Delaware Equipment Lease - Detailed

Description

How to fill out Equipment Lease - Detailed?

Are you presently in a scenario where you require documentation for either commerce or particular tasks nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms provides a plethora of document templates, such as the Delaware Equipment Lease - Detailed, which can be generated to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Delaware Equipment Lease - Detailed at any moment, if needed. Click on the required form to download or print the template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service offers expertly crafted legal document templates that can be employed for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Delaware Equipment Lease - Detailed template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

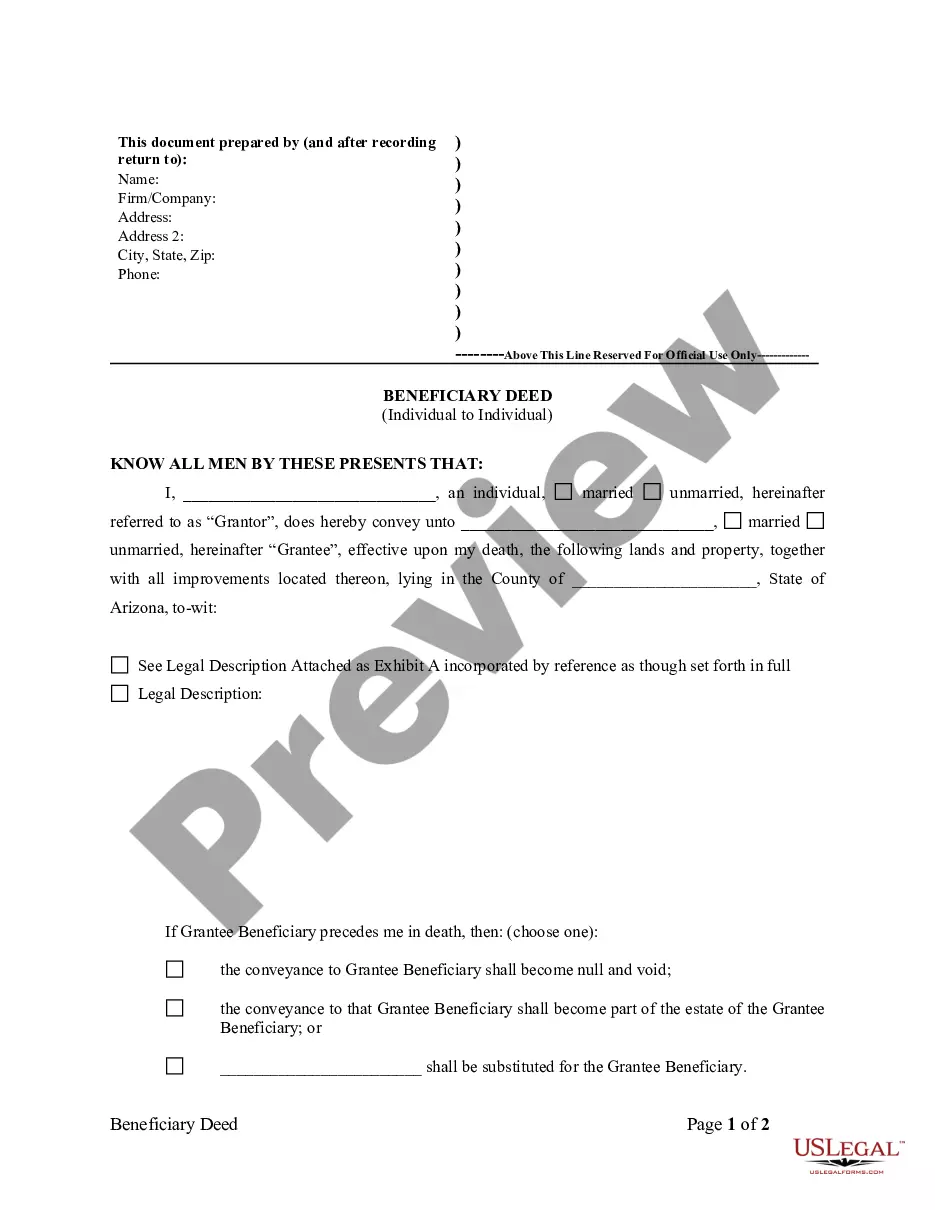

- Obtain the form you need and ensure it is for the correct city/county.

