Illinois Business Credit Application

Overview of this form

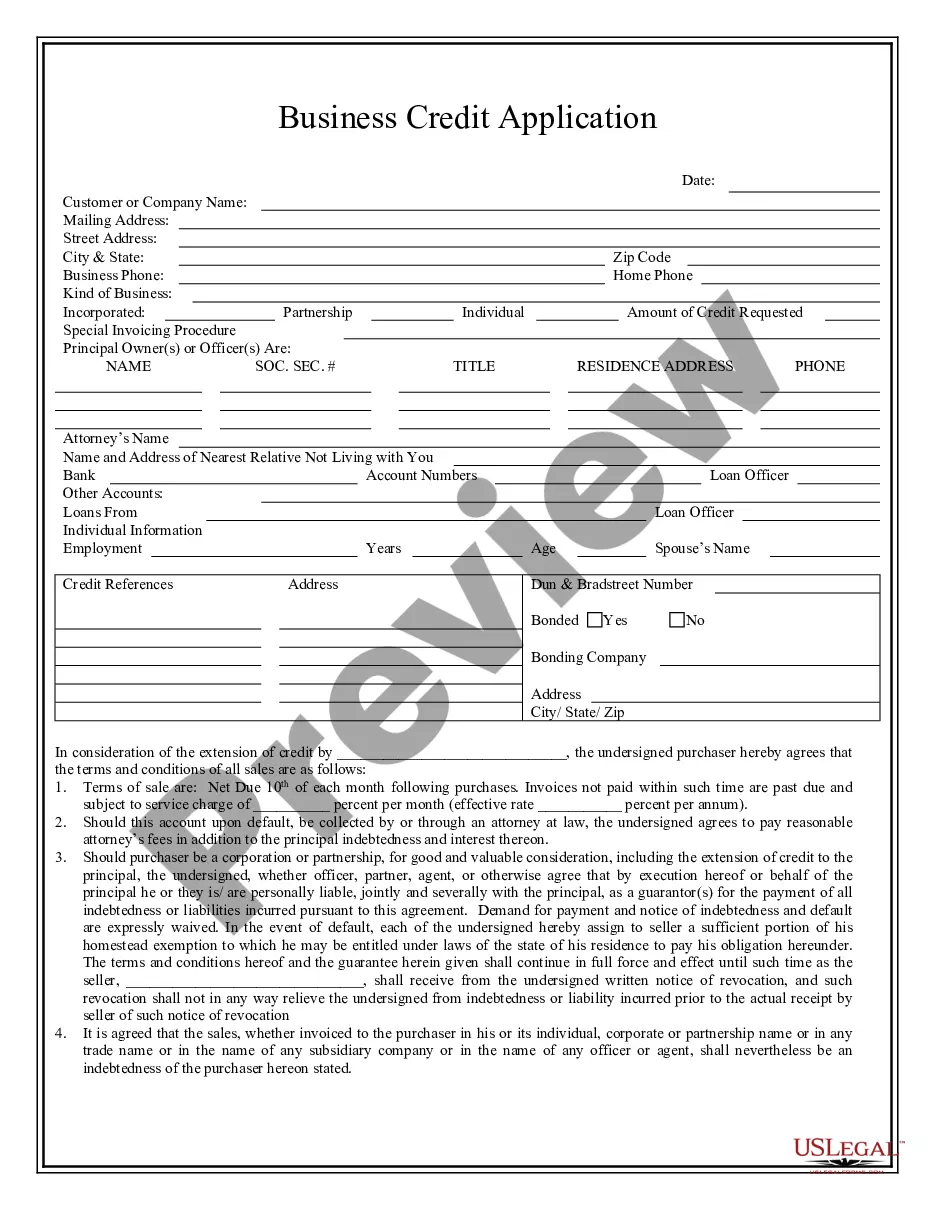

The Business Credit Application is a legal document used by individuals or businesses to request credit from a seller for purchasing goods or services. This form outlines the terms of sale, repayment schedules, and the responsibilities of the purchaser. It is essential for establishing a credit relationship between the buyer and seller, differentiating from other forms like standard purchase agreements by emphasizing credit terms and conditions.

