Delaware Industrial Contractor Agreement - Self-Employed

Description

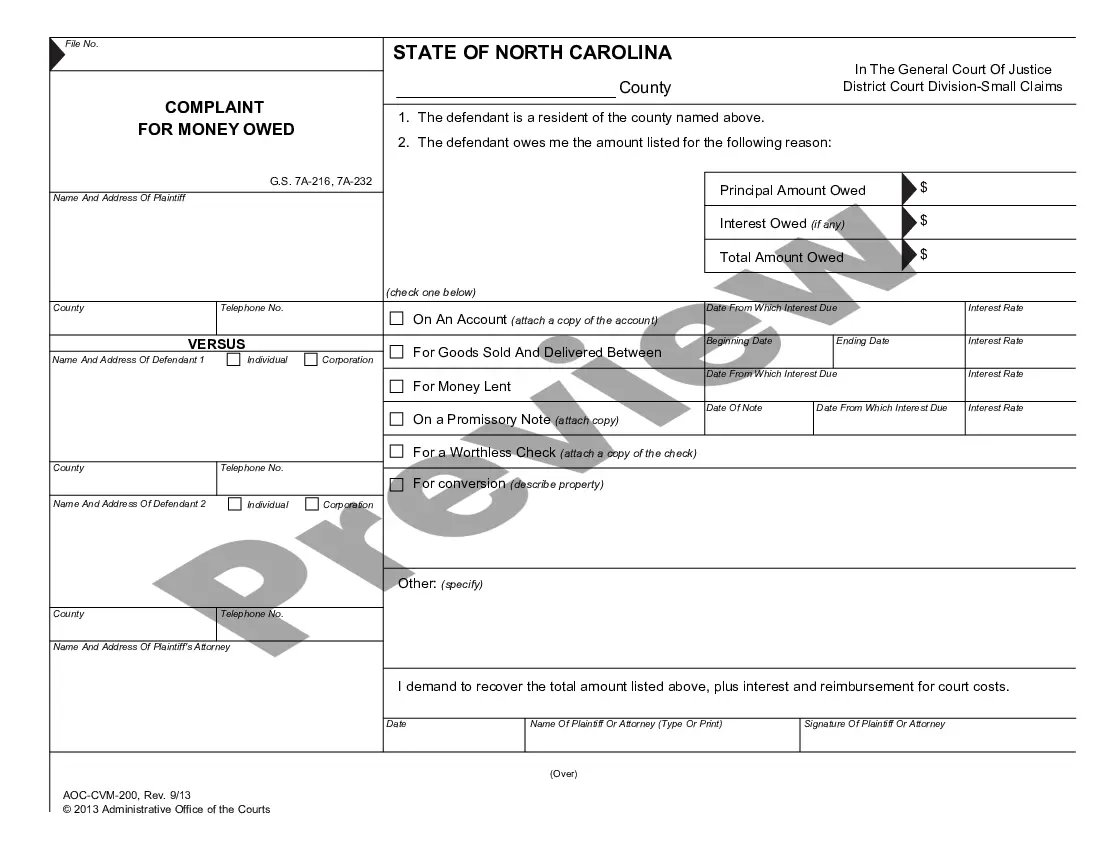

How to fill out Industrial Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest repositories of lawful documents in the United States - offers a diverse selection of legal document templates you can download or create.

Using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms like the Delaware Independent Contractor Agreement - Self-Employed within moments.

If you hold a monthly subscription, Log In and download the Delaware Independent Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the document to your device. Make modifications. Complete, edit, print, and sign the downloaded Delaware Independent Contractor Agreement - Self-Employed. Each template you add to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or produce another copy, simply visit the My documents section and click on the form you desire. Access the Delaware Independent Contractor Agreement - Self-Employed with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to view the form’s details.

- Read the form description to confirm you have chosen the correct document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Creating an independent contractor agreement requires a clear understanding of the terms you want to outline. Start by defining the scope of work, payment terms, and timelines, as these are essential components. Additionally, it is important to include clauses that address confidentiality and liability. Utilizing a platform like USLegalForms can simplify this process, providing you with a structured template for a Delaware Industrial Contractor Agreement - Self-Employed.

Yes, receiving a 1099 form typically indicates that you are considered self-employed. This means you are earning income from your business efforts rather than as a traditional employee. A Delaware Industrial Contractor Agreement - Self-Employed can help clarify your self-employment status and set expectations for both you and the client. Transparency in business relationships helps build trust and accountability.

A person qualifies as self-employed when they operate their own business and earn income directly rather than through an employer. This includes independent contractors, freelancers, and business owners. If you're drafting agreements, consider utilizing a Delaware Industrial Contractor Agreement - Self-Employed to highlight your status and ensure proper taxation and responsibilities are outlined. Keeping these processes transparent is essential.

Choosing between self-employed and independent contractor often depends on context. While both terms describe a person who works for themselves, 'self-employed' encompasses a broader range of businesses. If you engage with clients using a Delaware Industrial Contractor Agreement - Self-Employed, this term may resonate better, as it specifies your contractor status in a clearer manner.

While Delaware does not legally require an operating agreement, it is strongly recommended for LLCs and other business structures. This document outlines the management structure, responsibilities, and even member rights. For self-employed contractors, a well-structured Delaware Industrial Contractor Agreement - Self-Employed can serve a similar purpose by detailing your individual operating guidelines. Clarity is crucial for a smooth operation.

Absolutely, an independent contractor is classified as self-employed. This status provides flexibility and autonomy over work arrangements. Utilizing a Delaware Industrial Contractor Agreement - Self-Employed can be beneficial by defining the terms of your work relationship, expectations, and payment. It ultimately leads to better clarity and professionalism.

Yes, an independent contractor is indeed considered self-employed. This means they operate their own business and are responsible for their income and tax obligations. When engaging as a self-employed individual, a Delaware Industrial Contractor Agreement - Self-Employed can clarify the working relationship and responsibilities clearly. This forms a solid foundation for both sides.

An independent contractor must earn $600 or more in a calendar year to receive a 1099 form from a client. This threshold is important for tax reporting purposes, as it affects how income is declared. Consider using a Delaware Industrial Contractor Agreement - Self-Employed to clarify this income potential in your professional relationship. This can help both parties keep accurate records.

Yes, a self-employed person can absolutely have a contract. In fact, having a clear agreement is essential for outlining the terms of work. A Delaware Industrial Contractor Agreement - Self-Employed can protect both parties by detailing responsibilities and payment terms. Always ensure that contracts comply with state regulations to avoid any misunderstandings.

Filling out an independent contractor form involves providing your basic information, such as your name, address, and Social Security number. Next, outline the job details, including the services you will provide and the payment arrangement. Be sure to review the entire form for accuracy before submitting it. For added convenience, explore the templates available on uslegalforms to streamline this task.