Delaware Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

If you wish to finalize, download, or print legal document templates, utilize US Legal Forms, the best array of legal forms that can be accessed online.

Take advantage of the site’s simple and functional search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states or keywords.

Step 4. After you locate the form you need, click on the Acquire now button. Choose your preferred pricing plan and enter your details to register an account.

Step 5. Complete the payment process. You can use your Visa, MasterCard, or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Delaware Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to locate the Delaware Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction.

- You can also access forms you previously obtained in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps mentioned below.

- Step 1. Ensure you have selected the template for your correct city/state.

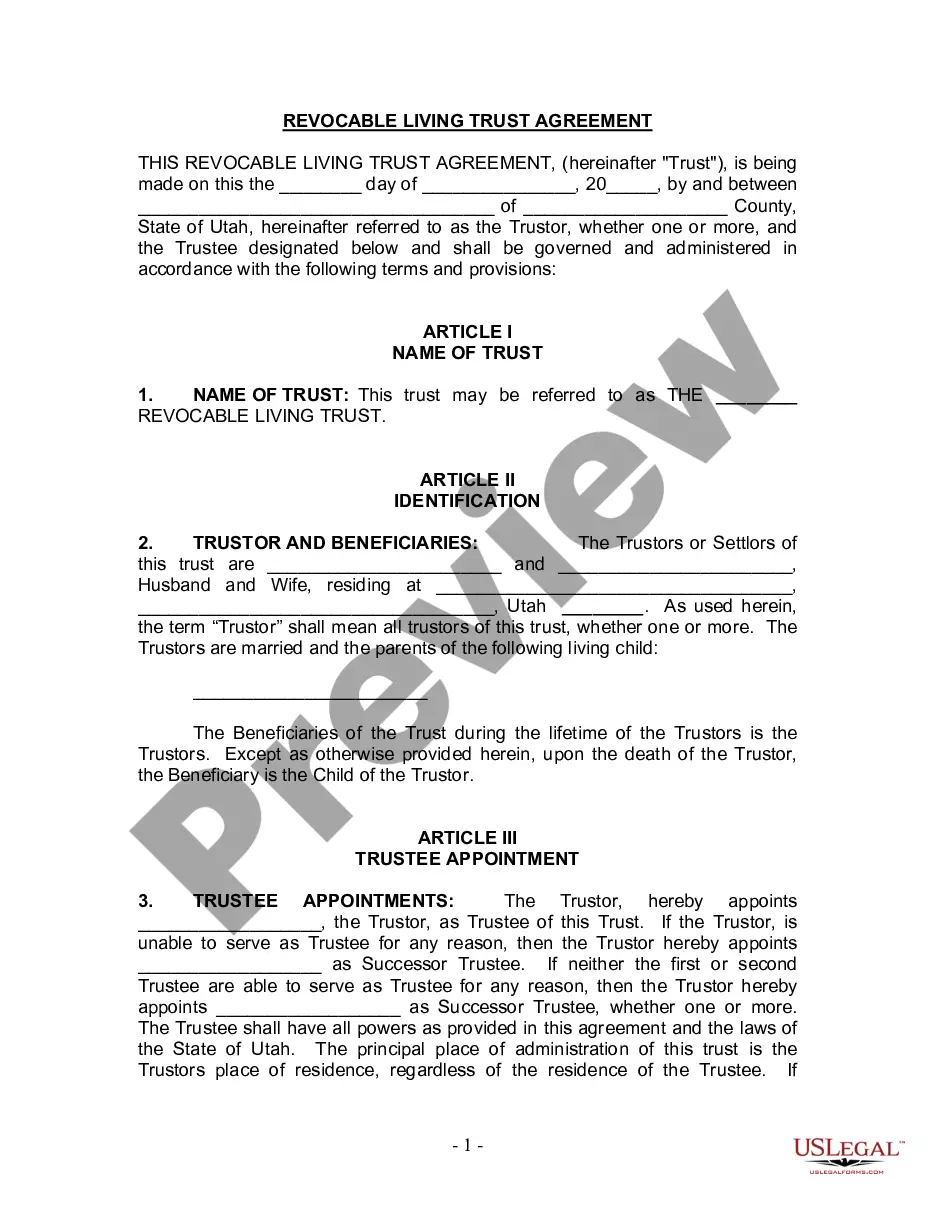

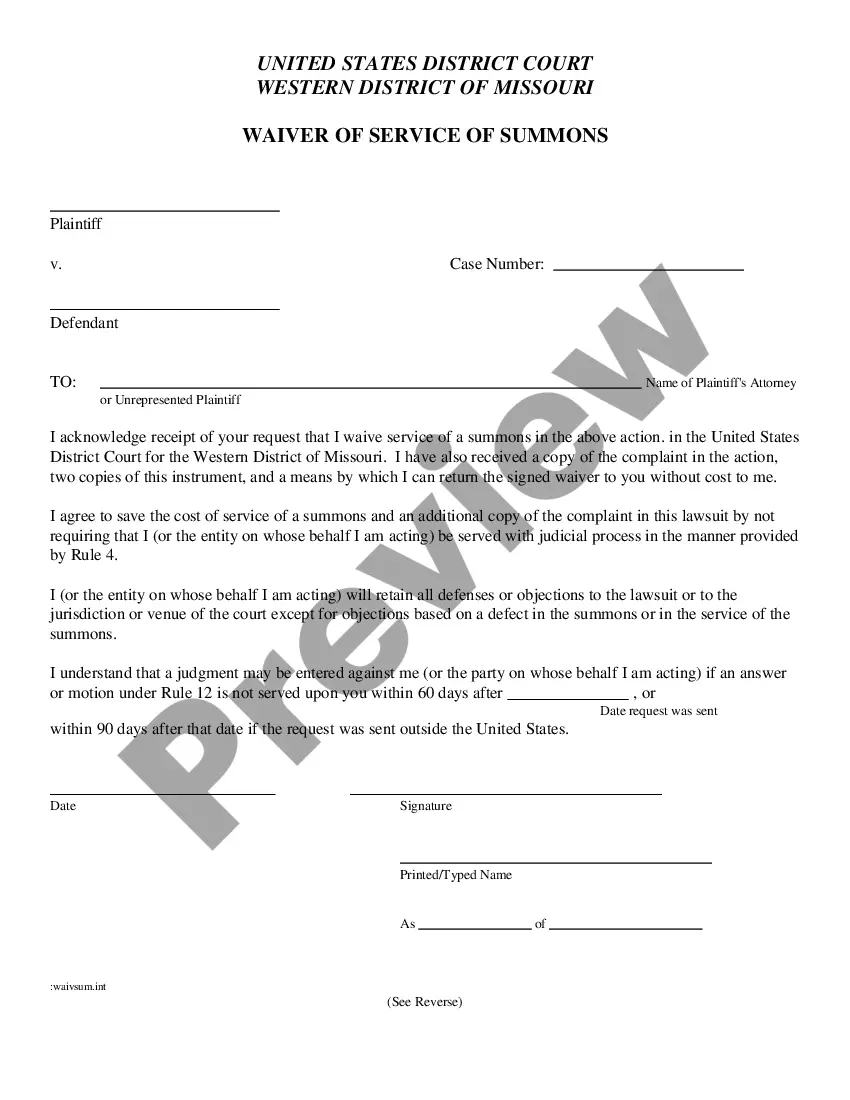

- Step 2. Utilize the Preview option to review the contents of the form. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

The sale of assets involves transferring ownership of specific business assets from the seller to the buyer, rather than the entire business entity. This may include equipment, inventory, intellectual property, or real estate. It is an important process in the Delaware Sale of Business, as it helps streamline the transition of key assets. Platforms such as uslegalforms can assist you in documenting the transaction effectively.

An example of a sale of assets could be a company selling its machinery and equipment to another firm in need of those resources. This type of transaction would require a Bill of Sale for Personal Assets to outline the details and terms of the sale. This approach allows the selling business to liquidate assets efficiently while the buyer can acquire necessary tools. Using USLegalForms ensures you have the right documentation for a smooth Delaware Sale of Business.

An asset sale in business means the selling of specific company assets rather than the entire business itself. This can encompass equipment, inventory, or intellectual property and is formalized through agreements, such as a Bill of Sale for Personal Assets. Asset sales can provide flexibility and help businesses maximize value while minimizing liabilities. Understanding this process is important for anyone engaged in a Delaware Sale of Business.

The sale of assets in business refers to the transfer of ownership from one party to another. This typically involves a Bill of Sale for Personal Assets, which documents the transaction and ensures clarity for both sides. Understanding the specifics of a Delaware Sale of Business is crucial, as the laws can vary by state. Engaging with a trusted service, like USLegalForms, can streamline this process and provide the necessary legal documentation.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).