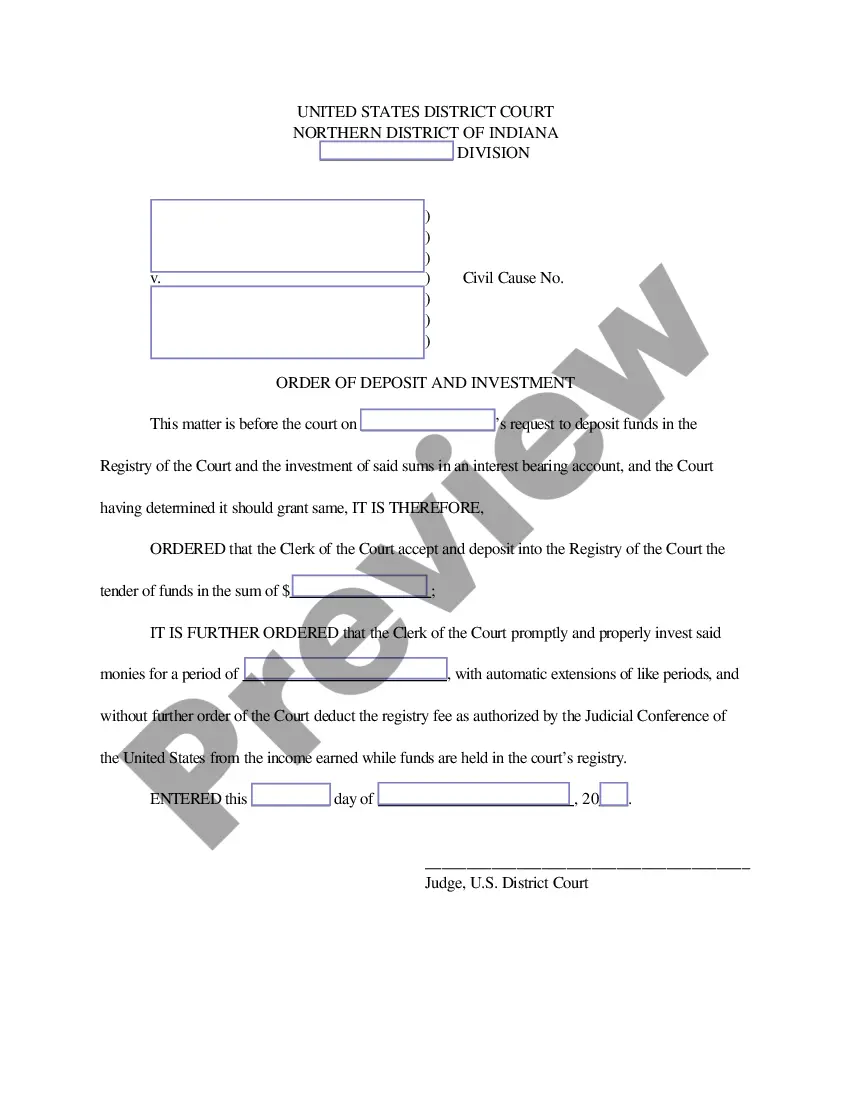

Indiana Order of Deposit and Investment (JODI) is a type of investment offered by the State of Indiana. It provides a safe and secure way for individuals, businesses, and organizations to invest their money and earn a competitive rate of return. JODI is a low-risk investment and is backed by the Full Faith and Credit of the State of Indiana. It is available in both term and demand deposit options, offering investors a range of choices to meet their individual needs. The term option is available in a variety of terms ranging from six months to five years. It pays a competitive rate of interest and is FDIC-insured up to $250,000. The demand option is a non-interest bearing account that provides the flexibility to access funds as needed. Both options are available through most financial institutions in Indiana. There are three main types of JODI investments: JODI Term Deposit, JODI Demand Deposit, and JODI Escrow. The JODI Term Deposit offers an FDIC-insured, competitive rate of return for a specified period of time. The JODI Demand Deposit is a non-interest bearing account with the flexibility to access funds as needed. The JODI Escrow account is a special purpose account used to deposit funds for a specific purpose, such as a court-ordered payment, and is held in trust until the purpose of the account is fulfilled.

Indiana Order of Deposit and Investment

Description

How to fill out Indiana Order Of Deposit And Investment?

How much time and resources do you usually allocate to creating formal documentation.

There’s a more efficient method to obtain such forms than hiring legal experts or spending hours searching the internet for a suitable template. US Legal Forms is the top online repository that offers professionally prepared and verified state-specific legal documents for any purpose, such as the Indiana Order of Deposit and Investment.

Another advantage of our service is that you can access previously downloaded documents that are securely stored in your profile in the My documents tab. Retrieve them anytime and redo your paperwork as often as necessary.

Save time and energy completing official documentation with US Legal Forms, one of the most reliable online services. Join us today!

- Review the document content to ensure it complies with your state laws. To do this, read the document description or utilize the Preview option.

- If your legal template does not meet your requirements, search for another one using the search bar at the top of the page.

- If you are already a member of our service, Log In and download the Indiana Order of Deposit and Investment. If not, continue to the next steps.

- Click Buy now once you identify the correct document. Select the subscription plan that best fits your needs to access our library’s full offerings.

- Register for an account and pay for your subscription. You can complete your payment via credit card or PayPal - our service is completely safe for that.

- Download your Indiana Order of Deposit and Investment onto your device and fill it out on a printed hard copy or electronically.