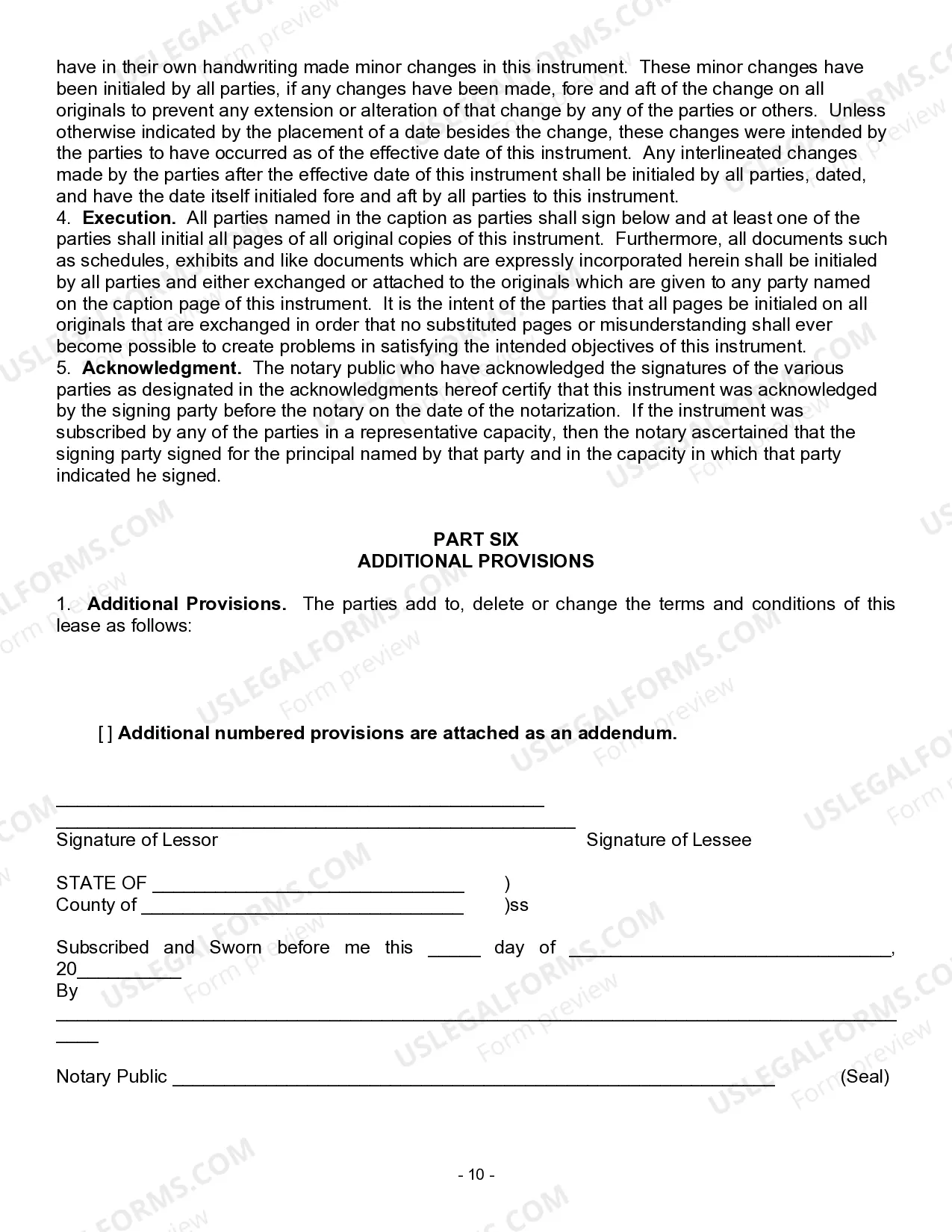

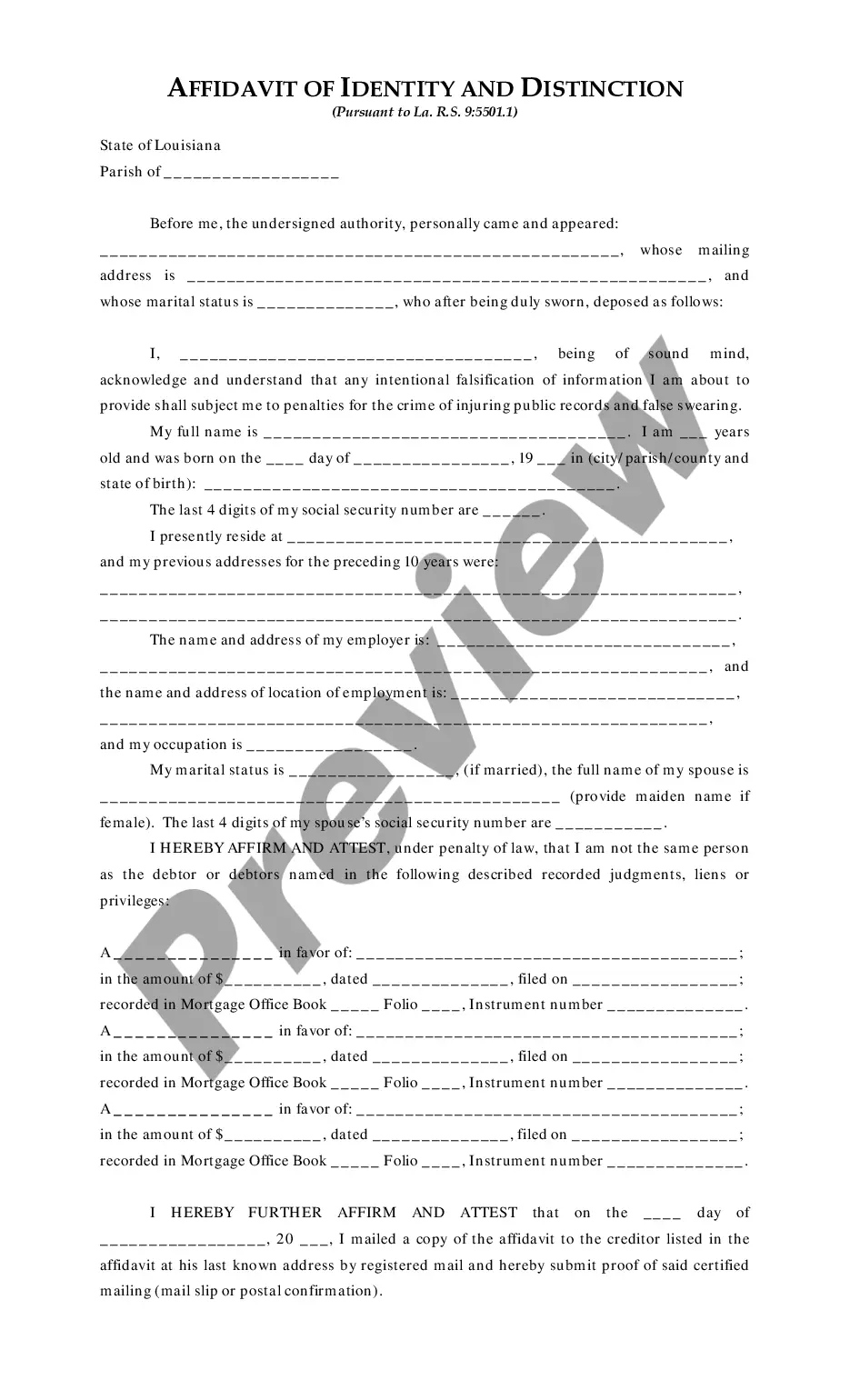

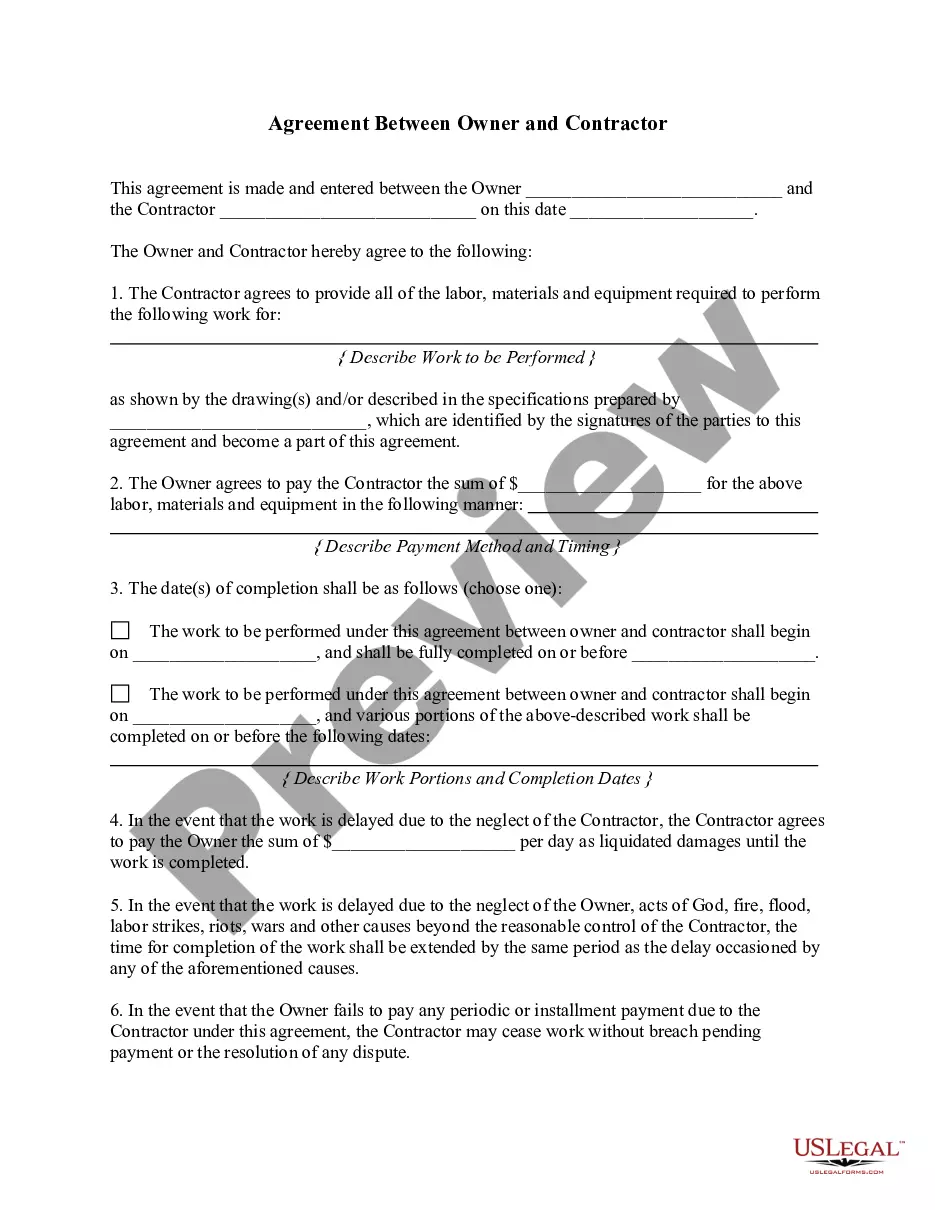

