Delaware Qualifying Event Notice Information for Employer to Plan Administrator

Description

How to fill out Qualifying Event Notice Information For Employer To Plan Administrator?

Selecting the appropriate authorized document template can be a challenge.

Of course, there are numerous templates available online, but how do you find the official form you require? Use the US Legal Forms website.

The service offers a plethora of templates, including the Delaware Qualifying Event Notice Information for Employer to Plan Administrator, which you can utilize for both business and personal purposes.

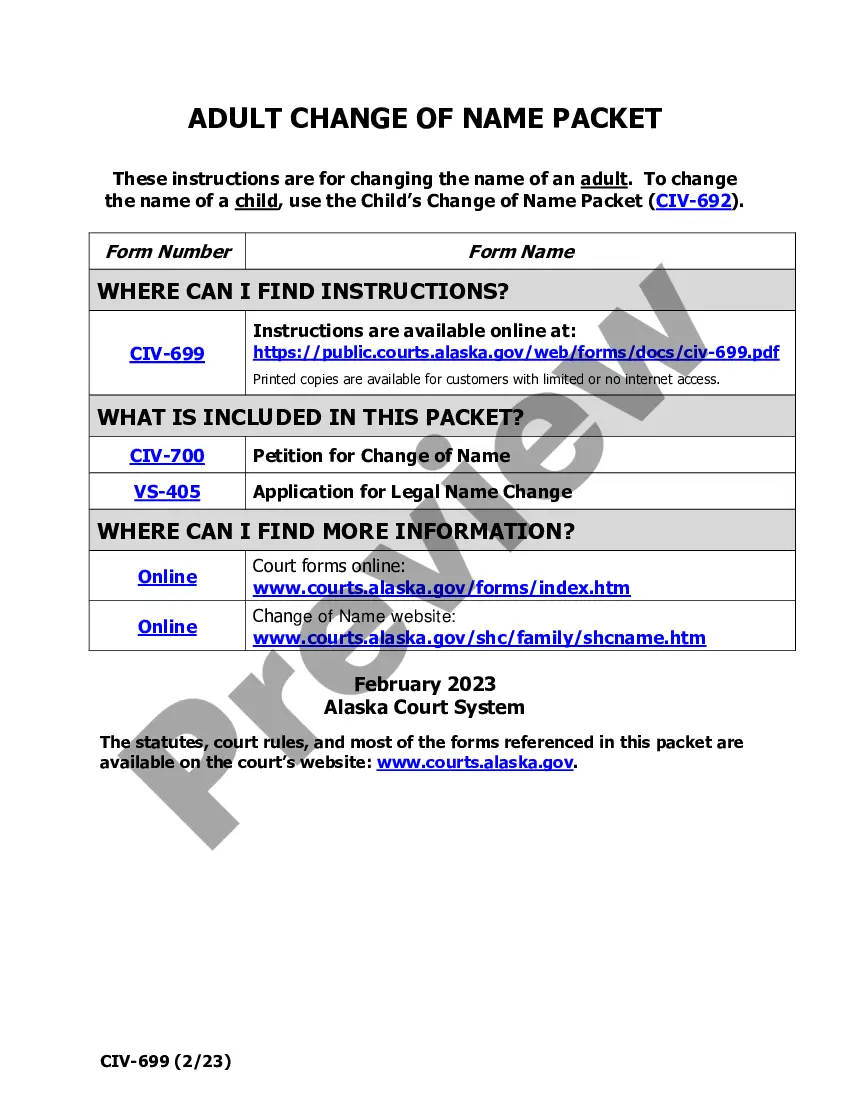

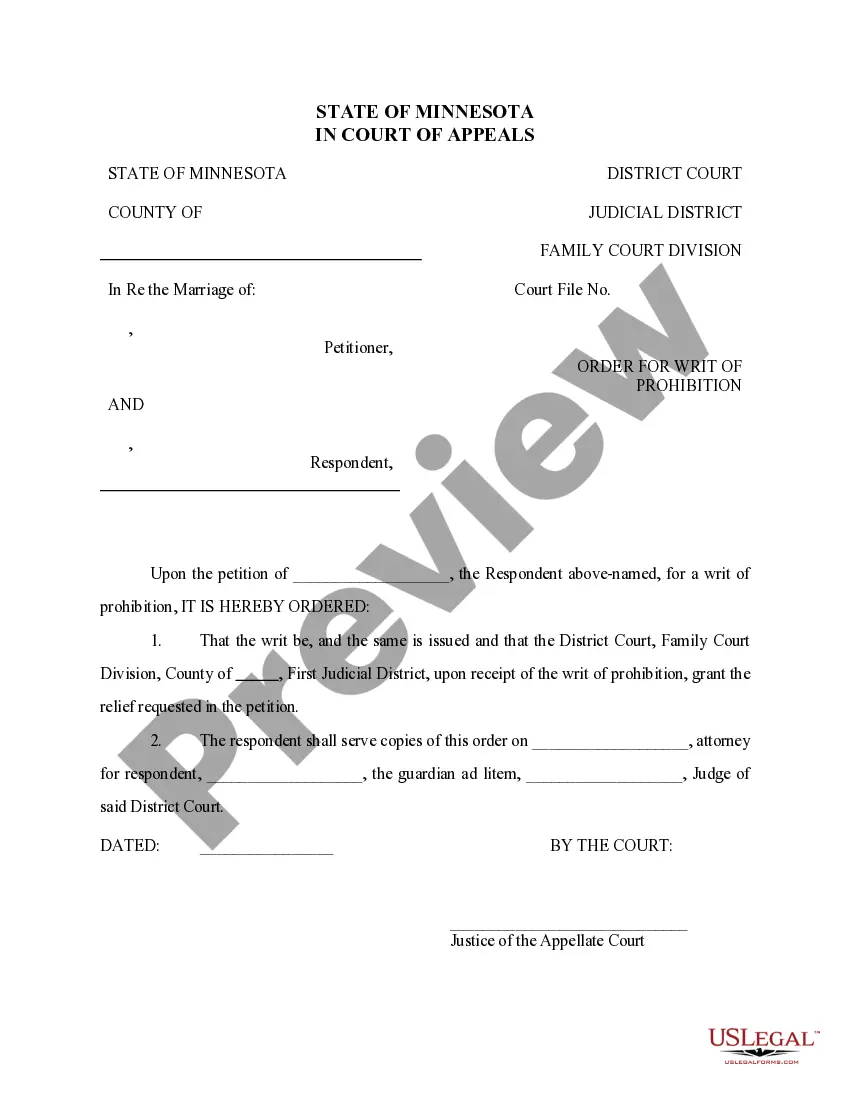

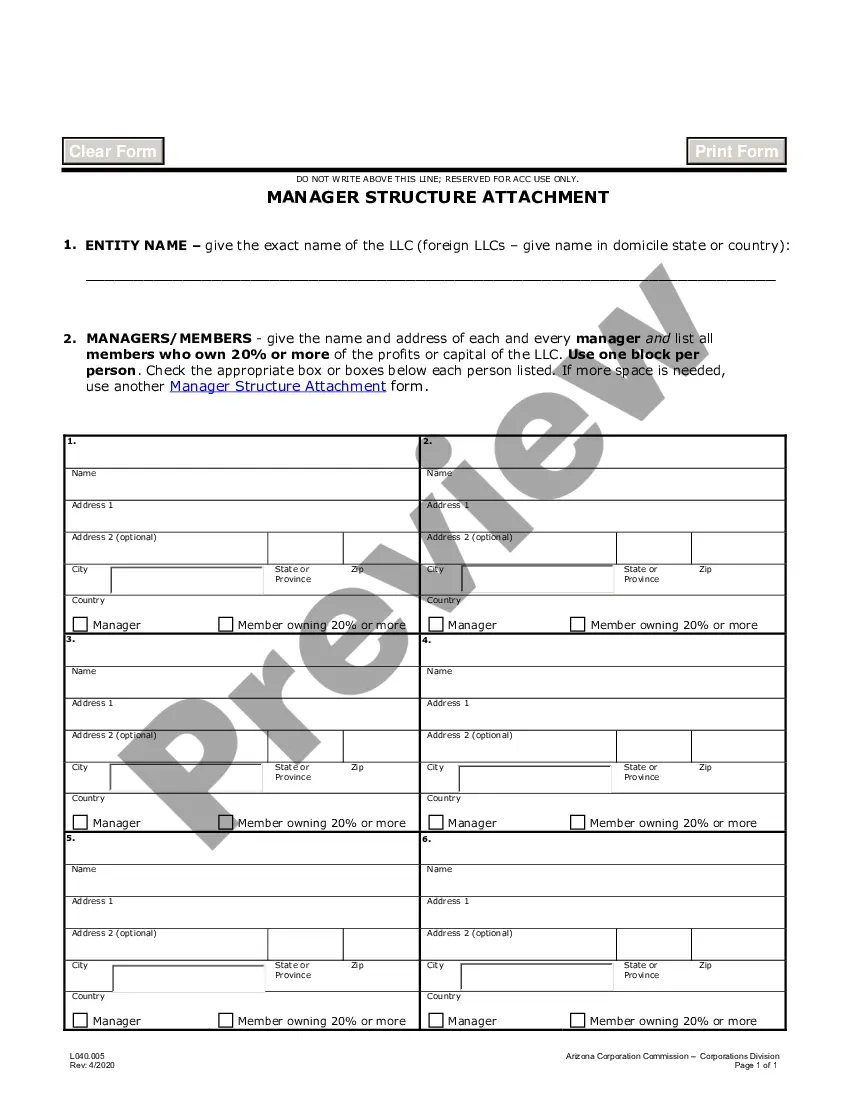

First, ensure you have selected the correct form for your area/county. You can preview the document using the Preview option and review the form outline to ensure this is right for you.

- All forms are reviewed by experts and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click the Download option to acquire the Delaware Qualifying Event Notice Information for Employer to Plan Administrator.

- Use your account to review the legal forms you may have purchased previously.

