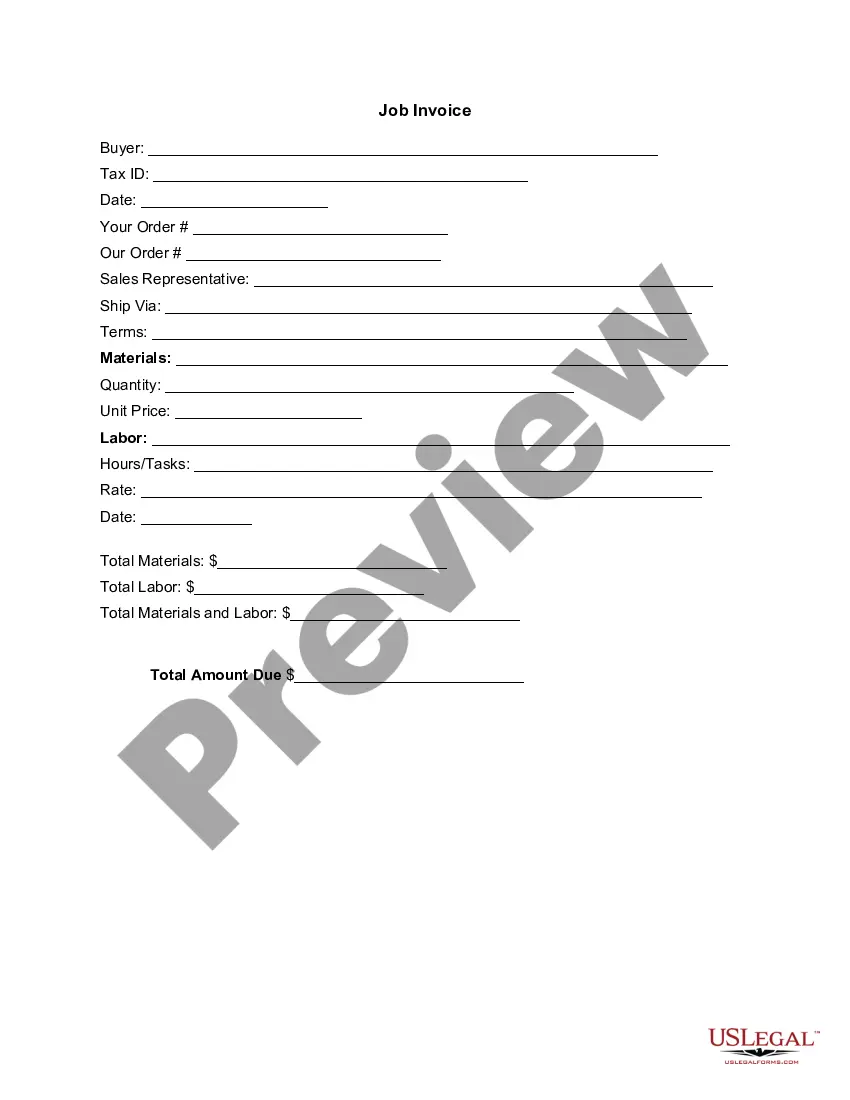

Delaware Invoice Template for Sole Trader

Description

How to fill out Invoice Template For Sole Trader?

Are you in a situation where you require documents for either business or personal reasons almost every workday.

There are numerous reliable document templates available online, but finding ones you can rely on is challenging.

US Legal Forms provides a vast array of form templates, including the Delaware Invoice Template for Sole Trader, which can be tailored to meet federal and state standards.

Choose the pricing plan you prefer, fill out the required information to create your account, and complete the payment through PayPal or Visa or Mastercard.

Select a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Delaware Invoice Template for Sole Trader format.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and verify it is for the correct city/state.

- Use the Preview button to review the document.

- Check the description to make sure you've selected the correct form.

- If the form does not meet your needs, utilize the Search bar to find the suitable form for your requirements.

- Once you locate the correct form, click Get now.

Form popularity

FAQ

Generating an invoice as a sole trader can be done quickly with a Delaware Invoice Template for Sole Trader. Fill in your details, the client’s information, a description of services, and payment terms. This ensures that you have a clear record and your clients know what to expect in terms of payment.

When you are self-employed, creating an invoice can be simplified with a Delaware Invoice Template for Sole Trader. Start by listing your business name, the services you provided, and the payment amount. This structured approach not only promotes professionalism but also helps you keep track of your income efficiently.

Yes, a sole trader can provide invoices for services rendered or products sold. Using a Delaware Invoice Template for Sole Trader makes this process easy and professional. An invoice not only serves as a request for payment but also acts as a record for your business transactions. This is crucial for bookkeeping and tax purposes.

As a sole proprietor, you can effortlessly create an invoice using a Delaware Invoice Template for Sole Trader. Begin by including your business name and contact information, followed by an invoice number and date. Clearly outline the services provided, along with the amount due to ensure clarity for your clients.

For beginners, invoicing can be straightforward using a Delaware Invoice Template for Sole Trader. First, write down your name, client’s details, and a description of services rendered. Then specify the amount due and payment terms. Keeping it simple allows you to focus on your work while having professional documents.

