Massachusetts Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

Finding the right legitimate file format could be a struggle. Of course, there are a variety of layouts available on the net, but how will you discover the legitimate kind you want? Use the US Legal Forms site. The assistance delivers a huge number of layouts, such as the Massachusetts Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock, which you can use for company and private needs. Every one of the kinds are checked by specialists and fulfill state and federal requirements.

When you are already registered, log in to the accounts and click the Down load button to find the Massachusetts Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock. Utilize your accounts to look through the legitimate kinds you possess purchased in the past. Go to the My Forms tab of your respective accounts and obtain yet another version of your file you want.

When you are a whole new customer of US Legal Forms, listed below are straightforward directions that you can follow:

- Very first, ensure you have chosen the appropriate kind for your town/area. You may look over the form while using Review button and browse the form outline to make certain this is basically the right one for you.

- In case the kind fails to fulfill your expectations, use the Seach discipline to get the right kind.

- Once you are certain the form is proper, click the Acquire now button to find the kind.

- Pick the pricing prepare you want and enter in the needed info. Design your accounts and purchase the order making use of your PayPal accounts or bank card.

- Pick the data file format and acquire the legitimate file format to the device.

- Comprehensive, modify and printing and sign the obtained Massachusetts Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

US Legal Forms is the largest collection of legitimate kinds for which you will find numerous file layouts. Use the service to acquire skillfully-manufactured documents that follow status requirements.

Form popularity

FAQ

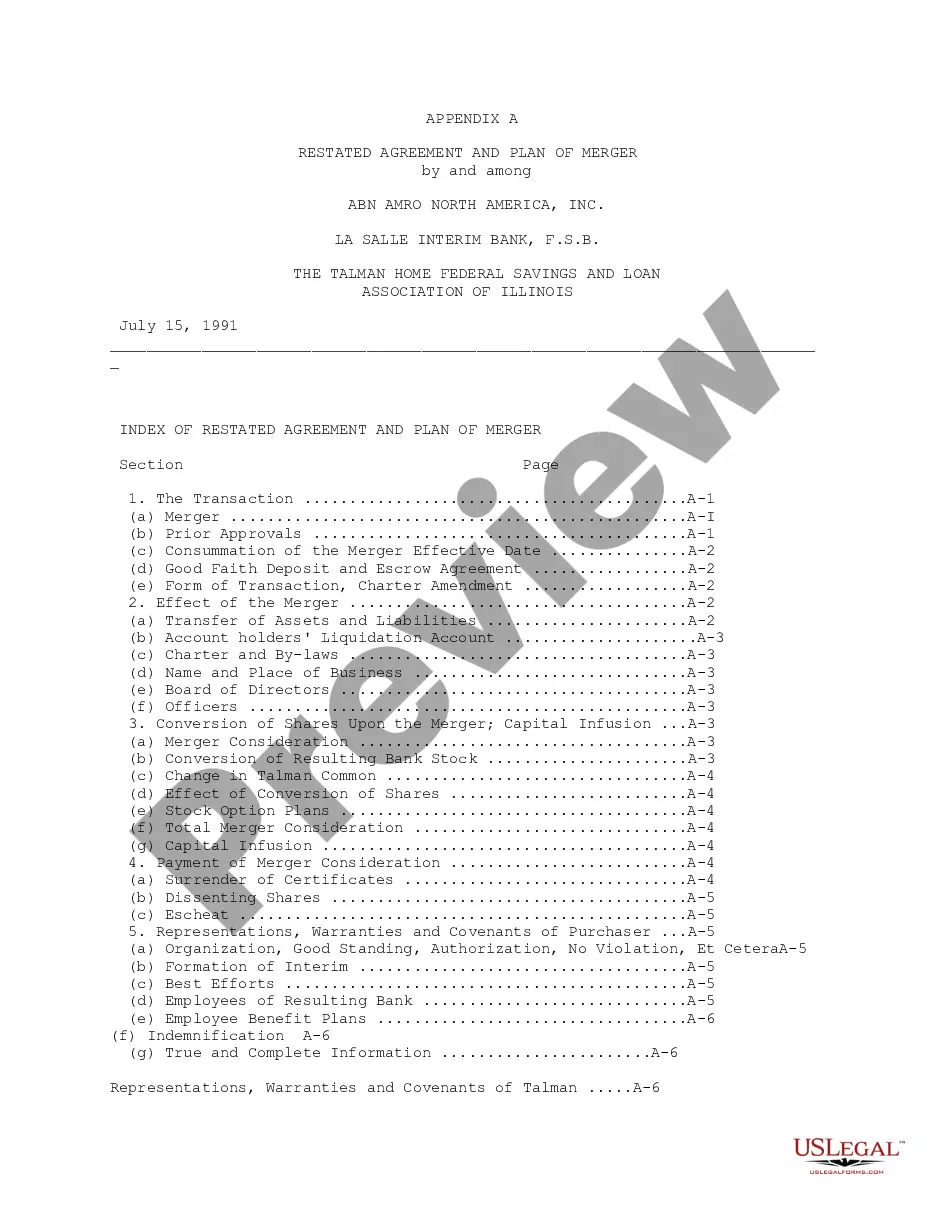

By Practical Law Corporate. This standard document is a short form agreement intended for use in an intra-group share purchase transaction where the consideration is to be satisfied by an issue of shares by the buyer to the seller.