- Go to the My documents tab in your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

Form popularity

FAQ

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

For disabled QBs who receive an 11-month COBRA extension (29 months in total), you can charge up to 150% of the group rate. Many states have regulations that are similar to federal COBRA. These state regulations are known as mini-COBRA.

Delaware Has A Mini-COBRA Law Similar to the federal legislation in scope and rules, the Delaware Mini-COBRA law requires businesses with fewer than 20 employees to offer health continuation after job loss. You are eligible for Delaware's Mini-COBRA should a qualifying event happen.

You May Cancel COBRA At Any Time To cancel your your COBRA coverage you will need to notify your previous employer or the plan administrator in writing. After you stop your COBRA insurance, your former employer should send you a letter affirming termination of that health insurance.

Consumers may also extend COBRA coverage longer than the initial 18-month period with a second qualifying event (e.g., divorce or death), up to an additional 18 months, for a total of 36 months.

Even if you enroll in COBRA on the last day that you are eligible, your coverage is retroactive to the date you lost your employer-sponsored health plan.

COBRA Qualifying Event Notice The employer must notify the plan if the qualifying event is: Termination or reduction in hours of employment of the covered employee, 2022 Death of the covered employee, 2022 Covered employee becoming entitled to Medicare, or 2022 Employer bankruptcy.

State continuation coverage refers to state laws that allow people to extend their employer-sponsored health insurance even if they're not eligible for extension via COBRA. As a federal law, COBRA applies nationwide, but only to employers with 20 or more employees.

You can cancel the COBRA coverage at any time within 18 months. You're not locked in. You will likely want to drop COBRA once you become eligible for a different health plan, such as if you get another job. If you stop paying premiums, COBRA coverage will end automatically.

COBRA requires that continuation coverage extend from the date of the qualifying event for a limited period of 18 or 36 months. The length of time depends on the type of qualifying event that gave rise to Page 6 6 the COBRA rights.