At one time all ?ˆ?clergy?ˆ were considered self-employed; however, in the mid 1980?ˆ™s the IRS decided to declare such ministers ?ˆ?employees?ˆ of the church . Most pastors should be considered employees. They typically have a governing council they work with or for to determine to work to be performed (which is one of the criteria the IRS uses to determine the status of a person). Exceptions to this would be supply pastors or missionaries who travel from church to church filling in or working for short periods

Misclassification of workers is a big issue with churches and the IRS, so be very certain you have properly classified your clergy and other workers such as musicians, nursery workers, and, custodians. A member of the clergy is considered an employee for federal income tax purposes and self-employed for Social Security and Medicare purposes.

See Topic 417 - Earnings for Clergy at https://www.irs.gov/taxtopics/tc417.html

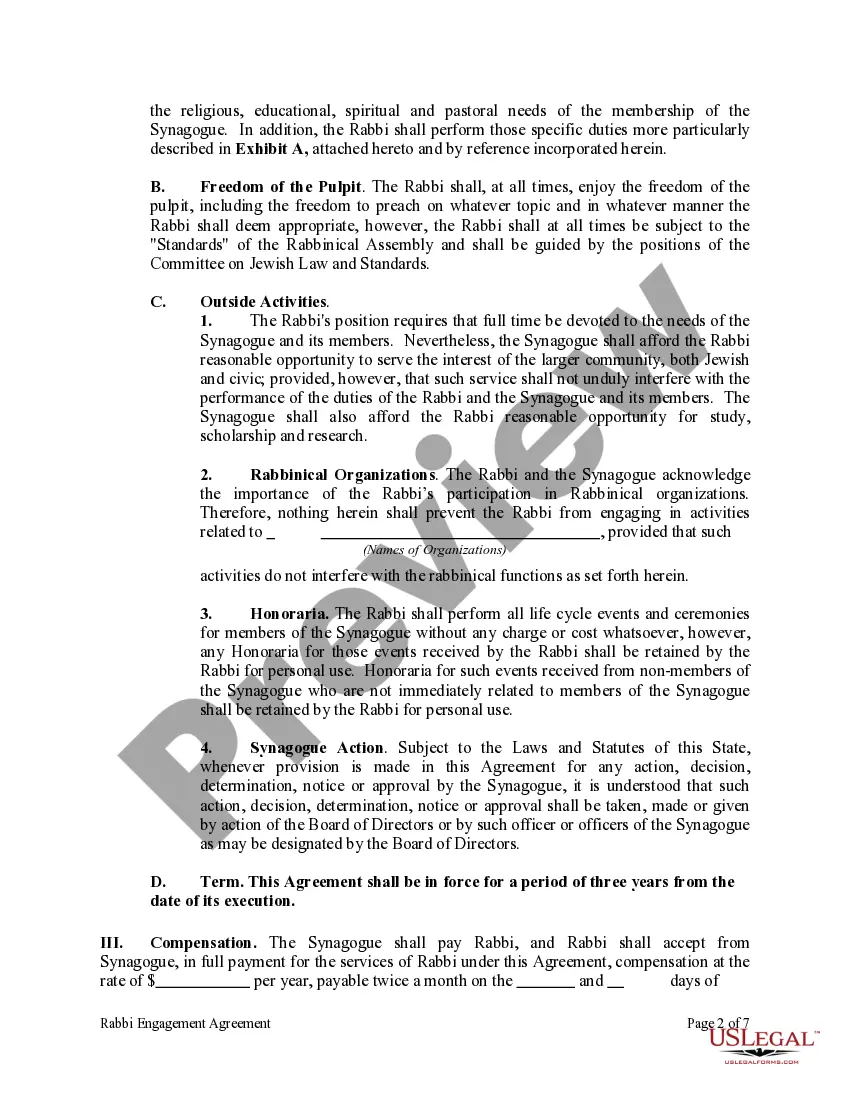

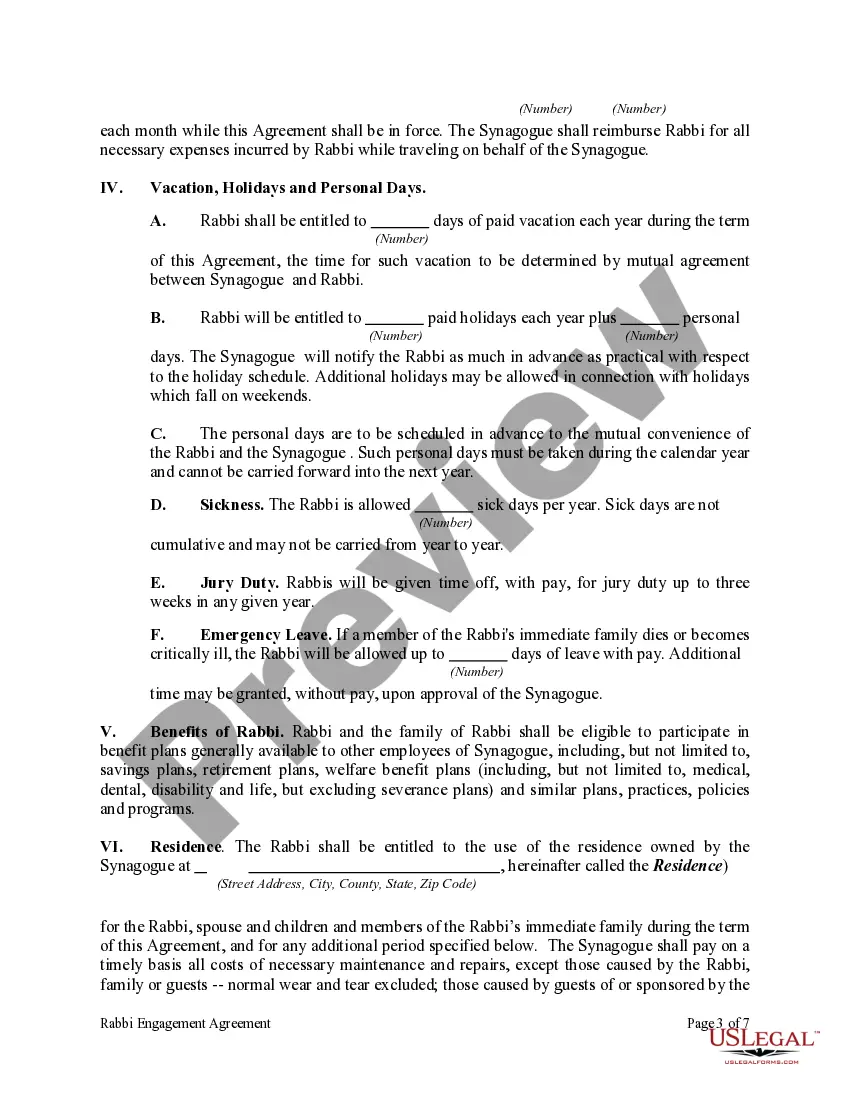

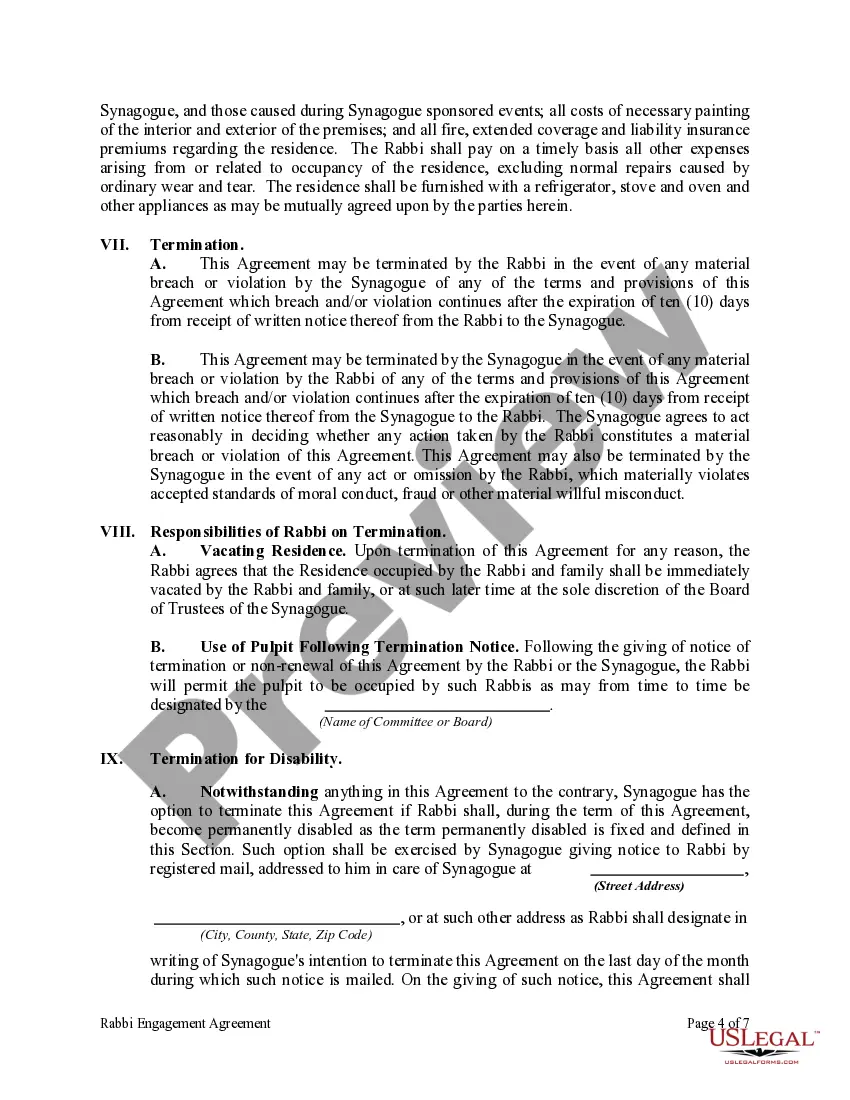

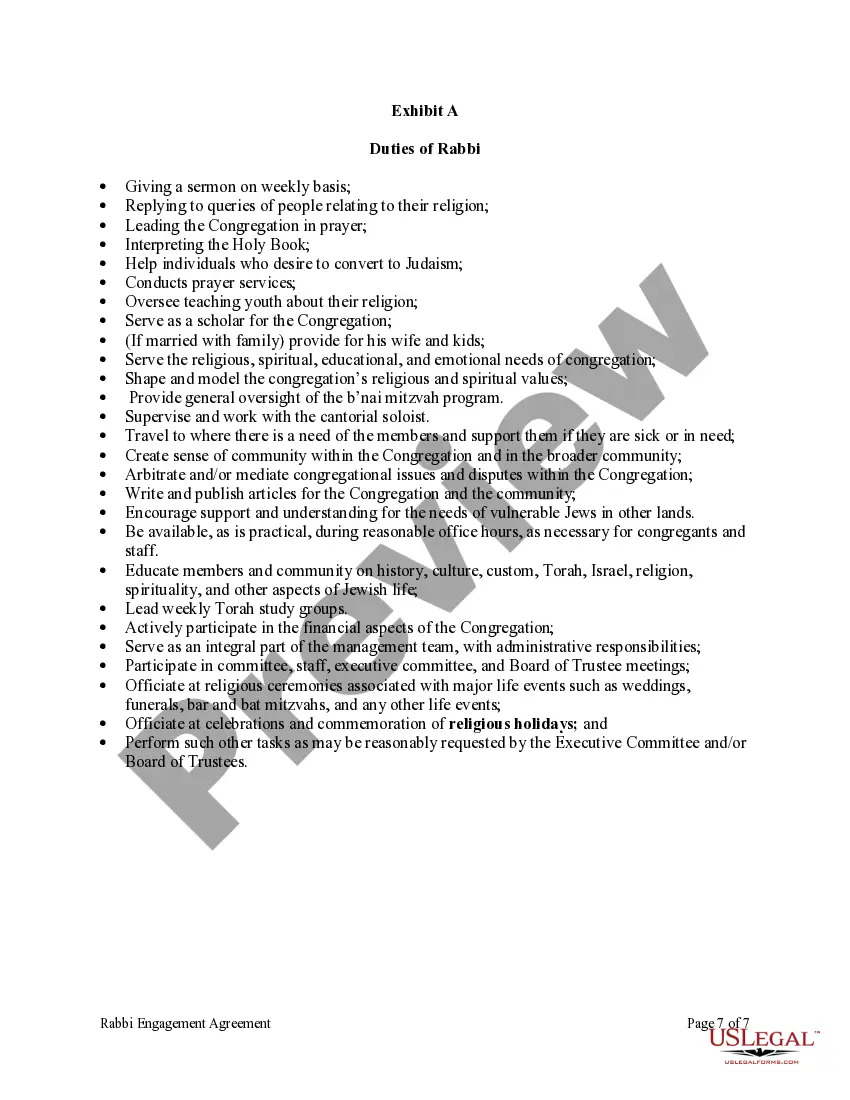

Delaware Rabbi Engagement Agreement

Description

How to fill out Rabbi Engagement Agreement?

If you want to compile, acquire, or print official document templates, utilize US Legal Forms, the largest collection of official forms available online.

Make use of the site's user-friendly and convenient search tool to locate the documents you need.

