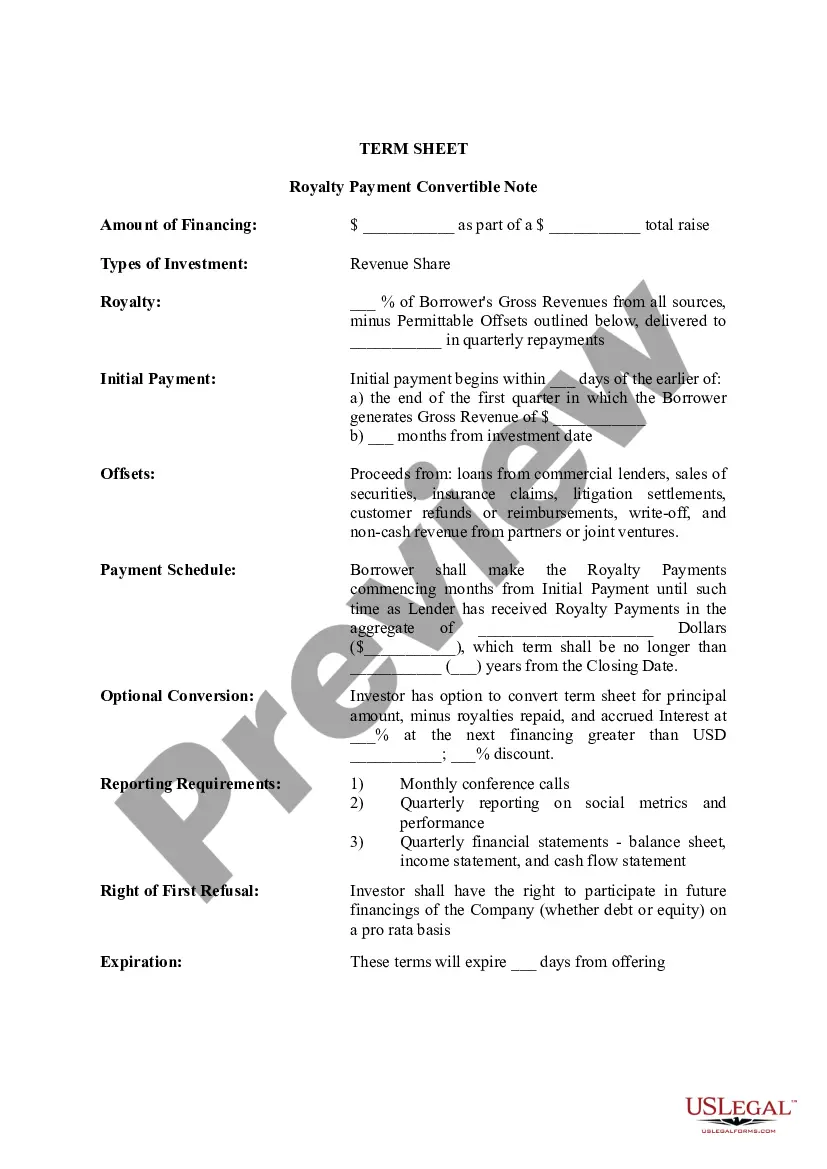

Delaware Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

US Legal Forms - one of the largest libraries of authorized types in the USA - gives a wide array of authorized document layouts you may acquire or printing. Making use of the website, you can find a large number of types for organization and person reasons, sorted by types, claims, or keywords and phrases.You can find the newest types of types such as the Delaware Term Sheet - Royalty Payment Convertible Note in seconds.

If you currently have a monthly subscription, log in and acquire Delaware Term Sheet - Royalty Payment Convertible Note from your US Legal Forms local library. The Down load option can look on every develop you perspective. You get access to all in the past acquired types in the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, listed here are basic guidelines to get you started:

- Be sure to have picked out the correct develop for your area/area. Click on the Review option to analyze the form`s articles. Look at the develop information to actually have selected the proper develop.

- In the event the develop does not satisfy your requirements, take advantage of the Search field towards the top of the monitor to obtain the one who does.

- If you are happy with the shape, verify your decision by clicking the Buy now option. Then, opt for the pricing prepare you like and give your credentials to sign up for an profile.

- Method the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Find the formatting and acquire the shape on your gadget.

- Make changes. Fill out, edit and printing and indicator the acquired Delaware Term Sheet - Royalty Payment Convertible Note.

Each and every design you included with your bank account does not have an expiry time and is yours for a long time. So, if you would like acquire or printing one more copy, just check out the My Forms area and click on the develop you need.

Get access to the Delaware Term Sheet - Royalty Payment Convertible Note with US Legal Forms, probably the most extensive local library of authorized document layouts. Use a large number of skilled and state-particular layouts that meet your small business or person requires and requirements.

Form popularity

FAQ

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

In recent years, SAFEs have become the most common convertible instrument due to their relative simplicity. Like convertible notes, SAFEs convert into stock in a future priced round. Unlike convertible notes, they are not debt and do not require the company to pay back the investment with interest.

Calculating post-money valuation Post-money valuation = Pre-money valuation + Size of investment. ... Share price = New investment amount / # of new shares received. ... Post-money valuation / total # of shares post-investment = New investment amount / # of new shares received.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Discount. The discount rate, typically 15% to 25% percent, gets applied to the per-share price of the new investor. For example, let's say your convertible note had a 20% discount and the new investors are paying $1 per share. The convertible note investor will convert at $0.80 per share.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).