Delaware Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

Finding the appropriate authentic document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you locate the authentic one you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some straightforward guidelines you can follow: First, ensure you have selected the appropriate form for your area/county. You can browse the form using the Review option and read the form description to ensure it is the correct one for you. If the form does not meet your needs, use the Search area to find the correct form. When you are confident that the form is suitable, proceed by clicking the Purchase now option to acquire the form. Choose the payment plan you wish and enter the required information. Create your account and finalize your purchase using your PayPal account or credit card. Select the submission format and download the legal document template to your device. Complete, edit, print, and sign the acquired Delaware Simple Equipment Lease. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted paperwork that adheres to state requirements.

- The service provides an extensive array of templates, such as the Delaware Simple Equipment Lease, suitable for business and personal purposes.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Delaware Simple Equipment Lease.

- Use your account to browse through the legal forms you have previously acquired.

- Go to the My documents tab in your account and obtain another copy of the document you need.

Form popularity

FAQ

Yes, you can eFile a Delaware tax extension. This option allows taxpayers additional time to file their returns, which can be beneficial if you're managing income from a Delaware Simple Equipment Lease. Make sure to follow the necessary steps and deadlines to ensure your extension is filed correctly.

In Delaware, certain groups may qualify for property tax exemptions. For example, veterans and individuals with disabilities may be eligible for tax relief. If you are involved in a Delaware Simple Equipment Lease, understanding these exemptions can help you manage your financial obligations effectively.

Currently, there is no specific new rental tax in Delaware. However, tax policies can change, so it's wise to stay informed about any legislative updates that could impact how you report income from a Delaware Simple Equipment Lease. Regularly checking with your tax advisor or the state tax office can keep you updated.

Yes, rental income is taxable in Delaware. If you are receiving payments from a Delaware Simple Equipment Lease, it’s essential to report this income on your Delaware state tax return. This ensures compliance with state tax laws and helps you avoid penalties.

Delaware does not impose a specific tax solely on equipment rentals. However, the income from a Delaware Simple Equipment Lease is considered part of your taxable income. It's essential to calculate this accurately when preparing your taxes to avoid any issues.

Certain types of income are not taxed in Delaware. For instance, Social Security benefits and some pension income may not be subject to state tax. Understanding what is exempt can help you when managing income from a Delaware Simple Equipment Lease, ensuring you take advantage of available tax benefits.

In Delaware, rental income is considered taxable income. This means that if you earn income from a Delaware Simple Equipment Lease, you must report that income when filing your state taxes. Delaware does not have a separate tax specifically for rental income, but it is usually included in your overall income tax calculations.

Leasing equipment, such as through a Delaware Simple Equipment Lease, can come with a few drawbacks. Firstly, you may end up paying more over time compared to purchasing the equipment outright. Additionally, leasing often restricts how you can use the equipment, and early termination of the lease may lead to penalties. Lastly, there could be hidden costs that appear over the duration of the lease, making it important to carefully review the contract.

Yes, you can create your own lease agreement, but it is crucial to ensure it covers all necessary details to avoid any potential issues. Consider using a standard format like the Delaware Simple Equipment Lease, which provides a solid foundation for your agreement. This approach not only makes writing easier but also helps you comply with relevant legal standards.

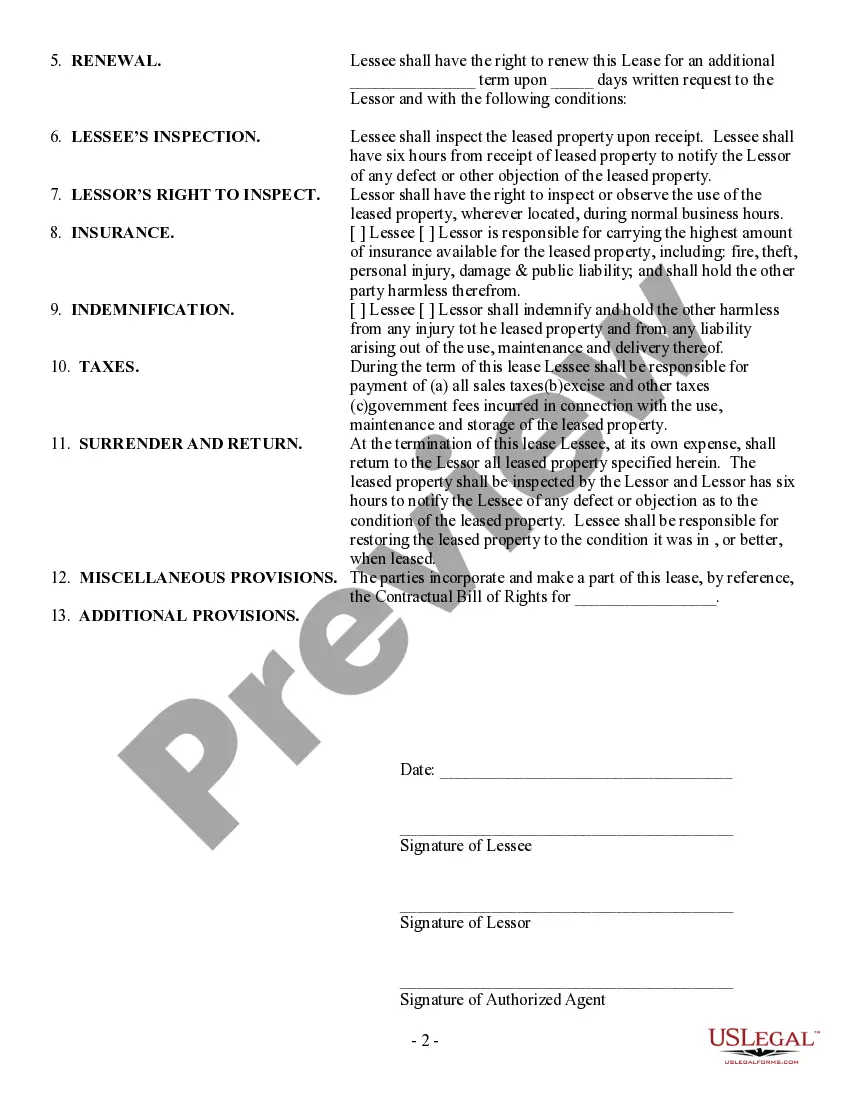

Creating an equipment rental agreement starts with identifying the equipment, as well as detailing the terms of use and rental fees. You should also include provisions for maintenance, liability, and termination to protect both parties. A Delaware Simple Equipment Lease provides customizable options to help you draft a comprehensive rental agreement easily.