A range of templates for commercial and personal purposes are organized by categories and states, or keywords.

Every official document template you acquire is yours permanently. You will have access to every form you saved in your account.

Click on the My documents section to select a form to print or download again. Complete, acquire, and print the Delaware Rabbi Engagement Agreement with US Legal Forms. There are various professional and state-specific forms you can utilize for your business or personal needs.

- Employ US Legal Forms to locate the Delaware Rabbi Engagement Agreement in just a few clicks.

- If you are currently a US Legal Forms client, sign in to your account and click the Download button to access the Delaware Rabbi Engagement Agreement.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview feature to review the form’s contents. Don’t forget to read the description.

- Step 3. If you’re dissatisfied with the form, use the Search field at the top of the screen to find alternate versions of the official form template.

- Step 4. Once you’ve found the form you need, click the Buy Now option. Choose your pricing plan and input your credentials to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the official form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Delaware Rabbi Engagement Agreement.

Form popularity

FAQ

Rabbi trusts are generally not subject to ERISA because they fall under non-qualified deferred compensation arrangements. This includes terms that allow for greater flexibility but also means less regulatory protection. Understanding this can inform your strategy when setting up a Delaware Rabbi Engagement Agreement, aligning it with your financial goals.

Rabbi trusts can be subject to bankruptcy proceedings, as the assets are still considered part of the employer's estate. This means that creditors may have access to these funds if the employer faces financial difficulties. It's pivotal to consider this factor when entering into a Delaware Rabbi Engagement Agreement, ensuring that all parties understand the risks involved.

A rabbi trust agreement is a legal document that outlines the terms of the rabbi trust, including contributions, benefits, and distribution schedules. This agreement serves as a roadmap for both the employer and the employee, specifying rights and obligations. When drafting a Delaware Rabbi Engagement Agreement, ensuring clarity in the trust agreement can prevent potential disputes down the line.

In a rabbi trust, the employer typically retains ownership of the assets, even though they are held for the benefit of employees. This structure allows the employer to control when and how benefits are distributed, providing flexibility. If you are considering a Delaware Rabbi Engagement Agreement, it is essential to grasp how ownership affects distribution and taxation.

Yes, a rabbi trust is considered a non-qualified deferred compensation arrangement. This means it does not meet the requirements of qualified plans under the Employee Retirement Income Security Act (ERISA). Understanding this aspect can aid you when creating a Delaware Rabbi Engagement Agreement, as it helps delineate the framework within which the trust operates.

One disadvantage of a rabbi trust is that it does not provide complete protection from creditors. In the event of bankruptcy or financial trouble, assets within a rabbi trust may still be accessible to creditors. Thus, when drafting your Delaware Rabbi Engagement Agreement, it is crucial to consider how these limitations may affect your financial planning.

A rabbi trust typically has several key features, including the ability to hold deferred compensation for employees, especially key executives. These trusts offer protection against creditors and allow the employer to maintain some control over the assets. When establishing a Delaware Rabbi Engagement Agreement, companies often choose rabbi trusts to balance employee benefits with financial security.

A secular trust is a type of trust that operates under general state law and is not tied to any religious obligations. Unlike a rabbi trust, it does not serve to defer income for religious figures but can manage and allocate assets for beneficiaries according to specified terms. Individuals considering a Delaware Rabbi Engagement Agreement may find a secular trust beneficial for non-religious contexts, providing security while ensuring compliance with applicable laws.