Main sections of this form

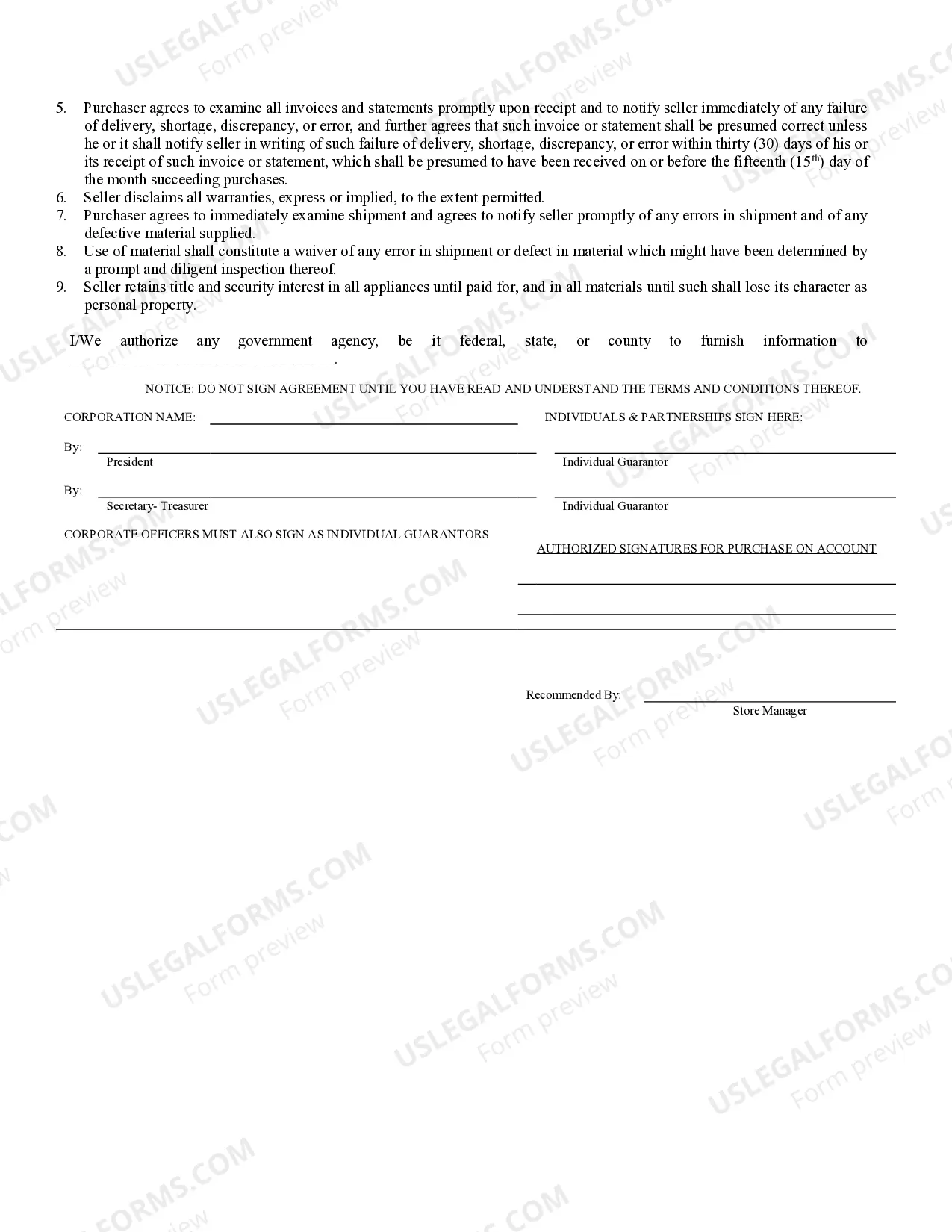

- Terms of sale specifying payment due dates and service charges for late payments.

- Provisions addressing default and attorney's fees in case of collection actions.

- Liability clauses for corporate and partnership purchasers guaranteeing payment.

- Requirements for the purchaser to examine invoices and notify of discrepancies.

- Disclaimer of warranties by the seller regarding goods provided on credit.

- Retention of title by the seller until full payment is received.

Common use cases

This form should be used when an individual or business seeks to obtain credit to make purchases from a seller. It is applicable in situations where the seller offers goods or services under credit terms, ensuring both parties have a clear understanding of repayment obligations and expectations.

Who this form is for

- Individuals looking to establish credit accounts with vendors.

- Small business owners requiring credit to manage cash flow for purchasing necessary supplies.

- Corporations or partnerships that intend to buy goods on credit and need to outline their financial obligations.

