Maryland Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

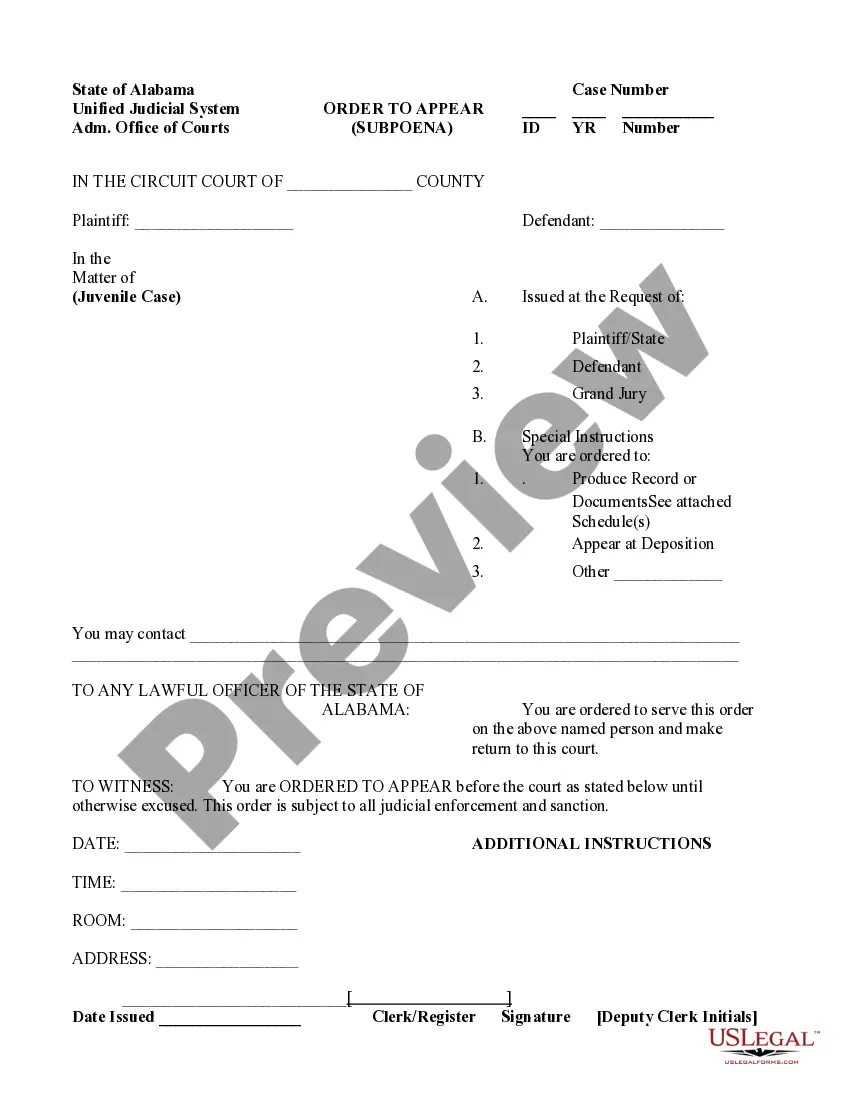

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

If you want to full, down load, or printing legal papers layouts, use US Legal Forms, the most important collection of legal types, that can be found on-line. Make use of the site`s easy and practical lookup to discover the files you want. Various layouts for enterprise and personal functions are categorized by types and states, or search phrases. Use US Legal Forms to discover the Maryland Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock with a handful of mouse clicks.

In case you are currently a US Legal Forms buyer, log in in your account and then click the Download option to get the Maryland Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock. You may also gain access to types you in the past downloaded within the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for your correct town/nation.

- Step 2. Take advantage of the Review choice to look over the form`s articles. Do not overlook to learn the explanation.

- Step 3. In case you are unsatisfied using the kind, take advantage of the Look for area at the top of the screen to get other types from the legal kind web template.

- Step 4. Once you have located the form you want, select the Purchase now option. Opt for the pricing strategy you choose and include your references to register for an account.

- Step 5. Procedure the purchase. You should use your bank card or PayPal account to perform the purchase.

- Step 6. Find the file format from the legal kind and down load it on your own product.

- Step 7. Total, revise and printing or indication the Maryland Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

Every legal papers web template you get is the one you have for a long time. You might have acces to each kind you downloaded within your acccount. Select the My Forms portion and decide on a kind to printing or down load once more.

Remain competitive and down load, and printing the Maryland Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock with US Legal Forms. There are many specialist and state-distinct types you can utilize to your enterprise or personal needs.

Form popularity

FAQ

Companies can offer different classes of shares, some with voting rights and others without voting rights. Google and Berkshire Hathaway are two notable examples of companies that offer voting and non-voting stock.

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A.

A Share Exchange is a type of share transaction where the shares of one class are exchanged for shares of another class. Unlike a share conversion, shares are not simply converted from one class to another directly.

forshare exchange involves a company issuing new shares or debentures to a person or a company in exchange for that person's shares or debentures in another company. One of the main reasons for implementing a shareforshare exchange is to create a group for company law and tax purposes.

Exchangeable Share Technique In the event that a non-Canadian buyer offers securities as all or part of the consideration for the securities of the Canadian target company, ?exchangeable shares? of the target company are often issued to Canadian shareholders of the tar- get in exchange for their shares in the target.

Technically, a share for share exchange is treated as a 'reorganisation' for tax purposes. The selling shareholders are therefore treated as not making a disposal of their old shares but as having acquired their new shares in the acquiring company at the same time and for the same amount as their old shares.

Voting common stock allows the shareholder to participate in corporate decision making through the use of their voting rights. Non-voting common stock does not come with voting rights, but the shareholder is still entitled to receive dividends and other financial benefits associated with being a shareholder.