Delaware Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

You can spend time online attempting to locate the legal document template that meets the federal and state requirements you will need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily obtain or create the Delaware Foundation Contractor Agreement - Self-Employed from their service.

If you wish to find another version of the form, utilize the Search field to find the template that meets your needs.

Once you find the template you desire, click Get now to proceed.

Select the pricing plan you want, enter your information, and register for a free account on US Legal Forms.

Complete the purchase.

You can use your credit card or PayPal account to pay for the legal form.

Choose the format of the document and download it to your device.

Make adjustments to your document if necessary.

You can complete, edit, sign, and print the Delaware Foundation Contractor Agreement - Self-Employed.

Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms.

Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Delaware Foundation Contractor Agreement - Self-Employed.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, confirm that you have selected the correct document template for your county/town of choice.

- Examine the form details to ensure you have chosen the right form.

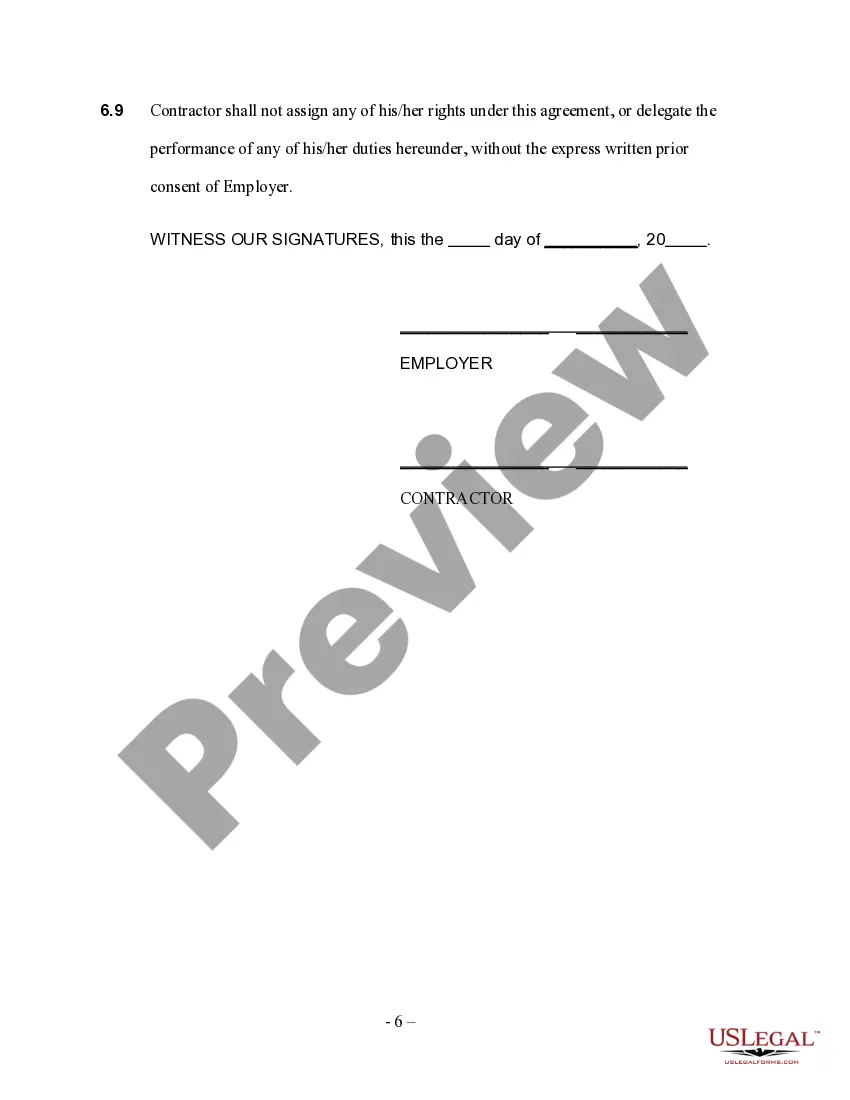

- If available, use the Review button to look through the document template as well.

Form popularity

FAQ

To fill out an independent contractor agreement, begin by entering the date and names of the parties involved. Clearly outline the work to be performed, the payment terms, and any conditions to expect. It’s also essential to review and agree on confidentiality and termination clauses. For ease, you can access ready-made documents like a Delaware Foundation Contractor Agreement - Self-Employed from US Legal Forms, ensuring you have a complete and accurate agreement.

Writing a self-employed contract begins with clearly defining the work scope, project timelines, and payment arrangements. Make sure to specify expectations and responsibilities for both parties. Including clauses for termination and confidentiality can protect your interests. For a polished document, consider leveraging resources like US Legal Forms that offer a Delaware Foundation Contractor Agreement - Self-Employed format.

To write an independent contractor agreement, start with a clear title and identify both parties involved. Next, detail the specific services to be provided, payment terms, and deadlines. Don't forget to include confidentiality clauses and dispute resolution processes. Using a Delaware Foundation Contractor Agreement - Self-Employed template from US Legal Forms can simplify this process and ensure you cover all necessary points.

Filling out an independent contractor form requires providing your personal information, business details, and payment terms. Ensure you include your legal name, address, and the scope of work you're agreeing to. It's crucial to outline payment methods and deadlines clearly. If you’re utilizing a Delaware Foundation Contractor Agreement - Self-Employed, consider consulting platforms like US Legal Forms for guidance.

Yes, independent contractors typically file taxes as self-employed individuals. This means they report their income and expenses on Schedule C of their tax return. By doing this, they can also deduct business-related expenses, which can lead to potential tax savings. If you are considering a Delaware Foundation Contractor Agreement - Self-Employed, understanding your filing obligations is essential.

Delaware does not mandate an operating agreement, but having one is highly beneficial. An operating agreement provides clarity on the roles, responsibilities, and management of your contract work. If you are entering into a Delaware Foundation Contractor Agreement - Self-Employed, consider drafting an operating agreement to streamline your business operations and prevent potential disputes.

An independent contractor is indeed regarded as self-employed. This classification emphasizes the contractor's independence in conducting their business and fulfilling contractual obligations. When entering a Delaware Foundation Contractor Agreement - Self-Employed, it's important to recognize this relationship to fully understand your rights as a contractor.

Yes, independent contractors are usually considered self-employed. They provide services based on a contract and are not entitled to the same benefits as employees. When working under a Delaware Foundation Contractor Agreement - Self-Employed, you typically manage your own taxes and benefits, giving you more flexibility in how you structure your work.

Absolutely, you can be a self-employed contractor. This classification means you run your own business and offer services to clients under a Delaware Foundation Contractor Agreement - Self-Employed. As a self-employed contractor, you have the freedom to choose your projects and set your hours, which can lead to increased job satisfaction and control over your work life.

Yes, receiving a 1099 form typically indicates that you are self-employed. This form reports income earned from services provided to clients who did not withhold taxes. If you operate under a Delaware Foundation Contractor Agreement - Self-Employed, you may need to keep track of your expenses and income for tax purposes. It's essential to understand this classification to ensure compliance with tax laws.