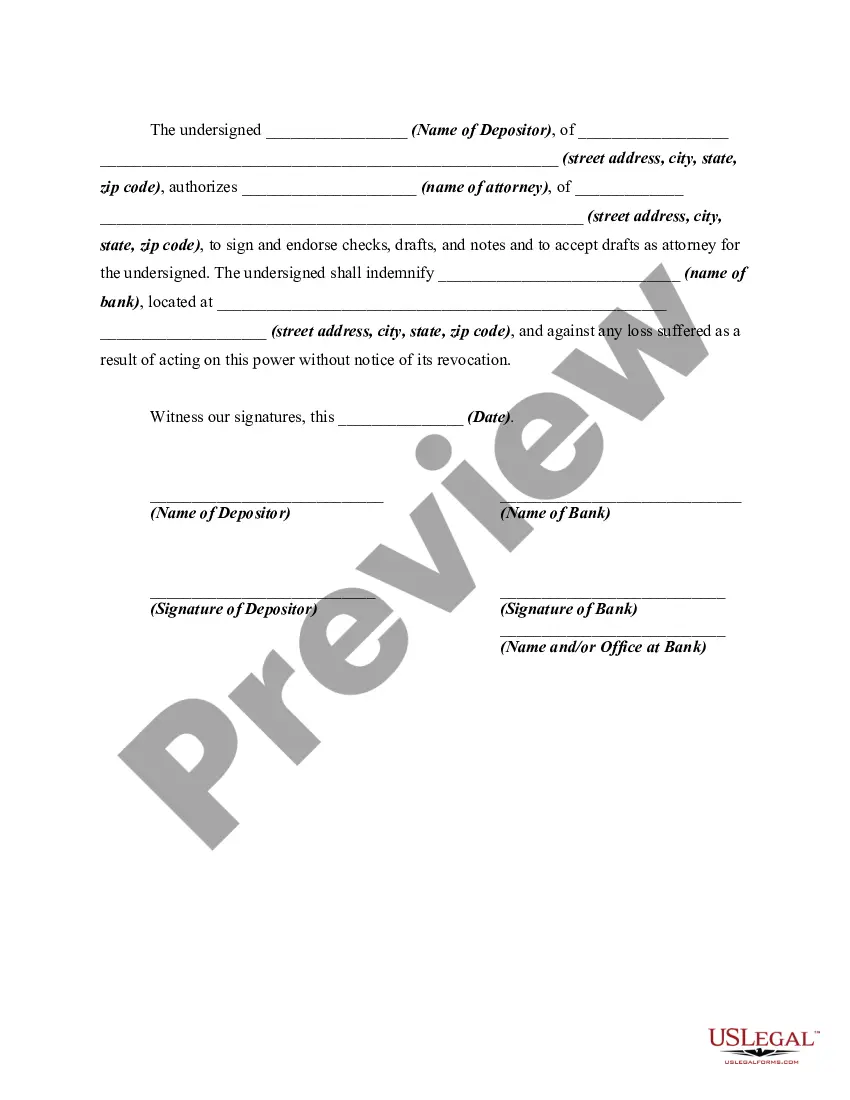

Steps to complete this form

- Identify the seller's name and contact information at the top of the form.

- Fill in the purchaser's details, including name, address, and type of business entity.

- Specify the terms of sale, including payment due dates and interest rates on overdue payments.

- Include signatures from all authorized representatives to indicate agreement to the terms.

- Ensure that any necessary notary requirements, if applicable, are followed before finalizing the document.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide accurate seller and purchaser contact information.

- Not clearly understanding and agreeing to the terms of sale before signing.

- Missing required signatures, especially if multiple parties are involved.

- Neglecting to review invoices and statements promptly.

Advantages of online completion

- Convenient access to legal documents without the need for in-person appointments.

- Editable templates allow users to customize the document based on their specific needs.

- Reliable legal language crafted by licensed attorneys for peace of mind.

Looking for another form?

Form popularity

FAQ

Electronically through MyTax Illinois, by calling us at 217-785-3707, or. at one of our offices.

For small businesses under 50 full-time employees: The credit is for $2,500 per job (that can be carried forward) and it must be applied against their Illinois withholding tax. The employer is entitled to a one credit ($2,500) if the position is filled for one year.

Name Your Illinois LLC. Choose a Registered Agent. File the Articles of Organization. Create an Operating Agreement. Get an EIN.

Electronically register through MyTax Illinois (approximately one to two days to process); complete and mail Form REG-1, Illinois Business Registration Application, to us at the address on the form (Form REG-1 is available on our web site as a fill-in and savable form. visit one of our offices.

Choose a Corporate Name. File Articles of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Directors and Hold First Board Meeting. File Annual Report. Obtain an EIN.

The State of Illinois requires you to file an annual report for your LLC. You can file the annual report online at the SOS website or by mail using Form LLC-50.1. The report contains mainly some of the same information as the articles of organization.

Small businesses are defined as firms employing fewer than 500 employees.

Illinois Corporation Incorporation: $150 filing fee + franchise tax ($25 minimum) + optional $100 expedite fee. The expedite fee is required if you file online.

The credit is limited to $500or 50% of your startup costs. You can claim it for the first three years of your plan. To be eligible, your business must: Have fewer than 100 employees who receive at least $5,000 in compensation.