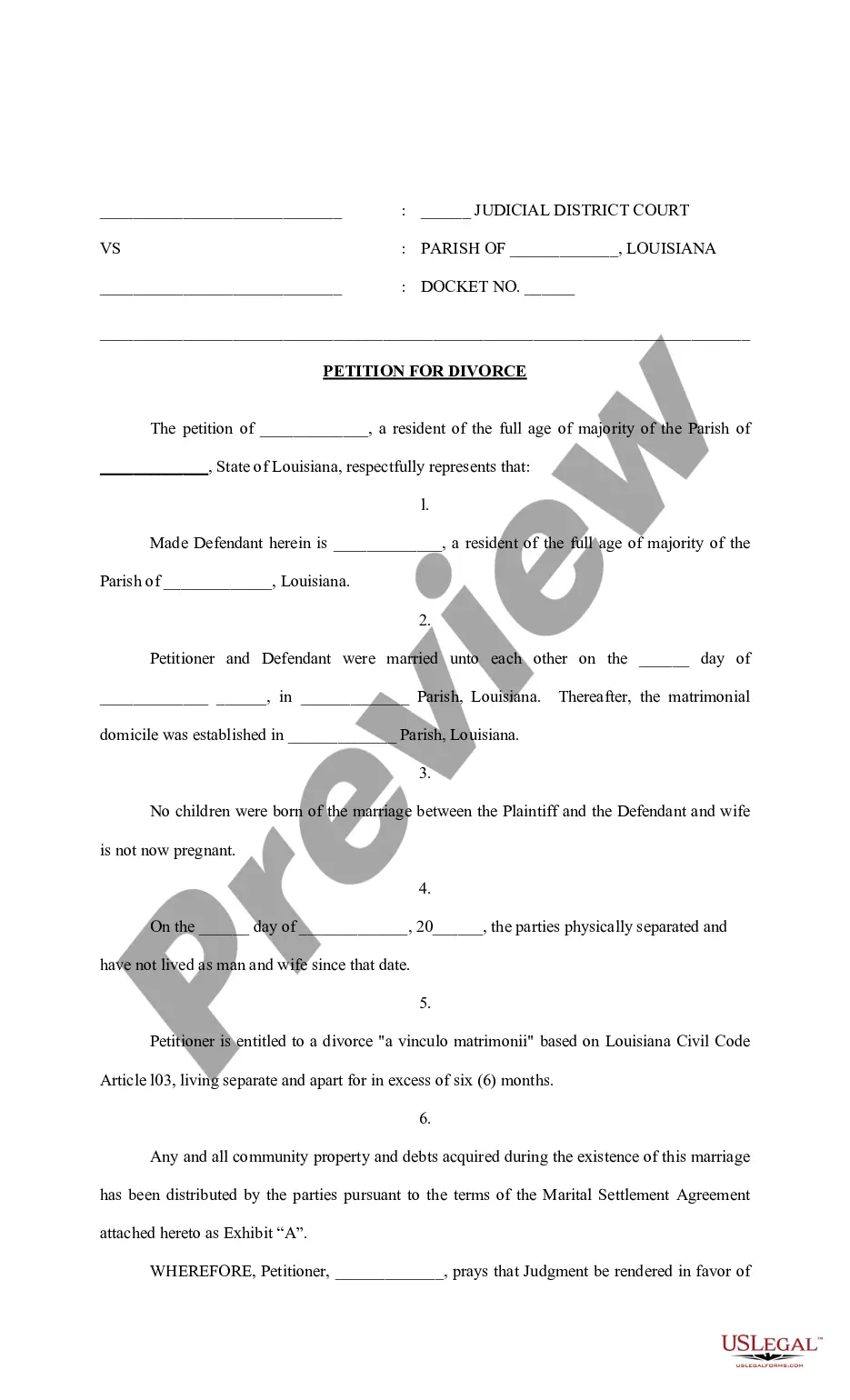

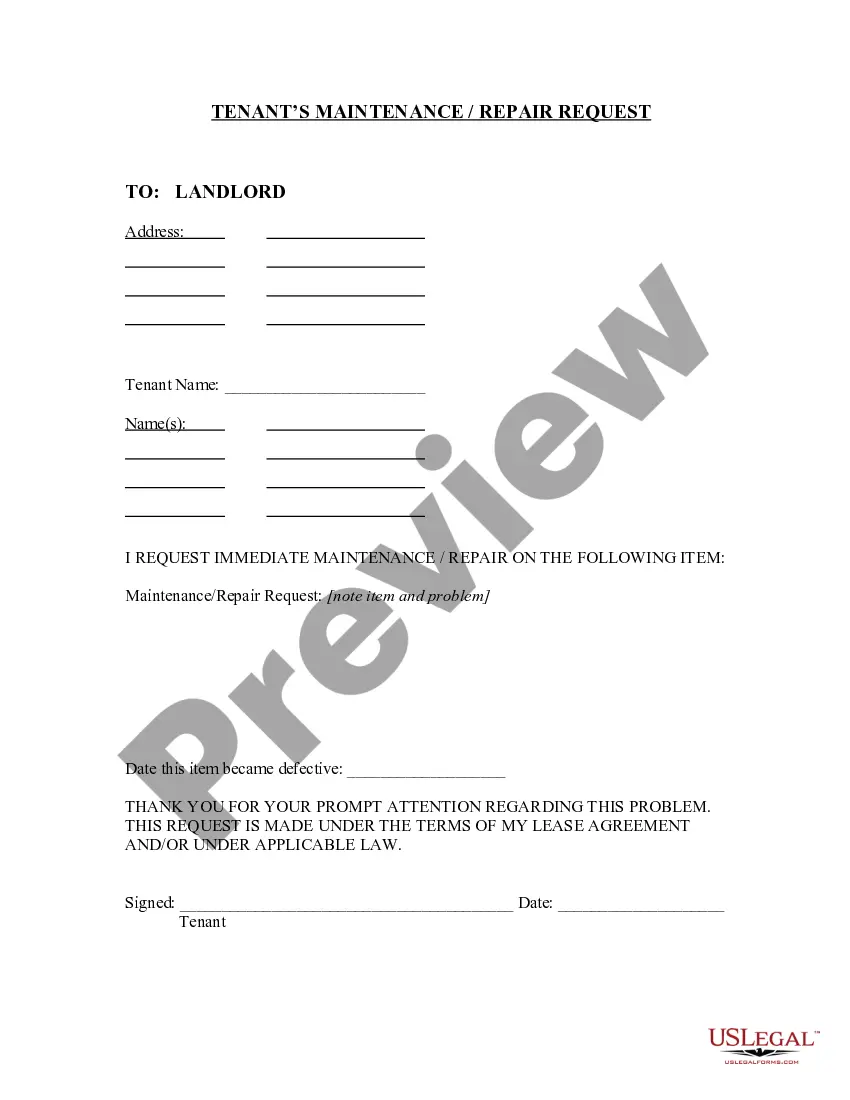

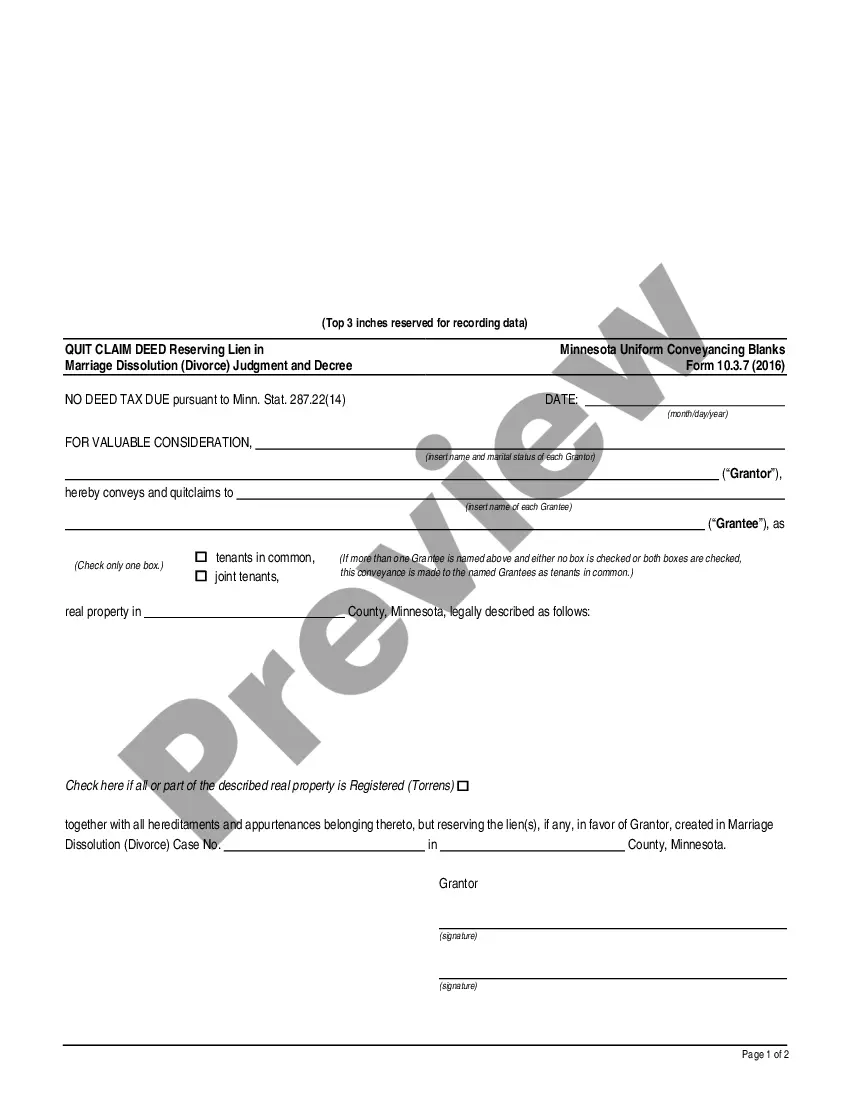

- Utilize the Review feature to examine the document.

- Read the description to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Lookup area to find the form that suits your needs.

- Once you have obtained the appropriate form, click Buy now.

- Select the pricing plan you prefer, fill in the required information to create your account, and complete the order using your PayPal or credit card.

