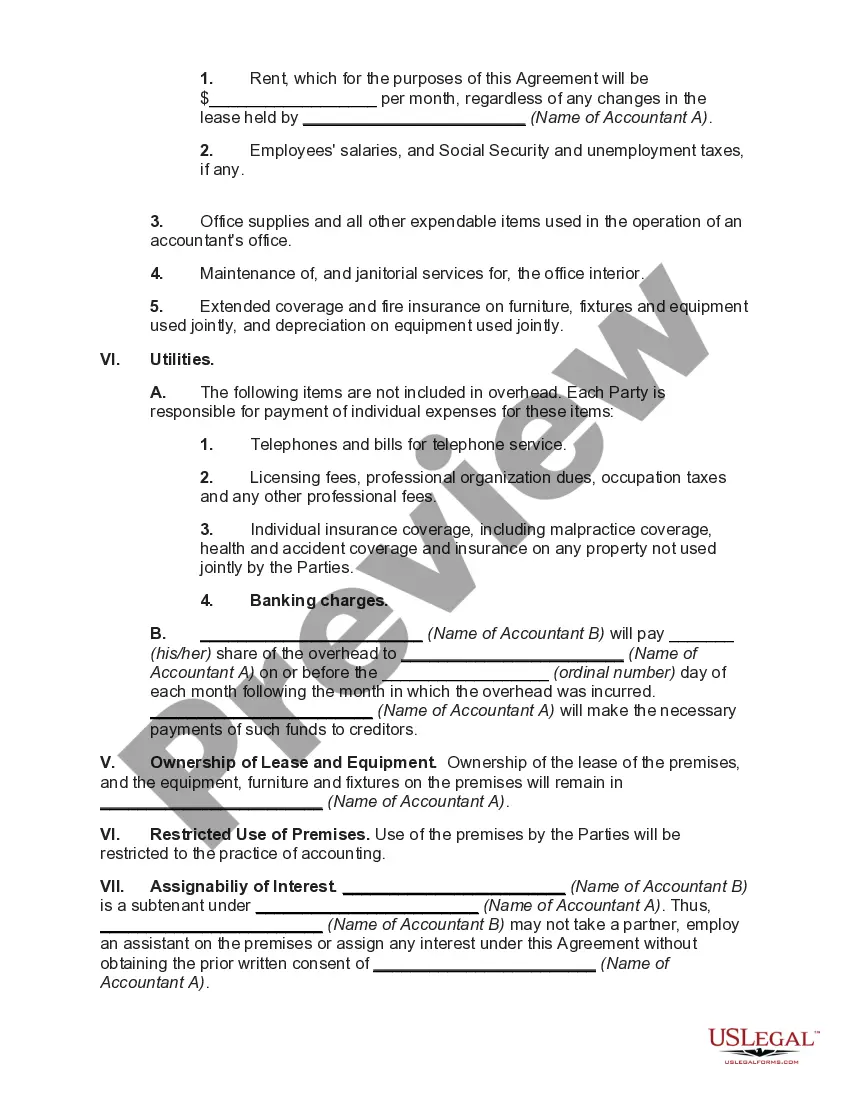

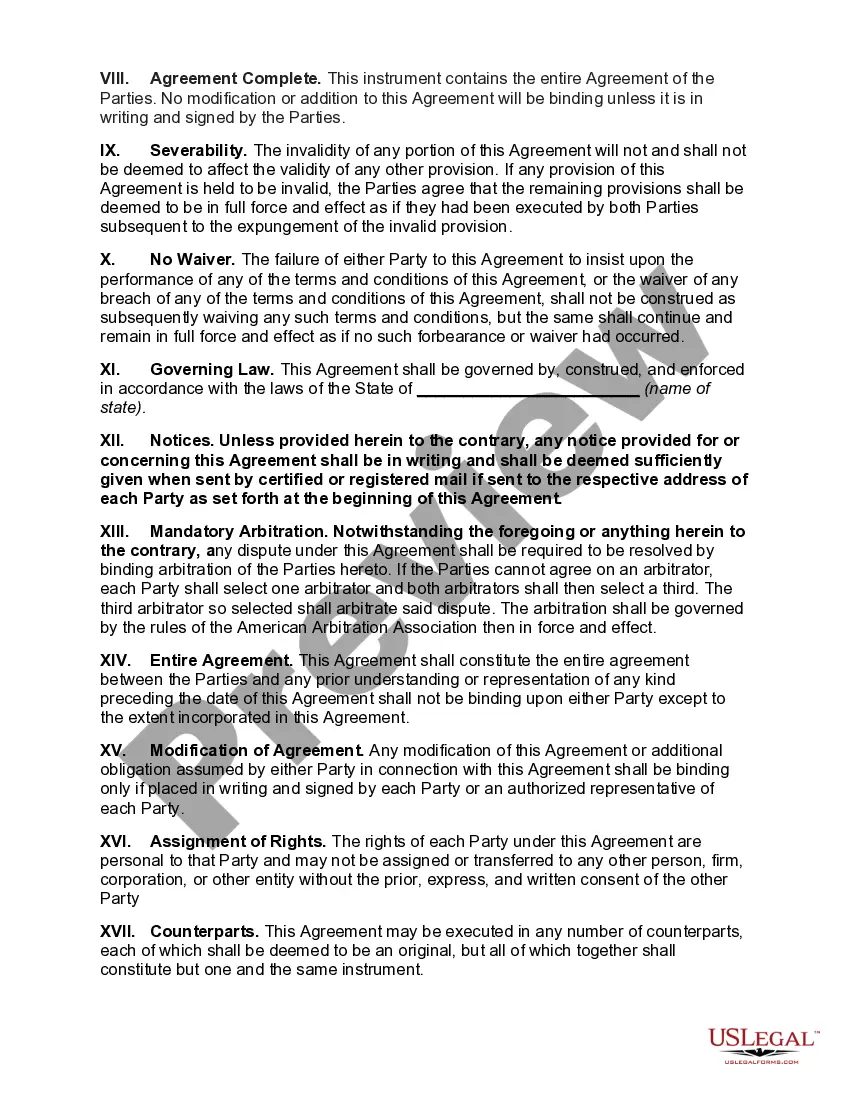

An Agreement by Accountants to Share Office Space without Forming Partnership is a written contract between two or more accounting professionals to share office space without entering into a formal partnership. This type of agreement typically outlines the responsibilities and rights of each accountant, as well as how the office space will be used and managed. It may also cover topics such as the payment of rent, the division of office equipment, and any other terms that the parties have agreed upon. There are various types of Agreement by Accountants to Share Office Space without Forming Partnership, including: 1. Joint Office Lease Agreement — This type of agreement outlines the terms and conditions of a joint lease between two or more accounting professionals. It covers the sharing of office space, the payment of rent, and the division of office equipment. 2. Shared Services Agreement — A Shared Services Agreement outlines the terms and conditions of the sharing of services, such as accounting, tax, and bookkeeping, between two or more accounting professionals. It may also cover the sharing of office equipment, office supplies, and other resources. 3. Office Space Sharing Agreement — This type of agreement outlines the terms and conditions of the sharing of office space between two or more accounting professionals. It covers topics such as the payment of rent, the division of office equipment, and any other terms that the parties have agreed upon. 4. Shared Office Resources Agreement — This type of agreement outlines the terms and conditions of the sharing of office resources, such as office equipment, office supplies, and other resources, between two or more accounting professionals.

Agreement by Accountants to Share Office Space without Forming Partnership

Description

How to fill out Agreement By Accountants To Share Office Space Without Forming Partnership?

How much time and resources do you often spend on drafting formal documentation? There’s a greater option to get such forms than hiring legal experts or spending hours searching the web for an appropriate template. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Agreement by Accountants to Share Office Space without Forming Partnership.

To get and complete a suitable Agreement by Accountants to Share Office Space without Forming Partnership template, adhere to these easy steps:

