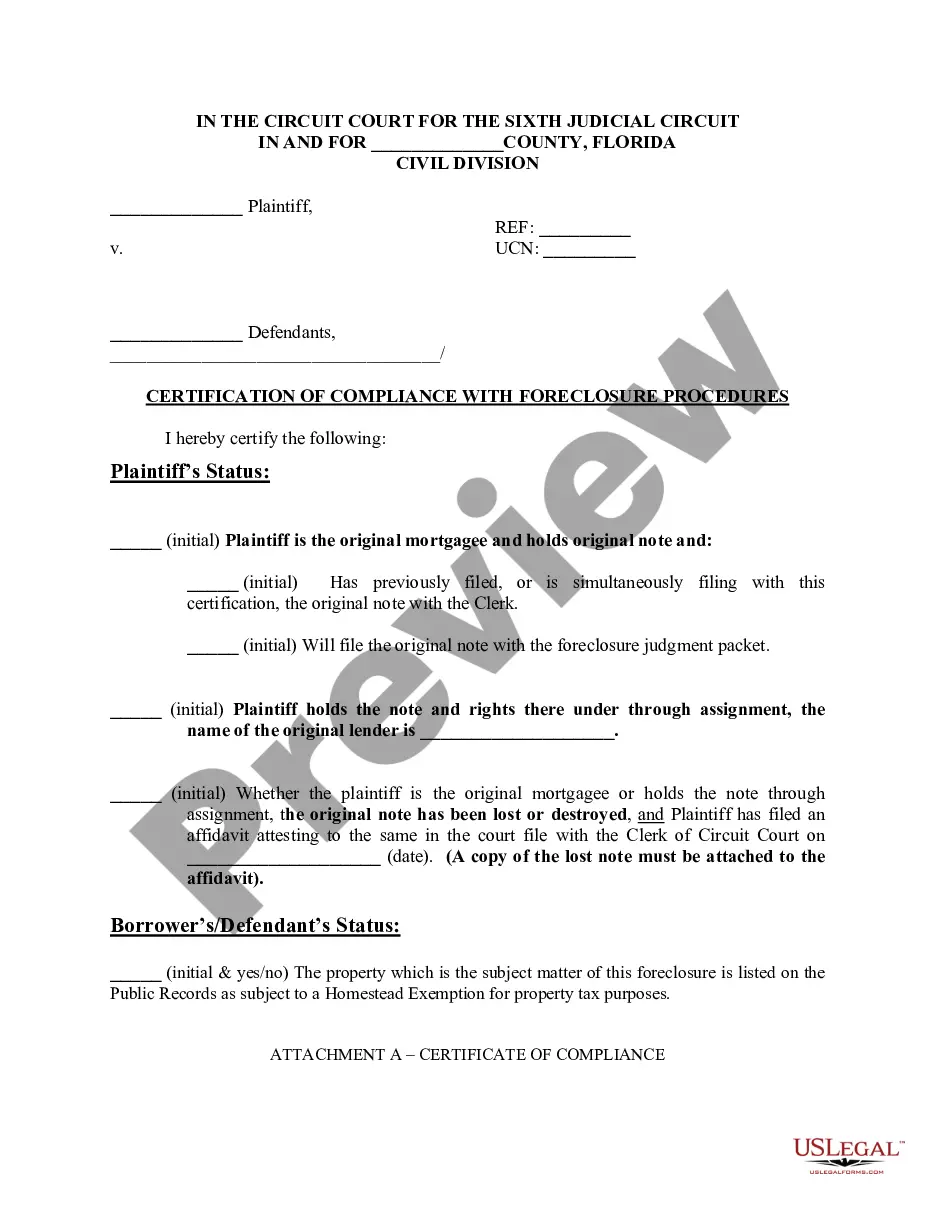

Florida Certification of Compliance with Foreclosure Procedures is a document that is required to be submitted to a court by a lender who wishes to initiate a foreclosure action. The certification details the steps the lender has taken to comply with the Florida Fair Foreclosure Act and Florida Statutes. It must include a statement confirming the lender has attempted to contact the borrower, has provided a written notice of default, and has provided an offer to mediate the dispute. The certification must also include a statement that the loan documents, foreclosure notice, and all other documents related to the foreclosure action have been reviewed for accuracy and are in compliance with the Florida Fair Foreclosure Act and Florida Statutes. There are two types of Florida Certifications of Compliance with Foreclosure Procedures: Short Form and Long Form. The Short Form is a one-page document that provides a summary of the lender's compliance with the Florida Fair Foreclosure Act and Florida Statutes. The Long Form is a more detailed certification that requires the lender to provide a detailed description of the steps taken to comply with the Florida Fair Foreclosure Act and Florida Statutes.

