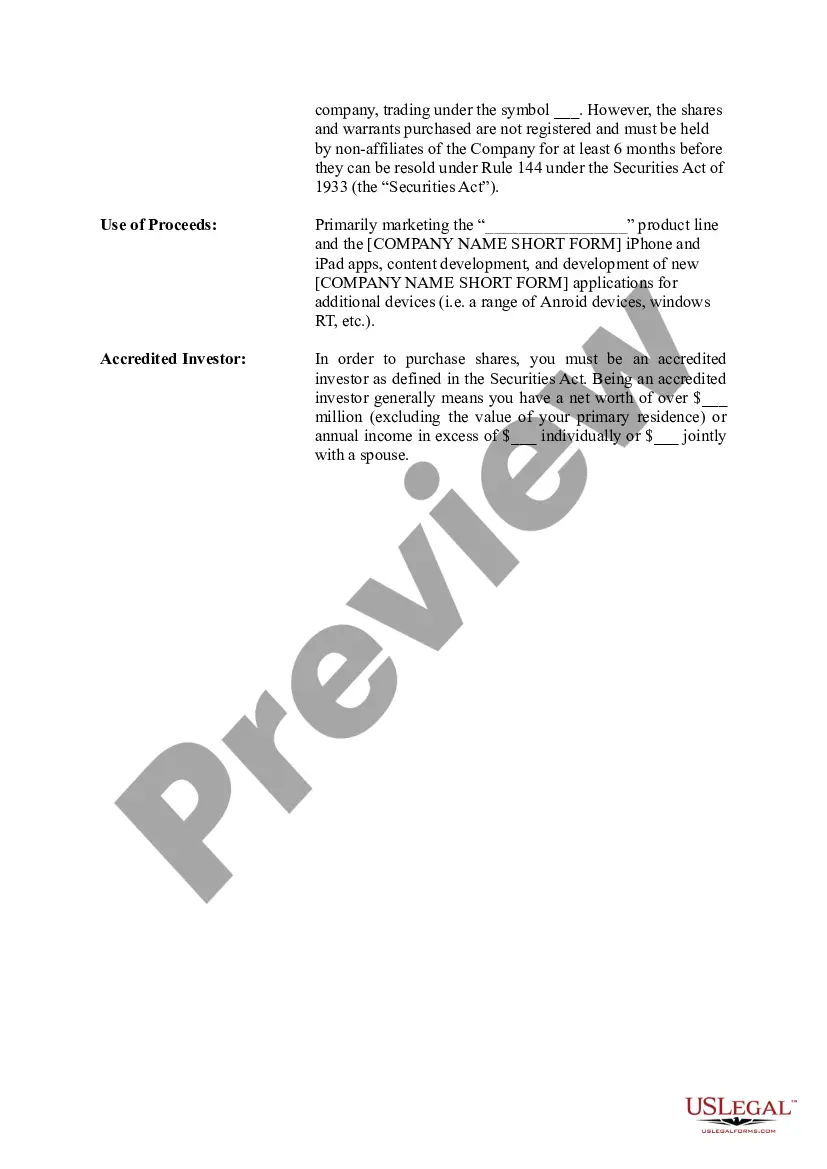

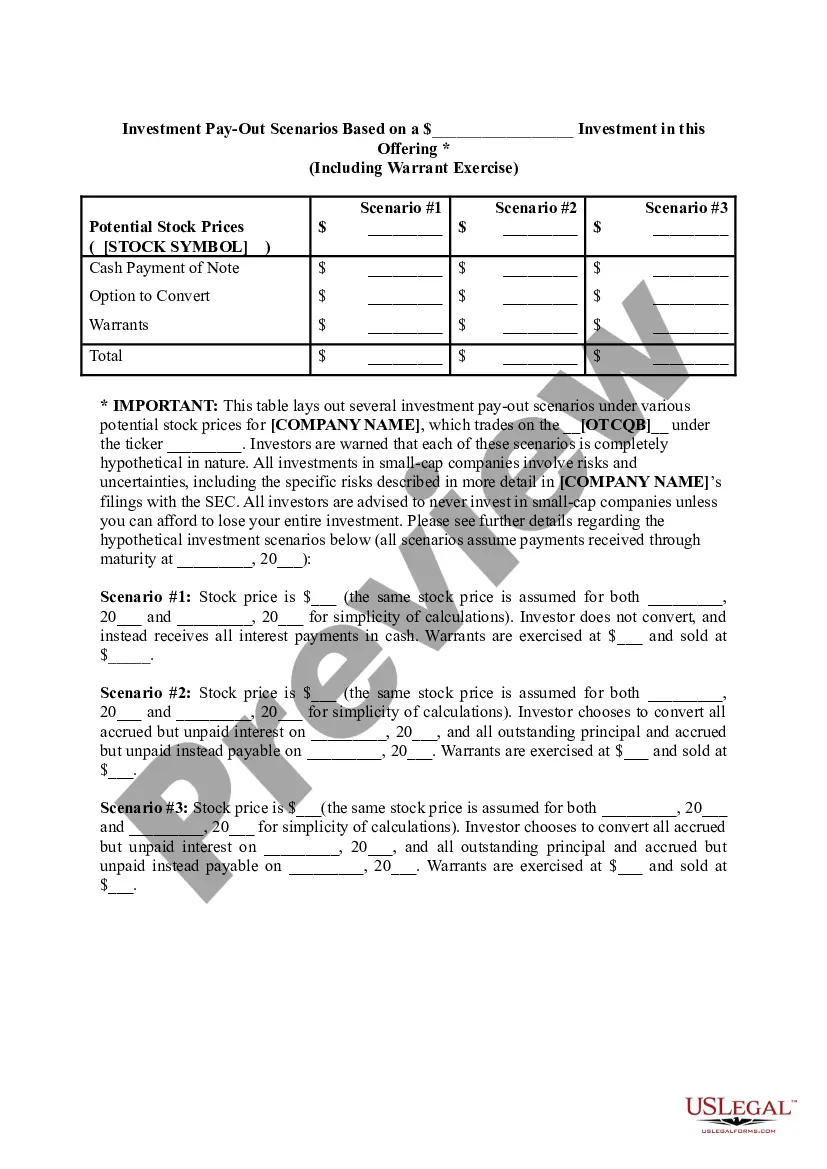

Delaware Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

US Legal Forms - one of several biggest libraries of authorized types in the USA - gives a wide array of authorized document layouts you are able to obtain or print out. Using the internet site, you will get a huge number of types for company and specific purposes, sorted by categories, claims, or search phrases.You will find the most up-to-date variations of types such as the Delaware Term Sheet - Convertible Debt Financing within minutes.

If you already possess a monthly subscription, log in and obtain Delaware Term Sheet - Convertible Debt Financing through the US Legal Forms library. The Acquire key can look on every single form you look at. You have accessibility to all in the past delivered electronically types within the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, listed here are basic instructions to help you began:

- Ensure you have chosen the right form to your metropolis/area. Select the Review key to check the form`s information. See the form outline to ensure that you have chosen the appropriate form.

- When the form does not suit your demands, take advantage of the Look for field at the top of the display screen to obtain the one which does.

- If you are happy with the form, confirm your option by simply clicking the Purchase now key. Then, pick the costs plan you prefer and supply your qualifications to sign up for an accounts.

- Procedure the financial transaction. Utilize your bank card or PayPal accounts to perform the financial transaction.

- Pick the format and obtain the form on your gadget.

- Make adjustments. Load, edit and print out and signal the delivered electronically Delaware Term Sheet - Convertible Debt Financing.

Each and every format you included in your money lacks an expiry date and it is yours permanently. So, if you wish to obtain or print out an additional copy, just visit the My Forms portion and then click about the form you need.

