Minnesota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

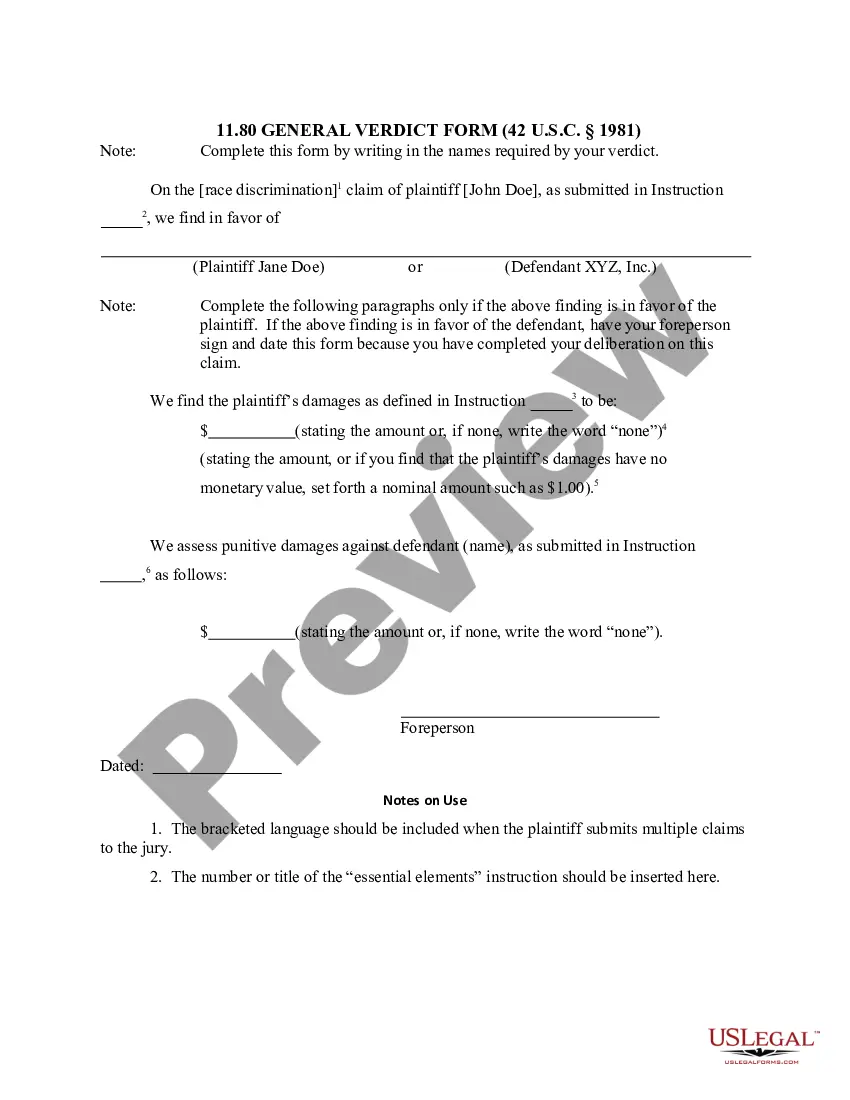

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

US Legal Forms - one of several most significant libraries of authorized forms in the States - offers a wide range of authorized papers web templates you may down load or printing. While using website, you will get 1000s of forms for organization and person functions, sorted by groups, says, or keywords.You will discover the latest types of forms just like the Minnesota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock in seconds.

If you already possess a registration, log in and down load Minnesota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock in the US Legal Forms collection. The Obtain key will appear on each and every type you see. You gain access to all formerly acquired forms from the My Forms tab of your respective account.

In order to use US Legal Forms initially, listed below are simple directions to obtain started off:

- Be sure you have picked the proper type for your personal metropolis/state. Select the Preview key to check the form`s content material. See the type description to actually have selected the right type.

- If the type doesn`t satisfy your requirements, use the Research industry at the top of the screen to obtain the one which does.

- In case you are happy with the shape, verify your decision by visiting the Acquire now key. Then, pick the rates strategy you want and offer your credentials to sign up on an account.

- Method the purchase. Make use of bank card or PayPal account to perform the purchase.

- Pick the file format and down load the shape in your product.

- Make alterations. Fill out, edit and printing and indication the acquired Minnesota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

Every single design you added to your account lacks an expiration particular date and is your own property for a long time. So, if you would like down load or printing an additional copy, just visit the My Forms portion and then click on the type you require.

Gain access to the Minnesota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock with US Legal Forms, one of the most extensive collection of authorized papers web templates. Use 1000s of professional and state-particular web templates that meet up with your small business or person needs and requirements.

Form popularity

FAQ

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

Documents needed for a share swap The revised articles or shareholders' agreement to fit the structure post transaction; The consultation with any employees affected as a result of the re-organisation; Review of the employment contracts and policies to see if the they are suitable for the new structure;

Technically, a share for share exchange is treated as a 'reorganisation' for tax purposes. The selling shareholders are therefore treated as not making a disposal of their old shares but as having acquired their new shares in the acquiring company at the same time and for the same amount as their old shares.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

This is calculated as the equity purchase price divided by the buyer's current share price. So, the buyer needs to issue 1,294 new shares to purchase 1,200 shares of the target company. Based on this information, we calculate the exchange ratio as 1294/1200 = 1.1.

Technically, a share for share exchange is treated as a 'reorganisation' for tax purposes. The selling shareholders are therefore treated as not making a disposal of their old shares but as having acquired their new shares in the acquiring company at the same time and for the same amount as their old shares.

Tax efficiency: As mentioned earlier, a share-for-share exchange can be structured as a tax-free transaction, which means that shareholders are not subject to capital gains tax on the exchange of their shares.

For example, one share in company A may be worth 5 shares in company B. All depends upon the facts. Often share for share exchanges take place with a transfer of assets from one company to another.