Delaware Structure Erection Contractor Agreement - Self-Employed

Description

How to fill out Structure Erection Contractor Agreement - Self-Employed?

You may invest multiple hours online attempting to locate the legal document template that complies with the federal and state regulations you will require. US Legal Forms provides a vast array of legal documents that are vetted by experts.

You can obtain or print the Delaware Structure Erection Contractor Agreement - Self-Employed from their service. If you already possess a US Legal Forms account, you can Log In and select the Obtain option.

Subsequently, you can fill out, modify, print, or sign the Delaware Structure Erection Contractor Agreement - Self-Employed. Every legal document template you acquire is yours indefinitely. To retrieve an additional copy of a purchased document, navigate to the My documents section and click on the appropriate option.

Choose the format of your document and download it to your device. Make adjustments to the document if necessary. You can fill out, modify, sign, and print the Delaware Structure Erection Contractor Agreement - Self-Employed. Access and print numerous document templates using the US Legal Forms website, which offers the largest variety of legal documents. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, ensure you have selected the correct document template for your county/town of choice. Review the document description to confirm you have chosen the right template.

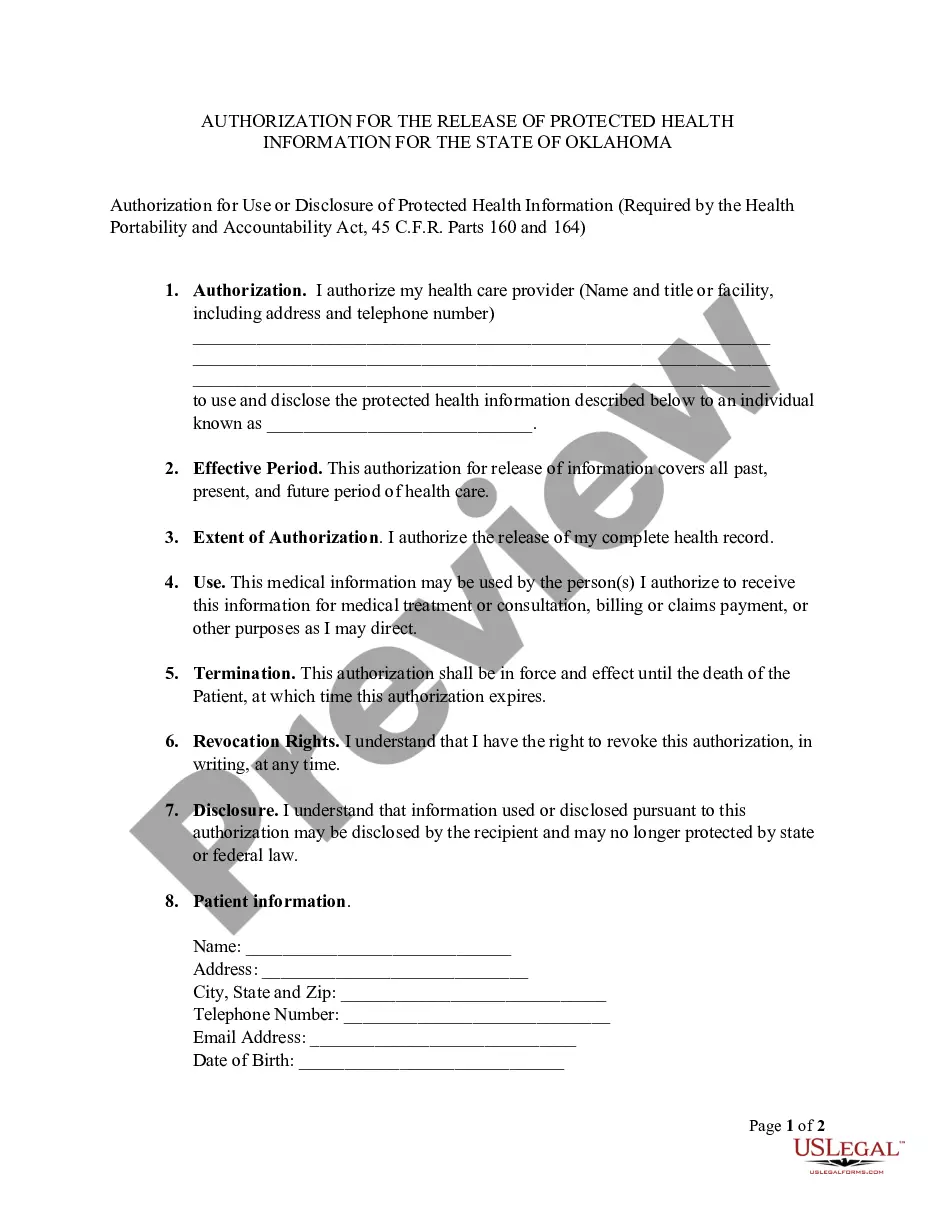

- If available, utilize the Review option to examine the document template as well.

- If you wish to obtain another version of your document, use the Search field to find the template that suits your needs and requirements.

- Once you have found the desired template, click on Acquire now to continue.

- Select the pricing plan you wish, input your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal document.

Form popularity

FAQ

Yes, you can be your own general contractor in Delaware if you meet the necessary licensing requirements. As a self-employed individual, you can manage your construction projects and hire subcontractors as needed. A well-drafted Delaware Structure Erection Contractor Agreement - Self-Employed will help clarify your responsibilities and ensure compliance with state regulations. Always be aware of local laws and regulations to avoid any issues.

When writing an independent contractor agreement, start by defining the roles and responsibilities of each party. Include essential elements like payment terms, project timelines, and termination clauses. Consider utilizing a template for a Delaware Structure Erection Contractor Agreement - Self-Employed for guidance. This structured approach helps ensure you cover all necessary aspects and creates a solid foundation for your working relationship.

Filling out an independent contractor form involves providing personal details like your name, address, and Social Security number. Additionally, include information on the services you offer and the payment structure. If you're working under a Delaware Structure Erection Contractor Agreement - Self-Employed, make sure your form aligns with the agreement's terms for a seamless process. Accuracy is key, so double-check all entries before submission.