- Look through the form content to ensure it meets your state regulations. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Agreement by Accountants to Share Office Space without Forming Partnership. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Agreement by Accountants to Share Office Space without Forming Partnership on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Form popularity

FAQ

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

Partnership agreements are not required to be in writing. If there is no partnership agreement, then state law will govern the partnership with default rules. However, when there is a written partnership agreement, the written agreement controls.

A written partnership agreement should show the following to avoid confusion and disagreements: The name of your business. The contributions of each partner and the percentage of ownership. Division of profits and losses between the partners. Each partner's authority or binding power.

An office lease agreement is a legal document between a landlord and tenant that will be occupying space for non-retail use. The space is generally suited for occupations such as accountants, attorneys, real estate agents, or other related fields where clients are welcome for professional consultation.

An Office Sharing Agreement is a legally binding agreement between the owner or commercial tenant of an office space and another business. Office Sharing Agreements are used to licence out the use of spare office workstations. To find out more about sharing space for business purposes, reading Sharing space.

If there is no agreement or procedure set forth, Judicial Dissolution is likely. In California, the partnership must file a Statement of Dissolution with the Secretary of State. The partnership is then responsible for distributing or liquidating the partnership assets.

By Practical Law Commercial. A boilerplate partnership or agency clause that seeks to ensure that parties to a commercial agreement will not be treated as partners or agents of each other, nor as entering into a joint venture arrangement with each other.

However, if you have no written business agreement in place, you may be unable to carry out the day-to-day tasks of the partnership, like paying yourself a salary. Instead, you and your partner may need to wait until the end of each year and split the partnership's profits and losses equally.