Obtain access to the Delaware Term Sheet - Convertible Debt Financing with US Legal Forms, one of the most extensive library of authorized document layouts. Use a huge number of specialist and status-distinct layouts that fulfill your business or specific needs and demands.

Form popularity

FAQ

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.

For tax purposes, the tax basis of the convertible debt is the entire proceeds received at issuance of the debt. Thus, the book and tax bases of the convertible debt are different. ASC 740-10-55-51 addresses whether a deferred tax liability should be recognized for that basis difference. 9.4A Tax accounting?convertible debt (before adoption of ASU 2020 ... pwc.com ? chapter_9_income_tax_US pwc.com ? chapter_9_income_tax_US

Copyright PURE Asset Management 2022. A convertible note, also called a hybrid security or hybrid, refers to a debt instrument that can be converted into equity (ownership in a company) at some point in time in the future.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months). Convertible Notes vs SAFE's - Accounting/Tax Considerations shaycpa.com ? convertible-notes-vs-safes-accounti... shaycpa.com ? convertible-notes-vs-safes-accounti...

The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.

Convertible notes are recorded as debt on the company's balance sheet up until the conversion event. After conversion, they become equity in the company. As debt instruments, convertible notes also have a maturity date and can earn interest (two key differences with SAFEs, as outlined further down).

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties. Convertible Notes Overview - Penn Law School University of Pennsylvania Carey Law School ? convertible-note University of Pennsylvania Carey Law School ? convertible-note PDF

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round). How should convertible note financing be handled on the ... Kruze Consulting ? Startup Q&A Kruze Consulting ? Startup Q&A