Guam Correspondent Agreement - Self-Employed Independent Contractor

Description

How to fill out Correspondent Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a range of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Guam Correspondent Agreement - Self-Employed Independent Contractor in moments.

If you already have a monthly subscription, Log In and download the Guam Correspondent Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the purchase. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the downloaded Guam Correspondent Agreement - Self-Employed Independent Contractor. Each template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents area and click on the form you need. Access the Guam Correspondent Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started:

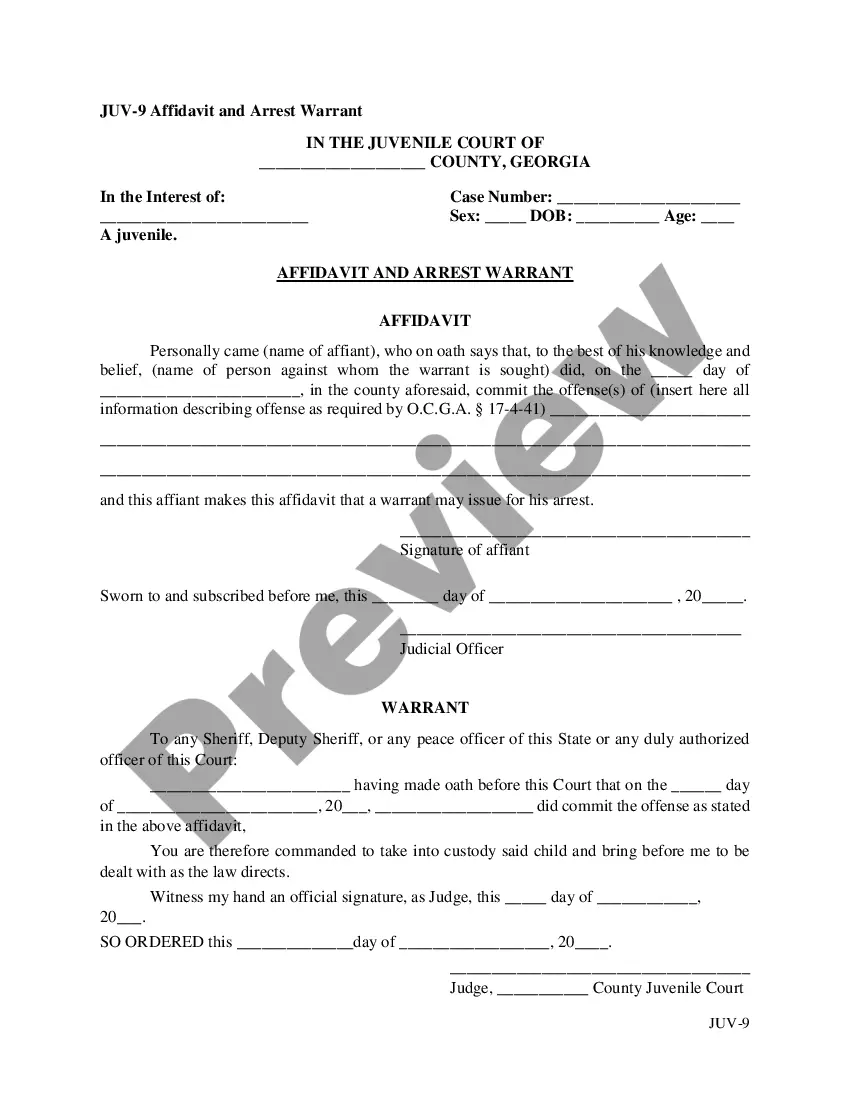

- Make sure you have selected the correct form for your city/region. Click the Preview button to review the form's content.

- Read the form description to ensure that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Begin writing your independent contractor agreement by identifying the parties involved and stating the purpose of the agreement. Clearly outline the scope of work, payment terms, and duration of the contract. By following the structure of the Guam Correspondent Agreement - Self-Employed Independent Contractor, you create a solid foundation for a successful working relationship.

To establish your status as an independent contractor, compile documents such as your contracts, payment records, and any invoices you’ve issued. These items demonstrate your business activity and can be supplemented by using the Guam Correspondent Agreement - Self-Employed Independent Contractor as proof of your working relationship. Consistent documentation will support your independent status.

Yes, independent contractors do file as self-employed individuals. They report their income and expenses on a Schedule C attached to their personal tax return. By operating under the Guam Correspondent Agreement - Self-Employed Independent Contractor, you will need to keep accurate records for tax purposes.

When filling out an independent contractor form, provide your personal details such as your name, address, and tax identification number. It is important to describe the services you will offer in detail and include the payment schedule. This form aligns with the Guam Correspondent Agreement - Self-Employed Independent Contractor criteria, ensuring you meet all necessary requirements.

To complete an independent contractor agreement, start by including both parties' names and contact information. Clearly outline the services you will provide, payment terms, and deadlines. Make sure to specify the nature of the relationship, emphasizing that it is based on the Guam Correspondent Agreement - Self-Employed Independent Contractor model.

Being self-employed means that you work for yourself and are not under the employment of another entity. You provide services or goods to clients, often through agreements like the Guam Correspondent Agreement - Self-Employed Independent Contractor. To qualify, you must manage your own business operations, set your own work hours, and handle your tax responsibilities. Awareness of these aspects will help you thrive as an independent business owner.

Yes, independent contractors are indeed classified as self-employed. When you operate under a Guam Correspondent Agreement - Self-Employed Independent Contractor, you take on self-employment through contract work. This classification has implications for taxes, benefits, and overall business independence. It’s important to understand this relationship to navigate your obligations effectively.

Both terms serve similar functions, but they can have different connotations. Self-employed generally describes anyone running their own business, while independent contractor specifically pertains to a person engaged in contract work. Depending on your context within a Guam Correspondent Agreement - Self-Employed Independent Contractor, you might choose one term over the other. Clarity in communication is essential, so use the term that best fits your situation.

Yes, receiving a 1099 typically indicates that you are self-employed. This tax form is issued to independent contractors, affirming their status under the Guam Correspondent Agreement - Self-Employed Independent Contractor. Being self-employed means you manage your own business affairs and are responsible for your own taxes. Ensure you keep track of your earnings and expenses to maintain accurate financial records.

The Acknowledgement of independent contractor status is a formal document that recognizes you as an independent contractor rather than an employee. This status is vital when entering into a Guam Correspondent Agreement - Self-Employed Independent Contractor. By signing this acknowledgement, you confirm your self-employment, which can affect tax obligations and benefits. It's essential to understand this distinction to ensure you're compliant with all regulations.