Delaware Assignment of Debt

Description

How to fill out Assignment Of Debt?

If you need to finalize, acquire, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to obtain the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you require, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Delaware Assignment of Debt in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to receive the Delaware Assignment of Debt.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

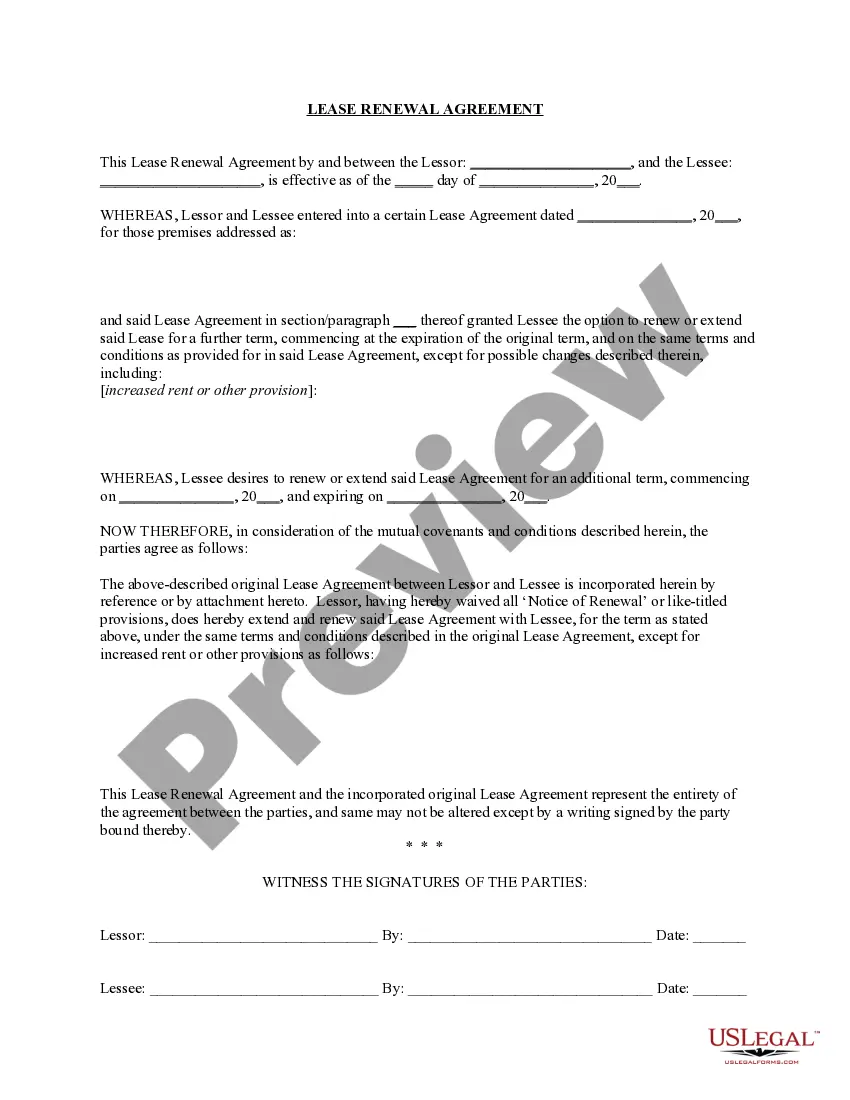

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search section at the top of the screen to find other forms in the legal document format.

Form popularity

FAQ

Delaware insolvency law governs how businesses and individuals handle financial distress and bankruptcy situations. It provides a structured process for debtors to resolve their financial obligations, aiming to balance the interests of creditors and debtors. In the context of a Delaware Assignment of Debt, understanding these laws can significantly impact your financial decisions and outcomes. Utilizing resources from USLegalForms can help you navigate these complexities with confidence.

Proof of assignment of debt serves as evidence that a creditor has legally transferred their right to collect a debt to another individual or entity. This documentation typically includes a written agreement outlining the details of the debt, the parties involved, and any relevant terms. For a Delaware Assignment of Debt, having this proof is vital for both the assignee and debtor to avoid disputes. By securing proper documentation, you can safeguard your financial interests.

An assignment of a debt is a process where a creditor transfers their rights to collect a debt to another party. This can happen for various reasons, such as selling the debt or settling financial obligations. When dealing with a Delaware Assignment of Debt, it's crucial to ensure that the assignment is documented properly to maintain legal validity. Understanding this concept helps you navigate your financial interactions more effectively.

To fill out a proof of debt form, you need to provide essential details such as the amount owed, the name of the creditor, and the basis for the debt. Accuracy is vital, as this document will serve as a formal claim in any proceedings. Make sure you follow the format specified for Delaware Assignment of Debt claims to ensure proper processing. Utilize the tools available on the US Legal platform to simplify this task.

The process of debt assignment begins with the original creditor and the assignee entering into an assignment agreement. This agreement outlines the specific debt being assigned and the terms of the transfer. After this, the debtor must be notified of this change to comply with future payment obligations. For an easy overview of these steps, the US Legal website offers valuable resources on Delaware Assignment of Debt.

The notice of assignment procedure involves informing the debtor that their debt has been assigned to a new party. This notice typically includes the details of the assignee and instructions on where to send future payments. It ensures that the debtor understands their obligations have shifted. For structured guides and templates, you can refer to the US Legal platform, which provides insights into Delaware Assignment of Debt.

When a debt is assigned, the original creditor transfers their rights to collect the debt to another party, known as the assignee. This means you will make payments to the assignee rather than the original creditor. The terms of the debt typically remain unchanged, but it is crucial to understand who now holds the obligation. For details on how this process works, consider exploring resources on Delaware Assignment of Debt.

Yes, a debt can indeed be transferred to another person through a Delaware Assignment of Debt. This transfer requires the consent of the original creditor, as they have the right to approve or deny the assignment. Clear communication between all parties, along with a legally binding agreement, is crucial to ensure a smooth transition during the debt transfer process.

To assign a debt, first agree with the new debtor on the terms surrounding the transfer. After reaching an agreement, create a written assignment that outlines both parties' responsibilities. It is essential to inform the original creditor about the assignment for it to be valid, and they may require some documentation to formalize the Delaware Assignment of Debt.

To assign debt, start by drafting a formal document that states your intent to transfer the debt to another party. This document should include essential details like the debtor's information, the creditor's details, and the specifics of the debt itself. Utilizing a reliable platform, such as US Legal Forms, can simplify this process by providing templates and guidance for creating an effective Delaware Assignment of Debt.