To create an invoice as an independent contractor, start with a Delaware Invoice Template for Sole Trader. Clearly state your name, contact information, and the services provided. Include the payment terms and any applicable taxes. This structured approach ensures that your clients understand what they are paying for.

Yes, it is legal to invoice yourself as a sole trader. By using a Delaware Invoice Template for Sole Trader, you can document your services or products clearly. This helps in maintaining accurate records for accounting purposes. Ensure that your invoices include all necessary details to comply with any local regulations.

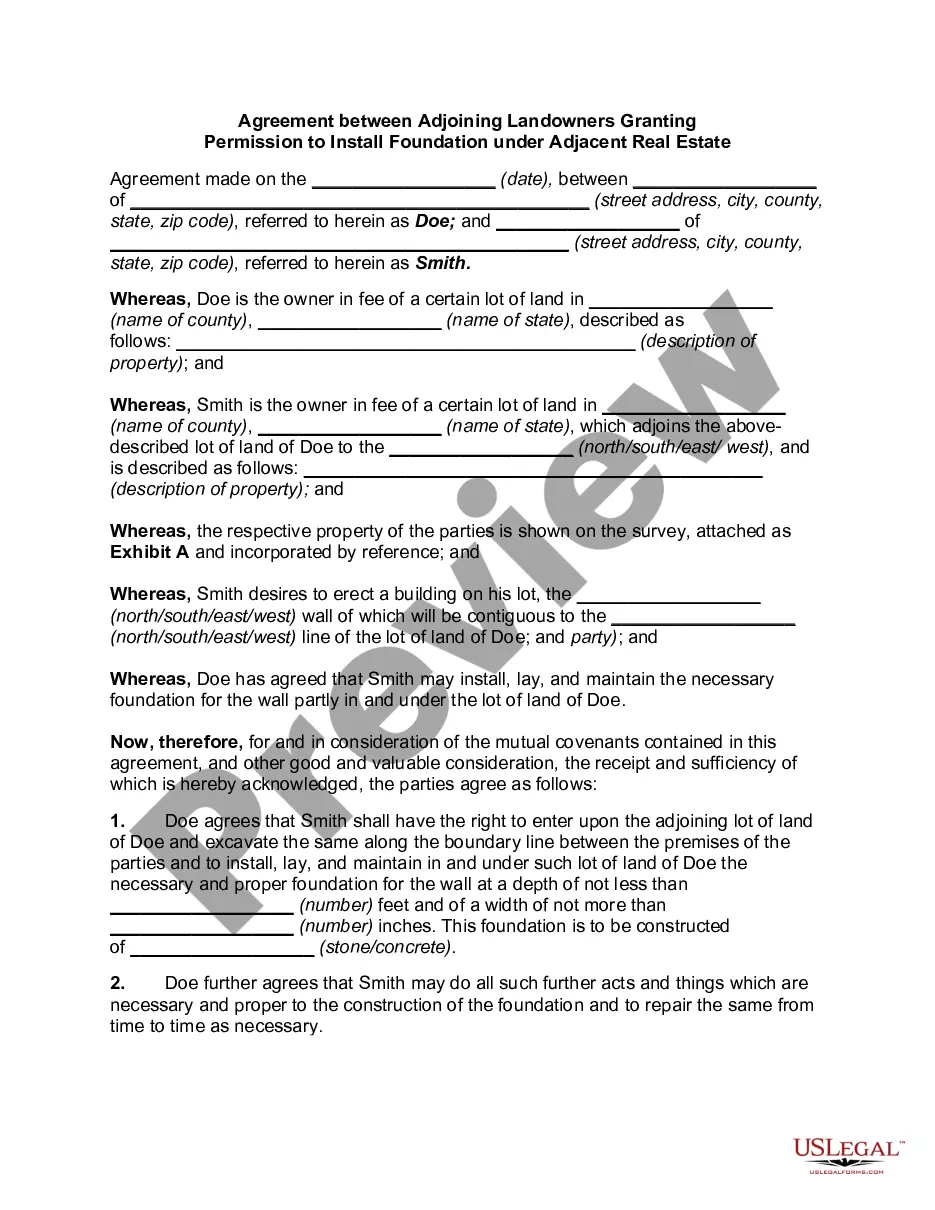

Section 228 permits stockholders of a Delaware corporation to take action without a formal meeting, provided they consent in writing. This allows for greater flexibility in decision-making and expedites corporate processes. Knowing this can streamline operations as you manage your Delaware Invoice Template for Sole Trader.

Delaware does not require your business to have a domestic principal office, which means you can operate from anywhere. This flexibility benefits many sole traders, allowing them to focus on their services without the burden of maintaining a physical office. You can use this freedom when drafting your Delaware Invoice Template for Sole Trader.

Section 133 pertains to the voting rights of stockholders in Delaware corporations. It outlines how shareholders can vote on important corporate matters. Understanding these regulations can help you create a strong foundation for your business while you develop your Delaware Invoice Template for Sole Trader.