Florida Certification of Compliance with Forclosure Procedures

Description

How to fill out Florida Certification Of Compliance With Forclosure Procedures?

US Legal Forms is the easiest and most affordable method to locate suitable official templates.

It boasts the largest online collection of business and personal legal documents drafted and validated by lawyers.

Here, you can discover printable and fillable forms that adhere to federal and local guidelines - just like your Florida Certification of Compliance with Foreclosure Procedures.

Examine the form description or preview the document to ensure you’ve found the one that matches your needs, or seek another one using the search tab above.

Click Buy now when you’re confident of its alignment with all the requirements, and select the subscription plan you prefer.

- Acquiring your template requires only a few straightforward steps.

- Users who already possess an account with a valid subscription only need to Log In to the online service and download the document onto their device.

- Subsequently, they can find it in their profile under the My documents section.

- And here’s how you can obtain a professionally prepared Florida Certification of Compliance with Foreclosure Procedures if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

The foreclosure process in Florida generally begins when a lender files a complaint after a borrower defaults on payments. This legal process includes several key steps, such as serving the borrower with notice, a court hearing, and potentially a judgment of foreclosure if the lender prevails. It is important to familiarize yourself with the Florida Certification of Compliance with Foreclosure Procedures, as this can significantly affect your case. Utilizing uslegalforms can simplify this process by providing the necessary documentation and guidance.

To file for foreclosure in Florida, you must initiate a legal process by submitting a complaint in the appropriate court. This includes providing documentation that demonstrates the mortgage default and ensuring compliance with the Florida Certification of Compliance with Foreclosure Procedures. You may want to consult with a legal professional for guidance to navigate the complexities of the process. Using a platform like uslegalforms can help you access the necessary forms and instructions to file correctly.

The statute of limitations for mortgage foreclosure in Florida is five years. This means that lenders must initiate foreclosure proceedings within five years of the borrower's default. Understanding this timeline is important for both homeowners and lenders as it directly impacts the rights and responsibilities involved. If you are seeking assistance or need to file the Florida Certification of Compliance with Foreclosure Procedures, our platform offers the resources to guide you through the process effectively.

Depending on the court schedule and load, it normally takes from 180 to 200 days to complete the foreclosure process in Florida. If contested by the borrower or if the borrower files for bankruptcy, this process may be delayed further.

The notice shall specify: (a) the default; (b) the action required to cure the default; (c) a date, not less than 30 days from the date the notice is given to Borrower, by which the default must be cured; and (d) that failure to cure the default on or before the date specified in the notice may result in acceleration

Florida Foreclosure Process Timeline Response (20 Days) A Homeowner must admit or deny the allegations in the Complaint.3 . Discovery (45 to 90 Days)Summary Judgment (60-90 days)Sale Date (35 to 120 Days from the date of Final Judgment)Certificate of Title (10 Days)Writ of Possession (30 Days)

If the claimant is in possession of the original promissory note, the claimant must file under penalty of perjury a certification contemporaneously with the filing of the claim for relief for foreclosure that the claimant is in possession of the original promissory note.

How long does the foreclosure process take in Florida? It can vary. Many foreclosure cases last anywhere between ten months and two years, when contested by a competent foreclosure defense attorney, although there is not a specific time frame for foreclosures and each case is unique.

The foreclosure procedure in Florida begins with the lender asking the court to allow the foreclosure to proceed. If the court allows it, the foreclosure sale typically must occur within 20 to 35 days of the judgment. Foreclosure sales are conducted as auctions that are open to the general public.

? After 120 days. Before 120 days of defaulting the mortgage payments, no lender can file foreclosure against a borrower.