Delaware Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

If you desire to aggregate, acquire, or print legal document templates, use US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are categorized by regions and states, or by keywords. Use US Legal Forms to discover the Delaware Carpentry Services Contract - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you obtain is your property for the long term. You have access to every form you saved in your account.

Select the My documents section and choose a form to print or download again. Be proactive and download, and print the Delaware Carpentry Services Contract - Self-Employed Independent Contractor with US Legal Forms. There are many professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log Into your account and click the Download button to access the Delaware Carpentry Services Contract - Self-Employed Independent Contractor.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

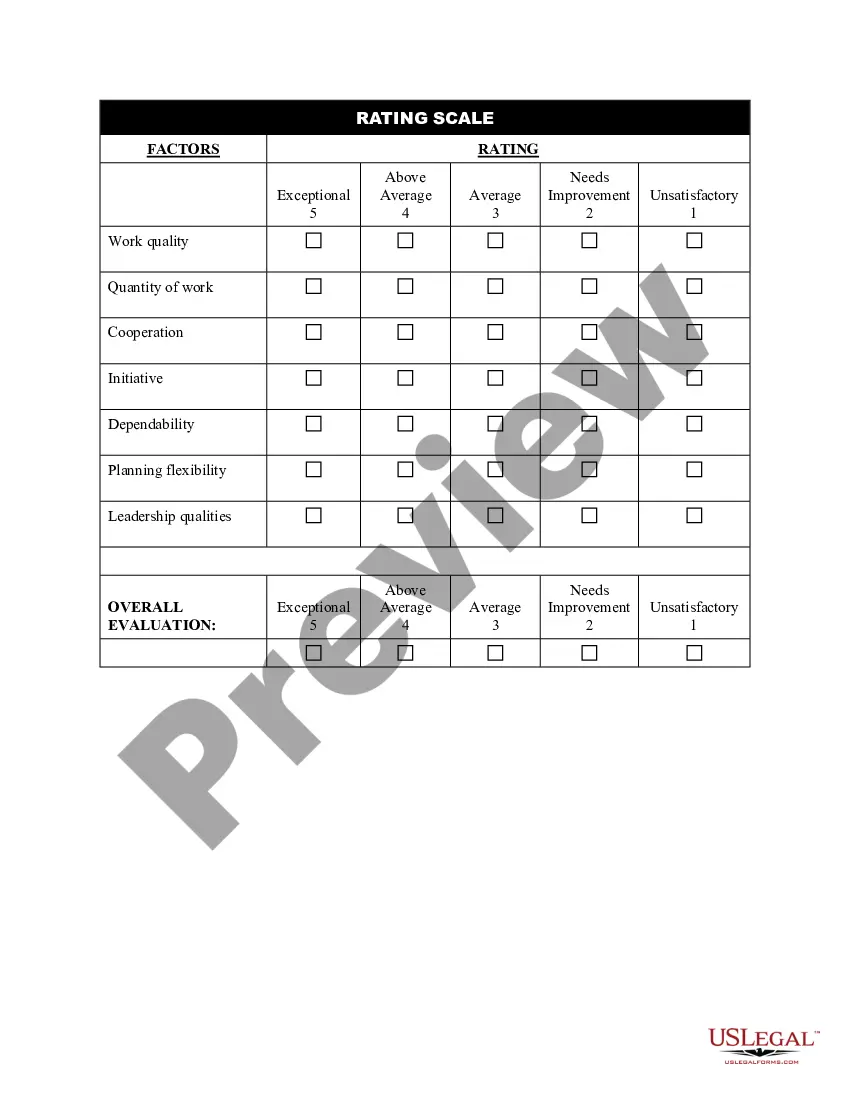

- Step 2. Use the Review option to inspect the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you find the form you need, click the Get now button. Choose your preferred pricing plan and enter your information to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Delaware Carpentry Services Contract - Self-Employed Independent Contractor.

Form popularity

FAQ

Yes, Delaware requires certain contractors, including those involved in carpentry, to obtain a contractor license. This protects consumers and ensures that professionals meet state standards while offering services. For those working under a Delaware Carpentry Services Contract as a self-employed independent contractor, acquiring this license is an essential step.

In general, if you earn $600 or more from a single client during a tax year, that client must issue you a 1099 form. This is especially important for self-employed independent contractors working under a Delaware Carpentry Services Contract. Keep accurate records of your earnings to ensure you report your income correctly.

Yes, an independent contractor is considered self-employed, as they operate their own business without a traditional employer-employee relationship. This classification is particularly relevant when discussing income, taxes, and legal obligations related to a Delaware Carpentry Services Contract. Understanding this distinction can help you manage your responsibilities more effectively.

In Delaware, anyone conducting business—whether through a storefront, online, or as an independent contractor—typically needs a business license. This includes those offering services outlined in a Delaware Carpentry Services Contract as a self-employed independent contractor. Check with the Division of Revenue to ensure you understand your requirements.

Both terms convey your role as a person running their own business; however, 'independent contractor' often specifies that you work under a contract for services. This distinction can be important when entering into agreements, such as a Delaware Carpentry Services Contract. Ultimately, choose the term that best fits your relationship with clients.

Independent contractors often need a business license in Delaware, particularly if they provide specific services like carpentry. Having a license legitimizes your work and protects you while fulfilling your Delaware Carpentry Services Contract as a self-employed independent contractor. It is advisable to check with local authorities to confirm your licensing needs.

Yes, as a self-employed independent contractor, you typically need to register your business, especially if you operate under a name different from your own. This registration helps formalize your structure and offers legal protections under your Delaware Carpentry Services Contract. It's a proactive step towards ensuring your business complies with state laws.

A business permit is often a specific approval for an activity, such as building construction or health inspections, while a business license is a broader authorization to operate a business within a jurisdiction. If you're planning on executing a Delaware Carpentry Services Contract as a self-employed independent contractor, you may need both, depending on your activities. Always verify local requirements to ensure compliance.

To prove your status as an independent contractor, you need to gather documentation such as your signed Delaware Carpentry Services Contract and any invoices you have issued. Additionally, having a separate business bank account or tax identification number can strengthen your position. It's important to present this information to clients and tax authorities to clarify your role. US Legal Forms can assist you in drafting the necessary contracts to clearly outline your status.

To report your income as a self-employed independent contractor, you should complete a Schedule C form when filing your taxes. This schedule allows you to track your income and expenses related to your Delaware Carpentry Services Contract. Make sure to keep detailed records of all payments received, as well as any associated business expenses. Using a reliable platform like US Legal Forms can help you create contracts and manage your documents efficiently.