Form popularity

FAQ

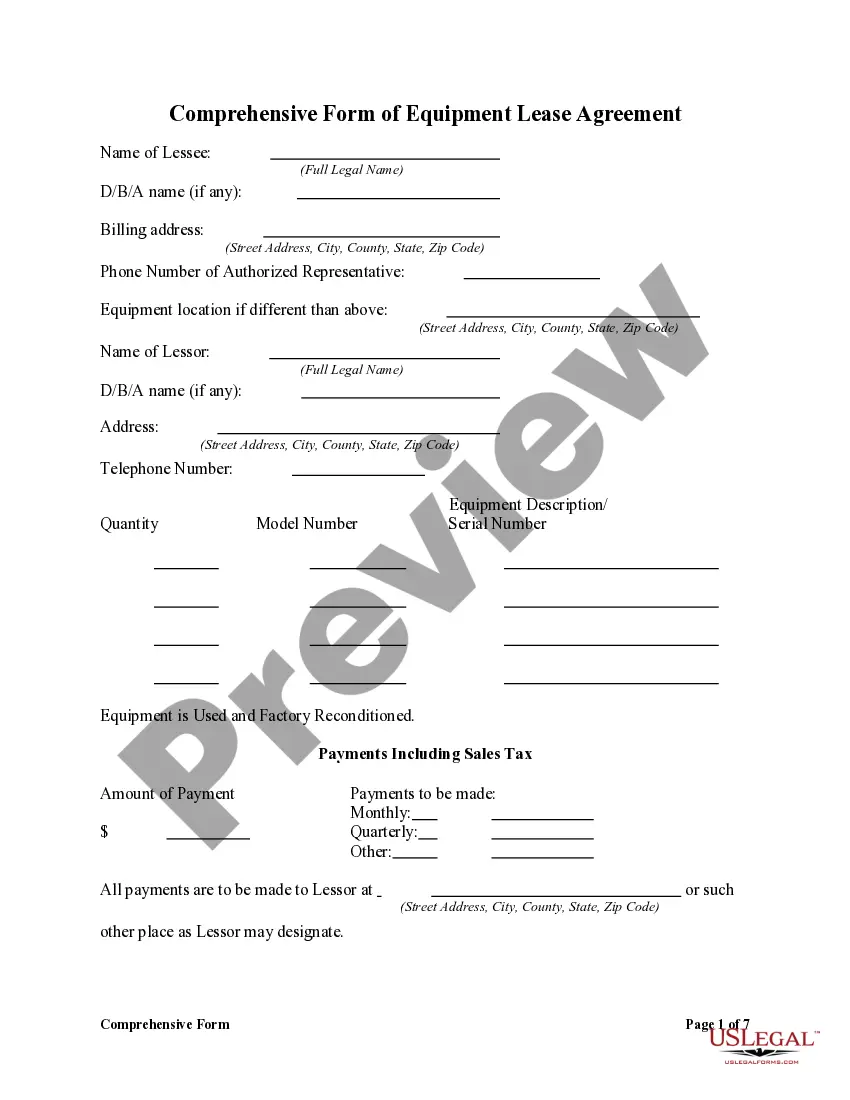

Setting up an equipment lease involves several steps, starting with selecting the right equipment and determining the lease terms. It’s crucial to draft a detailed lease agreement that covers payment structure, duration, and conditions relating to the Delaware Equipment Lease - Detailed. This careful planning will ensure the lease serves both your financial needs and operational goals effectively.

Leasing equipment to your LLC is a straightforward process that begins with drafting a lease agreement. This document should include key details about payment terms, duration, and responsibilities, specifically tailored under the Delaware Equipment Lease - Detailed guidelines. By following this structured approach, you ensure both the lessee and lessor understand their obligations clearly and avoid potential disputes.

The amount you can write off depends on the lease type and overall tax regulations. In general, businesses may deduct the entire lease payment as an expense if the lease adheres to certain conditions outlined in a Delaware Equipment Lease - Detailed. Always double-check with accounting professionals to ensure compliance and maximize your deductions.

To write off leased equipment, you typically recognize lease payments as expenses on your income statement. The accounting treatment may vary based on the lease type; hence, it is essential to refer to the Delaware Equipment Lease - Detailed for specific guidance. Additionally, maintaining thorough documentation will help you manage these write-offs effectively over time.

Writing off financed equipment involves removing the asset from your balance sheet when it no longer holds value. This process requires you to document depreciation and any impairment adjustments, ensuring you follow the guidelines for your specific industry. By doing so, you maintain transparency in financial reporting, particularly when dealing with a Delaware Equipment Lease - Detailed.

To record leased equipment in accounting, you typically create a lease liability and an asset account for the equipment. Under a Delaware Equipment Lease - Detailed, this involves recognizing the right to use the equipment over the lease term. You will also track regular lease payments as expenses. Accurate record-keeping will ensure compliance and provide clear financial insights.