Tax efficiency: As mentioned earlier, a share-for-share exchange can be structured as a tax-free transaction, which means that shareholders are not subject to capital gains tax on the exchange of their shares.

Documents needed for a share swap The revised articles or shareholders' agreement to fit the structure post transaction; The consultation with any employees affected as a result of the re-organisation; Review of the employment contracts and policies to see if the they are suitable for the new structure;

Technically, a share for share exchange is treated as a 'reorganisation' for tax purposes. The selling shareholders are therefore treated as not making a disposal of their old shares but as having acquired their new shares in the acquiring company at the same time and for the same amount as their old shares.

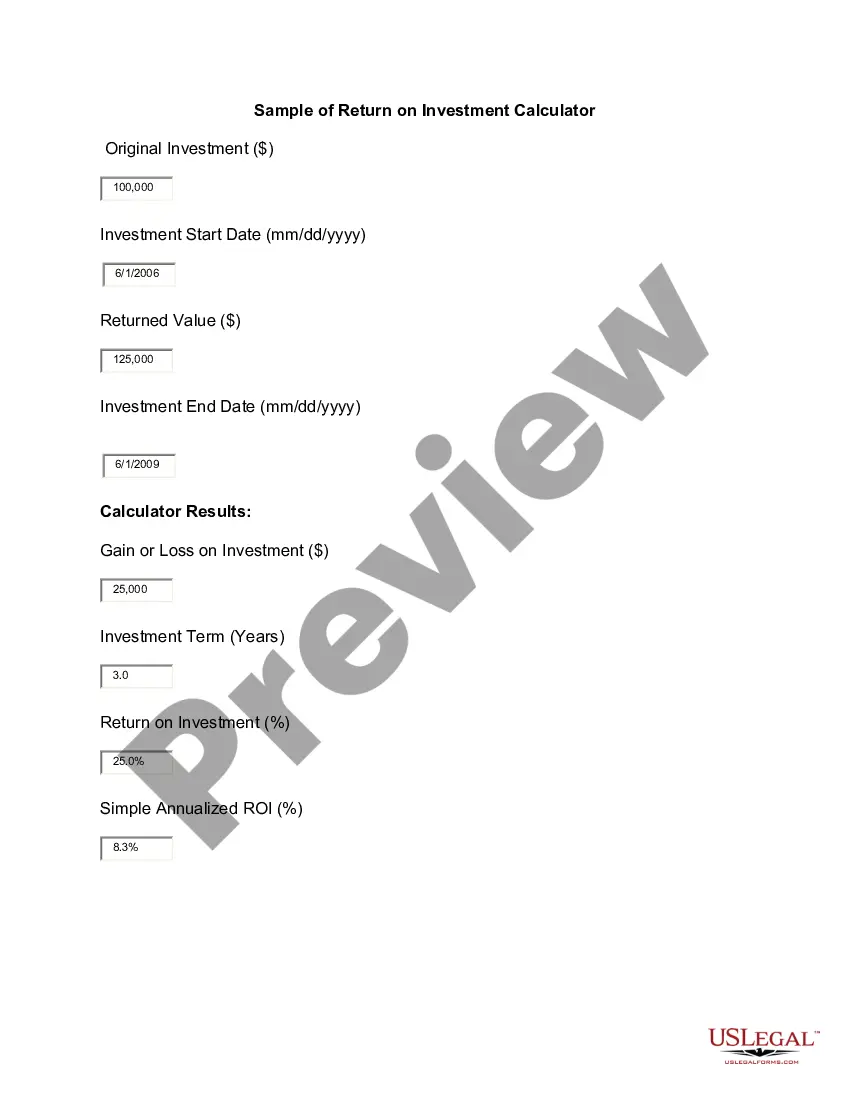

This is calculated as the equity purchase price divided by the buyer's current share price. So, the buyer needs to issue 1,294 new shares to purchase 1,200 shares of the target company. Based on this information, we calculate the exchange ratio as 1294/1200 = 1.1.

In a share-for-share exchange, the shareholders of the target company receive shares in the acquiring company in exchange for their existing shares in the target company.

Technically, a share for share exchange is treated as a 'reorganisation' for tax purposes. The selling shareholders are therefore treated as not making a disposal of their old shares but as having acquired their new shares in the acquiring company at the same time and for the same amount as their old shares.

For example, one share in company A may be worth 5 shares in company B. All depends upon the facts. Often share for share exchanges take place with a transfer of assets from one company to another.