To fill out an independent contractor agreement, start by clearly stating the name and address of both parties involved. Include specific details such as the scope of work, payment terms, and deadlines. If you are using a Delaware Structure Erection Contractor Agreement - Self-Employed, ensure you customize it to meet the specific needs of your project. Finally, both parties should sign the agreement to make it legally binding.

In the United States, an independent contractor must earn at least $600 within a calendar year to receive a 1099 form. This form reports income to the IRS and is essential for tax purposes. It's important to keep track of your earnings, especially if you are operating under a Delaware Structure Erection Contractor Agreement - Self-Employed. This ensures you comply with tax regulations and maintain clear financial records.

Yes, you can write your own legally binding contract as long as you understand the essential elements that make it enforceable. These elements include clear terms, agreed consideration, and mutual consent. Crafting a Delaware Structure Erection Contractor Agreement - Self-Employed can be straightforward if you use the right templates. To simplify the process, uslegalforms offers customizable contracts tailored to your needs.

A contractor agreement should include several key components such as the scope of work, payment terms, deadlines, confidentiality clauses, and termination conditions. It's also important to specify ownership of work products and ensure compliance with local laws. A comprehensive Delaware Structure Erection Contractor Agreement - Self-Employed will have all these elements covered to foster a smooth working relationship. For templates and legal insights, visit uslegalforms.

The new federal rule on independent contractors focuses on determining who qualifies as an independent contractor versus an employee. It emphasizes the importance of control and independence in the working relationship. Understanding these regulations is crucial for those drafting a Delaware Structure Erection Contractor Agreement - Self-Employed. For detailed insights, reviewing resources on uslegalforms can be very beneficial.

To structure an independent contractor agreement, begin by clearly defining the scope of work. Include key terms like payment schedule, deadline, confidentiality, and a termination clause. A well-structured Delaware Structure Erection Contractor Agreement - Self-Employed can provide clarity and protect both parties' interests. For effective templates and additional guidance, consider exploring uslegalforms.

The best business structure for an independent contractor often depends on specific needs and circumstances. Many choose to form a Limited Liability Company (LLC) because it provides liability protection and flexible tax options. A Delaware Structure Erection Contractor Agreement - Self-Employed can enhance this choice, making it easier to manage contracts and obligations. Consulting uslegalforms can help you determine which structure best suits your situation.