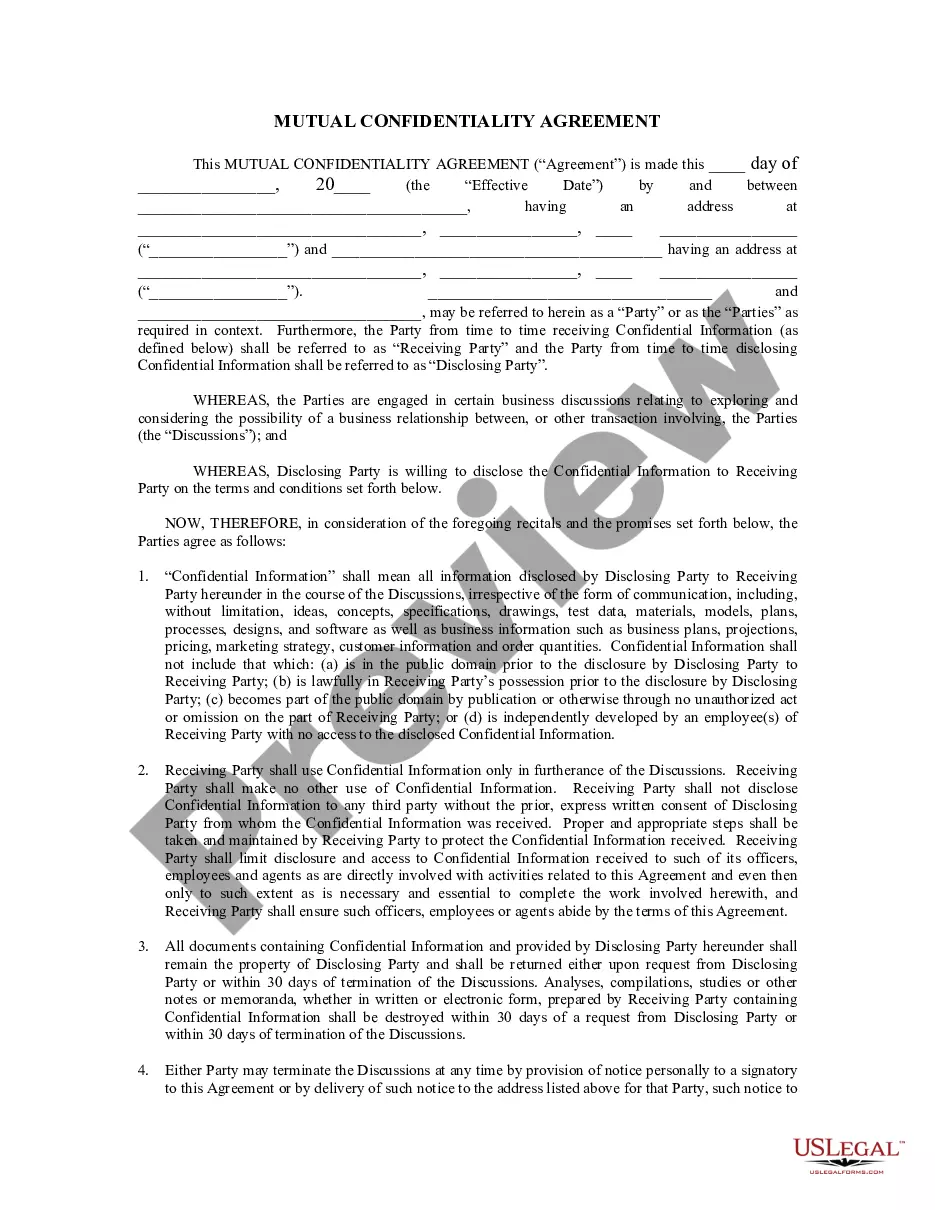

The tax lease structure refers to how taxes are applied and calculated within a lease agreement. In a Delaware Equipment Lease - Detailed, this structure may influence ownership, tax benefits, and overall costs. Understanding the tax lease structure helps in making informed financial decisions.

Exiting an equipment lease agreement involves reviewing the terms and conditions outlined in your Delaware Equipment Lease - Detailed. Often, there are specific clauses regarding termination that you should follow. If you're unsure, consulting a legal expert can help you navigate the process smoothly.

In Delaware, the lease tax rate can vary depending on the type of equipment you lease. It is crucial to check the specifications of your Delaware Equipment Lease - Detailed to find the exact tax rate that applies. This information helps you plan your budget effectively.

Lease sales tax refers to the tax that applies to the sale of leased goods or equipment. In the context of a Delaware Equipment Lease - Detailed, this tax varies based on the type of equipment and its use. Be aware of these taxes as they might affect your overall leasing costs.