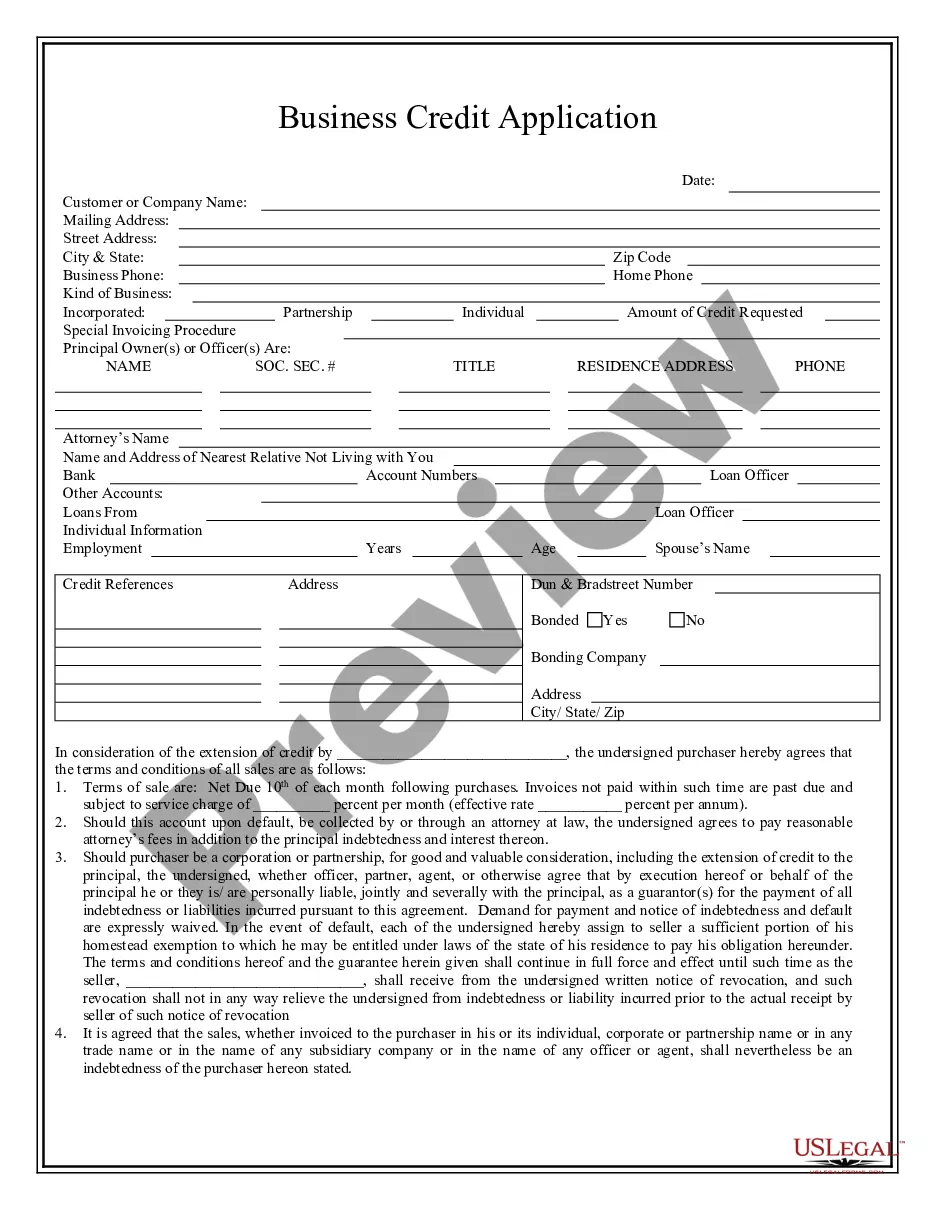

Delaware Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

How to fill out Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

You may spend hrs on-line searching for the legitimate papers design that fits the state and federal needs you require. US Legal Forms supplies 1000s of legitimate forms that are analyzed by pros. It is possible to obtain or produce the Delaware Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth from my service.

If you already possess a US Legal Forms bank account, you can log in and click the Obtain key. Next, you can comprehensive, modify, produce, or signal the Delaware Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth. Each and every legitimate papers design you get is yours forever. To have another backup associated with a purchased type, proceed to the My Forms tab and click the corresponding key.

If you are using the US Legal Forms web site for the first time, follow the easy recommendations under:

- Very first, make sure that you have selected the proper papers design for the area/town of your liking. Browse the type information to make sure you have selected the correct type. If accessible, use the Preview key to check through the papers design as well.

- In order to find another model of the type, use the Look for discipline to get the design that fits your needs and needs.

- Once you have identified the design you would like, click Get now to continue.

- Find the pricing program you would like, key in your accreditations, and register for an account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal bank account to cover the legitimate type.

- Find the formatting of the papers and obtain it to your system.

- Make modifications to your papers if needed. You may comprehensive, modify and signal and produce Delaware Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth.

Obtain and produce 1000s of papers web templates using the US Legal Forms website, that offers the greatest variety of legitimate forms. Use specialist and state-certain web templates to take on your business or personal requirements.

Form popularity

FAQ

§ 220. Inspection of books and records. (a) As used in this section: (1) ?Stockholder? means a holder of record of stock in a stock corporation, or a person who is the beneficial owner of shares of such stock held either in a voting trust or by a nominee on behalf of such person.

Issuer 251(g) Merger Event means a merger of an Issuer pursuant to which such Issuer becomes a wholly-owned subsidiary of a holding company; provided that such merger satisfies each of the following conditions: (a) Persons that ?beneficially owned? (within the meaning of Section 13(d) of the Exchange Act and the rules ...

(a) Every corporation may at any meeting of its board of directors or governing body sell, lease or exchange all or substantially all of its property and assets, including its goodwill and its corporate franchises, upon such terms and conditions and for such consideration, which may consist in whole or in part of money ...

§ 243. Retirement of stock. (a) A corporation, by resolution of its board of directors, may retire any shares of its capital stock that are issued but are not outstanding.

(a) Whenever stockholders are required or permitted to take any action at a meeting, a notice of the meeting in the form of a writing or electronic transmission shall be given which shall state the place, if any, date and hour of the meeting, the means of remote communications, if any, by which stockholders and proxy ...

Section 228 rules that unless otherwise described in a company's certificate of incorporation, shareholders have the right to proceed with any action that would typically be done at a meeting of shareholders, but are not required to have a meeting, give prior notice or hold a vote.

(a) A corporation may, whenever desired, integrate into a single instrument all of the provisions of its certificate of incorporation which are then in effect and operative as a result of there having theretofore been filed with the Secretary of State 1 or more certificates or other instruments pursuant to any of the ...

(a) Any 2 or more corporations of this State may merge into a single surviving corporation, which may be any 1 of the constituent corporations or may consolidate into a new resulting corporation formed by the consolidation, pursuant to an agreement of merger or consolidation, as the case may be, complying and approved ...